[ad_1]

PM Photos

I’ve been overlaying the Distillate U.S. Basic Stability & Worth ETF (NYSEARCA:DSTL) since January 2022. At present, I want to improve this funding car that I rated a Maintain twice prior to now, together with the September 2022 notice, to a Purchase. There are two causes for that.

- First, DSTL has an exceedingly convincing efficiency monitor document, because it beat the iShares Core S&P 500 ETF (IVV) in 33 out of 61 of its full buying and selling months because the launch in October 2018 and in 4 out of 4 of its full buying and selling years.

- Second, there’s a strong issue combine beneath the hood, with a plethora of adequately valued, cash-rich names with low leverage and spectacular capital effectivity. I imagine this mix ought to profit from the present market atmosphere.

Allow us to handle all that in the article.

FCF-centered lively technique

In accordance with web page 5 of the prospectus, DSTL has modified its funding technique this yr:

Previous to April 3, 2023, the Fund operated as an index-based ETF that sought to trace the efficiency of the Distillate U.S. Basic Stability & Worth Index.

The actual fact sheet accessible on its web site says the fund

…holds roughly 100 large-capitalization U.S.-listed shares, systematically chosen utilizing the agency’s proprietary measures of high quality and free money stream based mostly valuation. The fund seeks to generate long-term extra returns by avoiding shares of firms that possess excessive ranges of monetary indebtedness, and proudly owning these shares that exhibit a excessive diploma of elementary stability and essentially the most enticing valuations based mostly on normalized free money stream.

I’d say that the present technique relies on ideas largely comparable to those who have been on the crux of the index it tracked, i.e., it’s nonetheless targeted on low leverage (measured, as web page 3 of the prospectus says, utilizing the “proprietary debt-to-income calculation”), elementary stability (outlined as “the volatility of the corporate’s historic and projected money flows”), and enticing valuation (assessed by way of FCF yield). I supplied a extra in-depth evaluate of its methodology within the January 2022 article. On this regard, I will likely be discussing the interval since DSTL’s inception within the efficiency evaluation part.

DSTL portfolio: top-quality, adequately leveraged names, just a few nuances as nicely

As of December 22, DSTL had a portfolio of 98 shares, with Alphabet (GOOGL) being its largest place with a 3.8% weight. Relating to sectors, in comparison with IVV, DSTL meaningfully underweighted info expertise in favor of the economic sector, which has about 22% weight. I suppose this occurred largely as a result of IT names are likely to commerce at a premium to the market. As illustrated beneath, different sectors that noticed their weights boosted are shopper discretionary and well being care. The funds’ exposures to shopper staples and communication providers are on par. In contrast to IVV, DSTL has no publicity to utilities.

Created by creator utilizing information from the fund

As I stated above, DSTL has an element story I like. Extra particularly, I argue that the fund has:

- largely robust worth publicity, although traders ought to be ready for compromises;

- high quality traits which might be near glorious;

- not a lot development publicity, however with just a few notable development tales beneath the hood nonetheless.

Let me help all of those with the details introduced within the following desk:

| Metric | 22-Dec |

| Market Cap | $166.96 billion |

| EY | 4.42% |

| EBITDA/EV | 6.84% |

| FCFY (FCF/Market Cap) | 5.15% |

| FCFY (FCF/Enterprise Worth) | 4.45% |

| ROA | 10.08% |

| ROTC | 15.94% |

| Whole Debt/EBITDA | 2.18 |

| Income Fwd | 5.47% |

| EPS Fwd | 7.83% |

| Quant Valuation B- or higher | 15.1% |

| Quant Valuation D+ or worse | 59.94% |

| Quant Profitability B- or higher | 97.3% |

| Quant Profitability D+ or worse | 0.88% |

Calculated by creator utilizing information from Searching for Alpha and the fund

My calculations present that DSTL has a weighted common market cap of just about $167 billion, however it might be untimely to attract the conclusion that the portfolio is totally dominated by mega-caps. In truth, they account for under about 35%, and the determine is considerably influenced by GOOGL, which has a $1.77 trillion market cap. The remainder of the basket consists of large-caps and only a handful of mid-cap names, accounting for five%.

