[ad_1]

- Permabears are inclined to lose out on good points as they promote on the first signal of hassle

- However promoting throughout bear markets just isn’t the important thing to long-term investing success

- Weathering market volatility is essential to attaining important income in the long term

Ever questioned why so many individuals rally behind permabears, even when their monitor report suggests they’re usually vast of the mark?

Currently, I’ve discovered myself mulling over this query. Plainly buyers could typically rationalize their views incorrectly, particularly within the face of losses.

They console themselves by saying, “Effectively, at the least I did not lose extra capital,” as they rapidly exit the market.

This is the essential concept: in the event you’re bullish, you revenue when shares rise (basically, you are betting on an upswing), and in the event you’re bearish, you make good points when shares fall (taking a brief place available in the market). Is sensible, proper?

However here is the twist: whereas this method might sound logical, it isn’t at all times the wisest plan of action to stay steadfastly bullish or bearish.

By doing so, you are decreasing your publicity to cost fluctuations and shifting your funds from shares to money in an effort to attenuate danger.

Nonetheless, within the quest to eradicate danger, you additionally forfeit potential good points, whether or not your bearish or bullish prediction proves right or not. Actually, to realize our monetary aims, it is important to remain available in the market and endure the occasional bouts of short-term turbulence.

So whereas the market is unquestionably giving buyers many short-term bearish indicators, the trick is to adapt accordingly with out dropping deal with the long-term technique.

Let’s check out the present state of the market.

US Greenback Continues to Rally

In the meantime, the is as soon as once more in focus because it phases a strong comeback with a achieve of over 5% following a 3.5% dip in July.

The US greenback index is presently hovering across the identical ranges it recorded again in March 2023, marking greater than 9 consecutive weeks of good points. This development bears a resemblance to its efficiency in 2014-2015.

What makes this notably noteworthy is that the present DXY stage represents a major psychological resistance level, based mostly on its historic rejections and struggles to interrupt to the upside. This was additionally noticed in January 2023.

If the DXY had been to expertise a subsequent improve, it will undoubtedly exert stress on the inventory market. This situation is lower than very best for bullish buyers.

Shares Stay Bearish In comparison with Commodities

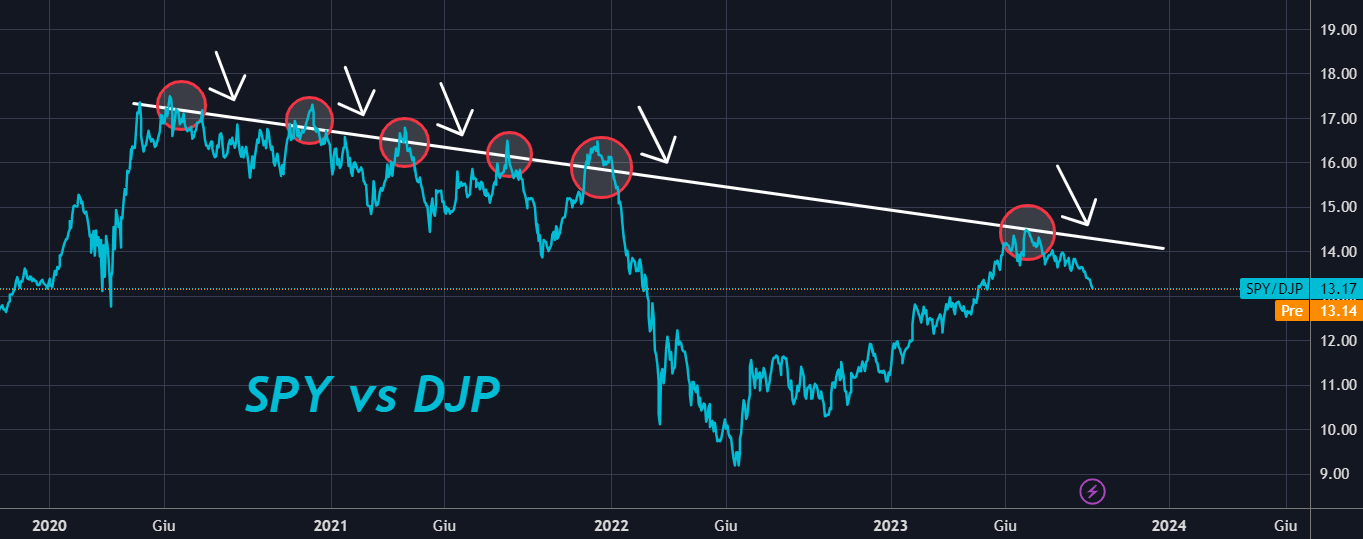

A very powerful relationship that’s usually missed is between equities and commodities, the previous are already of their fourth yr of a bearish development in comparison with the latter.

