[ad_1]

Up to date on July twenty fifth, 2023 by Bob Ciura

At Certain Dividend, we advocate long-term investing in high-quality dividend shares.

It is because there’s a swath of proof to recommend that dividend shares outperform. Extra particularly, dividend progress shares outperform.

There is no such thing as a higher instance of this than the Dividend Aristocrats – a bunch of elite dividend shares within the S&P 500 Index with 25+ years of consecutive dividend will increase.

We created a full listing of all 67 Dividend Aristocrats, together with essential monetary metrics comparable to dividend yields and price-to-earnings ratios. You may obtain a free copy by clicking on the hyperlink beneath:

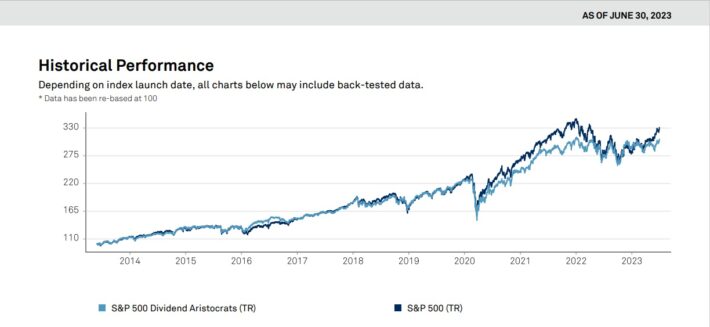

The long-term efficiency of the Dividend Aristocrats is proven within the following graph.

Supply: S&P Reality Sheet

The Dividend Aristocrats have carried out very properly prior to now 10 years, delivering 11.99% whole annual returns.

Whereas the Dividend Aristocrats present one piece of proof, there are a lot of different explanation why dividend shares – and significantly dividend progress shares – are our favourite asset class for long-term wealth constructing.

This text will present an in depth abstract of why dividend shares make higher investments than ‘simply progress’ shares that don’t pay dividends. We’ll additionally present you why dividend progress shares can help you harness the very best of each dividend shares and progress shares, and why we favor them over both of the alternate options.

The Efficiency of Dividend Shares

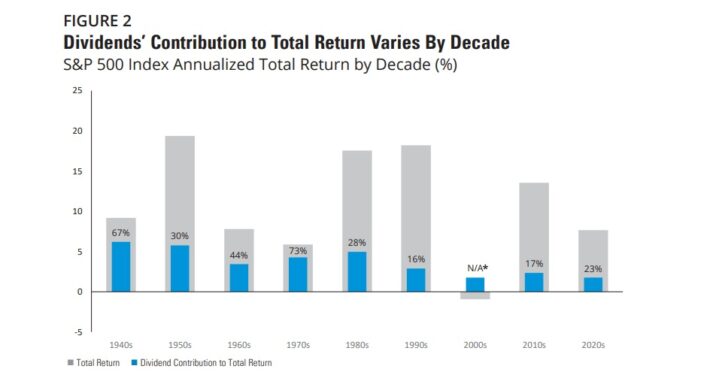

Dividends have traditionally been a robust contributor to the long-term whole returns of the broad S&P 500 index – which incorporates each dividend-paying shares and non-dividend-paying shares.

Between 1930 and 2021, the contribution from dividends to the S&P 500’s whole return was 40%. The next picture reveals how the determine has diversified over time.

Supply: Hartford Funds – The Energy Of Dividends

It follows that dividend-paying shares ought to have sturdy efficiency on a person foundation when in comparison with shares that don’t pay dividends.

Dividend shares have outperformed non-dividend-payers whereas additionally delivering increased risk-adjusted returns as measured by the Sharpe Ratio.

Clearly, there’s vital proof to help the long-term outperformance of dividend-paying shares. The next part will talk about the elemental causes why these securities are inclined to beat the market.

Why Dividend Shares Outperform

In our view, there are three major explanation why dividend shares outperform non-dividend shares:

Motive 1: An organization that pays dividends should have underlying operations that truly help that dividend. Stated one other means, dividend-paying securities should have earnings and money circulate to distribute to shareholders – or else their dividend funds wouldn’t be doable. Because of this dividend shares exclude the riskiest securities: ‘pre-earnings’ startups and companies experiencing chapter or different monetary misery.

Motive 2: Dividend-paying corporations have much less inner money circulate out there to fund natural progress alternatives, which means that company administration should concentrate on solely the very best progress alternatives. Having such a laser-sharp concentrate on the effectivity of capital allocation has a excessive chance of enhancing an organization’s efficiency over time.

Motive 3: Dividend funds suggest that an organization’s administration is keen to switch cash from their management to their shareholders’ management. In different phrases, it signifies that the corporate is shareholder-friendly, a attribute that seemingly impacts different habits on the C-suite stage.

Together with these business-level traits, there are different explanation why we like dividend shares.

First, from the angle of the portfolio supervisor, dividend shares are extremely most popular as a result of they generate a relentless stream of money that may be deployed into new funding alternatives.

This dividend revenue stream is way more fixed than inventory costs are, which suggests buyers have the power to purchase extra shares when inventory costs are low. The soundness of dividend funds additionally has a ‘smoothing’ impact on long-term portfolio efficiency.

Dividend shares additionally keep away from the primary drawback with progress shares: valuation danger. In our view, there are two main dangers that buyers ought to intention to keep away from within the inventory market:

- The chance that the enterprise you might be shopping for is a dud.

- The chance that you’re overpaying for the enterprise.

