[ad_1]

Up to date on January twenty third, 2023 by Quinn Mohammed

Shopper staples shares are a number of the most dependable dividend payers within the inventory market. Folks want staples merchandise for his or her day by day lives, which offers a sure degree of demand from 12 months to 12 months.

Demand for on a regular basis merchandise stays regular, even throughout recessions, which makes it an interesting business for traders on the lookout for constant dividends.

For this reason there are a number of client staples shares on the Dividend Aristocrats record, which incorporates 65 firms within the S&P 500 Index, with 25+ consecutive years of dividend will increase.

You may obtain an Excel spreadsheet of all 65 Dividend Aristocrats (with metrics that matter equivalent to dividend yields and price-to-earnings ratios) by clicking the hyperlink beneath:

Annually, we evaluation all Dividend Aristocrats individually. The subsequent inventory within the collection is The Clorox Firm (CLX). Clorox has raised its dividend for 45 years in a row.

This text will present an in-depth evaluation of Clorox’s enterprise mannequin, and future outlook.

Enterprise Overview

Clorox began out over 100 years in the past, with the debut of its namesake liquid bleach in 1913. At the moment, it’s a international producer of client {and professional} merchandise than collectively span all kinds of makes use of and clients. The corporate produces annual income in extra of $7 billion and it sells its merchandise in additional than 100 markets.

The corporate has a extremely numerous set of companies with myriad manufacturers and merchandise inside every, offering Clorox with enormous international scale.

Supply: Investor Presentation

The corporate’s largest phase is well being and wellness, which is a part of the core Cleansing phase. Nonetheless, Clorox is way more than a cleaner firm because it produces meals, pet merchandise, charcoal, and all kinds of different manufacturers.

The Family phase consists of the Glad, Kingsford, Contemporary Step, and Renew Life manufacturers. Cleansing merchandise embody Clorox, Pine-Sol, and the Clorox Business Options companies. Way of life manufacturers embody Hidden Valley, Burt’s Bees, and Brita. Lastly, the Worldwide phase sells Clorox’s manufacturers world wide.

A lot of Clorox’s manufacturers maintain the #1 or #2 market share of their respective product classes. In truth, greater than 80% of its complete income comes from merchandise that match this description.

This leads to pricing energy, and excessive revenue margins. The corporate states that 9 of ten of its portfolio of manufacturers have steady or rising family penetration, so natural development must be simpler to return by within the coming years.

Clorox reported first quarter fiscal 2023 outcomes on November 1st, 2022. For the quarter, Clorox reported gross sales of $1.74 billion, which was down 4% year-over-year. Clorox confronted a tough comparability, and the corporate identified gross sales on a three-year foundation had been up 5%. The year-over-year decline was on account of a discount in quantity, partially offset by a acquire from favorable worth combine. Natural gross sales had been down 2%.

Gross margin contracted by 110 foundation factors to 36% of income. This was pushed primarily by greater manufacturing, logistics, commodity prices, and decrease quantity. Adjusted earnings-per-share fell 23% to 93 cents. The decline was a results of decrease gross margin, decrease quantity, and better SG&A, partially offset by the advantages of pricing actions.

We count on Clorox to generate roughly $4.10 in earnings-per-share for 2023, which is roughly unchanged from 2022 outcomes.

Progress Prospects

Trying forward, Clorox has some levers it might probably pull to proceed its development. The corporate is constantly innovating with product extensions on its present lineup, equivalent to flavors and cross-branding. It has accomplished these issues for a very long time and can proceed to take action as a way to keep aggressive.

Additionally it is focusing its mergers and acquisitions on firms which might be rising, centered within the US, and are margin-accretive. Clearly, the corporate desires to spice up home development and margins via acquisitions.

