[ad_1]

Markets are torn. Will the ECB hike this week or not? We expect it can, however we have a look at how totally different situations can affect charges and FX. Even in our base case, we suspect that convincing markets that this isn’t the height can be very laborious, and dovish dissenters might get in the best way. The upside for EUR charges and the might not be that massive and above all, fairly short-lived

As mentioned in our economics staff’s European Central Financial institution assembly preview, we narrowly favor a price hike this week. The consensus of economists is barely tilted in direction of a maintain, and markets additionally see a higher probability of no change (60%). Within the chart above, we analyze 4 totally different situations, together with our base case, and the projected affect on EUR/USD and 10-year bunds.

We anticipate to see a extra fragmented than common Governing Council at this assembly. Whichever course the ECB decides to take, the talk will probably be fiercer than in earlier conferences, as lingering core inflationary strain is being counterbalanced by proof of quickly worsening financial situations within the euro space. Accordingly, anticipate the general messaging by the ECB to be influenced not solely by the written communication but in addition by: a) how a lot President Christine Lagarde manages to hide rising division and disharmony inside the Governing Council through the press convention and; b) any post-meeting “leaks” to the media, which might be utilized by dissenters to affect the market affect.

Charges: Easy methods to Convey a Hawkish Message Towards Macro Headwinds

A subdued macro outlook is retaining a lid on ECB hike expectations and this has led to actual rates of interest, a measure of how the market perceives the ECB’s coverage stance, dropping significantly since July. In actual fact, because the ECB’s Isabel Schnabel identified lately, the extent of actual rates of interest out the curve has fallen to ranges that additionally prevailed on the ECB assembly in February, if not even decrease.

With the ECB preaching information dependency, it has curbed its potential to make credible commitments with regard to the speed outlook, regardless of its pledge to maintain insurance policies sufficiently restrictive to realize its inflation targets.

Because of this we see the stability of dangers nonetheless tilted to a hike this week – actions communicate louder than phrases. The market is attaching solely a 40% chance to a hike, highlighting some potential to shock the market. However the market does see an general chance for a hike at 70% earlier than year-end, which suggests a lot of the repricing might simply be pulling ahead future hike expectations, however not essentially embracing additional tightening on prime of that. In any case, the macro story has not modified and even within the ECB’s personal deliberations this week, the weakening backdrop might acquire a higher weight.

Markets might sense that that is the probably finish of the mountain climbing cycle. Nonetheless, the ECB might need to counter the notion that that is the top of its general inflation-fighting endeavors. The diploma to which that is profitable will decide how a lot of a curve bear-flattering we get within the occasion of a hike. A renewed concentrate on quantitative tightening might assist to prop up longer charges on a relative foundation. Different technique of tightening, akin to adjusting the minimal reserve ratios (some ECB members akin to Bundesbank President Joachim Nagel see room for motion right here) would most likely have much less affect on longer charges.

ECB Could Be a Lifeline, Not a Trampoline, for EUR/USD

September’s ECB assembly can be a binary danger occasion for the euro. Our baseline state of affairs sees a price hike, which might translate right into a stronger euro within the aftermath of the announcement, as market pricing is leaning in favor of a maintain. However with EUR/USD has been on a gentle bearish path for the reason that 1.12 July peak, the actual query is whether or not a hike would invert the development. The quick reply might be not, however there are some vital issues to make.

Initially, it’s price explaining why we expect the FX affect of an ECB hike can be short-lived. One key cause is pricing: markets have doubted the power of the ECB to hike this week (9bp priced in), however are nonetheless factoring in a complete of 17bp of tightening to the height by year-end. Arguably, the ECB hawks gained’t have a lot curiosity in delivering one hike this week and putting a dovish tone, because the efficient tightening by way of charges can be restricted, so they need to accompany a hike with openness to do extra. Nonetheless, with financial situations deteriorating quick within the eurozone and dovish dissent inside the ECB rising, it will likely be laborious to persuade markets to cost in any extra tightening.

