[ad_1]

US Greenback (DXY) Evaluation

- US greenback ready recreation continues forward of subsequent week’s CPI information with the 50 SMA in focus as soon as extra

- Consolidating DXY symptomatic of a market ready for the following catalyst. Key ranges to observe

- College of Michigan Sentiment and extra Fed communicate into the top of the week

- The evaluation on this article makes use of chart patterns and key assist and resistance ranges. For extra data go to our complete training library

Advisable by Richard Snow

Get Your Free USD Forecast

Greenback Workouts Endurance Forward of Inflation information Subsequent Week

Fed officers have been out of their numbers this week to have their say on the state of the US economic system and their outlook on inflation in addition to charges. Apparently sufficient, the precise Fed assertion after the Federal Open Market Committee’s (FOMC) two-day assembly did not see a beneficial market response, within the view of the Fed. It was then down to an enormous beat in NFP and really encouraging companies PMI information to align market expectations with that of the Fed. We now we see the market anticipating a terminal price at 5.1% – exactly the quantity detailed within the Fed’s December dot plot.

Implied Curiosity Fee Possibilities by way of Fed Funds Futures

Supply: refinitiv, ready by Richard Snow

Markets Await the Subsequent Catalyst: US CPI

Looking at DXY value motion, it’s clear to see an absence of observe by means of as market contributors look forward to subsequent week’s US CPI information on Tuesday. It’s no secret that each headline and core inflation have proven encouraging disinflationary momentum and markets rejoiced on the mere point out of this within the FOMC assertion.

