Since Donald Trump was elected US President, has not proven such a transparent development—this time in the other way of November. The present outlook suggests additional upward motion as issues a couple of US recession develop, weakening the .

Regardless of by the European Central Financial institution and no motion from the , the euro is strengthening in opposition to the US greenback. This week, US on Wednesday shall be necessary. If forecasts are appropriate, it would verify a slowdown within the year-over-year rise in CPI since final October.

Market Focus Shifts to Potential US Recession

Current weeks have highlighted the US financial system’s key function in international markets. Rising fears of a commerce struggle are reviving recession issues, mirrored within the US greenback’s decline final week. If the financial system slows considerably, the Fed will possible pace up charge cuts—one thing buyers are already factoring in. Market expectations now recommend the subsequent Fed may occur in Could as a substitute of September.

Determine 1: Chance of the extent of US rates of interest in Could

Subsequently, now we have an uncommon scenario during which the EUR/USD foreign money pair is rising even supposing the ECB is slicing rates of interest and never the Fed. Nonetheless, it needs to be remembered that the latest determination of the Governing Council was already discounted by the market, whereas the market is now pricing a doable change within the conduct of the Fed’s management within the coming months.

US Labor Market Knowledge Falls Barely In need of Expectations

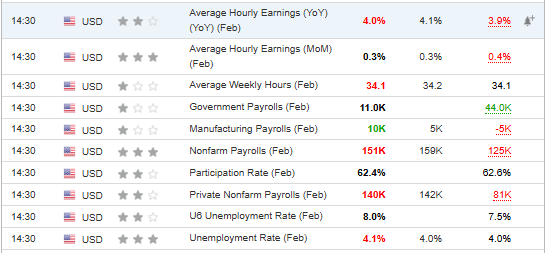

As standard, the primary Friday of the month introduced , which got here in barely beneath expectations.

Determine 2: US labor market knowledge

Given the slight deviation from forecasts, the information had a restricted impression in the marketplace, however one should additionally preserve behind one’s thoughts the context of the tariff struggle and its impression on the US financial system. If the subsequent few months point out the start of a broader unfavourable development then the strain on the Fed shall be rising, which ought to proceed to weaken the US greenback.

Is the EUR/USD Rally Coming to an Finish?

The sturdy rise in EUR/USD has slowed round $1.09, the place a key resistance zone from final November is positioned. Nonetheless, with minimal promoting strain and a robust bullish response in yesterday’s session, the outlook nonetheless favors additional upward motion.

Determine 3: Technical evaluation of EUR/USD

If the breakout happens, the subsequent goal for patrons would be the resistance close to the important thing 1.10 stage. These in search of a greater entry level could look ahead to help ranges beneath 1.07, round 1.0640 and 1.0530 per euro.

****

Disclaimer: This text is written for informational functions solely. It isn’t meant to encourage the acquisition of property in any means, nor does it represent a solicitation, supply, advice or suggestion to speculate. I wish to remind you that every one property are evaluated from a number of views and are extremely dangerous, so any funding determination and the related threat belongs to the investor. We additionally don’t present any funding advisory companies.