[ad_1]

Gold, Silver Evaluation

Gold costs ease after diplomatic efforts permit for momentary de-escalation

An settlement was reached that will see support flowing to these affected in Gaza and two Israeli hostages made their method again residence. This and different ongoing conversations might lead to a momentary respite in what has in any other case been a frantic struggle with the potential to spillover right into a regional battle.

After all, the combating is predicted to proceed however Israel could also be open to delay its floor offensive for the secure return of extra hostages. That is in distinction to what we’ve got witnessed for the reason that begin of the battle earlier on this month as rockets from either side with regularity.

Really useful by Richard Snow

Get Your Free Gold Forecast

Subsequently, the gold market has taken this a chance to take some threat off the desk and reassess the subsequent transfer. Panic shopping for of the secure haven steel led gold larger, solely displaying a lack of momentum across the $1985 stage. Nonetheless, the probabilities of an prolonged pullback seem unlikely with the struggle removed from over. $1937 seems as potential assist for the pullback and a immediate bid larger might see $1985 come into focus in a short time within the occasion tensions warmth up once more.

Gold Day by day Chart

Supply: TradingView, ready by Richard Snow

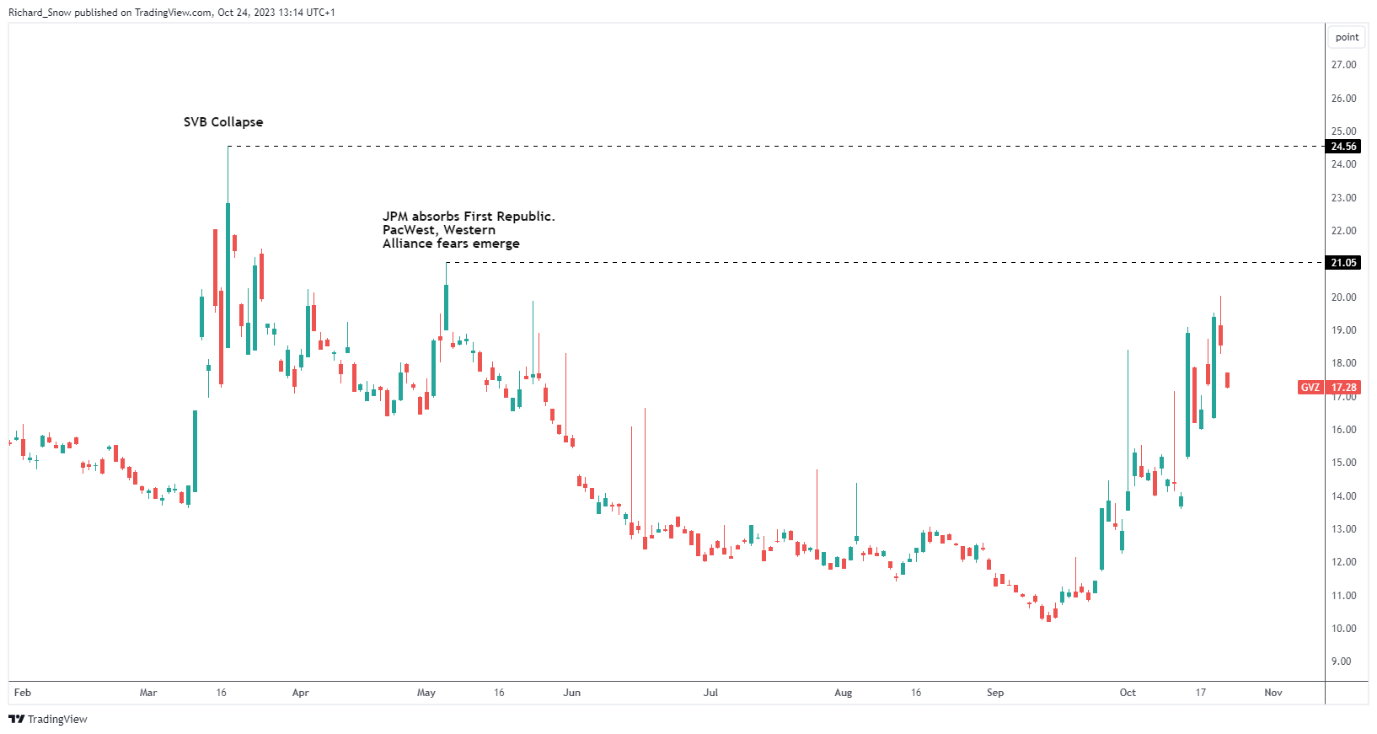

The 30-day anticipated gold volatility index (GVZ) has escalated in direction of ranges not seen for the reason that SVB demise and the return of regional banking turmoil in March and Could this 12 months. Such a surge in anticipated volatility suggests gold is prone to stay effectively supported as GVZ tends to rise extra when gold costs speed up.

Gold Volatility Index (GVZ)

Supply: TradingView, ready by Richard Snow

In search of actionable buying and selling concepts? Obtain our high buying and selling alternatives information filled with insightful suggestions for the fourth quarter!

