[ad_1]

Up to date on March twentieth, 2024 by Bob Ciura

Nucor Company (NUE) is the most important metal producer in North America. Regardless of working within the notoriously unstable uncooked supplies sector, Nucor can also be a remarkably constant dividend progress inventory. The corporate is within the S&P 500 Index and has elevated its annual dividend for over 50 consecutive years, which qualifies it to be a member of the Dividend Aristocrats listing.

The Dividend Aristocrats have lengthy histories of elevating their dividends every year, even throughout recessions, which makes them comparatively uncommon finds inside the broader S&P 500. With this in thoughts, we created a listing of all 68 Dividend Aristocrats, together with necessary monetary metrics like price-to-earnings ratios and dividend yields.

You possibly can obtain an Excel spreadsheet with the total listing of Dividend Aristocrats by clicking on the hyperlink beneath:

Disclaimer: Positive Dividend just isn’t affiliated with S&P World in any manner. S&P World owns and maintains The Dividend Aristocrats Index. The knowledge on this article and downloadable spreadsheet relies on Positive Dividend’s personal evaluation, abstract, and evaluation of the S&P 500 Dividend Aristocrats ETF (NOBL) and different sources, and is supposed to assist particular person buyers higher perceive this ETF and the index upon which it’s primarily based. Not one of the data on this article or spreadsheet is official knowledge from S&P World. Seek the advice of S&P World for official data.

Nucor’s dividend consistency permits it to face out in its business. Metal is a very tough business because of the cyclical nature of the enterprise mannequin, which makes Nucor’s streak of annual dividend will increase much more spectacular.

This text will analyze Nucor’s enterprise mannequin, progress prospects, and valuation to find out whether or not the inventory is a purchase proper now.

Enterprise Overview

Nucor is the most important metal producer in North America after many years of progress. The corporate is headquartered in Charlotte, North Carolina, and has a market capitalization of $39.5 billion.

Nucor was not at all times a pacesetter within the metal manufacturing business. The corporate has an extended and convoluted company historical past that may be traced again to the corporate’s founder, Ransom E. Olds (the creator of the Oldsmobile vehicle). Olds left his personal automotive firm over a disagreement with shareholders to type the REO Motor Firm, which ultimately remodeled into the Nuclear Company of America – Nucor’s first predecessor.

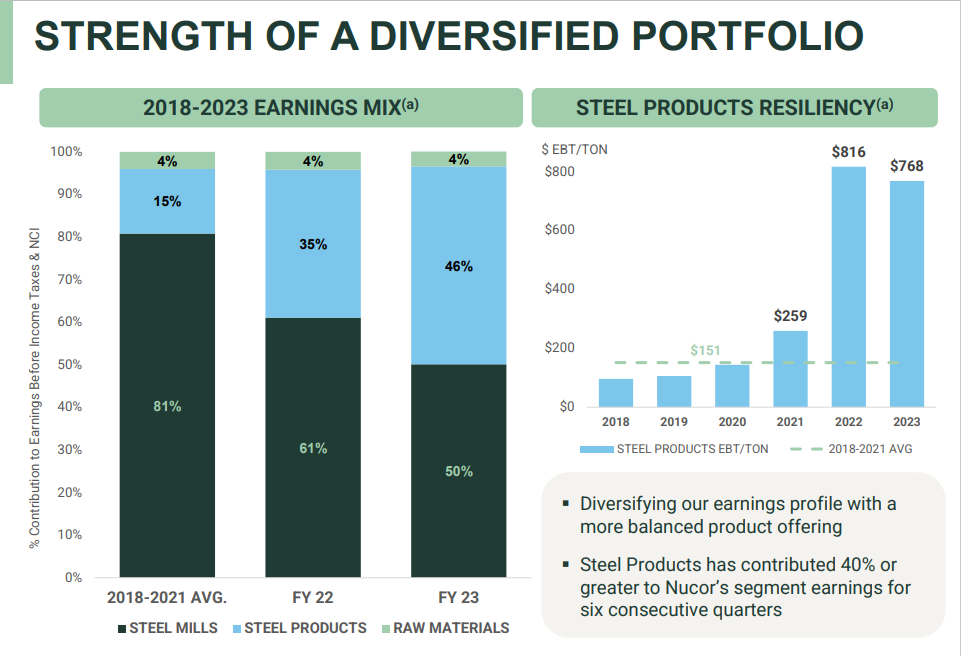

The corporate at the moment operates in three segments: Metal Mills (the most important phase by income), Metal Merchandise, and Uncooked Supplies.

Supply: Investor presentation

Nucor manufactures all kinds of fabric sorts, together with sheet metal, metal bars, structural formations, metal plates, downstream merchandise, and uncooked supplies. Nearly all of the corporate’s manufacturing comes from a mixture of sheet and bar metal, as has been the case for a few years.