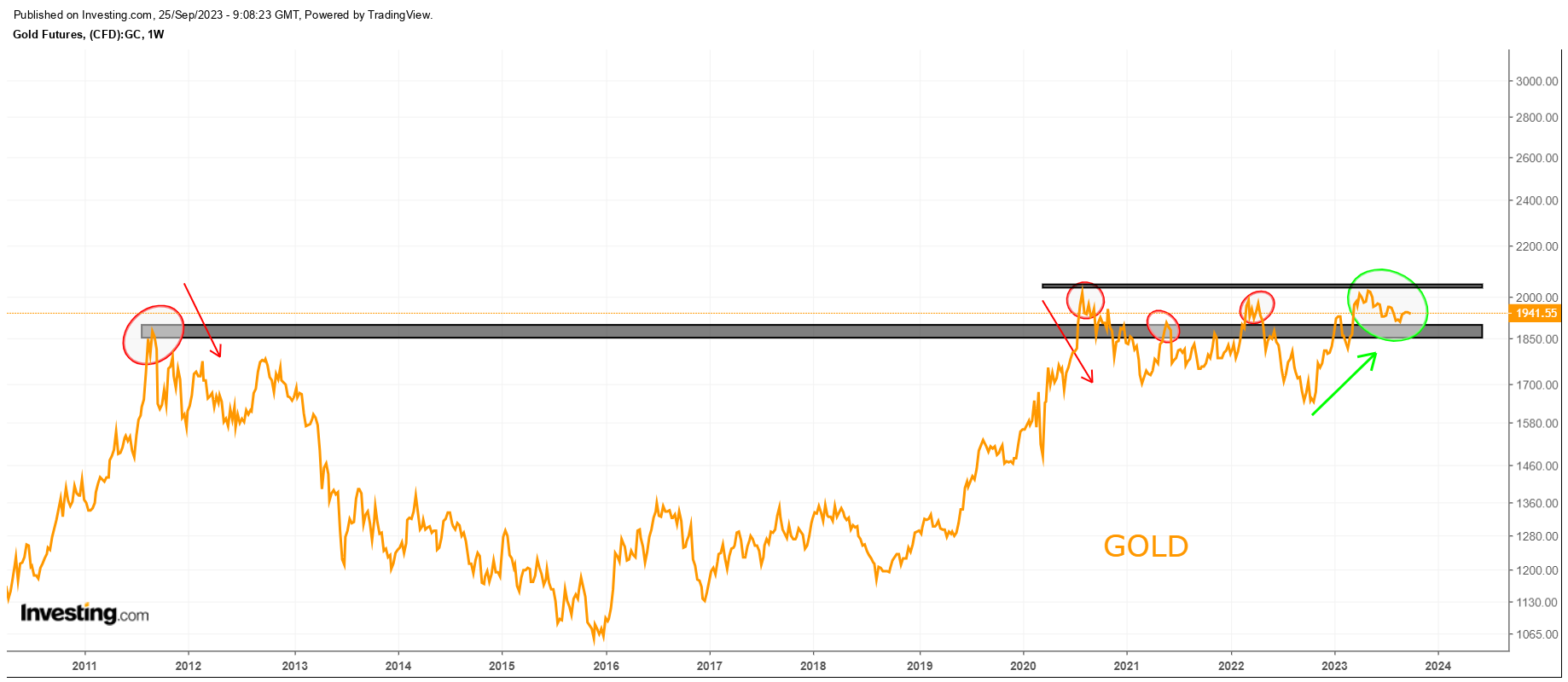

If one hadn’t appeared on the : ratio chart, it might need been exhausting to consider. Additional confirming that is ‘s value motion.

If the present breakout might be sustained, and we see the value breaking above $2050, it may present important momentum to the complete sector.

Backside Line

In conclusion, whereas a number of elements can level towards declines within the close to time period, it is very important concentrate on the potential dangers and rewards of each bullish and bearish positions.

Whereas it might be tempting to stay to a single stance, it’s usually extra prudent to be versatile and adapt your technique to the altering market circumstances.

Moreover, it is very important keep in mind that the market tends to be constructive 80% of the time. Because of this buyers who’re too bearish could miss out on important income.

In the end, one of the simplest ways to realize your monetary targets is to remain invested available in the market and experience out the occasional durations of volatility.

***

Discover All of the Data you Want on InvestingPro!

Disclaimer: This text is written for informational functions solely; it doesn’t represent a solicitation, provide, recommendation, or suggestion to take a position as such it isn’t meant to incentivize the acquisition of property in any approach. I want to remind you that any kind of asset, is evaluated from a number of views and is extremely dangerous subsequently, any funding determination and the related danger stays with the investor.

[ad_2]

Source link