Euro (EUR/USD) Newest – German Financial Outlook Slumps in August

Beneficial by Nick Cawley

Get Your Free EUR Forecast

The financial outlook for Germany is breaking down, in response to the most recent ZEW survey, exhibiting ‘the strongest decline of the financial expectations over the previous two years.’ In line with in the present day’s report,

‘It’s probably that financial expectations are nonetheless affected by excessive uncertainty, which is pushed by ambiguous financial coverage, disappointing enterprise information from the US financial system and rising issues over an escalation of the battle within the Center East. Most not too long ago, this uncertainty expressed itself in turmoil on worldwide inventory markets,’ feedback ZEW President Professor Achim Wambach, PhD on the survey outcomes.

ZEW Indicator of Financial Sentiment – Expectations Break Down

For all market-moving financial information and occasions, see the DailyFX Financial Calendar

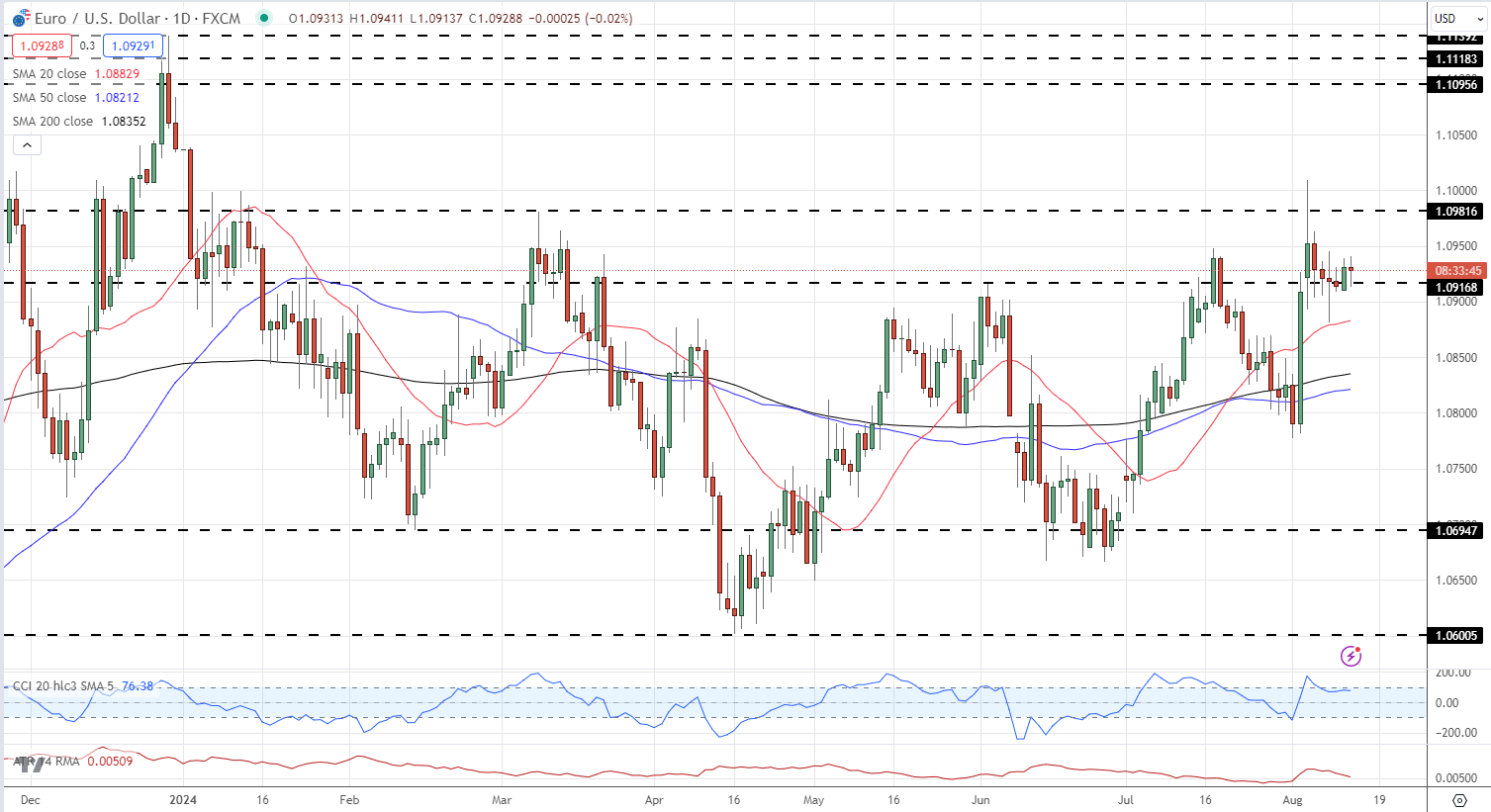

EUR/USD moved marginally decrease towards the US greenback however stays in a good, short-term vary. Preliminary assist is seen off final Thursday’s low at 1.0881 and the 50-day sma at 1.0883, whereas preliminary resistance at 1.0950.

