EUR/USD Information and Evaluation

- ECB member favours a number of price cuts forward of the summer season

- EUR/USD flirts with acquainted zone of resistance

- Extra ECB audio system scheduled right this moment as occasion danger quietens down

- The evaluation on this article makes use of chart patterns and key assist and resistance ranges. For extra info go to our complete schooling library

Really useful by Richard Snow

How you can Commerce EUR/USD

ECB Member Favours A number of Price Cuts Forward of the Summer season

The Greek central financial institution head, Yannis Stournaras (dove) talked about in an interview this morning that there stays round 30% of previous tightening but to filter into the true economic system, stressing the necessity to transfer the needle on charges forward of the Fed.

The European economic system has stagnated since This fall 2024, with GDP progress oscillating round zero % whereas the US exhibits outstanding financial resilience. Due to this fact, there’s some logic behind the current name to ease financial coverage in an try to assist the ailing economic system.

Stournaras went so far as to advocate for 2 cuts earlier than the summer season break which suggests a complete of fifty foundation factors shaved off the present benchmark rate of interest. The ECB official warned in opposition to exaggerating the potential for a wage-price spiral as Christie Lagarde and different governing council members turned their deal with wage negotiations and the potential for increased wages including to inflation issues.

Rapid Market Response

EUR/USD dropped as Stournaras’ statements filtered appeared throughout buying and selling displays, however the pair managed to stabilise moments after.

EUR/USD 5-Minute Chart

Supply: TradingView, ready by Richard Snow

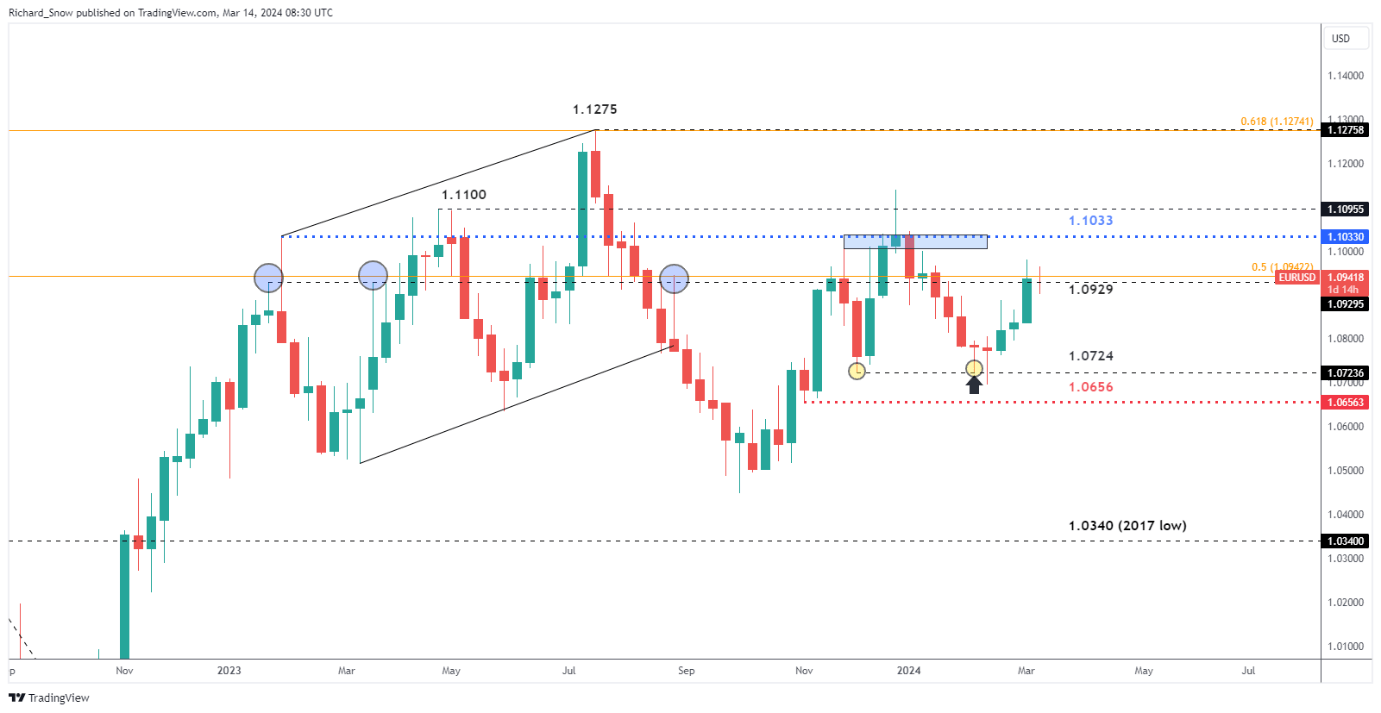

EUR/USD Flirts with Acquainted Zone of Resistance

The weekly EUR/USD chart exhibits the pair struggling for bullish momentum across the 1.0930/1.0940 zone that had despatched costs decrease on a number of events in 2023. This week is somewhat gentle so far as the financial calendar is worried which means consolidation round present ranges might proceed. Notable US information consists of PPI and retail gross sales later right this moment with tomorrow’s College of Michigan shopper sentiment survey in a position to present restricted volatility into the tip of the week relying on whether or not inflation expectations are a lot modified.

