EURO FORECAST:

- The Fed is predicted to lift charges by 25 foundation factors on Wednesday

- The ECB will unveil its financial coverage announcement on Thursday, adopted by the Financial institution of Japan on Friday

- This text appears at EUR/USD and EUR/JPY’s key tech ranges to look at over the approaching buying and selling periods

Beneficial by Diego Colman

Get Your Free EUR Forecast

Most Learn: Japanese Yen Forecast – USD/JPY Fumbles Forward of Fed and Financial institution of Japan Determination

Three of the world’s most essential central banks will announce their financial coverage choices this week. The Federal Reserve would be the first to take action on Wednesday, adopted by the ECB on Thursday and the Financial institution of Japan on Friday. In opposition to this backdrop, the U.S. greenback, euro, and Japanese yen are more likely to expertise elevated volatility, which might create engaging buying and selling setups, but in addition carry extra dangers.

Focusing first on the Federal Reserve, the rate-setting committee is forecast to lift borrowing prices by 25 foundation factors to five.25%-5.50% after a quick pause. This transfer is already absolutely discounted, so traders will focus totally on the coverage outlook for clues concerning the normalization marketing campaign.

If Powell maintains an aggressive stance as a part of a method to stop monetary situations from easing considerably and to protect optionality in case inflationary pressures reaccelerate later this 12 months to the purpose the place extra tightening is critical, rate of interest expectations might drift larger, boosting the U.S. greenback. This state of affairs might weigh on EUR/USD.

Euro Forecast – EUR/USD and EUR/GBP’s Path Tied to Fed and ECB Coverage Outlook

As for the European Central Financial institution, the establishment spearheaded by Christine Lagarde can also be seen delivering a quarter-point fee rise, however its steerage is unlikely to be hawkish. In reality, it’s potential that the financial institution will chorus from committing to additional tightening, given the rising dangers of an financial downturn within the Euro Space, opting as a substitute for a data-dependent strategy.

If Lagarde embraces a conciliatory message and exhibits reluctance to elevate charges once more in September, merchants might rapidly reprice decrease the mountaineering path, creating headwinds for the euro. This might imply a pointy pullback within the EUR/USD and EUR/JPY.

Lastly, the Financial institution of Japan is predicted to carry its present coverage settings unchanged. Nonetheless, there’s a small probability that policymakers might vote to regulate the yield curve management program in a context of steadily rising inflation. Ought to the latter state of affairs happen, the Japanese yen might stage a robust comeback in forex markets, reversing a few of its earlier losses in opposition to the U.S. greenback and the euro

| Change in | Longs | Shorts | OI |

| Day by day | 20% | -7% | 2% |

| Weekly | 51% | -28% | -9% |

EUR/USD TECHNICAL ANALYSIS

After Monday’s pullback, EUR/USD slipped under technical assist at 1.1080. If this breakdown is sustained within the coming days, we might see a transfer in the direction of the psychological 1.1000. On additional weak spot, the main focus shifts decrease to 1.0950, adopted by 1.0840. In distinction, if EUR/USD resumes its restoration, preliminary resistance seems at 1.1180, and 1.1275 thereafter. If each ceilings are taken out, patrons might launch an assault on 1.1375.

