About two weeks in the past on this submit we thought-about the speculation that the USD was about to quickly finish its downtrend that started final autumn:immediately we are going to see how it’s doing by specializing in a very powerful pair, which weighs 57.6% of the USD Index basket: the EURUSD.

Over the following 3 days there can be lots of knowledge from the Eurozone on inflation, shopper sentiment, and numerous GDPs; in 2 weeks’ time (15/06) it will likely be the ECB’s flip once more. However immediately we are going to focus solely on technical evaluation and charts.

Technical Evaluation

In the long run weekly chart, we will clearly see the significance of 1.105 /1.11 upwards and much more so of 1.05 downwards, ranges which have proven their significance from 2014 onwards. Technically, this latter one appears to be like actually robust.

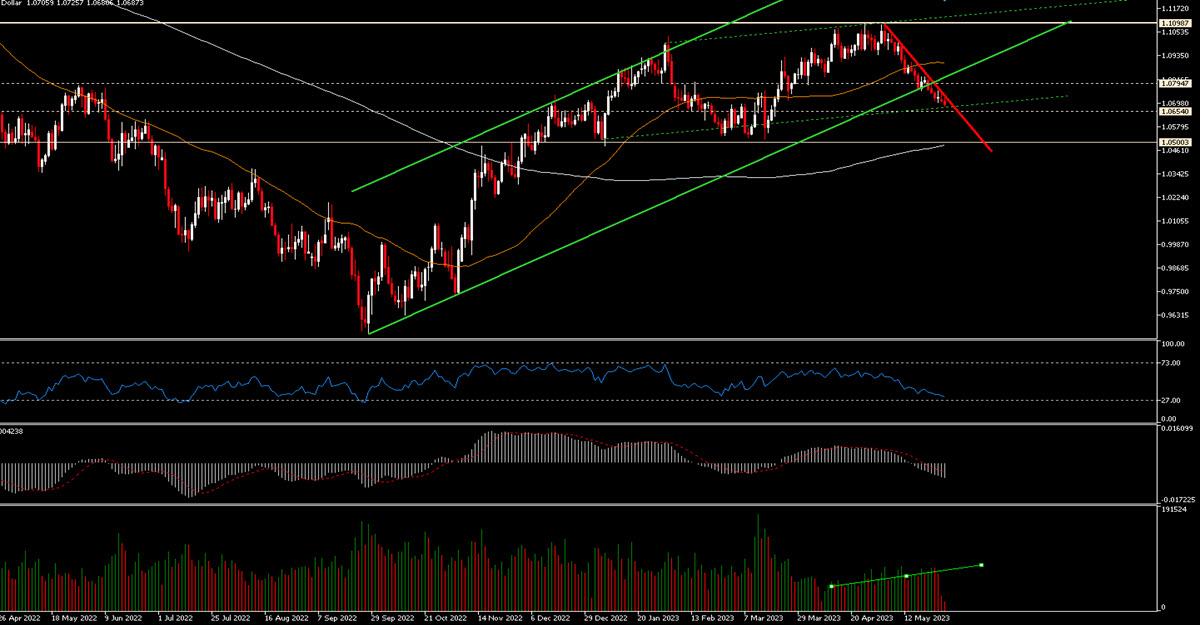

EurUsd, weekly

On the every day chart we will see that having reached 1.11, the downward part started: this additionally broke the bullish channel in mild inexperienced, indicating not less than a slowdown within the appreciation of the pair. We tried to attract the speculation of a bullish sideways consolidation part (darkish inexperienced dashed channel) and we are going to see if the value will transfer inside it. What is for certain are the static ranges: 1.08, 1.05 and in between 1.0650, amongst all of the least ”clear” stage. The bearishness may be very clear in the intervening time and it’s best to have in mind how relentless the FX actions tends to be; it is usually attention-grabbing that the transfer -on this descent from 1.11 to 1.06875- is on the again of accelerating volumes though decrease than these recorded till March. RSI is unfavorable with out being oversold, MACD is unfavorable, ATR (10) every day is coming all the way down to 55 pips, the bottom ”realised volatility” since 2021.

