[ad_1]

Up to date on March 25h, 2024 by Bob Ciura

Yearly, Certain Dividend evaluations the Dividend Aristocrats, which we contemplate to be among the finest shares for buyers searching for to construct long-term wealth.

Firms who’ve attained Dividend Aristocrat standing have met the next standards:

- Are a member of the S&P 500 index.

- Have not less than 25 consecutive years of dividend will increase.

- Meet sure measurement and liquidity necessities.

Membership on this group could be very unique, as there are simply 68 shares on the Dividend Aristocrats checklist.

We’ve got compiled a listing of all 68 Dividend Aristocrats, together with essential monetary metrics comparable to price-to-earnings ratios and dividend yields. You may obtain the total checklist by clicking on the hyperlink beneath:

Disclaimer: Certain Dividend just isn’t affiliated with S&P International in any approach. S&P International owns and maintains The Dividend Aristocrats Index. The data on this article and downloadable spreadsheet relies on Certain Dividend’s personal evaluate, abstract, and evaluation of the S&P 500 Dividend Aristocrats ETF (NOBL) and different sources, and is supposed to assist particular person buyers higher perceive this ETF and the index upon which it’s primarily based. Not one of the info on this article or spreadsheet is official information from S&P International. Seek the advice of S&P International for official info.

NextEra Vitality, Inc. (NEE) is a Dividend Aristocrat since 2021 when it managed to hit the 25-year dividend progress aim. It has since continued to extend its dividend annually since.

This text will focus on NextEra Vitality’s enterprise mannequin, progress prospects, and valuation to find out whether or not it’s a pretty inventory for revenue buyers proper now.

Enterprise Overview

With a market capitalization of ~$130 billion, NextEra Vitality has grown into one of many largest utility firms on the earth since its founding in 1925.

Whereas the corporate has nuclear energy crops in Iowa, New Hampshire, and Wisconsin, it’s in Florida the place it has the overwhelming majority of its enterprise. The corporate consists of three working segments: Florida Energy & Mild, NextEra Vitality Sources, and Gulf Energy. The Florida Energy & Mild and Gulf Energy segments are rate-regulated electrical utilities that serves about 5.8 million buyer accounts in Florida.

NEE generates roughly 80% of its revenues from FPL. NextEra Vitality is likely one of the largest mills of wind and photo voltaic vitality on the earth.

NextEra Vitality reported its This fall and full-year 2023 monetary outcomes on 01/25/24. The utility continues to ship steady outcomes, however the inventory valuation has come down. For the quarter, the corporate reported revenues of $6.9 billion (up 11.6% yr over yr), translating to adjusted earnings of $1.1 billion (up 5.5% yr over yr). On a per-share foundation, adjusted earnings climbed 2% to $0.52.

For the total yr, the corporate generated revenues of $28.1 billion (up 34%) and adjusted earnings of $6.4 billion (up 12% yr over yr). Adjusted earnings per share have been $3.17 (up 9.3%), exceeding the highest finish — $3.13 — of administration’s estimate.

Significantly, FPL added about 1,200 MW of cost-effective price base photo voltaic initiatives, whereas NEER added 9,000 MW value of recent renewables and storage initiatives, bringing its backlog to over 20 GW.

Development Prospects

NextEra Vitality advantages from a number of key components that ought to allow the corporate to proceed to develop. Its utility enterprise is well-positioned to seize new clients because it resides in one of many largest states within the nation.

Florida’s inhabitants additionally continues to develop, which ought to present the corporate with the potential to extend its buyer depend, which ought to profit its income progress sooner or later.

NextEra can also be positioned in a state that could be very constructive in its regulation of utilities. This permits the corporate to get well its investments in new initiatives shortly.

For instance, Florida Energy & Mild, together with Gulf Energy, notified regulators that it could search annual base price will increase of greater than $600 million in 2023, with additional base price will increase being seen in 2024 and past.

The corporate’s monumental buyer base permits it to make huge investments with out leading to extraordinarily excessive base price will increase.