Development shares are, by definition, rising at a quick fee. Buyers are often keen to pay a premium valuation a number of because of this, which signifies that any momentary disappointment from the corporate in query may lead to fast valuation contraction (and unfavorable returns).

For dividend shares, this isn’t typically an issue. There are often many dividend shares buying and selling at affordable valuations, permitting price-conscious buyers to purchase nice companies at honest costs.

To conclude, ‘dividend shares’ make higher investments than ‘progress shares,’ at the least in our view. There’s one other aspect to the story; right here’s the counter-argument to dividend shares versus progress shares.

There’s a substitute for these two choices that mixes the very best of each worlds – dividend progress shares. We make our case for why dividend progress shares are our favourite asset class beneath.

The Case For Dividend Development Shares

Dividend progress shares are corporations that pay dividends and develop their dividends at a gentle tempo, combining the dividend funds of ‘plain’ dividend shares with the expansion of ‘plain’ progress shares.

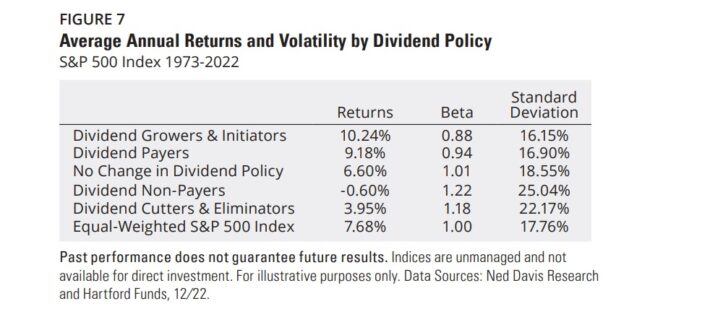

A large physique of analysis means that dividend progress shares are inclined to outperform the broader inventory market. In analysis carried out by Ned Davis and Hartford Funds, it was discovered that dividend growers and initiators delivered whole returns of 10.24% per yr from 1973 by way of 2022, higher than the equal-weighted S&P 500’s efficiency of seven.68% per yr.

Curiously, the dividend growers and initiators analyzed on this research generated outperformance with much less volatility – a rarity and a contradiction to what trendy tutorial monetary idea tells us.

A abstract of this analysis may be discovered beneath.

Supply: Hartford Funds – The Energy Of Dividends

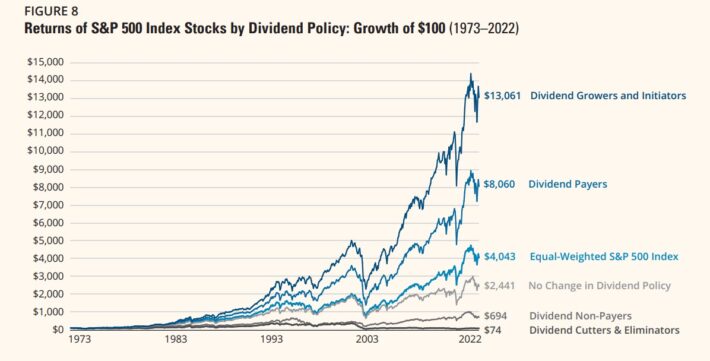

Outperformance of two.56% yearly may not seem to be a game-changer, nevertheless it actually is because of the surprise that’s compound curiosity.

Utilizing knowledge from the identical piece of analysis, buyers who selected to speculate completely in dividend growers and initiators have been able to turning $100 into $13,061. Throughout the identical time interval, the S&P 500 index turned $100 into $4,043.

Supply: Hartford Funds – The Energy Of Dividends

Shares that didn’t pay dividends couldn’t match the efficiency of all forms of dividend payers, turning $100 into $694 from 1973-2022. Dividend cutters and eliminators fared even worse, turning $100 into simply $74–which means these shares truly misplaced cash.

Clearly, dividend progress shares have the ability to generate wonderful funding returns. Other than efficiency, there are different explanation why we like investing in dividend progress shares.

To begin with, dividend progress shares are a superb choice for retirees and different income-focused buyers as a result of they can help you generate rising revenue over time with out contributing any more cash to your funding portfolio. This simulates the wage will increase that non-retirees (often) expertise year-in and year-out.

Secondly, most dividend progress shares are steady, well-established companies with easy-to-understand enterprise fashions. Notable examples embrace Johnson & Johnson (JNJ), Wal-Mart (WMT), and McDonald’s (MCD). The soundness of those corporations permit buyers to have appreciable peace of thoughts whereas proudly owning fractional pursuits in these corporations.

Lastly, dividend progress shares are right here for the long term. Once you purchase shares of an organization that has raised its dividend each yr for a number of many years, you recognize that its enterprise mannequin will stand the take a look at of time. When recessions come (as we all know they may), proudly owning dividend progress shares will permit us to remain the course whereas uncertainty and volatility improve.

Last Ideas

Whereas dividend shares and progress shares each have their deserves, we far favor dividend shares for the explanations mentioned on this article.

The beauty of debating the professionals and cons of dividend progress shares is that you just don’t essentially want to decide on. Dividend progress shares provide the advantages of each dividend shares and progress shares, whereas additionally having a observe report of long-term outperformance.

Associated: The Professionals and Cons of Dividend Investing.

When you’re fascinated with discovering particular person dividend progress shares appropriate for long-term funding, the next databases (together with the previously-mentioned Dividend Aristocrats listing) are incredible sources:

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to [email protected].

[ad_2]

Source link