EUR/USD FORECAST:

- EUR/USD fails to stay above the psychological 1.1000 stage and pulls again heading into the weekend, difficult trendline assist

- Disappointing financial knowledge within the Eurozone prompts merchants to trim publicity to the widespread forex

- This text appears to be like at main EUR/USD’s tech ranges to look at within the week forward

Really helpful by Diego Colman

Get Your Free EUR Forecast

Most Learn: Japanese Yen Outlook – USD/JPY Breaks Out however AUD/JPY Lacks Bullish Spark

EUR/USD rallied and briefly recaptured the psychological 1.1000 stage earlier within the week, however failed to carry on to its advance, ending the five-day interval a tender notice close to 1.0890 after a steep sell-off on Friday following poor Buying Managers’ Index knowledge in Europe.

Whereas the euro has been on a robust bullish run for the reason that begin of the month, particularly after the ECB lifted its inflation projections and signaled extra tightening for the forecast horizon, upward momentum is exhibiting some actual indicators of exhaustion, simply because the U.S. greenback begins to perk up once more.

Friday’s batch of disappointing EU statistics could also be accountable for the shift in sentiment. For context, manufacturing unit exercise deepened its droop in June, sinking to 43.6 from 44.8 in Might, hitting its lowest stage in 37 months, an indication that the manufacturing recession is intensifying.

EU ECONOMIC DATA AT A GLANCE

Supply: DailyFX Financial Calendar

The HCOB Flash Eurozone PMI additionally revealed that the providers sector softened considerably, falling from 55.1 to 52.4, effectively beneath the median estimate of 54.5. For interpretation, any determine above 50 signifies an enlargement of output, whereas values beneath that threshold denote a contraction.

Though no broad conclusions needs to be drawn from a single report, the deteriorating development atmosphere is worrisome and a possible supply of weak spot for the widespread forex. If demand circumstances don’t stabilize and enhance within the area quickly, the ECB will discover it troublesome to justify additional hikes, as a extra restrictive stance might set off a deeper downturn.

On this context, incoming financial experiences needs to be intently scrutinized, as they might make clear the outlook for financial coverage. That stated, the important thing releases that deserve consideration within the coming days would be the German Ifo enterprise local weather survey on Monday, German GfK client confidence on Tuesday, and Eurozone CPI outcomes on Friday.

Really helpful by Diego Colman

The right way to Commerce EUR/USD

EUR/USD TECHNICAL ANALYSIS

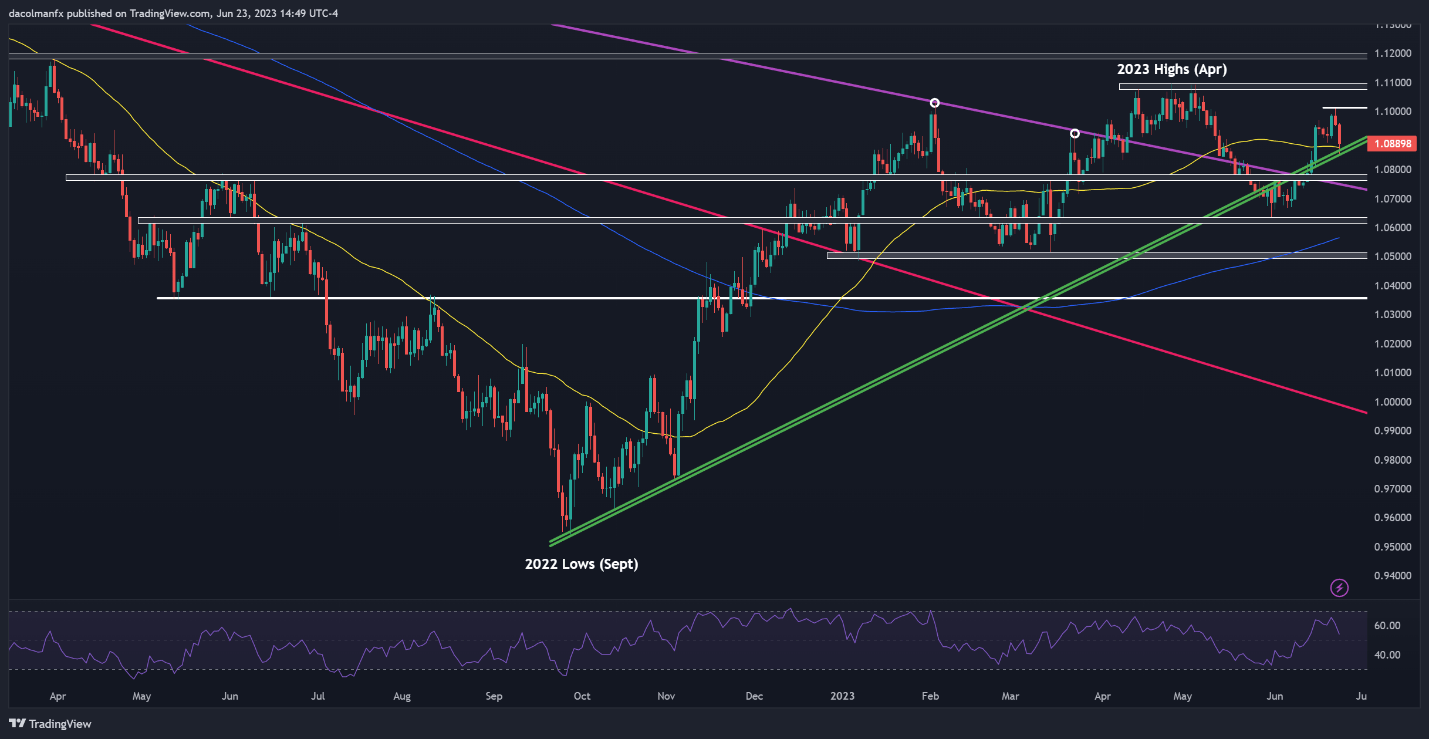

After reaching multi-week highs on Thursday, the EUR/USD has began to tug again, with the pair difficult its 50-day easy transferring common and a rising trendline close to 1.0865 heading into the weekend. Whereas near-term technicals stay constructive, the market bias might turn out to be much less constructive if the change price pierces the technical assist zone described above.

By way of potential situations, if EUR/USD drops beneath 1.0865 on a sustained foundation, sellers could achieve confidence to provoke an assault on 1.0780/1.0755. Costs could possibly set up a base round these ranges earlier than rebounding, however within the occasion of a breakdown, we might be taking a look at a potential retest of the Might lows.

Alternatively, if consumers return and spark a bullish turnaround, preliminary resistance seems on the psychological 1.1000 mark. Additional upside could also be in retailer on a push above this barrier, with the following goal situated across the 1.1100 space, adopted by 1.1190.

| Change in | Longs | Shorts | OI |

| Every day | 12% | -17% | -5% |

| Weekly | 21% | -20% | -4% |

EUR/USD TECHNICAL CHART

EUR/USD Technical Chart Ready Utilizing TradingView