Beneficial by Nick Cawley

How one can Commerce EUR/USD

EUR/USD Each day Value Chart

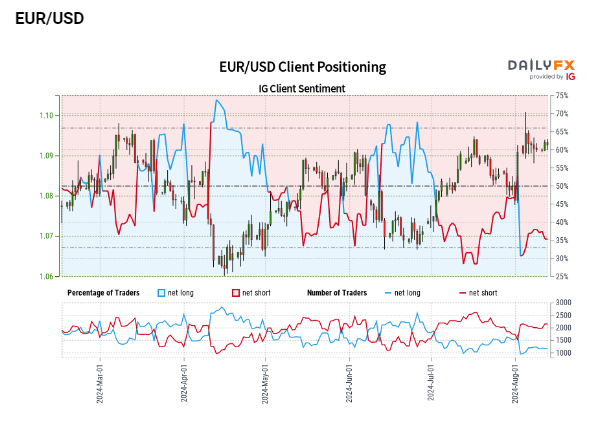

Retail dealer information reveals 37.51% of EUR/USD merchants are net-long with the ratio of merchants quick to lengthy at 1.67 to 1.The variety of merchants net-long is 2.42% greater than yesterday and 14.11% greater from final week, whereas the variety of merchants net-short is 0.42% decrease than yesterday and a couple of.32% greater from final week.

We sometimes take a contrarian view to crowd sentiment, and the very fact merchants are net-short suggests EUR/USD costs might proceed to rise. But merchants are much less net-short than yesterday and in contrast with final week. Latest modifications in sentiment warn that the present EUR/USD worth development might quickly reverse decrease regardless of the very fact merchants stay net-short.

| Change in | Longs | Shorts | OI |

| Each day | -5% | 1% | -1% |

| Weekly | -10% | 11% | 3% |

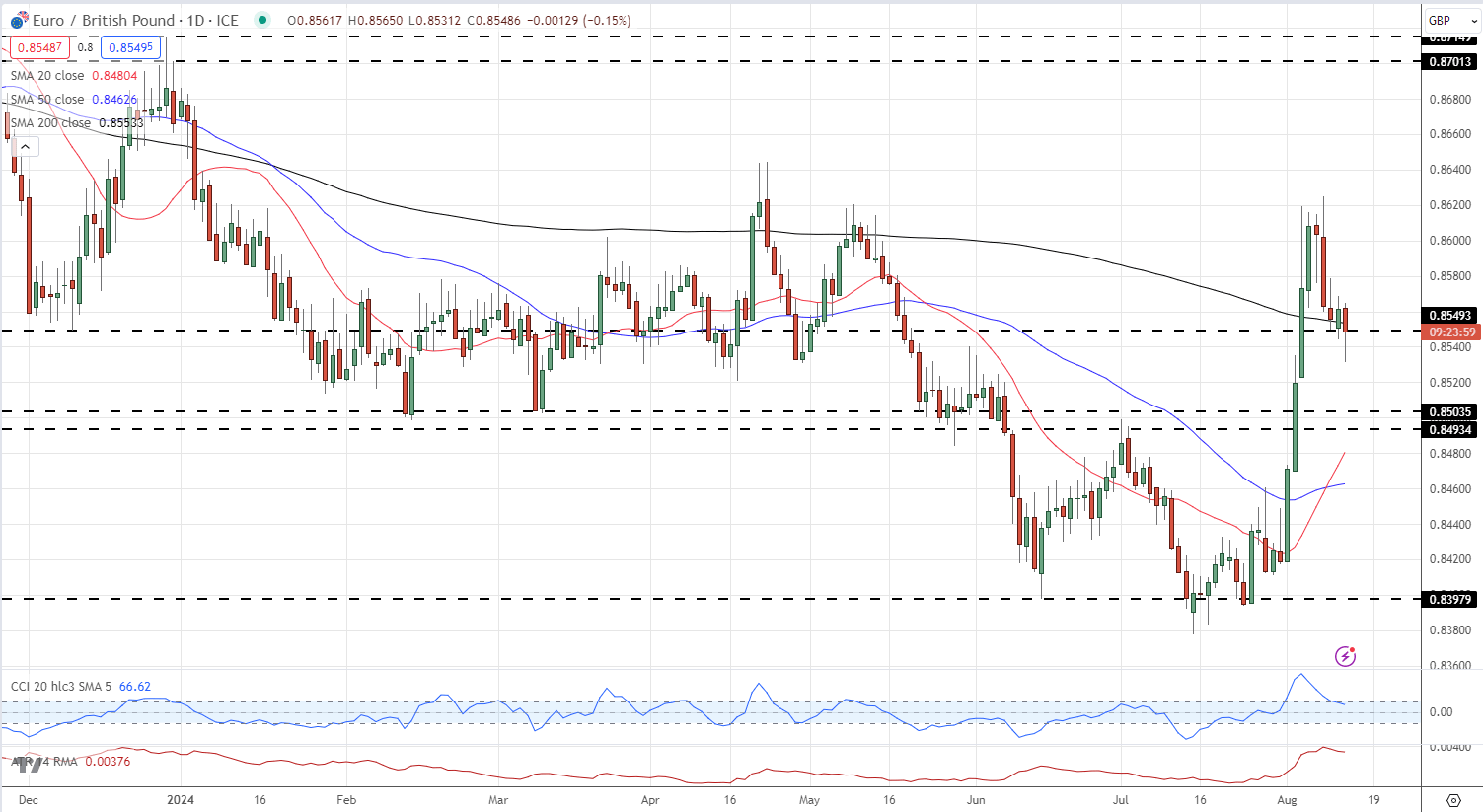

EUR/GBP fell to a contemporary one-week low on a mixture of Euro weak point and Sterling power. Earlier in the present day information confirmed UK unemployment falling unexpectedly – from 4.4% to 4.2% – dialing again UK price reduce expectations.

UK Unemployment Price Falls Unexpectedly, Main Considerations Reappear

After making a four-month final week, EUR/GBP has light decrease and is now buying and selling on both facet of an previous space of significance at 0.8550. Under right here 0.8500 comes into focus. Quick-term resistance is seen at 0.8580 and 0.8600.

EUR/GBP Each day Chart

Charts utilizing TradingView