[ad_1]

Up to date on September nineteenth, 2023 by Bob Ciura

Solely the perfect corporations can improve dividends via a number of recessions.

The Dividend Kings are a gaggle of shares which have raised dividends for no less than 50 years. Undertaking this activity isn’t any small feat. The truth that there are simply 50 corporations that meet the requirement to turn into a Dividend King is proof of this.

You possibly can see all 50 Dividend Kings right here.

You can even obtain an Excel spreadsheet with the complete listing of Dividend Kings (plus essential metrics equivalent to price-to-earnings ratios and dividend yields) by clicking on the hyperlink under:

Johnson & Johnson (JNJ) has elevated its dividend for 61 consecutive years, one of many longest progress streaks discovered anyplace within the inventory market.

This healthcare big is one in all hottest dividend progress shares due to its wonderful recession-resistant enterprise mannequin, and dividend monitor report.

Johnson & Johnson inventory stays a superb holding for long-term dividend progress.

Enterprise Overview

Johnson & Johnson was based in 1886 and has reworked into one of many largest corporations on the earth. Johnson & Johnson is a mega-cap inventory with a market capitalization of $390 billion. The corporate generates annual gross sales above $99 billion.

Johnson & Johnson operates a diversified enterprise mannequin, permitting it to attraction to all kinds of consumers inside the healthcare sector. J&J now operates two segments, prescribed drugs and medical units, after spinning off its client well being franchises.

On Might 4th, 2023, Kenvue started buying and selling on the New York Inventory Trade below the ticker image KVUE.

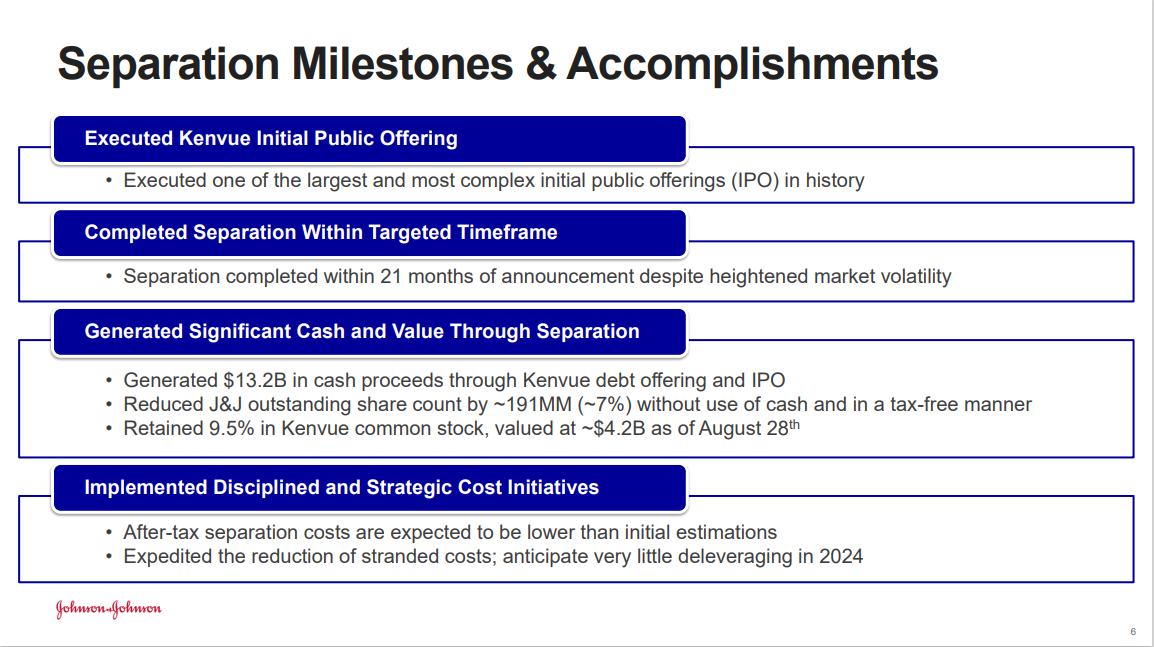

Supply: Investor Presentation

J&J believes the separation will unlock worth. The purpose is that the 2 corporations will garner the next cumulative valuation than they might as a single entity.

We imagine that the corporate will proceed to be a high dividend progress title for traders to personal following the separation.

Development Prospects

We count on Johnson & Johnson to generate 6% annual earnings-per-share progress over the following 5 years. The pharmaceutical phase will proceed to be the corporate’s primary progress driver, as has been the case for a number of years.