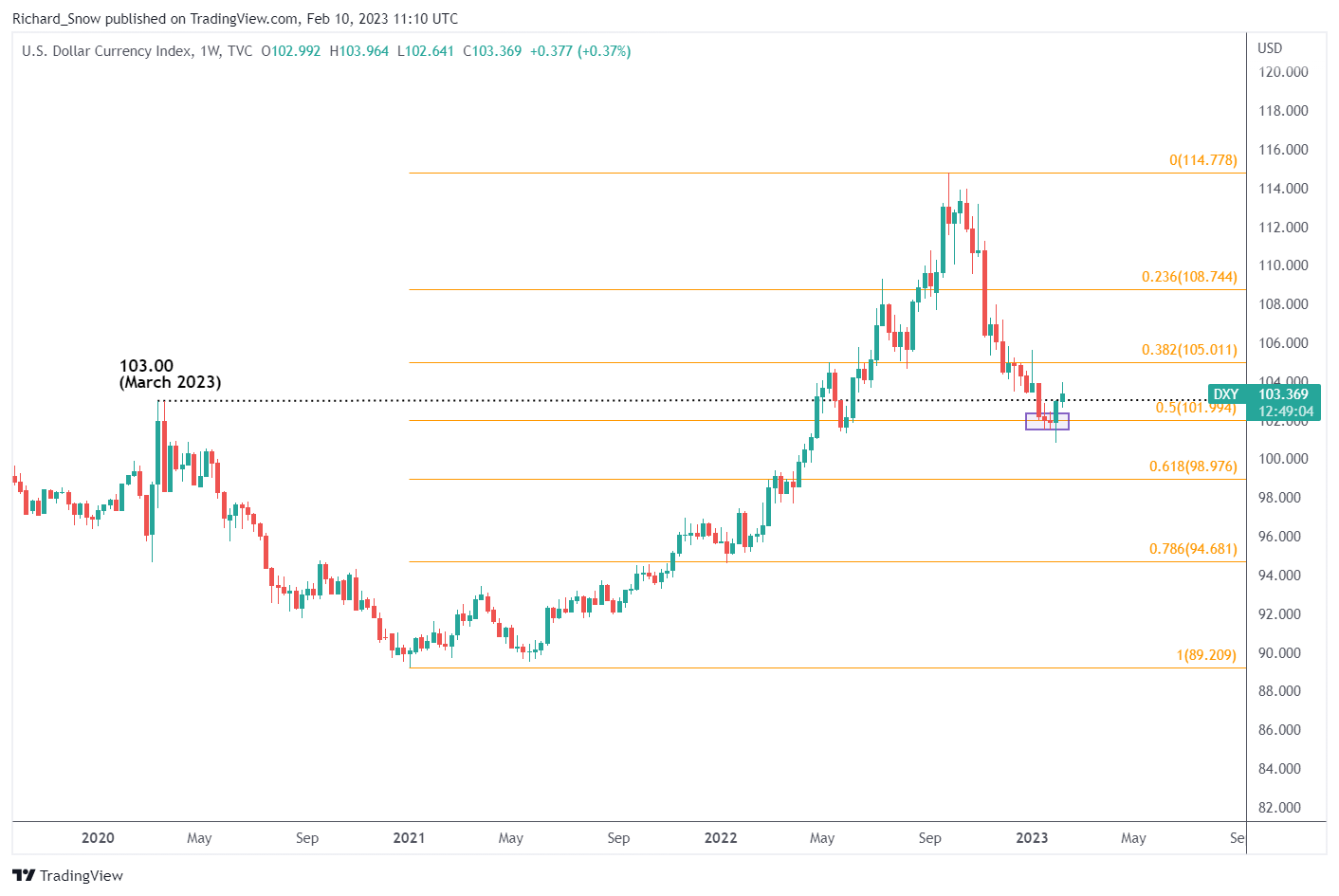

On the technical entrance, DXY seems to have discovered assist on the 50% retracement of the key rise spanning from late 2021 to late 2022 as forward-looking markets started to cost within the probability of future price cuts. One other sturdy element of the selloff was the narrowing of euro and US yield differentials because the US reaches the top of its price climbing cycle whereas the ECB discovered renewed motivation to push on aggressively, supporting the euro whereas the greenback weakened. Fee hikes sometimes increase native FX valuations.

DXY Weekly Chart with US-Bund Yield Differential (US10Y-DE10Y) in Purple

Supply: Tradingview

The following space of curiosity is across the 103 stage, the March 2020 excessive. If the greenback holds right here, it could be a shallow victory contemplating present disinflationary tendencies counsel we’ll see one other encouraging CPI print, including to a softer greenback.