On the every day chart we will see that having reached 1.11, the downward part started: this additionally broke the bullish channel in mild inexperienced, indicating not less than a slowdown within the appreciation of the pair. We tried to attract the speculation of a bullish sideways consolidation part (darkish inexperienced dashed channel) and we are going to see if the value will transfer inside it. What is for certain are the static ranges: 1.08, 1.05 and in between 1.0650, amongst all of the least ”clear” stage. The bearishness may be very clear in the intervening time and it’s best to have in mind how relentless the FX actions tends to be; it is usually attention-grabbing that the transfer -on this descent from 1.11 to 1.06875- is on the again of accelerating volumes though decrease than these recorded till March. RSI is unfavorable with out being oversold, MACD is unfavorable, ATR (10) every day is coming all the way down to 55 pips, the bottom ”realised volatility” since 2021.

EURUSD, every day

Lastly the downward motion might proceed within the coming hours with an vital first goal at 1.0650 after which the following helps about each 50 pips at 1.0600, 1.0550; lastly, the pivotal 1.05. This can be a actually robust help and the MA 200 will cross near that stage as effectively.

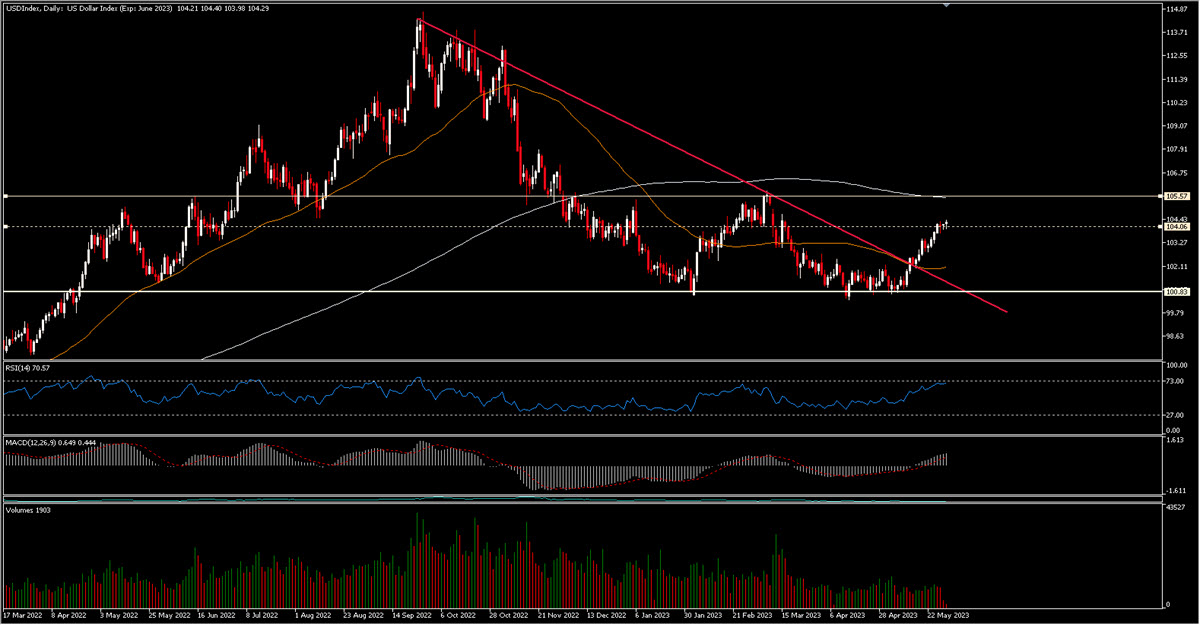

Briefly, preventing the pattern shouldn’t be a great possibility and it is very important look ahead to the response at sure ranges, with out anticipating it. Evaluating to the broader USD Index, 1.05 would correspond to about 105.57, which is resistance on that chart whereas the Index’s RSI (14) is already printing 70.72.

USD Index, Each day

Click on right here to entry our Financial Calendar

Marco Turatti

Market Analyst

Disclaimer: This materials is supplied as a basic advertising and marketing communication for data functions solely and doesn’t represent an unbiased funding analysis. Nothing on this communication comprises, or ought to be thought-about as containing, an funding recommendation or an funding advice or a solicitation for the aim of shopping for or promoting of any monetary instrument. All data supplied is gathered from respected sources and any data containing a sign of previous efficiency shouldn’t be a assure or dependable indicator of future efficiency. Customers acknowledge that any funding in Leveraged Merchandise is characterised by a sure diploma of uncertainty and that any funding of this nature entails a excessive stage of danger for which the customers are solely accountable and liable. We assume no legal responsibility for any loss arising from any funding made primarily based on the knowledge supplied on this communication. This communication should not be reproduced or additional distributed with out our prior written permission.