EUR/USD ANALYSIS

- ECB revisions assist bolster bullish market response.

- US retail gross sales unable to discourage EUR.

- Euro rallies to ranges final seen in mid-Might.

Beneficial by Warren Venketas

Get Your Free EUR Forecast

EURO FUNDAMENTAL BACKDROP

The euro has pushed increased on the European Central Financial institution (ECB) announcement to hike rates of interest by 25bps as anticipated (see financial calendar under). The stronger euro comes by way of increased revised projections for inflation regardless of decreasing financial progress estimates. The common inflation and GDP revisions are as follows:

- 2023 = 5.4%; 2024 = 3.0%; 2025 = 2.2% – HEADLINE INFLATION

- 2023 = 5.1%; 2024 = 3.0%; 2025 = 2.3% – CORE INFLATION

- 2023 = 0.9%; 2024 = 1.5%; 2025 = 1.6% – ECONOMIC GROWTH

Taking these projections into consideration, the ECB could possibly be forecasting the area to hit its 2% goal submit 2025 which can be farfetched contemplating latest readings have been on the decline (albeit slower than the popular charge of decline). World charge hikes have proven there’s a lagged impact on the general economic system and may even see extra important outcomes faster than anticipated.

Commerce Smarter – Join the DailyFX E-newsletter

Obtain well timed and compelling market commentary from the DailyFX crew

Subscribe to E-newsletter

EUR/USD ECONOMIC CALENDAR (GMT +02:00)

Supply: DailyFX financial calendar

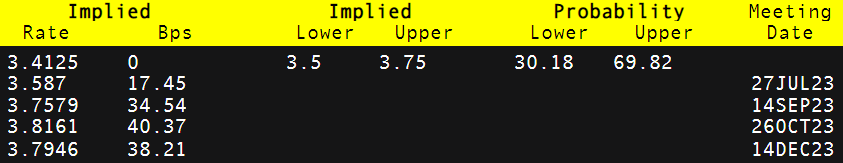

Apparently cash markets (check with desk under), have ‘dovishly’ repriced their expectations for 2023 down from over 60bps of cumulative charge hikes to 40bps. This could possibly be because of the decrease financial progress projections that could possibly be heightening recessionary fears within the eurozone whereas taking into consideration the areas declining manufacturing statistics.

ECB INTEREST RATE PROBABILITIES

Supply: Refinitiv

TECHNICAL ANALYSIS

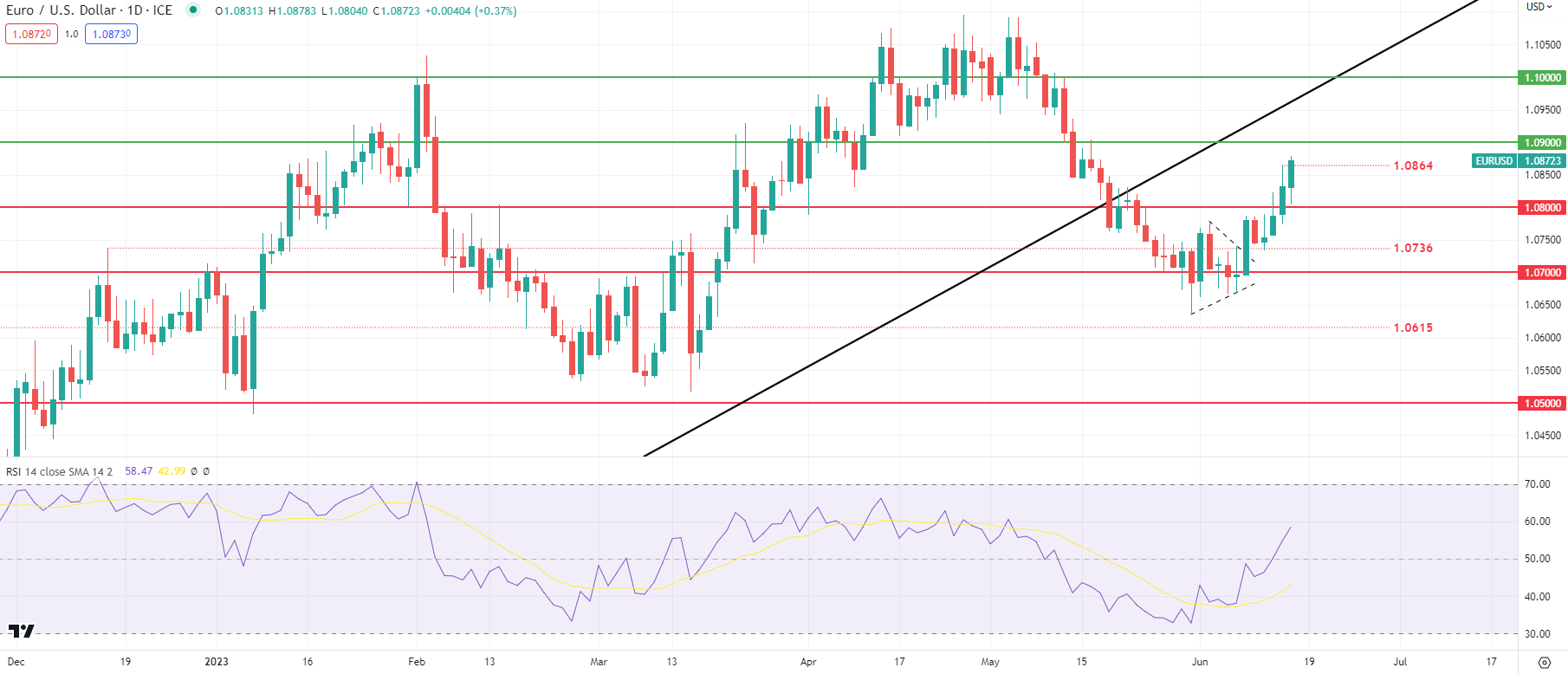

EUR/USD DAILY CHART

Chart ready by Warren Venketas, IG

Day by day EUR/USD worth motion exhibits the markets bullish response to the information regardless of the higher than anticipated US retail gross sales report which included a beat on preliminary jobless claims. With no additional excessive impression knowledge scheduled for right now, will probably be attention-grabbing to see whether or not or not these ranges can maintain all through the US buying and selling session.

Resistance ranges:

Assist ranges:

IG CLIENT SENTIMENT DATA: BULLISH

IGCS exhibits retail merchants are presently LONG on EUR/USD, with 52% of merchants presently holding lengthy positions (as of this writing). At DailyFX we sometimes take a contrarian view to crowd sentiment however because of latest adjustments in lengthy and quick positioning we arrive at a short-term upside bias.

Contact and followWarrenon Twitter:@WVenketas