[ad_1]

EUR/USD AND GBP/USD FORECAST:

- EUR/USD pivots decrease and resumes its decline after failing to interrupt above a key technical resistance space

- GBP/USD seems to shut to validating a double prime bearish sample

- The surge in U.S. Treasury yields is boosting volatility within the FX house, creating fascinating buying and selling setups

Beneficial by Diego Colman

Get Your Free EUR Forecast

Most Learn: US Greenback Soars Lifted by Surging Yields, S&P 500 Falls Regardless of VIX’s Slide

The surge in U.S. Treasury yields over the previous a number of days has fueled volatility within the FX market, creating fascinating buying and selling set-ups in a number of foreign money pairs, together with EUR/USD, GBP/USD and USD/JPY. This text will discover engaging value motion configurations that merchants ought to regulate over the approaching days and weeks.

EUR/USD TECHNICAL ANALYSIS

After failing to clear resistance within the 1.0690/1.0700 space earlier this week, EUR/USD has resumed its descent, breaking down one assist after one other, with bearish stress accelerating on Thursday. If sellers retain management of the market, the subsequent technical ground to contemplate is situated close to 1.0565, adopted by 1.0535. On additional weak point, the main target shifts to January’s low printed at 1.0480.

On the flip facet, if bulls regain the higher hand, which appears unlikely at the moment given the U.S. greenback bullish momentum, preliminary resistance be discovered simply above the psychological 1.0600 stage. After that, the subsequent area of curiosity lies at 1.0650/1.0660.

EUR/USD TECHNICAL CHART

EUR/USD Technical Chart Ready Utilizing TradingView

Associated Studying: USD/JPY Retains Bullish Outlook, Fundamentals Undermine the Japanese Yen

Beneficial by Diego Colman

Get Your Free GBP Forecast

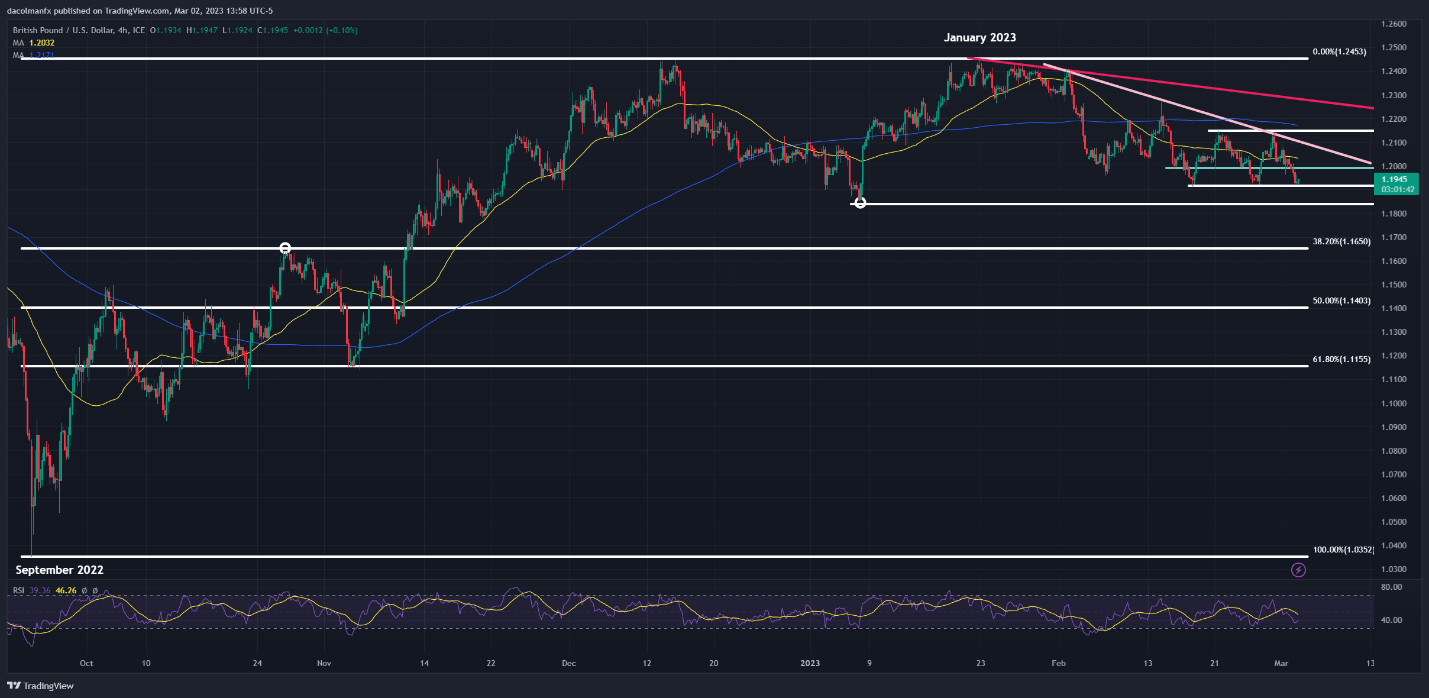

GBP/USD TECHNICAL ANALYSIS

Over the previous a number of weeks, GBP/USD has been carving out a double prime formation, a bearish setup composed of two peaks of comparable peak, divided by an intermediate melancholy seen because the sample’s assist. If that ground is taken out, which within the case of GBP/USD is situated at 1.1920, the double prime can be validated, creating the technical situations for a pullback in the direction of 1.1840, adopted by 1.1650, the 38.2% Fibonacci retracement of the September 2022/January 2023 advance.

Alternatively, if patrons defend the value zone of 1.1920 and spark a bullish comeback, preliminary resistance lies at 1.1990 and 1.2090 thereafter. Above that, the sample’s two crests close to 1.2150 will come into play.

GBP/USD TECHNICAL CHART

GBP/USD Chart Created Utilizing TradingView

Written by Diego Colman, Contributing Strategist for DailyFX

[ad_2]

Source link