[ad_1]

Updated on October 10th, 2022 by Nikolaos Sismanis

PPG Industries (PPG) is one of the most recent additions to the Dividend Kings list.

The Dividend Kings have raised their dividend payouts for at least 50 consecutive years. You can see all 45 Dividend Kings here.

You can download the full list of Dividend Kings, plus important financial metrics such as dividend yields and price-to-earnings ratios, by clicking on the link below:

PPG has maintained its long history of dividend increases thanks to its superior position in its industry. Its competitive advantages have fueled the company’s long-term growth.

As we see the potential for continued growth in PPG’s core markets, the company should keep increasing its dividend each year.

We also view the stock as relatively undervalued right now.

This article will discuss PPG’s business model, growth potential, and valuation.

Business Overview

PPG Industries is the world’s largest paints and coatings company. Its only competitors of similar size are Sherwin–Williams and Dutch paint company Akzo Nobel.

PPG Industries was founded in 1883 as a manufacturer and distributor of glass (its name stands for Pittsburgh Plate Glass) and today has approximately 50,000 employees located in more than 70 countries at 100 locations.

The company generates annual revenue of about $17 billion.

PPG Industries announced second-quarter results on July 21st, 2022. Revenue grew 7.8% to a quarterly record of $4.7 billion, beating expectations by $40 million.

Organic growth was 8% for the quarter, as a 12% contribution from higher selling prices and 4% from acquisitions were only partially set by a 4% decline in volume and a 4% headwind from currency translation.

You can see a breakdown of the company’s quarterly sales performance in the image below:

Source: Investor Presentation

Adjusted net income was $430 million, or $1.81 per share, compared to adjusted net income of $465 million, or $1.94 per share, in the prior year. Adjusted earnings-per-share also beat estimates by $0.09.

Performance coatings’ revenues grew 7% to $2.93 billion. Higher selling prices (+11%) and benefits from acquisitions (+4%) more than offset foreign currency translation (-4%) and a decline in volumes (-4%).

Automotive refinish grew high low teens-percentage and aerospace volumes improved by 10%. Finally, industrial coatings increased by 9% to $1.76 billion.

Volume (-3%) and currency translation were once again headwinds (-5%), but selling prices (+14%) and acquisition-related sales (+3%) more than offset these weak areas. Pricing more than offsets lower volume for automotive OEMs, which continues to be limited due to the limited availability of semiconductor chips.

Looking ahead, PPG Industries expects aggregate sales volumes flat to down a low-single-digit percentage in its results. The company is expected to deliver adjusted EPS of roughly $6.68 for fiscal 2022, relatively flat year-over-year.

Growth Prospects

PPG Industries’ earnings–per–share have achieved a growth rate of 5.8% over the last decade. We expect earnings–per–share to grow at a rate of 8% through 2027.

PPG Industries’ demand dropped significantly due to the impact of COVID–19 in 2020. However, we expect the recovery from the pandemic to offer a higher rate of growth for the company.

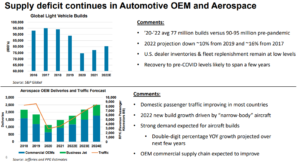

The company expects several businesses, including automotive OEMs and aerospace, to deliver strong growth due to large supply deficits and low inventories in these end-use markets.

Source: Investor Presentation

As the above image shows, positive demand trends are generally expected to continue in North America.

These trends are aided by stronger sequential automotive OEM production, further aerospace recovery, and the continuation of recent trends in the auto refinish sales as PPG works to fulfill strong backorders.

That said, PPG management believes that the ongoing recovery will span across a few years, with U.S. dealer inventories and fleet replenishment remaining at low levels.

Acquisitions are another component of the company’s future growth plan. PPG has historically used smaller, bolt-on acquisitions to complement its organic growth.

The company has made five recent acquisitions that cumulatively added $1.7 billion in annual sales and achieved ~$30 million in savings. Going forward, similar deals should provide at least a couple of percentage points in annual revenue growth.

Finally, we expect the company’s period share repurchase to aid earnings growth on a per-share basis. For context, the company has reduced its share count by 44.9% and 23.3% since 1995 and over the past decade, respectively.

Competitive Advantages & Recession Performance

PPG enjoys a number of competitive advantages. It operates in the paints and coatings industry, which is economically attractive for several reasons.

First, these products have high-profit margins for manufacturers. They also have low capital investment, which results in significant cash flow.

With that said, the paint and coatings industry is not very recession-resistant because it depends on healthy housing and construction markets. This impact can be seen in PPG’s performance during the 2007-2009 financial crisis:

- 2007 adjusted earnings-per-share: $2.52

- 2008 adjusted earnings-per-share: $1.63 (35% decline)

- 2009 adjusted earnings-per-share: $1.02 (37% decline)

- 2010 adjusted earnings-per-share: $2.32 (127% increase)

PPG’s adjusted earnings-per-share fell by more than 50% during the last major recession and took two years to recover. The silver lining during a recession is that homeowners may be more likely to paint their houses than to move or take on more costly home renovations.

As PPG’s 2020 results showed, the decline in new construction is the dominant factor for PPG during a recession. However, over the course of its history, the company has shown an ability to successfully navigate recessions.

Currently, the company’s margins are threatened due to the highly inflationary and ongoing macroeconomic turmoil. However, the company has historically managed to increase prices by equal to or above inflation rates. Thus, we remain confident regarding its profitability moving forward.

Valuation & Expected Returns

We expect PPG to generate earnings-per-share of $6.68 this year. As a result, the stock is currently trading at a price-to-earnings ratio of 17.9. We expect the stock’s valuation multiple to converge toward its historical average over time, at around 19. It’s a somewhat premium multiple in the current environment, but investors have historically overpaid for PPG’s qualities and exceptional track record of dividend increases.

As a result, we view PPG stock as relatively undervalued right now.

If the P/E multiple declines from 17.9 to 19 over the next five years, shareholder returns would be reduced by 1.2% per year.

Dividends and earnings-per-share growth will boost shareholder returns. PPG shares currently yield 2.1%. Further, we expect 8% annual EPS growth over the next five years.

Putting it all together, PPG stock is expected to generate annual returns of 11.1% over the next five years.

Final Thoughts

PPG Industries is one of the newest additions to the Dividend Kings list, having raised its dividend for the 51st consecutive year in 2022.

The company has maintained a long history of dividend increases each year, even during recessions, despite operating in a cyclical industry that is reliant on the health of the U.S. economy.

2020 was a very challenging year for the company due to the coronavirus pandemic. And while 2021 has gone much better, multiple end markets have not returned to their sales volumes from 2019.

PPG is experiencing a significant increase in raw material costs, and supply chain issues are also impacting results. Still, most inflationary costs have been passed along to the consumer, while PPG Industries’ earnings-per-share growth prospects over the medium term appear attractive.

We believe the stock is relatively undervalued, which could extend future returns. With expected returns in the low-double-digits, we rate this Dividend King a buy.

The following articles contain stocks with very long dividend or corporate histories, ripe for selection for dividend growth investors:

Thanks for reading this article. Please send any feedback, corrections, or questions to [email protected].

[ad_2]

Source link