EUR/USD Fee Speaking Factors

EUR/USD trades to contemporary yearly low (1.1090) regardless of the uptick in Germany’s Client Worth Index (CPI), and looming developments within the Relative Power Index (RSI) could accompany an extra decline within the change charge if the indicator pushes into oversold territory for the primary time in 2022.

Euro Forecast: EUR/USD Susceptible to First RSI Oversold Studying in 2022

EUR/USD clears the June 2020 low (1.1101) after filling the value hole initially of the week, and the Russia-Ukraine disaster could proceed to provide headwinds for the Euro because the disruptions in financial exercise places strain on the European Central Financial institution (ECB) to delay normalizing financial coverage.

In consequence, the ECB could endorse a wait-and-see strategy because the central financial institution plans to “finish internet purchases below the pandemic emergency buy programme (PEPP) on the finish of March, and President Christine Lagarde and Co. could tame hypothesis for an imminent change in regime because the Governing Council “stands able to take no matter motion is required to fulfil its duties to make sure worth stability and monetary stability within the euro space.”

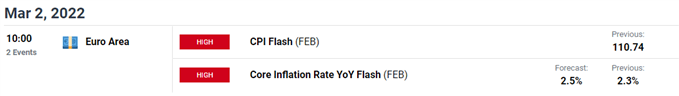

With that in thoughts, contemporary information prints popping out of the Euro Space could do little to affect the financial coverage outlook regardless that the core CPI is anticipated to extend to 2.5% from 2.3% each year in January, and EUR/USD could proceed to depreciate forward of the subsequent ECB rate of interest resolution on March 10 because the Federal Reserve is broadly anticipated to ship a charge hike later this month.

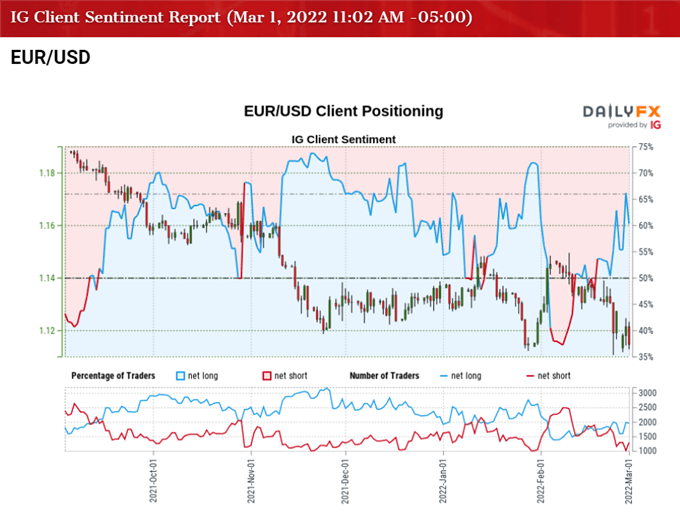

In flip, EUR/USD could proceed to commerce to contemporary yearly lows because it carves a contemporary sequence of decrease highs and lows, and an extra decline within the change charge could gasoline the current flip in retail sentiment just like the conduct seen earlier this 12 months.

The IG Shopper Sentiment report reveals 63.08% of merchants are presently net-long EUR/USD, with the ratio of merchants lengthy to brief standing at 1.71 to 1.

The variety of merchants net-long is 8.56% increased than yesterday and 21.12% increased from final week, whereas the variety of merchants net-short is 3.66% decrease than yesterday and 34.65% decrease from final week. The rise in net-long curiosity has fueled the current flip in retail sentiment as 49.43% of merchants had been net-long EUR/USD final week, whereas the decline in net-short place might be a operate of profit-taking conduct because the change charge trades to a contemporary yearly low (1.1090).

With that mentioned, EUR/USD could resume the bearish pattern seen in the course of the earlier 12 months because the Fed is on monitor to normalize financial coverage forward of its European counterpart, and looming developments within the Relative Power Index (RSI) could accompany an extra decline within the change charge if the indicator pushes into oversold territory for the primary time in 2022.

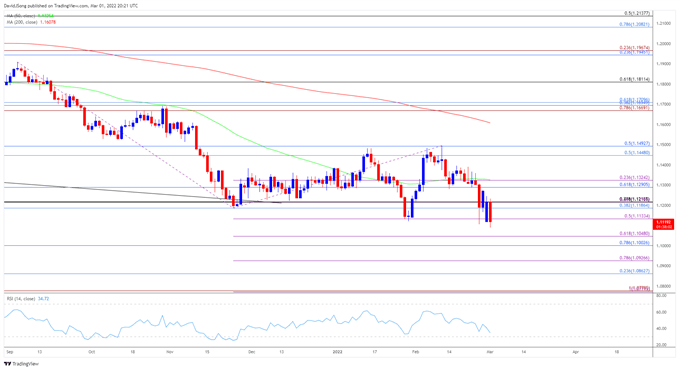

EUR/USD Fee Every day Chart

Supply: Buying and selling View

- The broader outlook for EUR/USD stays tilted to the draw back because the 200-Day SMA (1.1608) continues to mirror a detrimental slope, with the change charge clearing the June 2020 low (1.1101) because it fails to defend the opening vary for 2022.

- Looming developments within the Relative Power Index (RSI) could present the bearish momentum gathering tempo if the indicator slips beneath 30 to push into oversold territory for the primary time in 2022, with an in depth beneath the 1.1130 (50% growth) area bringing the Fibonacci overlap round 1.1000 (78.6% retracement) to 1.1050 (61.8% growth) on the radar.

- Subsequent space of curiosity is available in round 1.0860 (23.6% growth) to 1.0930 (78.6% growth) adopted by the 1.0770 (100% growth) to 1.0780 (100% growth) area, which largely traces up with the Could 2020 low (1.0767).

— Written by David Track, Foreign money Strategist

Comply with me on Twitter at @DavidJSong