[ad_1]

400tmax

This text collection goals at evaluating ETFs (exchange-traded funds) relating to the relative previous efficiency of their methods and metrics of their present portfolios. Evaluations with up to date information are posted when mandatory.

DJD technique and portfolio

Invesco Dow Jones Industrial Common Dividend ETF (NYSEARCA:DJD) began investing operations on 12/16/2015 and tracks the Dow Jones Industrial Common Yield Weighted Index. It has 27 holdings, a 12-month distribution yield of three.36% and an affordable expense ratio of 0.07%.

As described by Invesco within the prospectus,

the Underlying Index is calculated utilizing a yield-weighted methodology that weights all dividend-paying constituents of the Dow Jones Industrial Common™ by their twelve-month dividend yield outlined as a inventory’s annual dividend (not together with any particular dividends) divided by its worth. The Underlying Index is rebalanced semi-annually (…)

The underlying index description reminds of the Canines of the Dow technique, which consists in shopping for the ten corporations with the very best dividend yields within the Dow Jones Industrial Common (DIA). The highest 10 holdings of DJD are the “Canines” on every rebalancing day. Then, positions might drift with worth motion. The present high 10 names are listed beneath with basic ratios. The fund is kind of concentrated: they symbolize 56.7% of asset worth. Publicity to dangers associated to the highest names is analogous for DIA, whose high 10 holdings weigh 55.4% in mixture.

|

Ticker |

Identify |

Weight% |

EPS development %TTM |

P/E TTM |

P/E fwd |

Yield% |

|

VZ |

Verizon Communications, Inc. |

8.25 |

-0.20 |

6.76 |

7.41 |

7.52 |

|

IBM |

Worldwide Enterprise Machines Corp. |

7.00 |

-67.77 |

67.59 |

14.07 |

5.00 |

|

MMM |

3M Co. |

6.82 |

0.48 |

10.19 |

11.41 |

6.10 |

|

WBA |

Walgreens Boots Alliance, Inc. |

6.65 |

-150.22 |

N/A |

7.02 |

6.09 |

|

DOW |

Dow, Inc. |

6.20 |

-56.40 |

13.14 |

16.77 |

5.32 |

|

CVX |

Chevron Corp. |

4.75 |

73.94 |

8.42 |

11.04 |

3.88 |

|

AMGN |

Amgen, Inc. |

4.63 |

44.96 |

15.03 |

12.28 |

3.85 |

|

CSCO |

Cisco Programs, Inc. |

4.29 |

-2.28 |

17.89 |

13.08 |

3.13 |

|

KO |

The Coca-Cola Co. |

4.09 |

-4.27 |

26.57 |

23.13 |

3.05 |

|

JNJ |

Johnson & Johnson |

3.99 |

-35.60 |

33.08 |

14.85 |

3.01 |

Three constituents of the Dow Jones are lacking in DJD as a result of they don’t pay dividends: Boeing (BA), Salesforce (CRM) and Disney (DIS).

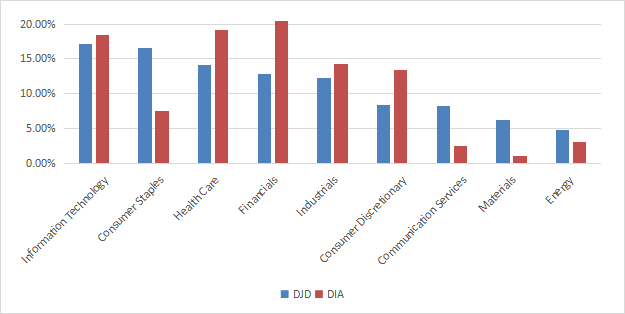

The 2 heaviest sectors are expertise (17.1% of belongings) and client staples (16.3%). In comparison with the mother or father index, DJD overweights client staples, vitality, communication, supplies, and to a lesser extent, vitality. It underweights principally healthcare, financials and client discretionary. DJD is extra balanced than DIA throughout sectors.