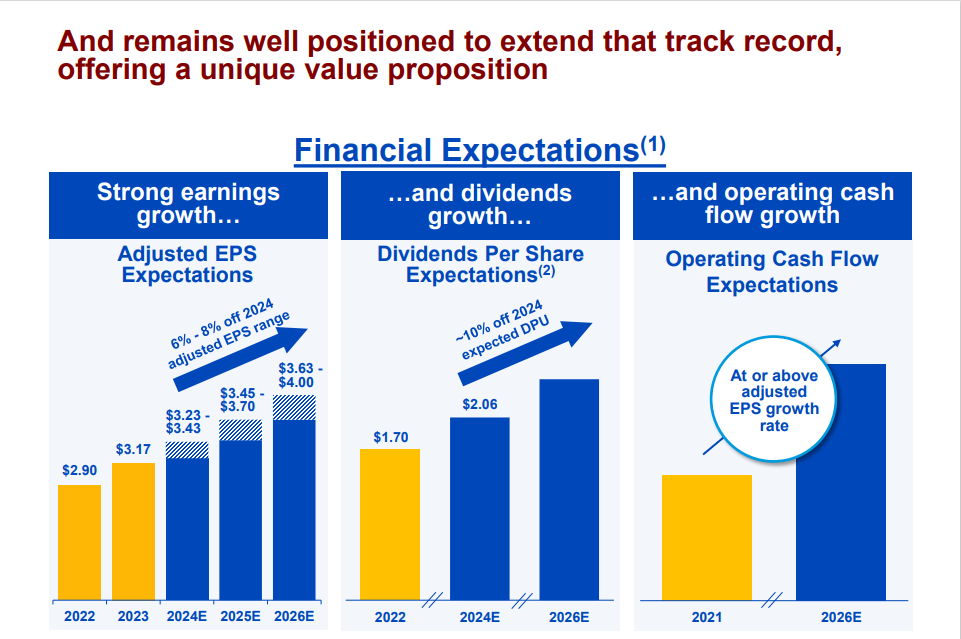

Total, NEE sees robust progress up forward.

Supply: Investor Presentation

However what actually units NextEra Vitality aside from most of its friends is the corporate’s renewable vitality enterprise. This enterprise is rising at a a lot quicker tempo than the corporate’s different segments.

NEER commissioned ~5.6 GW of renewable and storage initiatives in 2023. On the finish of 2023, its backlog stood

at ~20 GW. The corporate will deliver a big portion of that on-line over the following two to a few years, and buyers can anticipate additional investments in renewable vitality property in the long term.

NEE administration initiated its 2024 adjusted EPS steering vary at $3.23-$3.43. We anticipate the corporate to develop its adjusted EPS by 7% per yr over the following 5 years.

Aggressive Benefits & Recession Efficiency

Dimension and scale are NextEra’s largest aggressive benefits. No different firm on the earth can declare a bigger renewable vitality enterprise than NextEra. A really massive (and rising) buyer base is an extra benefit.

The corporate commonly expands its huge scale by way of acquisitions, comparable to its 2019 buy of Gulf Energy from Southern Firm, for $6.5 billion. These acquisitions normally are instantly accretive for NextEra’s earnings-per-share, which creates important worth for shareholders, particularly when further synergies are captured over time.

Utility shares are sometimes considered as dependable investments given the stableness of their revenues and earnings. This makes these shares particularly engaging to buyers in unsure occasions.

NextEra Vitality is not any totally different and carried out very effectively over the last recession. Listed beneath are the corporate’s earnings-per-share earlier than, throughout, and after the final recession:

- 2006 earnings-per-share: $0.81

- 2007 earnings-per-share: $0.82 (1.2% enhance)

- 2008 earnings-per-share: $1.02 (24.4% enhance)

- 2009 earnings-per-share: $0.99 (2.9% lower)

- 2010 earnings-per-share: $1.19 (20.2% enhance)

NextEra Vitality did endure a slight drop in earnings-per-share in 2009, however total, noticed its backside line develop rather a lot within the 2006-2010 timeframe.

On the identical time, the corporate’s dividend continued to develop annually.

Valuation & Anticipated Returns

Primarily based on anticipated adjusted earnings-per-share for 2024 of $3.33, NEE inventory has a price-to-earnings ratio of 18.7 at present costs. We expect a a number of of about 21 is honest given the present increased rate of interest atmosphere.

Shareholders might see valuation adjustments enhance the anticipated whole returns by 2.3% per yr by 2029 if the inventory have been to commerce with our goal price-to-earnings ratio.

Earnings progress and dividend yield can even contribute to whole returns. We consider that the corporate’s intensive renewable portfolio, along with its progress prospects and aggressive benefits, will permit NextEra to develop at a price of seven% per yr over the following 5 years.

Lastly, NEE inventory at the moment yields 3.3%.

Annual returns will include the next:

- 7% earnings-per-share progress

- 3.3% dividend yield

- 2.3% P/E a number of growth

In whole, we anticipate that NextEra Vitality will provide an annual return of 12.6% over the approaching 5 years, which is engaging.

Last Ideas

There are a excessive variety of positives that buyers ought to discover in NextEra Vitality. The corporate’s measurement, capability to thrive in recessionary occasions, and its lengthy dividend historical past are simply three gadgets we discover engaging in regards to the firm.

NextEra Vitality can also be positioned in a state that we consider to be very constructive for approving price base will increase. Florida’s inhabitants additionally continues to develop, which ought to present further clients.

The corporate is also adept at making strong additions to its core enterprise by acquisitions. We anticipate that this can even be the case in future years as NextEra augments its natural progress with strategic additions.

Lastly, NextEra’s management place within the renewable vitality house can’t be overstated. The corporate has a really massive backlog that ought to present for ample progress within the coming years.

With anticipated annual returns above 10%, NEE inventory will get a purchase score.

In case you are taken with discovering high-quality dividend progress shares appropriate for long-term funding, the next Certain Dividend databases can be helpful:

The foremost home inventory market indices are one other strong useful resource for locating funding concepts. Certain Dividend compiles the next inventory market databases and updates them month-to-month:

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to [email protected].

[ad_2]

Source link