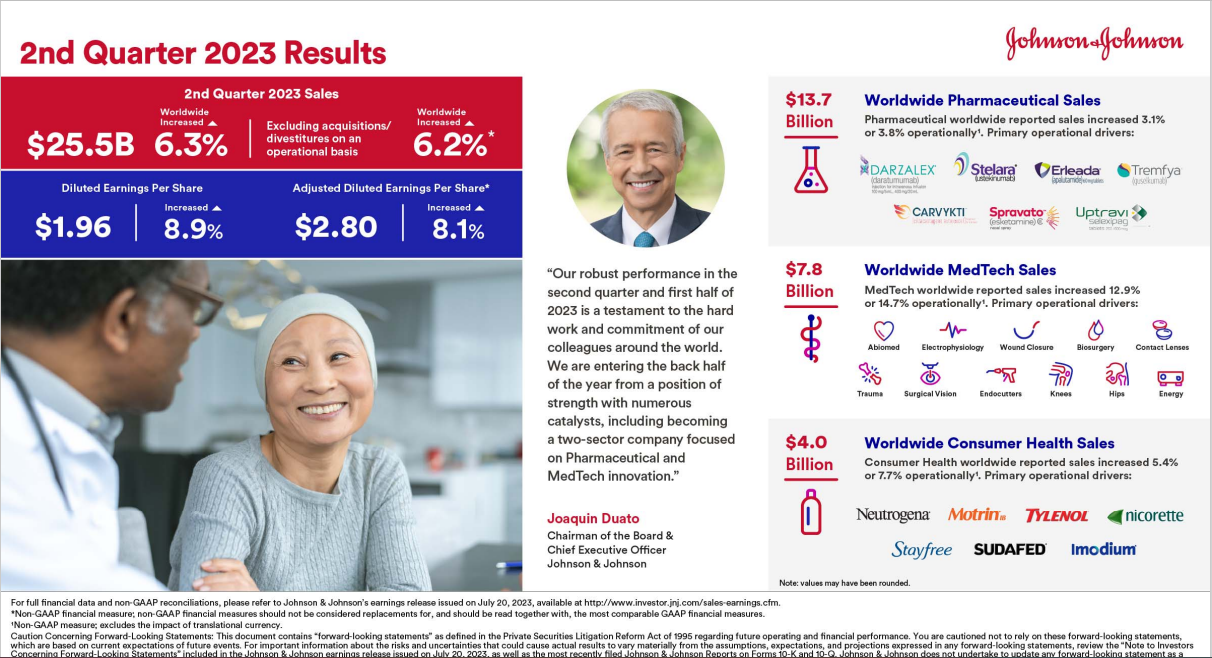

On July twentieth, 2023, Johnson & Johnson introduced outcomes for the second quarter for the interval ending June thirtieth, 2023. For the quarter, income grew 6.4% to $25.5 billion, which was $860 million greater than anticipated. Adjusted earnings-pershare of $2.80 in contrast favorably to $2.59 within the prior yr and was $0.18 greater than anticipated.

Supply: Investor Presentation

Pharmaceutical revenues grew 3.1% on a reported foundation (up 7.2% excluding foreign money trade). Oncology was greater by 8.8% (+9.7%) as Darzalex, which treats a number of myeloma, continues to develop market share. Immunology was up 1.9% (+2.6%) as a result of market share positive factors for Stelara, which treats immunemediated inflammatory illnesses.

MedTech was the perfect performing phase, with income rising 12.9%, or 14.7% in fixed currencies.

Johnson & Johnson revised its steering for 2023 as nicely. The corporate now expects income in a spread of $98.8 billion to $99.8 billion for the yr, up from $97.9 billion to $98.9 billion. Adjusted earnings-per-share is anticipated in a spread of $10.70 to $10.80, up from $10.60 to $10.70.

Aggressive Benefits & Recession Efficiency

Johnson & Johnson has a number of benefits over its opponents.

The corporate’s measurement and scale are unmatched in its business. Johnson & Johnson additionally has a AAA credit standing from Commonplace & Poor’s and Moody’s Traders Service. It is a greater credit standing than the U.S. authorities.

The one different firm to have a AAA credit standing is Microsoft Company (MSFT).

The corporate’s measurement and scale, along with its credit standing, present Johnson & Johnson the monetary flexibility to make acquisitions to gasoline additional progress.

Johnson & Johnson additionally invests closely in analysis and growth with a purpose to carry new merchandise to market. The results of this funding is that the corporate has a big portfolio of manufacturers that lead their respective classes.

These aggressive benefits allowed Johnson & Johnson to climate a number of recessions. Listed under are the corporate’s earnings-per-share outcomes earlier than, throughout, and after the final main recession:

- 2006 earnings-per-share: $3.76

- 2007 earnings-per-share: $4.15 (9.4% improve)

- 2008 earnings-per-share: $4.57 (10.1% improve)

- 2009 earnings-per-share: $4.63 (1.3% improve)

- 2010 earnings-per-share: $4.76 (2.8% improve)

Johnson & Johnson had EPS progress of virtually 12% from 2007 via 2009, a powerful accomplishment given the circumstances of the Nice Recession.

The corporate’s dividend additionally continued to develop. And with six a long time of dividend progress, it’s possible that Johnson & Johnson will proceed to extend its dividend nicely into the longer term.

Johnson & Johnson’s aggressive benefits and its recession efficiency make the inventory a superb defensive inventory to carry.

Valuation & Anticipated Returns

With a present share worth of $162 and anticipated earnings-per-share of $10.75 for the yr, Johnson & Johnson has a price-to-earnings ratio of 15.0.

We view the inventory as barely undervalued, with a good worth P/E estimate of 17. Enlargement of the P/E a number of from 15 to 17 would improve annual returns by 2.5% over the following 5 years.

Whole returns may also encompass earnings progress and dividends.

Given the corporate’s aggressive benefits and up to date enterprise efficiency, we really feel {that a} 6% common annual EPS progress fee is achievable over the following 5 years.

Lastly, Johnson & Johnson inventory has a present dividend yield of two.9%. Subsequently, complete annual returns are anticipated as follows:

- 6.0% EPS progress

- 2.5% a number of enlargement

- 2.9% dividend yield

Total, Johnson & Johnson is anticipated to supply a complete annual return of 11.4% via 2028. This makes the inventory a purchase because the anticipated return is above 10%.

Remaining Ideas

Relating to the Dividend Kings, few are as well-known or as widespread amongst dividend progress traders as Johnson & Johnson.

And for good cause: Johnson & Johnson’s diversified enterprise mannequin has allowed the corporate to endure a number of recessions and nonetheless improve its dividend for the previous 61 years. This progress streak is almost unmatched.

Total, projected returns earn the inventory a purchase suggestion.

The next articles comprise shares with very lengthy dividend or company histories, ripe for choice for dividend progress traders:

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to [email protected].

[ad_2]

Source link