EUR/USD Forecast – Costs, Charts, and Evaluation

- German inflation continues to fall as power prices tumble.

- FOMC and US NFPs will steer EUR/USD within the brief time period.

Obtain our Q1 Euro Technical and Basic Experiences Under:

Advisable by Nick Cawley

Get Your Free EUR Forecast

Most Learn: Euro (EUR/USD) Pares Latest Losses After German and Euro Aera This autumn Releases

German inflation fell by greater than anticipated in January, official knowledge confirmed in the present day, hitting the bottom stage since June 2021, as items inflation fell sharply. Vitality prices fell by 2.8%, in comparison with a 4.1% improve in December, whereas meals inflation fell from 4.5% to three.8%.

For all market-moving financial knowledge and occasions, see the real-time DailyFX Financial Calendar

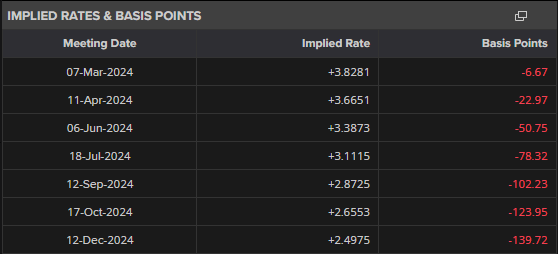

The only forex has been beneath of stress lately as expectations develop that the European Central Financial institution (ECB) will begin to trim borrowing prices on the April eleventh assembly. Euro Space rate of interest possibilities at present present a 75% likelihood of a 25 foundation level lower initially of Q2 with a collection of cuts taking the Deposit Price all the way down to 2.50% by the tip of the 12 months.

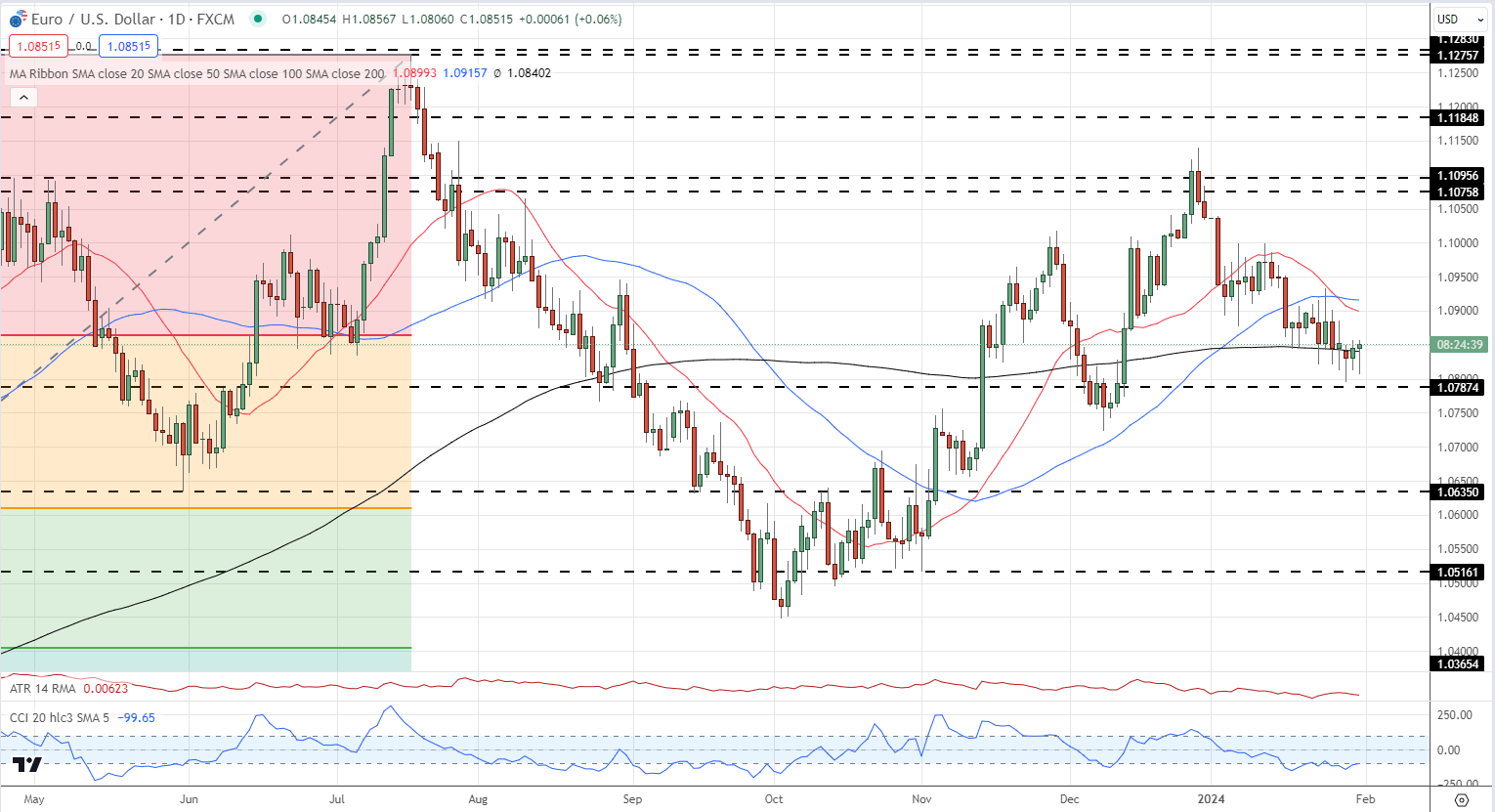

EUR/USD briefly dipped under 1.0800 on Tuesday however didn’t check a previous stage of horizontal assist at 1.0787. The pair are at present buying and selling on both aspect of the 200-day easy shifting common round 1.0840 and are prone to stay round this stage forward of this night’s FOMC assembly. Chair Powell is anticipated to go away US rates of interest untouched however might give some extra element about when the Fed will begin to lower rates of interest on the post-decision press convention.

EUR/USD Day by day Chart

Charts Utilizing TradingView

IG retail dealer knowledge present 55.75% of merchants are net-long with the ratio of merchants lengthy to brief at 1.26 to 1.The variety of merchants net-long is 1.04% decrease than yesterday and three.74% greater than final week, whereas the variety of merchants net-short is 1.31% decrease than yesterday and 6.77% decrease than final week.

To See What This Means for EUR/USD, Obtain the Full Retail Sentiment Report Under

| Change in | Longs | Shorts | OI |

| Day by day | -2% | -5% | -4% |

| Weekly | 17% | -21% | -4% |

What’s your view on the EURO – bullish or bearish?? You’ll be able to tell us by way of the shape on the finish of this piece or you may contact the writer by way of Twitter @nickcawley1.