Euro ZEW Economic Sentiment Key Points:

- EU ZEW Economic Sentiment Index: Actual -59.7 vs -60.7 September.

- German ZEW Economic Sentiment Index: Actual -59.2 vs -61.9 September.

- ZEW Current Conditions Hint that the Downturn has Already Become a Reality.

Recommended by Zain Vawda

Get Your Free EUR Forecast

The ZEW Economic Sentiment Index in the Euro Area improved slightly to -59.7 in October from -60.7 September, while Europe’s most industrialized economy saw a rise in investor morale. The Indicator of Economic Sentiment for Germany rose to -59.2 in October 2022 from the previous month’s 14-year low of -61.9 while the current conditions subindex slumped to -72.2 from -60.5.

Following the most recent CPI print the European Central Bank (ECB) remains hamstrung in terms of options. Today’s improving ZEW numbers may serve to strengthen the ECBs case for a continuation of rate hikes toward its 2% target. The fear is that in doing so the central bank runs the risk of pushing the economy back into the doldrums with recessionary signs visible in the declining ZEW current conditions print. On the flip side, lack of action by the central bank could see the Euro lose further ground against the greenback.

Customize and filter live economic data via our DailyFX economic calendar

The ZEW Economic Sentiment figure is an aggregation of institutional investors and analysts’ six-month projections of the economy and functions as a reputable leading indicator. The data carries a lot of weight in the industry as the forecasts of future financial conditions are carried out by highly informed individuals by virtue of their jobs.

Today’s data print and tomorrow’s final CPI release will be key as the ECB enters its pre-meeting blackout period on Thursday. Markets are pricing in a 90% probability of a further 75bp hike at next week’s meeting as the central bank strives for its 2% target. Later in the day we will hear from ECB policymaker Isabel Schnabel who is expected to continue the rhetoric of rate hikes despite the fragility present in Eurozone economies.

Market reaction

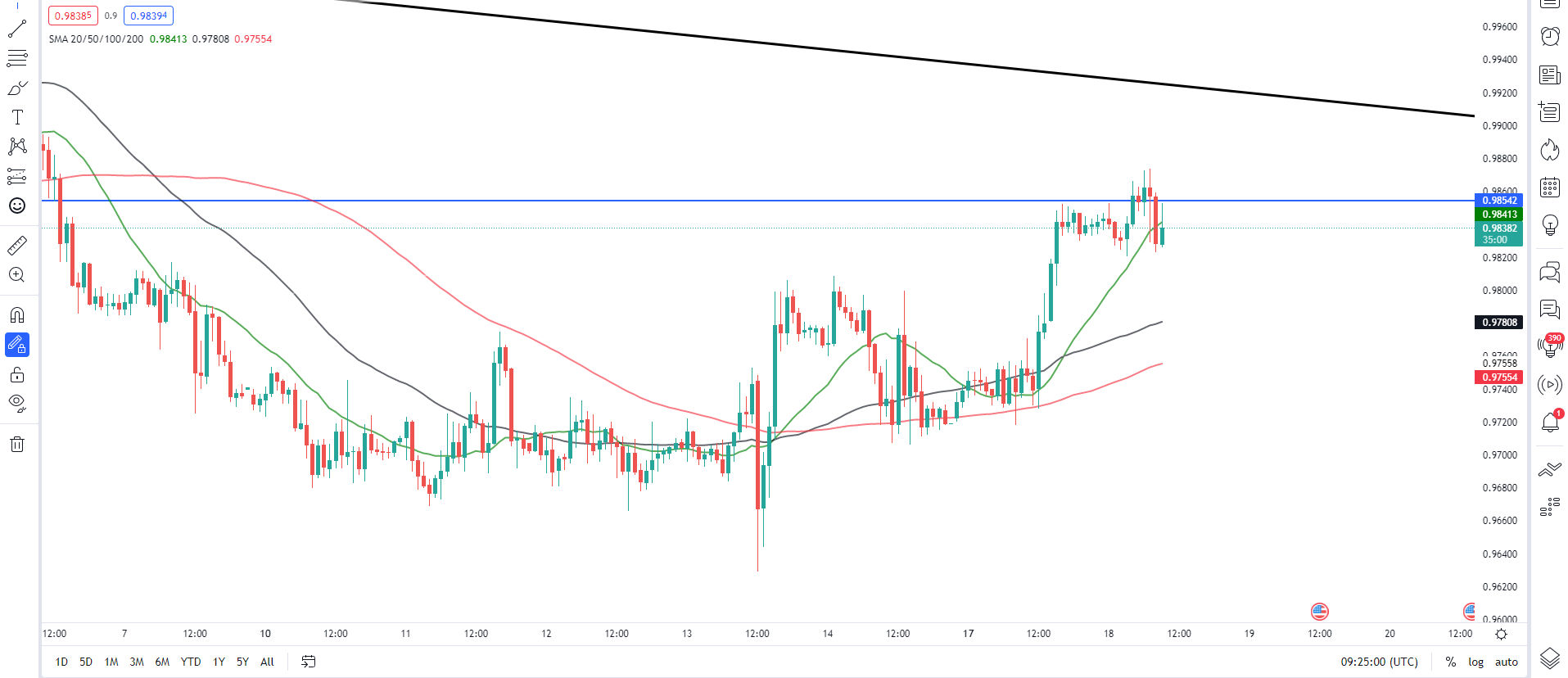

EUR/USD 1H Chart

Source: TradingView, prepared by Zain Vawda

Initial reaction saw the pair jump 20 pips higher. Following yesterday’s rally the pair has declined 30-odd pips in European trade prior to the data release with 1H price action hinting at a deeper pullback

If the price remains belong the long term trendline resting around the 0.9900 area as well as parity, the bearish downtrend remains intact. Bears may look at rallies as a potential opportunity for better positioning. A sustained break of parity may bring the bearish trend into question depending on the hiking cycles employed by both the Federal Reserve and the ECB.

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

Key Intraday Levels Worth Watching:

Support Areas

Resistance Areas

| Change in | Longs | Shorts | OI |

| Daily | -6% | 20% | 4% |

| Weekly | -10% | 7% | -3% |

— Written by Zain Vawda for DailyFX.com

Contact and follow Zain on Twitter: @zvawda