Really useful by Richard Snow

Get Your Free Prime Buying and selling Alternatives Forecast

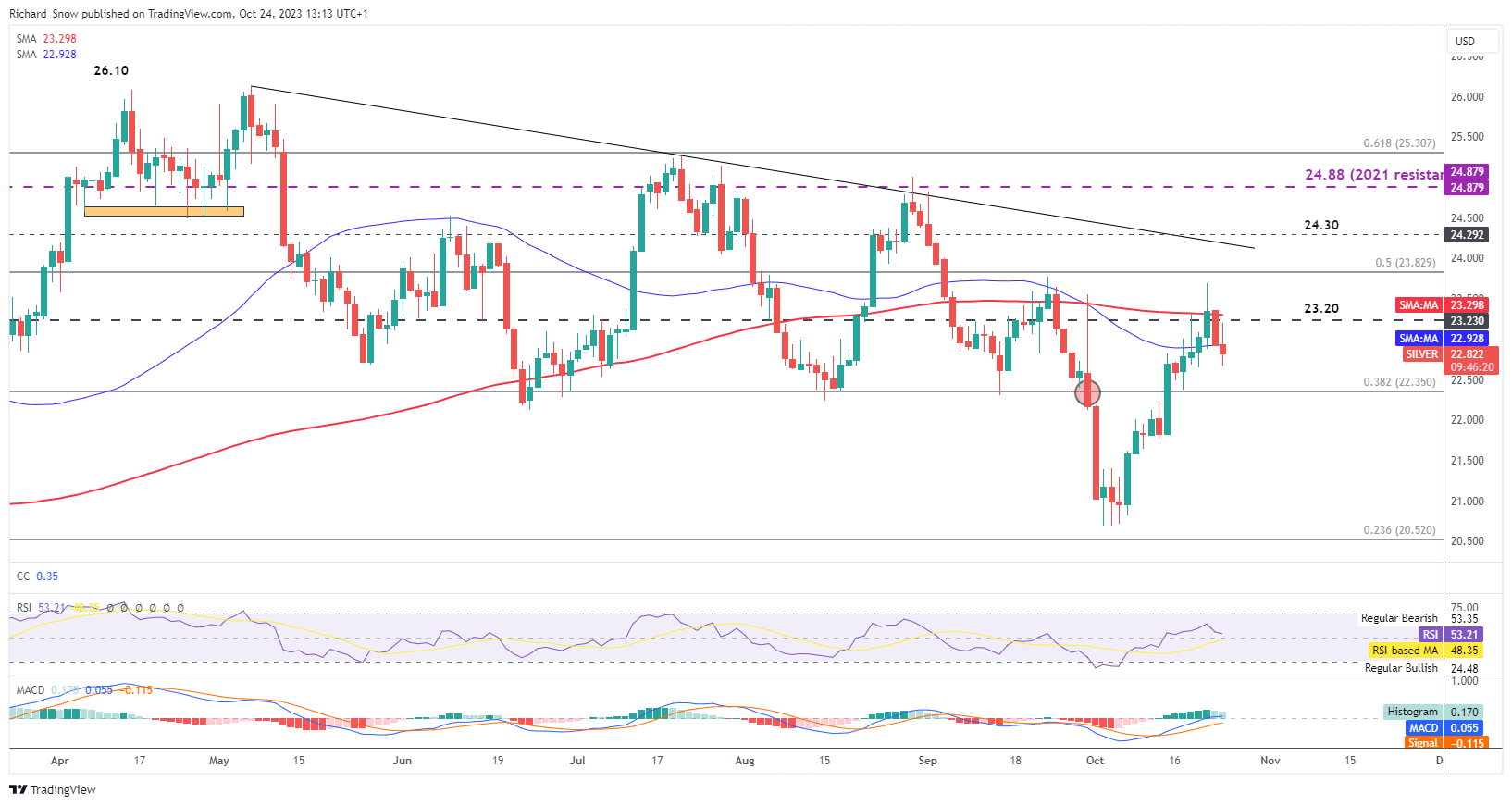

Silver Eases After Failing to Construct on Break Above 200 SMA

Silver has risen however to not the identical diploma because the better-known secure haven that’s gold. XAG/USD rose and breached the 200-day easy shifting common, posting an in depth marginally above the road. The lengthy higher wick supplied the primary clue of waning bullish momentum and since then, silver has been on the decline.

The momentary reprieve highlights the 38.2% Fibonacci retracement of the 2021 to 2022 main transfer round 22.35. Nonetheless, the bullish bias stays intact, with a return to 23.20 not out of the query and even a doable advance in direction of the 50% Fibonacci stage as a suggestion.

Silver Day by day Chart

Supply: TradingView, ready by Richard Snow

— Written by Richard Snow for DailyFX.com

Contact and comply with Richard on Twitter: @RichardSnowFX

[ad_2]

Source link