[ad_1]

Up to date on September twentieth, 2023 by Bob Ciura

The Dividend Kings are the most effective shares available in the market for returning money to shareholders over time. To make the listing, an organization has to extend its per-share dividend for a minimum of 50 consecutive years.

Given this extraordinarily excessive bar, solely the companies that may present stability by way of all types of financial situations make the minimize.

Certainly, simply 50 corporations qualify as Dividend Kings. You’ll be able to see all 50 Dividend Kings right here.

You too can obtain an Excel spreadsheet with the complete listing of Dividend Kings (plus metrics that matter, similar to price-to-earnings ratios and dividend yields) by clicking on the hyperlink beneath:

Hormel Meals Company (HRL) is a processed meals producer that competes in a number of grocery classes. The corporate was based 131 years in the past and has managed to extend its dividend for the previous 57 years.

Hormel is a famously recession-resistant firm carried out comparatively effectively throughout the coronavirus pandemic.

On this article, we’ll check out Hormel’s fundamentals to judge the attractiveness of the inventory.

Enterprise Overview

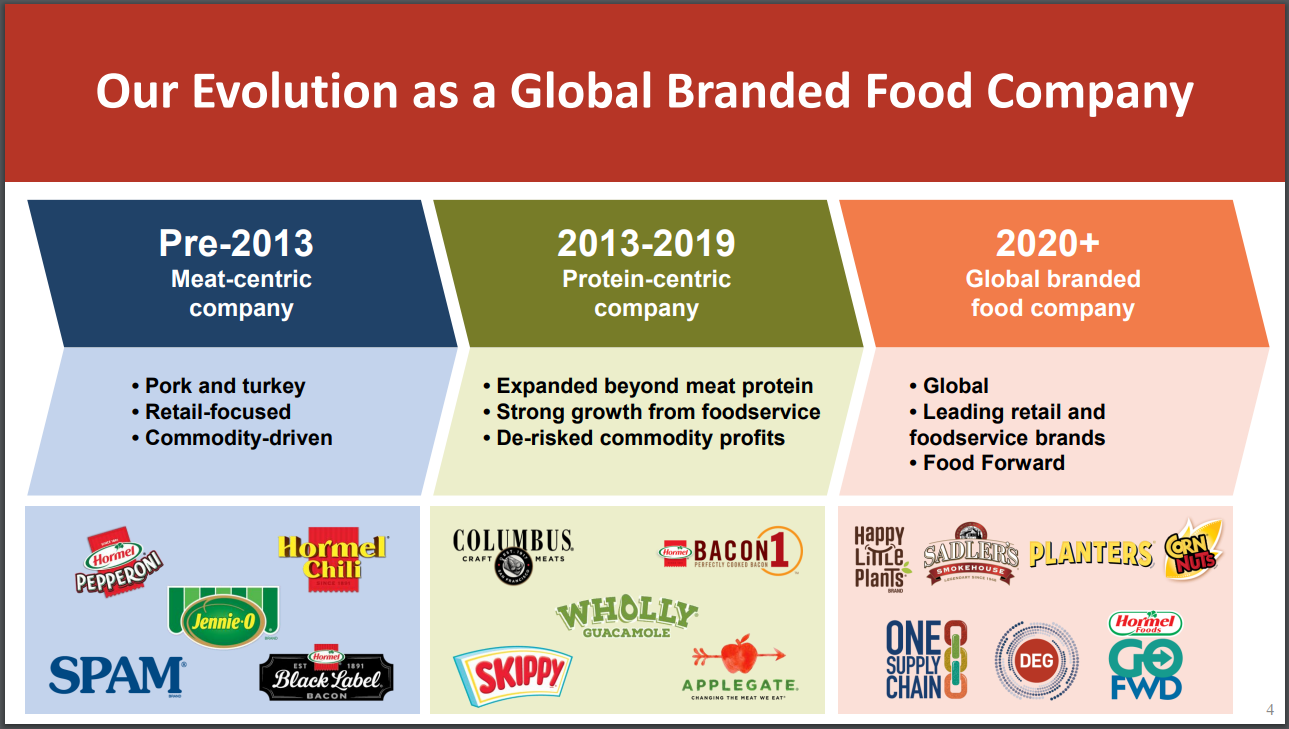

Hormel was based in 1891. Within the years since, it has grown by way of natural enlargement and an in depth historical past of acquisitions and divestitures.

As we speak, the corporate produces over $12 billion in annual income, with its core merchandise remaining true to its historical past as a meat processor.

Hormel’s attain is expansive, with distribution in additional than 80 international locations throughout the globe.