Nonetheless, because of the scale premium, DSTL’s earnings yield is simply 4.4%, whereas IVV, for instance, has an EY of 4.2%. I suppose most worth traders would level out right here that that is beneath their consolation zone. So does that imply the fund has a market-like valuation? I’ll touch upon that shortly.

Subsequent, solely 15.1% of the holdings have a Quant Valuation grade of B- or decrease, whereas nearly 60% earned a D+ score or worse. The corollary right here is that a lot of the fund’s web property are allotted to firms which might be buying and selling at a premium to their 5-year common ratios and/or sector medians. Once more, that is the consequence of the scale and, probably, high quality premia. So worth traders ought to be ready for compromises.

Anyway, allow us to take a look at that situation from a special angle. A pleasant different to the EY is its debt-adjusted model or EBITDA/EV. And it tells a considerably completely different story. DSTL has that metric at 6.8%, whereas IVV has simply ~5.1%, although an necessary comment is that I calculated this determine excluding the monetary and actual property sectors. Moreover, DSTL has each market cap- and EV-based FCF yields at pretty wholesome ranges (5.15% and 4.45%, respectively).

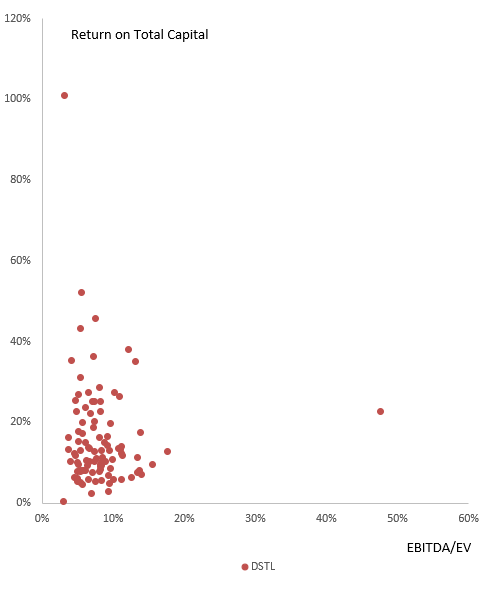

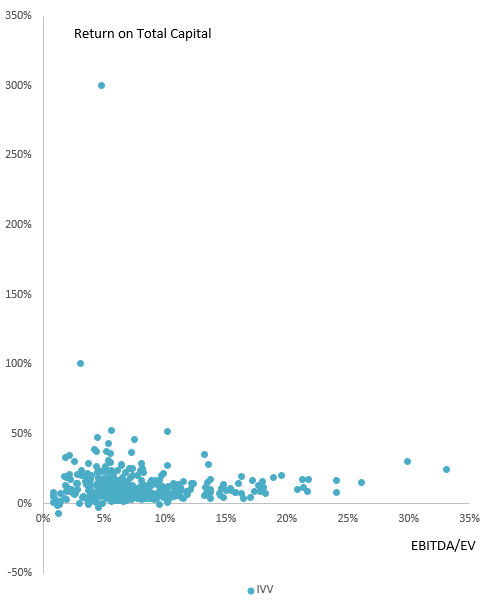

To present a bit extra shade, I ready the scatter plots combining the Return on Whole Capital and EBITDA/EV of IVV’s (84.3% of the portfolio) and DSTL’s holdings. I’ve eliminated the next S&P 500 constituents with unfavourable EV/EBITDA:

| Ticker | Firm | Sector |

| (MRNA) | MODERNA, INC. | Well being Care |

| (WDC) | WESTERN DIGITAL CORP | Data Know-how |

| (NRG) | NRG ENERGY, INC. | Utilities |

DSTL ROTC, EBITDA/EV evaluation (Created by the creator utilizing information from Searching for Alpha and DSTL) IVV ROTC, EBITDA/EV evaluation (Created by the creator utilizing information from Searching for Alpha and IVV)

We see that IVV has publicity to ROTC-negative firms, whereas DSTL doesn’t. This is without doubt one of the explanation why the ETF has such a robust weighted common determine at nearly 16%, as per my calculations, whereas IVV’s result’s round 14% (excluding financials and actual property). One other indication of DSTL’s sturdy high quality is that over 97% of its holdings have a Quant Profitability score of B- or greater. A weighted common Whole debt/EBITDA of simply 2.18x can also be telling.