Sector breakdown (Chart: creator, information: Invesco, SSGA)

Efficiency

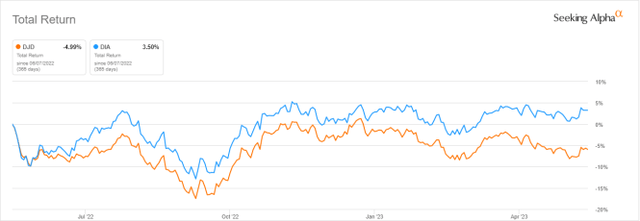

Since inception in December 2015, DJD has underperformed its mother or father index by about 21% in whole return.

DJD vs. DIA since Dec. 2015 (Searching for Alpha)

It has lagged by 8.5% within the final 12 months.

DJD vs. DIA, final 12 months (Searching for Alpha)

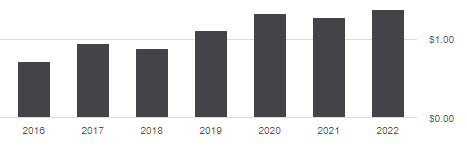

The fund pays quarterly dividends. The annual sum of distributions has elevated from $0.71 per share in 2016 to $1.38 in 2022. It is a development of 94%, whereas the cumulative inflation has been about 23% on the similar time (primarily based on CPI). DJD appears to be like fairly enticing relating to previous dividend development, however the underlying index shouldn’t be designed to ensure it sooner or later.

DJD distribution historical past (Searching for Alpha)

In earlier articles, I’ve proven how three elements might assist reduce the danger in a dividend portfolio: Return on Property, Piotroski F-score, and Altman Z-score.

The subsequent desk compares DJD since 1/1/2016 with a subset of the S&P 500 together with shares with an above-average dividend yield, an above-average ROA, an excellent Altman Z-score, an excellent Piotroski F-score and a sustainable payout ratio. It’s rebalanced yearly to make it comparable with a passive index.

|

since 1/1/2016 |

Tot. Return |

Annual Return |

Drawdown |

Sharpe ratio |

Volatility |

|

DJD |

108.02% |

10.36% |

-33.97% |

0.67 |

15.05% |

|

Dividend high quality subset |

146.38% |

12.90% |

-34.96% |

0.75 |

16.32% |

Previous efficiency shouldn’t be a assure of future returns. Knowledge Supply: Portfolio123

DJD lags this dividend high quality subset by 38% in whole return. Nevertheless, the fund’s efficiency is actual, whereas the subset is simulated. My core portfolio holds 14 shares chosen on this subset (extra information on the finish of this put up).

Scanning DJD portfolio

DJD is considerably cheaper than DIA relating to the standard valuation ratios, as reported within the desk beneath.

|

DJD |

DIA |

|

|

P/E |

14.73 |

19.7 |

|

P/E book |

2.71 |

3.83 |

|

P/Gross sales |

1.19 |

2.23 |

|

P/Money Circulate |

9.76 |

15.3 |

Knowledge: Constancy

In my ETF critiques, dangerous shares are corporations with no less than 2 pink flags amongst: dangerous Piotroski rating, destructive ROA, unsustainable payout ratio, dangerous or doubtful Altman Z-score, excluding financials and actual property the place these metrics are unreliable. Out of 27 holdings, three are dangerous relating to these standards: Intel (INTC), Verizon (VZ) and Walgreens Boots Alliance (WBA). They weigh 17.9% of asset worth, which is kind of heavy.

Based mostly on my calculation of mixture Altman Z-score, Piotroski F-score and ROA, DJD could be very near DIA in portfolio high quality.

|

DJD |

DIA |

|

|

Altman Z-score |

3.27 |

3.51 |

|

Piotroski F-score |

5.23 |

5.41 |

|

ROA % TTM |

7.34 |

7.67 |

Takeaway

Invesco Dow Jones Industrial Common Dividend ETF holds the 27 shares of the Dow Jones Industrial Common paying a dividend, with weights primarily based on yields. The fund is healthier balanced throughout sectors than the mother or father index. Nevertheless, it’s fairly concentrated within the high holdings. DJD appears to be like higher than DIA relating to valuation, and high quality is analogous. Furthermore, the dividend development charge since inception has outpaced inflation by a large margin. Nonetheless, whole return is underwhelming, particularly within the final 12 months.

[ad_2]

Source link