Up to date on February 2nd, 2023 by Nathan Parsh

PPG Industries (PPG) is among the largest paint corporations on the earth. It is usually one of the crucial dependable dividend shares out there–PPG has paid dividends each quarter since 1899.

Furthermore, the corporate has elevated its dividend every year for the final 51 years, which qualifies it to be a member of the unique Dividend Aristocrats listing.

This can be a group of 68 shares within the S&P 500 Index with at the least 25 consecutive years of dividend development.

We think about the Dividend Aristocrats to be among the many elite dividend-paying corporations. With this in thoughts, we created a full listing of all 68Dividend Aristocrats.

You possibly can obtain the whole Dividend Aristocrats listing, with essential monetary metrics like dividend yields and P/E ratios, by clicking on the hyperlink under:

The inventory can also be on the unique listing of Dividend Kings.

PPG’s outstanding dividend consistency offers it broad attraction to the extra conservative members of the dividend development investing group.

Certainly, the corporate has a really protected dividend fee with room for regular dividend will increase every year, due to its sturdy enterprise mannequin. That is nonetheless very a lot the case right this moment.

This text will analyze PPG’s funding prospects intimately and decide whether or not the corporate deserves a purchase suggestion at present costs.

Enterprise Overview

PPG Industries was initially based in 1883 as a producer and distributor of glass. PPG stands for Pittsburgh Plate Glass, which is a reference to the corporate’s authentic operations.

Over time, PPG has made outstanding strides in turning into an trade chief within the paints and coatings trade.

With annual revenues of about $18 billion, PPG’s solely rivals of comparable measurement are fellow Dividend Aristocrat Sherwin-Williams (SHW), in addition to Dutch paint firm Akzo Nobel (AKZOY).

PPG Industries has grown to such a powerful measurement due to its worldwide working presence and concentrate on expertise and innovation.

Its analysis and growth focus is a key differentiator between PPG and different paint & coatings corporations. Due to its heavy R&D investments, PPG has grown to be a market chief right this moment.

As well as, PPG has an extended historical past of accretive acquisitions which have helped it develop over time. PPG has been very busy in simply the previous couple of years, securing acquisitions that may add almost $2 billion in income to its prime line, and also will bolster its worldwide presence. It has a really lengthy historical past of profitable acquisitions, that means it may possibly develop not solely organically, but in addition by means of buying scale and market share.

PPG reported fourth-quarter and full yr outcomes on January nineteenth, 2023.

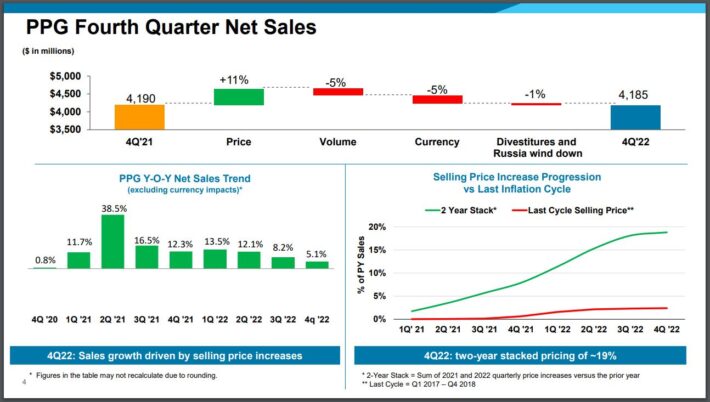

Supply: Investor presentation, web page 4

Income was flat for the quarter, however up 5.4% to $17.7 billion for 2022. Adjusted earnings-per-share fell to $1.22 from $1.26 for the quarter. Full yr earnings-per-share of $6.05 in contrast unfavorably to $6.77 in 2021.

PPG has developed unbelievable model loyalty through the years, which has helped it to endure the rising enter value going through the corporate in recent times. PPG has largely offset these prices by elevating costs on its merchandise with out seeing a major drawdown in quantity. As you may see, pricing added 11% to quarterly outcomes with quantity down a mid-single-digit determine.

Our preliminary estimate for 2023 is $6.99 in earnings-per-share.

Development Prospects

By and huge, an organization’s skill to extend revenues and income is a perform of its capital allocation.

PPG has spent billions of {dollars} in recent times shopping for its subsequent technology of development. It tries to take care of a considerably balanced capital allocation technique, however additionally it is not afraid to spend large on acquisitions when alternatives current themselves.

PPG has spent rather more of its deployed money on share repurchases than its rivals, which has been a serious supply of earnings-per-share development over time.

It is usually seemingly that mergers and acquisitions will probably be a continued focus for PPG shifting ahead, as the corporate strikes again in direction of its core competency of portfolio optimization.

