[ad_1]

POUND STERLING ANALYSIS & TALKING POINTS

- UK inflation soars after vitality inputs proceed to harm customers.

- Chancellor Jeremy Hunt Autumn Assertion in focus tomorrow.

- Pound falls post-CPI.

Commerce Smarter – Join the DailyFX E-newsletter

Obtain well timed and compelling market commentary from the DailyFX staff

Subscribe to E-newsletter

GBP/USD FUNDAMENTAL BACKDROP

The UK inflation report this morning beat estimates on virtually all metrics (see financial calendar beneath) with the headline learn printing decade highs. Based on the Workplace for Nationwide Statistics (ONS), the primary contributors to the ultimate inflation statistics have been electrical energy, gasoline and meals costs despite the Vitality Value Assure. With vitality and meals prices impacting important items, low and center earnings households shall be negatively influenced attributable to a bigger portion of their spending going in the direction of important items.

GBP/USD ECONOMIC CALENDAR

Supply: DailyFX Financial Calendar

Shortly after the CPI report, UK Chancellor Hunt launched an announcement highlighting the necessity to make troublesome choice to quell inflationary pressures and help the Financial institution of England’s (BoE) of their task. Markets will know sit up for Thursdays Autumn Assertion with nice anticipation contemplating the decline within the UK labor market because of illness and immigration. With the winter months and recessionary fears looming, the UK authorities and BoE has a tricky process forward.

Advisable by Warren Venketas

Get Your Free GBP Forecast

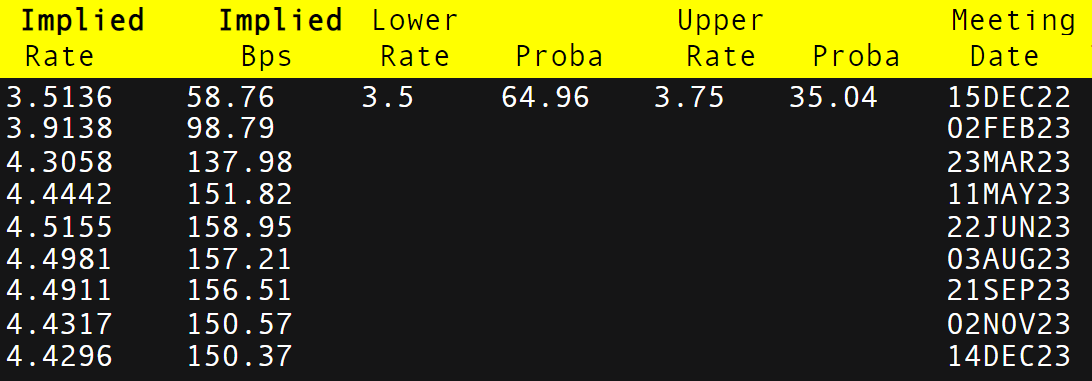

present cash market pricing for the December assembly beneath, 59bps is proven which does depart room for both a 50bps or 75bps rate of interest hike as an choice. I are likely to favor a 50bps increment beneath the present circumstance however there may be nonetheless extra knowledge factors forward of the assembly on December fifteenth.

BOE INTEREST RATE PROBABILITIES

Supply: Refinitiv

TECHNICAL ANALYSIS

GBP/USD DAILY CHART

Chart ready by Warren Venketas, IG

Day by day GBP/USD value motion noticed an rejection on the 1.2000 psychological deal with yesterday put up U.S. PPI and considerations round Russia doubtlessly bombing Poland (NATO member). This has since offered as an extended higher wick exposing a subsequent transfer decrease. The response to the UK CPI launch has been surprisingly detrimental for the pound however regardless of a weaker buck however ought to mirror extra precisely as European markets come on-line.

Key resistance ranges:

Key help ranges:

Introduction to Technical Evaluation

Candlestick Patterns

Advisable by Warren Venketas

MIXED IG CLIENT SENTIMENT

IG Consumer Sentiment Information (IGCS) reveals retail merchants are at present SHORT on GBP/USD, with 54% of merchants at present holding lengthy positions (as of this writing). At DailyFX we sometimes take a contrarian view to crowd sentiment however attributable to current modifications in lengthy and quick positioning, we arrive at a cautious bias.

Contact and followWarrenon Twitter:@WVenketas

[ad_2]

Source link