EUR/USD Weekly Chart

Supply: TradingView, ready by Richard Snow

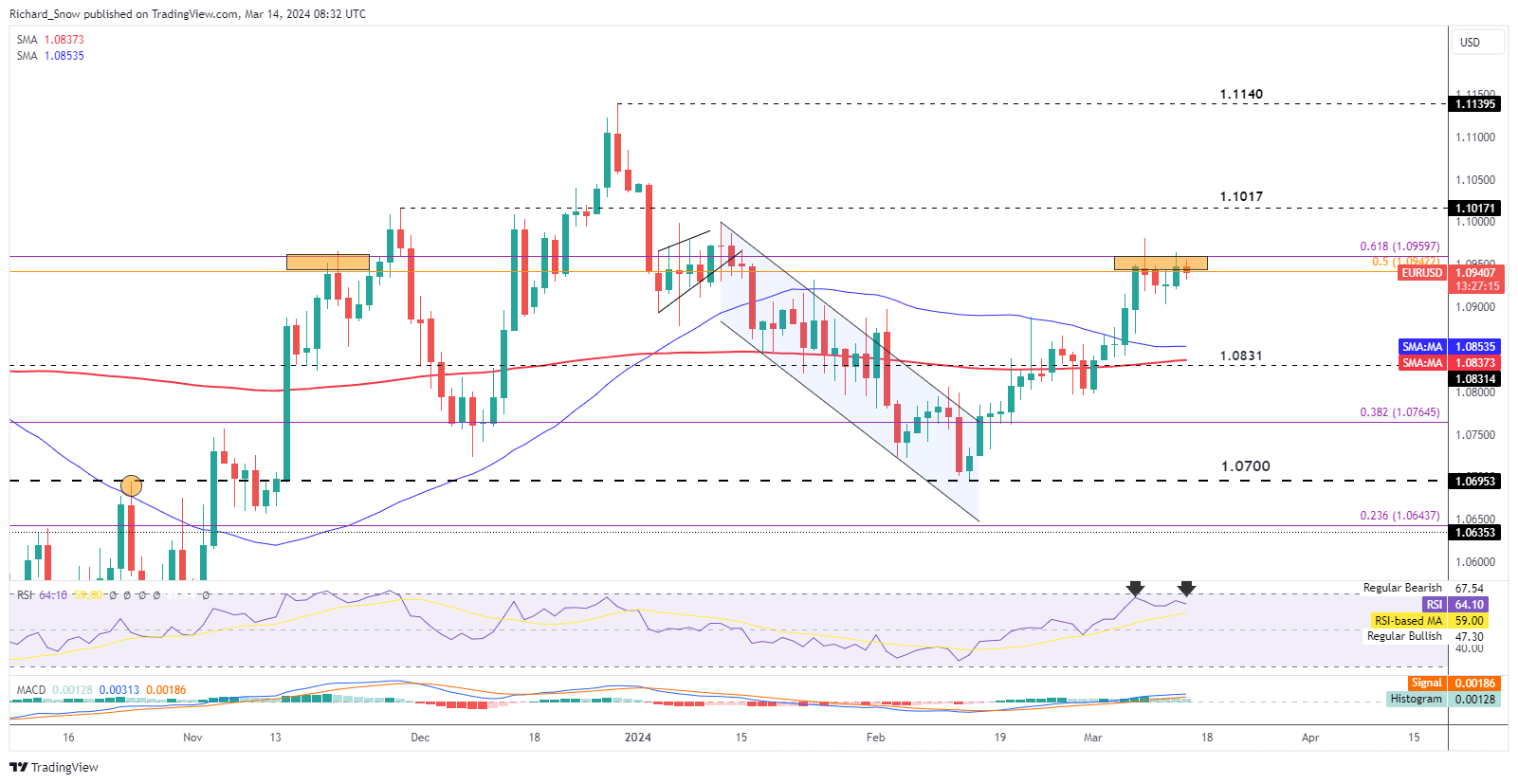

The every day chart highlights the resistance zone as the realm between the 2 Fibonacci retracements that are made up of the 2020 to 2022 main decline and the 2023 decline. The degrees of curiosity correspond to the 50% and 61.8% retracements of the respective, implied Fibonacci projections.

Worth motion stays above the 50 and 200-day easy shifting averages (SMAs) – which is often bullish. Nevertheless, value momentum seems to be stalling and the 50 SMA reveals as a lot, dropping decrease in direction of the 200 SMA. Ought to the bullish transfer proceed, a break above 1.0960 might be required with subsequent momentum, eying 1.1017.

EUR/USD Every day Chart

Supply: TradingView, ready by Richard Snow

Keep updated with the newest market strikes and themes driving value motion by signing as much as our weekly e-newsletter:

Commerce Smarter – Join the DailyFX E-newsletter

Obtain well timed and compelling market commentary from the DailyFX group

Subscribe to E-newsletter

Hold an eye fixed out for any additional assist of this view as quite a lot of different governing council members are due to offer their ideas on financial coverage later right this moment.

Customise and filter reside financial information by way of our DailyFX financial calendar

— Written by Richard Snow for DailyFX.com

Contact and comply with Richard on Twitter: @RichardSnowFX