Nucor has been profitable over the long-term due to a concentrate on low-cost manufacturing. This permits it to take care of profitability throughout downturns, in addition to to provide important working leverage throughout higher occasions. As well as, it has labored to increase its product choices to new markets, and preserve and develop its market management in current channels.

Progress Prospects

The previous a number of years have been unstable for Nucor and its rivals across the globe. Metal costs have been fluctuating wildly, pushed primarily by a provide glut popping out of worldwide markets, particularly China. Nevertheless, the business outlook has been fairly favorable these days.

Nucor Company disclosed its This autumn 2023 earnings on January 30, 2024, demonstrating resilience amid difficult market situations. The corporate reported earnings of $3.16 per share for the quarter, a lower from the earlier 12 months’s $4.89 per share however surpassing the consensus estimate of $2.83.

Nucor’s internet gross sales for the quarter amounted to $7.70 billion, marking an 11.7% lower year-over-year, but exceeding the consensus estimates. The decline in earnings throughout the fourth quarter was primarily attributed to decrease costs, reflecting the unstable metal market situations.

For the total 12 months 2023, Nucor reported internet earnings of $4.52 billion or $18 per share, a lower from 2022’s internet earnings of $7.61 billion or $28.79 per share. The overall internet gross sales for the 12 months stood at $34.71 billion, exhibiting a 16% lower from the earlier 12 months.

Total, we count on Nucor’s earnings-per-share to say no by 0.9% per 12 months over the subsequent 5 years, as the corporate is coming off a multi-year interval of document earnings.

Aggressive Benefits & Recession Efficiency

Nucor is a producer and distributor of uncooked supplies and metal. Accordingly, the corporate is a ‘commodity enterprise’ – one by which the only largest differentiator between rivals is worth.

Warren Buffett has the next to say about commodity companies:

“Shares of corporations promoting commodity-like merchandise ought to include a warning label: ‘Competitors might show hazardous to human wealth.’” – Warren Buffett

Actually, commodity companies should not probably the most defensive companies, due to their cyclicality. This may be seen by Nucor’s efficiency throughout the 2007-2009 monetary disaster:

- 2007 adjusted earnings-per-share: $4.98

- 2008 adjusted earnings-per-share: $6.01

- 2009 adjusted earnings-per-share: internet lack of ($0.94)

- 2010 adjusted earnings-per-share: $0.42

- 2011 adjusted earnings-per-share: $2.45

Nucor’s earnings-per-share had been decimated by the monetary disaster. The corporate is one in all few Dividend Aristocrats whose earnings truly turned detrimental throughout this tumultuous time interval. Earnings have solely just lately caught as much as their pre-recession ranges, though Nucor has continued to steadily improve its dividend funds.

Valuation & Anticipated Returns

Nucor is predicted to report adjusted earnings-per-share of about $13.60 in fiscal 2024. That places the price-to-earnings ratio at ~14.1, which is above our honest worth estimate of 12.0. For metal producers, we stay extra cautious than the overall market, partly because of the volatility of commodity costs.

We see honest worth at 12 occasions earnings, that means Nucor is overvalued at present. If the P/E a number of contracts from 14.1 to 12, it might cut back annual returns by -3.2% over the subsequent 5 years.

The present yield is 1.1%, and we count on EPS to say no by 0.9% every year over the subsequent 5 years. We see detrimental complete annual returns of -3% within the subsequent 5 years.

Nucor has a extremely spectacular dividend historical past. It has elevated its dividend for 51 consecutive years. It has paid over 200 consecutive quarterly dividends. That stated, the speed of dividend progress has lagged common over the past decade, with most annual will increase within the low single-digits on a proportion foundation.

Closing Ideas

Nucor’s standing as a Dividend Aristocrat and, following its most up-to-date dividend improve as a Dividend King, helps it to face out among the many extremely unstable supplies sector. There are a handful of uncooked supplies companies which have multi-decade monitor data of compounding their adjusted earnings-per-share.

Regardless of Nucor that includes an extended historical past of annual dividend will increase and having a robust business place and a wholesome stability sheet, Nucor now has a decrease dividend yield than the S&P 500 Index common on account of its rising share worth lately.

The share worth rally has additionally elevated Nucor’s valuation, and we now see the inventory as considerably overvalued. Total, the inventory has a promote advice on the present worth.

Moreover, the next Positive Dividend databases include probably the most dependable dividend growers in our funding universe:

In the event you’re searching for shares with distinctive dividend traits, take into account the next Positive Dividend databases:

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to [email protected].

[ad_2]

Source link