Lastly, the fund has solely single-digit weighted common ahead development charges. Nonetheless, there are nonetheless just a few notable income development tales on this portfolio, like Fortinet (FTNT) and Broadcom (AVGO).

Returns: beating the market with ease over the long term

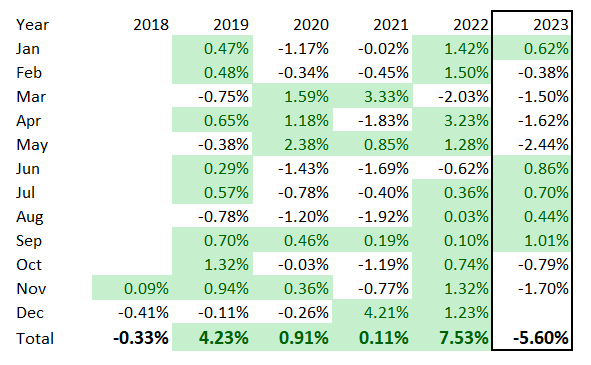

DSTL has had a largely sturdy efficiency since its inception in 2018, beating IVV persistently in 2019–2022. It has been performing a bit softer this yr, however I suppose this isn’t a sign of the technique dropping its edge over less complicated alternate options.

IVV and DSTL comparability (Created by the creator utilizing information from Portfolio Visualizer)

What’s fascinating is that DSTL has additionally crushed just a few FCF-focused counterparts, together with the Pacer US Money Cows 100 ETF (COWZ) and the FCF US High quality ETF (TTAC).

| Portfolio | IVV | DSTL | COWZ | TTAC |

| Preliminary Steadiness | $10,000 | $10,000 | $10,000 | $10,000 |

| Ultimate Steadiness | $18,367 | $19,841 | $19,636 | $15,905 |

| CAGR | 12.70% | 14.43% | 14.20% | 9.56% |

| Stdev | 18.85% | 19.05% | 22.86% | 18.89% |

| Finest Yr | 31.25% | 35.48% | 41.70% | 26.04% |

| Worst Yr | -18.16% | -10.63% | -8.45% | -15.74% |

| Max. Drawdown | -23.93% | -19.56% | -27.84% | -24.89% |

| Sharpe Ratio | 0.63 | 0.71 | 0.61 | 0.48 |

| Sortino Ratio | 0.97 | 1.16 | 0.96 | 0.72 |

| Market Correlation | 1 | 0.97 | 0.89 | 0.97 |

Information from Portfolio Visualizer. The interval analyzed is November 2018–November 2023.

Whereas having the very best annualized return, DSTL has additionally delivered a way more comfy most drawdown.

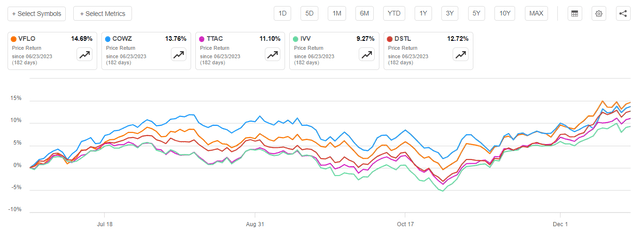

I imagine additionally it is price evaluating DSTL’s efficiency to the outcomes delivered by a novel car, the VictoryShares Free Money Circulation ETF (VFLO), which was incepted in June 2023.

Value return (Searching for Alpha)

VFLO has outperformed DSTL, in addition to the market (represented by IVV) and different friends, with each complete and value returns being greater. DSTL has had the third-strongest complete return.

Whole return (Searching for Alpha)

I’ve assigned a Purchase score to VFLO earlier this December, and I nonetheless imagine FCF-focused traders ought to take into account this ETF, along with DSTL.

Investor takeaway

In sum, I imagine alpha-generating DSTL is positioned for robust features going ahead. Now actively managed, the fund gives a pleasant stability of worth and high quality, with a tilt towards the latter. Moreover, for an lively technique, the ETF has a modest expense ratio of simply 39 bps, whereas property beneath administration are spectacular at $1.5 billion, and so is its liquidity general.

[ad_2]

Source link