EUR/USD TECHNICAL CHART

EUR/USD Chart Ready Utilizing TradingView

| Change in | Longs | Shorts | OI |

| Day by day | 64% | 0% | 11% |

| Weekly | -5% | 5% | 2% |

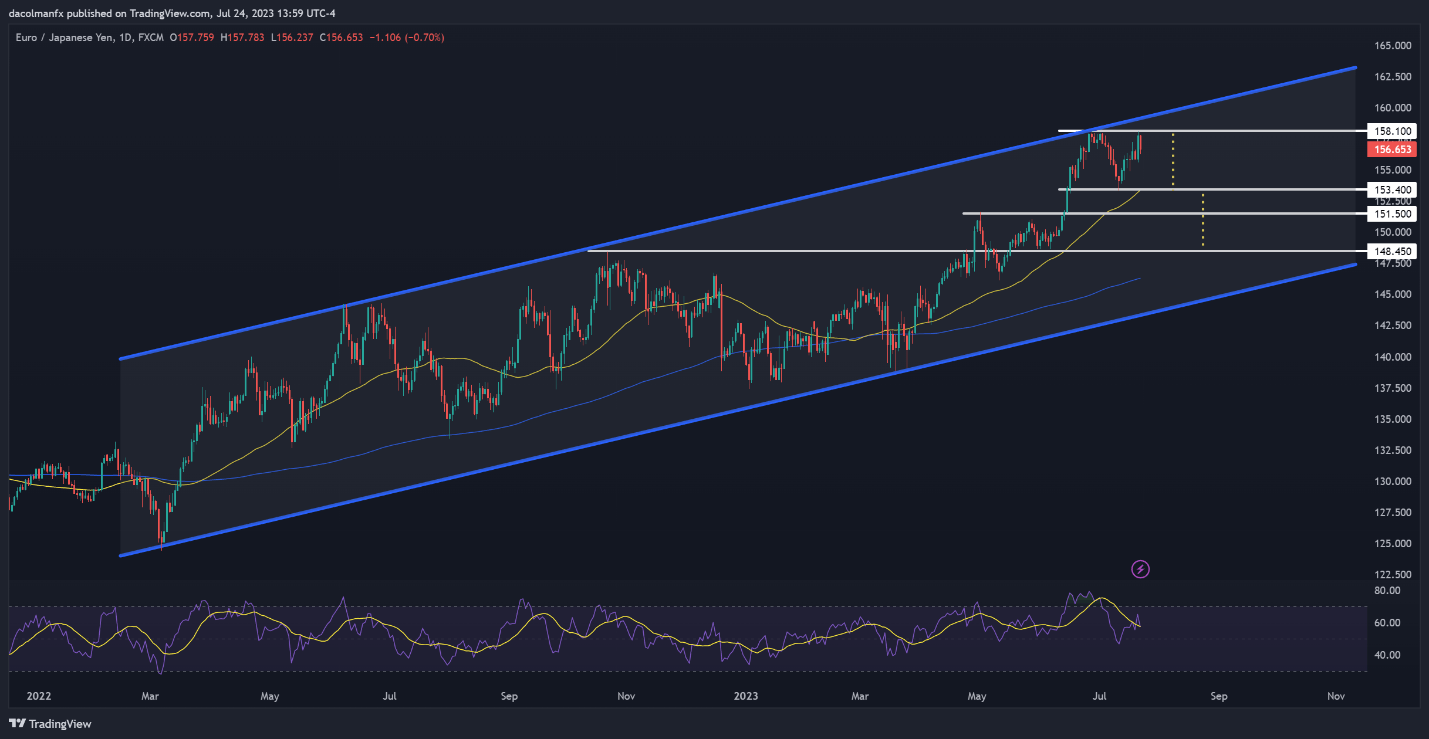

EUR/JPY TECHNICAL ANALYSIS

EUR/JPY rallied late final week and retested its multi-year highs, however failed clear this peak, with costs slipping on Monday following a rejection from technical resistance. It’s too quickly to say, however the pair seems to be creating a double-top, a bearish reversal sample that usually kinds within the context of an prolonged transfer larger.

If costs prolong their slide, preliminary assist seems at 153.40. If this flooring is taken out, the double high can be confirmed, setting the stage for a drop towards 151.50, adopted by 148.45. Conversely, if patrons retake management of the market and set off a bullish turnaround, the primary resistance to think about is positioned at 158.10, and 159.25 thereafter.

EUR/JPY TECHNICAL CHART

EUR/JPY Chart Ready Utilizing TradingView

Commerce Smarter – Join the DailyFX Publication

Obtain well timed and compelling market commentary from the DailyFX staff

Subscribe to Publication