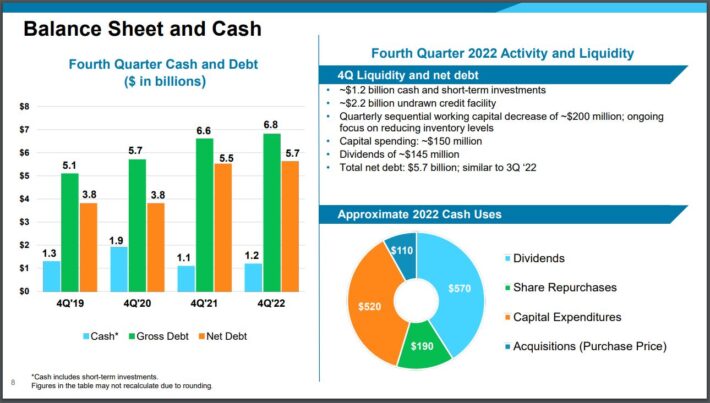

Acquisitions have been a key development driver for PPG for a few years. That development has come at a price, specifically a rise within the firm’s debt.

Supply: Investor Presentation, web page 8

PPG is now just about solely a coatings enterprise. The transformation in recent times away from legacy companies like glass and chemical substances has left the corporate with a powerful portfolio of coatings merchandise that collectively generate almost $18 billion in annual income.

PPG acknowledged years in the past that its future development could be in coatings, and has positioned itself accordingly.

Its observe report means that its underlying enterprise is more likely to proceed rising at a passable fee for the foreseeable future. Up to now decade, the corporate has grown its earnings-per-share at a mean fee of just below 6%.

PPG has been an elite development inventory for a very long time. This development has not been linear, as there have been ups and downs from yr to yr, however over time, PPG has delivered spectacular development.

Given its very sturdy fundamentals and its concentrate on coatings, we consider buyers can moderately count on 8% adjusted earnings-per-share development from PPG Industries by means of full financial cycles.

Nevertheless, PPG’s efficiency is more likely to endure in periods of financial recession. The excellent news is that we’d seemingly see such an occasion as a shopping for alternative for this high-quality enterprise.

Aggressive Benefits & Recession Efficiency

PPG enjoys numerous aggressive benefits. It operates within the paints & coatings trade, which is economically enticing for a number of causes. First, these merchandise have high-profit margins for producers.

Additionally they have low capital funding, which leads to important money circulate. PPG has put this important money circulate to make use of over time, as mentioned above.

Given all this, it is smart that there are simply two coatings corporations (Sherwin-Williams and PPG Industries) on the Dividend Aristocrats listing.

With that stated, the paint and coatings trade shouldn’t be very recession-resistant as a result of it is dependent upon wholesome housing and development markets. This impression will be seen in PPG’s efficiency in the course of the 2007-2009 monetary disaster:

- 2007 adjusted earnings-per-share: $2.52

- 2008 adjusted earnings-per-share: $1.63 (35% decline)

- 2009 adjusted earnings-per-share: $1.02 (37% decline)

- 2010 adjusted earnings-per-share: $2.32 (127% improve)

PPG’s adjusted earnings-per-share fell by greater than 50% over the last main recession and took two years to get well.

As PPG’s 2020 outcomes confirmed, the decline in new development is the dominant issue for PPG throughout a recession. The 2020 recession was no totally different, as PPG confronted manufacturing facility shutdowns and severely decreased demand from customers, though that proved to be transitory.

Whereas the long-term prospects of this Dividend Aristocrat stay brilliant, buyers ought to be prepared to simply accept volatility in a recession.

If something, a recession and corresponding decline in PPG’s share value would permit buyers to buy extra shares of this inventory at a way more enticing value.

Valuation & Anticipated Whole Returns

We’re forecasting earnings-per-share of $6.99 for the fiscal yr of 2023, placing the price-to-earnings ratio at 19.2. That is simply above our truthful worth estimate of 19 occasions earnings, that means PPG is barely overvalued right this moment.

As such, we count on a modest 0.2% headwind to complete returns from valuation within the coming years.

In complete, we mission that PPG will return 9.5% yearly by means of 2028, stemming from 8% earnings development and the beginning yield of 1.9%, partially offset by a 0.2% headwind from a number of contraction. Given this, we proceed to fee PPG a maintain, although we’d discover the identify extra enticing on a slight pullback.

Ultimate Ideas

PPG Industries has most of the traits of a really high-quality enterprise. It has a confirmed enterprise mannequin and has generated sturdy development over the previous a number of years.

It additionally has a major worldwide presence and a number of catalysts for future development. Lastly, it has elevated its dividend for 51 years.

Nevertheless, the inventory is barely overvalued.

PPG’s dividend outlook is exemplary and we see many extra years of dividend will increase on the horizon. That stated, we recommend ready for a pullback earlier than shopping for.

If you’re serious about discovering high-quality dividend development shares appropriate for long-term funding, the next Positive Dividend databases will probably be helpful:

The main home inventory market indices are one other stable useful resource for locating funding concepts. Positive Dividend compiles the next inventory market databases and updates them month-to-month:

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to [email protected].