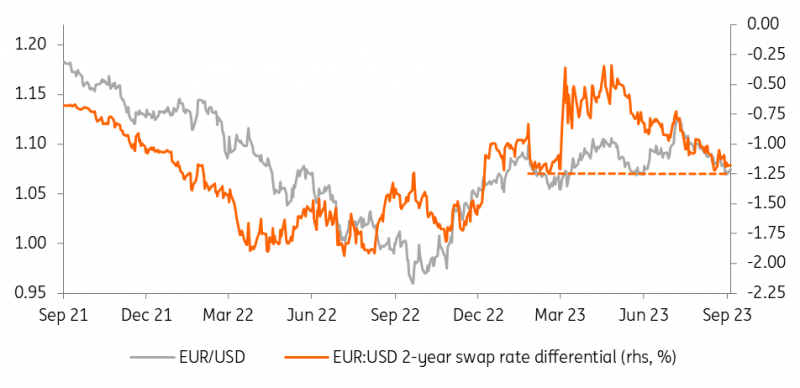

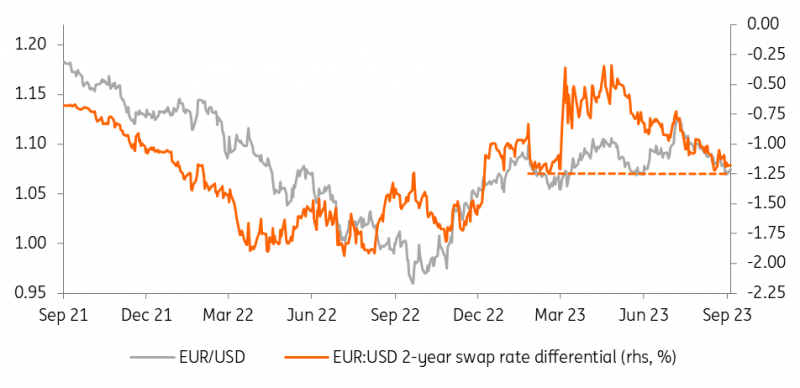

After we have a look at the 2-year swap price unfold between the euro and the greenback, an vital driver of foreign money fluctuations, we will inform that it has lately approached the -125bp assist degree (5 central financial institution “lengths” between the Federal Reserve and ECB). Let’s do not forget that the swap price tells us the anticipated common price for the subsequent two years, so contains expectations for the ultimate strikes within the tightening cycle (if any) and price cuts. What has actually pushed the latest widening of the unfold in favour of the greenback has not been any repricing larger in Fed price hike expectations, however a downsizing of easing bets within the US for subsequent yr.

EUR/USD and Brief-Time period Swap Unfold

EUR/USD vs Brief Time period Swap Unfold

EUR/USD vs Brief Time period Swap Unfold

With price hike cycles coming to an finish, swap charges are more and more delicate to expectations in regards to the timing and tempo of easing cycles. These expectations are, nevertheless, far much less controllable by central financial institution communication, and rather more depending on information.

However can the ECB at the least present indicators of a united hawkish entrance and convincingly push again towards price minimize hypothesis? (The primary ECB minimize is priced in for July 2024). If it may possibly, then you have got a trampoline for a sustainable EUR/USD rebound, in any other case – and we actually suppose this would be the case – the very best President Lagarde can do for the euro is to supply a lifeline.

A method the ECB might, nevertheless, find yourself having a longer-lasting FX affect is by way of an acceleration in quantitative tightening. Nonetheless, that clearly comes with non-negligible dangers to peripheral spreads, and policymakers might need to tread fairly fastidiously in that sense.

After the short-term affect, EUR/USD ought to revert to being pushed primarily by the leg, or in different phrases by Fed price expectations and US information. We nonetheless anticipate a flip larger within the pair, however persistence is the secret for EUR/USD bulls like us, and extra draw back corrections even after a possible ECB hawkish shock are a really tangible danger.

Disclaimer: This publication has been ready by ING solely for info functions no matter a specific person’s means, monetary scenario or funding goals. The knowledge doesn’t represent funding advice, and neither is it funding, authorized or tax recommendation or a suggestion or solicitation to buy or promote any monetary instrument. Learn extra

Authentic Put up

[ad_2]

Source link