The eurozone restoration is prone to come to a standstill on the again of the fall-out from the conflict in Ukraine. A large number of opposed shocks is about to push to six% in 2022. In the intervening time the ECB will restrict itself to ‘normalising’ its financial coverage: stopping QE within the third quarter and a primary charge hike within the fourth

Shoppers underneath stress

With the Ukraine border a mere 1,500 km away from the European capital, it’s no shock that Europe is extra straight affected by the conflict than the US or Asia. Admittedly, it’s laborious to foresee how the battle will evolve and the way structural its penalties will develop into. It seems to be very seemingly, nonetheless, that the brief time period optimistic progress impact brought on by the lifting of the Covid-19 containment measures will likely be greater than compensated by this new unfavorable shock. We now really count on to shrink within the second quarter, although a recession for the entire of the yr nonetheless seems to be an extended shot given the substantial carry-over impact from 2021.

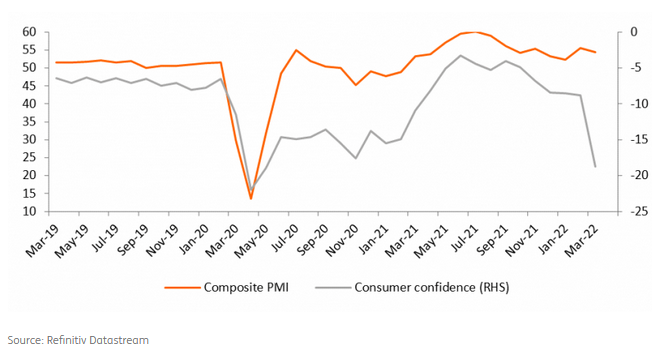

There may be nonetheless little or no financial knowledge that displays the state of affairs since Russia invaded Ukraine, though the primary survey outcomes are actually coming in. We all know that shopper confidence plummeted in March. Whereas this positively signifies a unfavorable affect on consumption expenditure, the amplitude of the autumn in confidence must be certified. Certainly, customers are inclined to react fairly strongly in surveys to ‘headline-grabbing’ occasions, however that doesn’t imply that consumption will undergo too dramatically. In the intervening time the labour market stays comparatively sturdy, which continues to help family expenditure. In March companies nonetheless reported sturdy hiring to fight workers shortages. However we will’t deny that actual earnings is dealing with downward stress from excessive inflation which is, in the interim, not compensated by increased wages.

Combined confidence figures

Sturdy enterprise confidence unlikely to final

Enterprise sentiment additionally softened in March, however nonetheless remained comparatively sturdy, with the printing 54.5, nonetheless comfortably above the 50 factors boom-bust stage. Nonetheless, orders slowed with export orders within the manufacturing sector really declining for the primary time in 21 months. Provide chains frictions are additionally growing once more on the again of the Ukraine conflict, sanctions in Russia and renewed lockdowns in China. As a consequence provider supply occasions lengthened in March to the best extent since November 2021. On the similar time, a variety of energy-intensive companies are being pressured to close down product traces within the wake of too costly power prices. So the present comparatively excessive enterprise confidence readings are in all probability not going to final.

We now count on GDP progress to hover round 0% within the first quarter, contract within the second quarter, to provide option to a subdued restoration within the third. That is underneath the belief that power costs stay excessive for the rest of the yr. For the entire of 2022, this leads to a GDP progress downgrade to 2% whereas 2023 might see a slight progress acceleration to 2.3%.

Greater agricultural commodity costs will preserve inflation excessive

ECB caught between a rock and a tough place

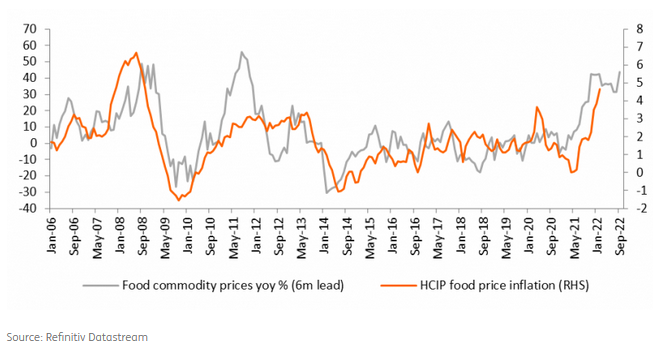

We would have used the expression earlier than, however the inflation horror present continues. Each opposed shock is adopted by a brand new one, that means that the normalisation of inflation charges simply isn’t taking place. Other than power costs the conflict in Ukraine is now additionally affecting meals costs, as each Ukraine and Russia are essential producers of agricultural commodities. We, due to this fact, needed to revise our inflation forecast as soon as once more, this time to six.0% for 2022, with the yr ending with an inflation charge of round 4.5%. Due to extra beneficial base results, inflation might fall again under 2% in the middle of 2023, however we see underlying inflation remaining above 2%.

The European Central Financial institution continues to wrestle with the chance of stagflation. Due to the brief time period downward danger to progress, there may be nonetheless little probability of an early charge hike. The 5yr ahead break-even inflation charge is now at 2.25%, considerably increased than a yr in the past, however nonetheless near the ECB’s medium-term inflation goal. That stated, we imagine that the ECB will stick with its plan to eliminate distinctive coverage measures, ending web property purchases within the third quarter. We see a primary charge hike within the fourth quarter and a second within the first few months of 2023. Whereas that is already totally anticipated by the markets, the Bund yield remains to be prone to creep increased in tandem with US treasury yields to succeed in 1% in 12 months’ time.

Disclaimer: This publication has been ready by ING solely for info functions no matter a specific person’s means, monetary state of affairs or funding aims. The knowledge doesn’t represent funding advice, and neither is it funding, authorized or tax recommendation or a proposal or solicitation to buy or promote any monetary instrument. Learn extra

Authentic Submit