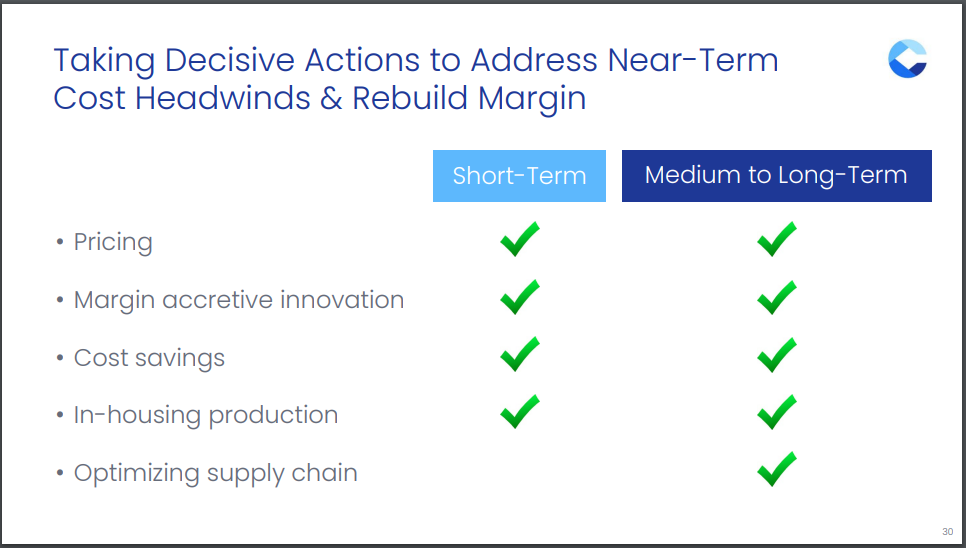

Margin growth is one other longer-term objective for the corporate, although Clorox should first rebuild its margins which have been negatively impacted all through 2022. Clorox sees potential in rebuilding its margins via pricing actions, price financial savings, and by optimizing its provide chain over the long-term.

Supply: Investor Presentation

Clorox can also be taking a prudent method by shopping for firms with a greater margin profile than its current portfolio, which boosts income and margins concurrently. That is congruent with the corporate’s fixed give attention to driving each foundation level of margin from every product, which has served it effectively in the course of the latest high line weak spot.

We forecast 12% earnings-per-share good points within the subsequent 5 years. Whereas this seems to be an amazing development charge for such a big firm, this development charge is simply forecasted because of the low comparability base fashioned for fiscal 12 months 2023 outcomes.

Aggressive Benefits & Recession Efficiency

Clorox has a number of aggressive benefits. First, it holds a tremendously sturdy model portfolio. As beforehand talked about, Clorox merchandise take pleasure in very excessive market share throughout the portfolio.

Supply: Investor Presentation

Clorox retains its excessive business place partly via promoting and it spends very closely to keep up that place. Product advertising is a necessity for client merchandise producers and Clorox spends ~10% of its income on this annually.

One other benefit of Clorox’s enterprise mannequin is that its merchandise are utilized by tens of millions of individuals every day, in good economies and unhealthy. Based on the corporate, Clorox-branded merchandise are in about 9 of ten U.S. households.

There’ll at all times be a sure degree of demand for family cleansing merchandise and meals, even when the financial system enters a downturn. This enables the corporate to stay worthwhile throughout recessions. Certainly, Clorox is a robust instance of a defensive inventory. Its earnings-per-share via the Nice Recession are proven beneath:

- 2007 earnings-per-share of $3.23

- 2008 earnings-per-share of $3.24 (0.3% enhance)

- 2009 earnings-per-share of $3.81 (18% enhance)

- 2010 earnings-per-share of $4.24 (11% enhance)

As you’ll be able to see, Clorox elevated earnings-per-share annually all through the recession, together with double-digit earnings development in 2009 and 2010.

Clorox additionally carried out very effectively in the course of the coronavirus pandemic, as its merchandise noticed a lot greater demand as customers spent way more time at dwelling. This demonstrates the corporate has a really recession-resistant enterprise mannequin and a excessive degree of security.

Valuation & Anticipated Returns

We count on Clorox to generate earnings-per-share of $4.10 for fiscal 2023. Based mostly on this, shares commerce for a price-to-earnings ratio of 34.8. That is considerably above our estimate of truthful worth, which is 23 occasions earnings.

Because the inventory is buying and selling above truthful worth, we see it as considerably overvalued. If the P/E a number of falls from 34.8 to 23 over the following 5 years, it might scale back annual returns by 8.0%.

Shareholder returns will probably be additional boosted by future earnings-per-share development, which we estimate at 12% per 12 months. Lastly, Clorox’s 3.3% dividend yield will add to shareholder returns. This results in complete anticipated returns of 6.2% per 12 months over the following 5 years.

This can be a first rate anticipated charge of return however is just not excessive sufficient to warrant a purchase ranking right now.

Ultimate Ideas

Clorox is a dependable dividend inventory. The corporate has a management place throughout its product markets, with potential for some development. The corporate ought to have the ability to proceed its four-decade lengthy streak of annual dividend raises whatever the total financial local weather. This makes it a constant dividend inventory for risk-averse earnings traders.

Nonetheless, the inventory stays a maintain in our view, and traders focused on complete return potential ought to look ahead to an additional pullback within the share worth.

Moreover, the next Positive Dividend databases include essentially the most dependable dividend growers in our funding universe:

If you happen to’re on the lookout for shares with distinctive dividend traits, contemplate the next Positive Dividend databases:

The key home inventory market indices are one other stable useful resource for locating funding concepts. Positive Dividend compiles the next inventory market databases and updates them month-to-month:

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to [email protected].

[ad_2]

Source link