US Greenback Basket (DXY) Weekly Chart

Supply: TradingView, ready by Richard Snow

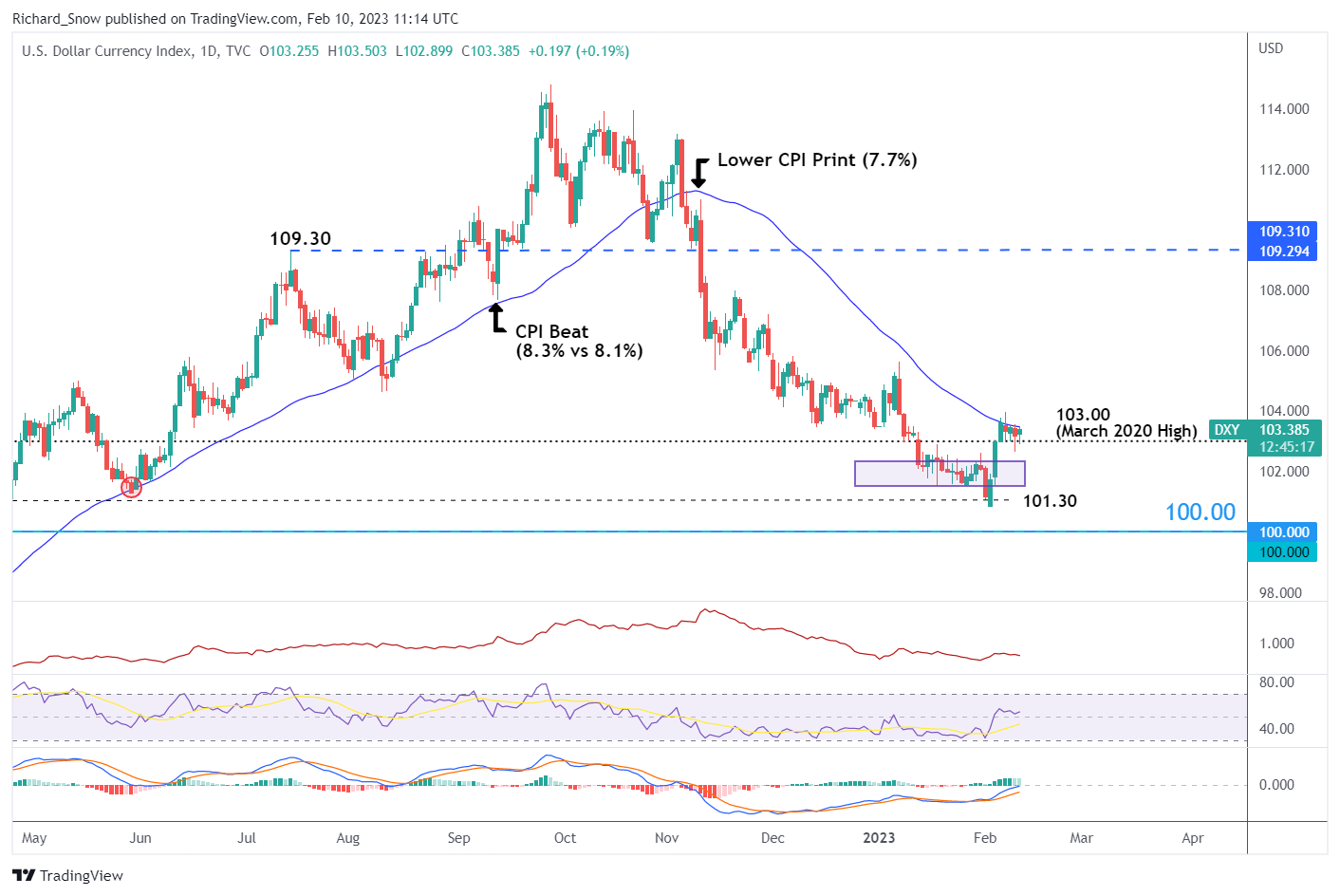

The every day chart reveals an attention-grabbing sample of adherence to the 50 easy shifting common (SMA), which supported the greenback on the best way up and has capped DXY upside on the best way down. Value motion over the past 4 classes have nestled comfortably beneath the shifting common the place costs stay restricted, consolidation forward of a fairly essential CPI determine.

The 50 SMA stays as dynamic resistance with the prior swing excessive of 105.60, thereafter. The MACD indicator suggests upside continuation stays doable whereas the RSI (purple) is much off overbought ranges. Nevertheless, a breakdown of the 103 stage highlights assist at 101.30 as soon as once more after which the psychological 100 flat.

US Greenback Basket (DXY) Day by day Chart

Supply: TradingView, ready by Richard Snow

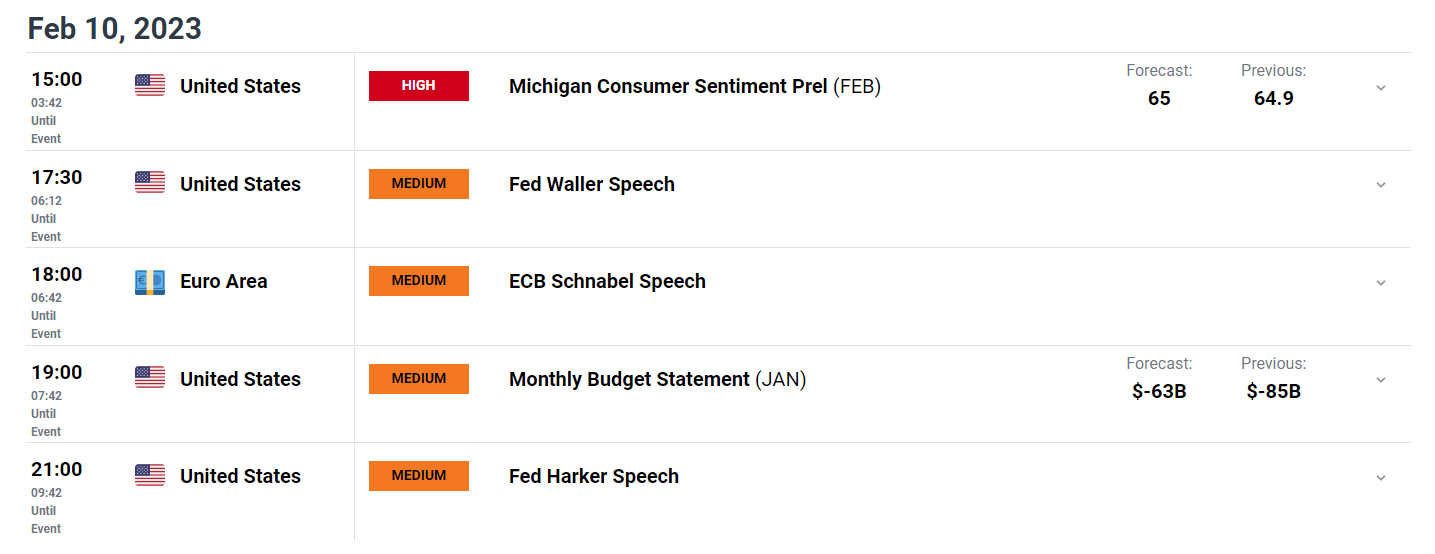

Fed Communicate and US Sentiment on the Dockett Right this moment

Might we be seeing peak optimism because the US Michigan Sentiment survey is anticipated to flatten out round 65? Aside from this report we have now two extra speeches from distinguished Fed members to around the week off which must be monitored forward of Tuesday’s CPI report.

Customise and filter dwell financial information by way of our DailyFX financial calendar

— Written by Richard Snow for DailyFX.com

Contact and observe Richard on Twitter: @RichardSnowFX

[ad_2]

Source link