Supply: Investor Presentation

Hormel has a staggering 40 product classes the place its manufacturers are first or second when it comes to market share.

The corporate has targeted on constructing scale and model recognition in all of its classes, which has paid off over time. This sort of dominance is troublesome to search out in any business, however Hormel has managed to do it.

Hormel’s merchandise are organized in 4 classes: Refrigerated Meals, Middle Retailer Meals, Jennie-O Turkey, and Worldwide.

The Jennie-O model sells turkey merchandise, with equal elements of income going to grocery and meals service.

Progress Prospects

We at present count on Hormel to provide 6% annual earnings-per-share development for the foreseeable future because it continues to remake its portfolio to speed up development.

Hormel is executing six strategic priorities to push development. And every strategic precedence can also be geared toward particular manufacturers inside the firm. Gross sales development must be the first driver of earnings-per-share enlargement. Margins are additionally a key focus in 2023 and past, given the present value of inflation.

As well as, Hormel has been busy remaking its portfolio by way of acquisitions and divestitures lately.

For instance, in 2021, Hormel introduced the acquisition of the Planters snack nuts enterprise from Kraft-Heinz (KHC) for $3.35 billion. The acquisition has boosted Hormel’s development.

Supply: Investor Presentation

Hormel posted third quarter earnings on August thirty first, 2023. Adjusted earnings-per-share of $0.40 missed estimates by one cent. Income fell 2.3% year-over-year to $2.96 billion, which missed consensus by $90 million. Retail section quantity was up 1%, whereas web gross sales fell 2%, and section revenue was down 7%.

Foodservice quantity was up 2%, whereas web gross sales fell 3%, however section revenue rose 14%. The worldwide section noticed quantity decline 10%, whereas web gross sales fell 6%, and section revenue was minimize in half. The corporate mentioned quantity development was pushed by stronger outcomes from turkey, broad demand for meals service merchandise, and power in SPAM, Black Label, Planters, and pepperoni.

Aggressive Benefits & Recession Efficiency

Hormel’s aggressive benefit is its roughly 40 merchandise which are #1 or #2 when it comes to market share of their respective classes. It competes very effectively in classes with secure demand and repeats purchases, because it solely sells consumables.

Its distribution community that will get merchandise to greater than 80 international locations means Hormel’s income stream may be very effectively diversified.

Hormel’s recession file is pretty sturdy, having grown its earnings throughout and after the Nice Recession:

- 2007 earnings-per-share of $0.54

- 2008 earnings-per-share of $0.52 (3.7% lower)

- 2009 earnings-per-share of $0.63 (21.1% enhance)

- 2010 earnings-per-share of $0.76 (20.6% enhance)

Hormel noticed a small decline throughout the preliminary downturn throughout the Nice Recession however posted enormous earnings development in 2009 and 2010.

The coronavirus pandemic was comparable, as Hormel reaped the advantage of pantry-stocking worldwide.

Due to this fact, Hormel stays a good selection for traders searching for defensive shares for his or her dividend portfolio.

Valuation & Anticipated Returns

We count on Hormel will generate adjusted earnings-per-share of $1.65 for the present 12 months. Due to this fact, the inventory trades for a price-to-earnings ratio of 23.5, which is above our honest worth P/E of twenty-two.0.

That works out to be a modest headwind to whole returns over the subsequent 5 years because the inventory stays costly. Given Hormel’s struggles with quantity and margins, we consider traders are more likely to scale back the earnings a number of than develop it additional.

If the P/E declines from 23.5 to 22.0 over the subsequent 5 years, annual shareholder returns could be decreased by 1.3% per 12 months.

On a constructive be aware, anticipated earnings-per-share development of 4.0% and the two.8% dividend yield will add to shareholder returns.

General, we see the potential for annual returns of 5.5% per 12 months for Hormel inventory. It is a ok return to take care of a maintain ranking on Hormel, particularly because of the firm’s constant dividend development.

Certainly, the dividend may be very secure, as Hormel has a projected dividend payout ratio of 57% for 2023. Due to this fact, the corporate shouldn’t have a lot hassle rising the dividend every year going ahead.

Remaining Ideas

Hormel’s monitor file of earnings stability and dividend development are troublesome to match. The corporate has confirmed it could survive and thrive in a wide range of situations, together with maybe essentially the most difficult situations the financial system has ever confronted with the coronavirus disaster.

Nonetheless, the inventory seems to be overvalued proper now, which limits its whole return potential. We at present charge the inventory as a maintain for dividend development traders, however it’s not a purchase proper now because of valuation.

The next articles comprise shares with very lengthy dividend or company histories, ripe for choice for dividend development traders:

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to [email protected].

[ad_2]

Source link