[ad_1]

Up to date on March twenty ninth, 2024 by Bob Ciura

Buyers in search of high-quality dividend progress shares ought to focus, partly, on corporations that keep lengthy histories of dividend will increase.

Regular dividend raises from 12 months to 12 months, whatever the financial local weather, is an indication of an organization with sturdy aggressive benefits and long-term progress potential.

With that in thoughts, yearly, we overview every of the Dividend Aristocrats, a gaggle of 68 corporations within the S&P 500 Index, with 25+ consecutive years of dividend will increase.

You possibly can obtain your copy of the Dividend Aristocrats checklist, together with vital metrics like dividend yields and price-to-earnings ratios, by clicking on the hyperlink under:

Disclaimer: Positive Dividend will not be affiliated with S&P International in any approach. S&P International owns and maintains The Dividend Aristocrats Index. The knowledge on this article and downloadable spreadsheet is predicated on Positive Dividend’s personal overview, abstract, and evaluation of the S&P 500 Dividend Aristocrats ETF (NOBL) and different sources, and is supposed to assist particular person traders higher perceive this ETF and the index upon which it’s based mostly. Not one of the info on this article or spreadsheet is official information from S&P International. Seek the advice of S&P International for official info.

The following Dividend Aristocrat within the collection is healthcare large Medtronic (MDT).

Medtronic has a powerful historical past of dividend progress. The corporate has elevated its dividend for 46 years in a row. With an roughly 3.2% yield, Medtronic will not be precisely a high-yield inventory.

Nevertheless, the inventory’s yield continues to be increased than the typical yield of the S&P 500.

And, Medtronic sometimes raises its dividend at a excessive fee annually, because of its sturdy earnings and management place throughout the medical gadgets {industry}.

These qualities make Medtronic a pretty dividend progress inventory for long-term traders.

Enterprise Overview

Medtronic was based in 1949 as a medical gear restore store by Earl Bakken and his brother-in-law, Palmer Hermundslie. Right this moment, Medtronic is among the largest healthcare corporations on this planet.

Medtronic PLC is the most important producer of biomedical gadgets and implantable applied sciences on this planet. Medtronic at the moment has 4 working segments: Cardiovascular, Neuroscience, Medical Surgical, and Diabetes.

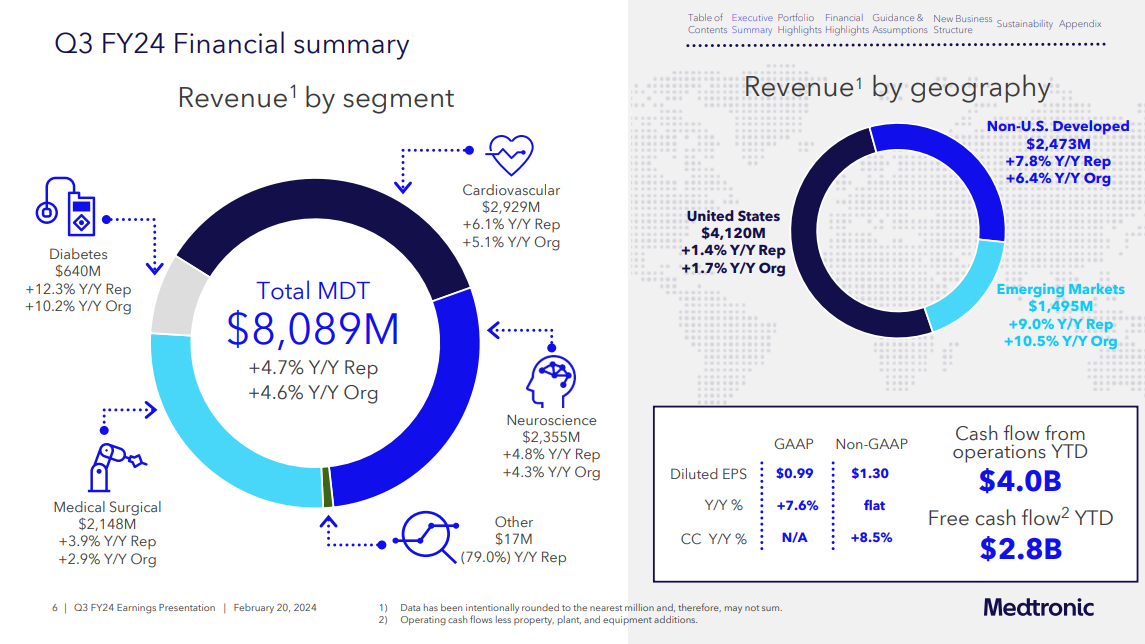

In mid-February, Medtronic reported (2/20/24) monetary outcomes for the third quarter of fiscal 12 months 2024.

Supply: Investor Presentation

Natural income grew 5% over the prior 12 months’s quarter because of broad-based progress in all of the 4 segments. Earnings-per-share remained flat at $1.30 because of an -8% foreign money headwind however exceeded the analysts’ consensus by $0.04.

Due to improved enterprise momentum, Medtronic raised its steering for fiscal 2024. It expects 4.75%-5.0% natural income progress (vs. 4.75% beforehand) and earnings-per-share of $5.19-$5.21.

Development Prospects

Medtronic is investing in progress, each organically through R&D and thru acquisitions. The primary catalyst for Medtronic is the getting old inhabitants. There are ~70 million Child Boomers within the U.S., these aged 51-69 years. 1000’s of persons are getting into retirement day-after-day. Mixed with longer life expectancy and rising healthcare spending, the working atmosphere may be very enticing for Medtronic.

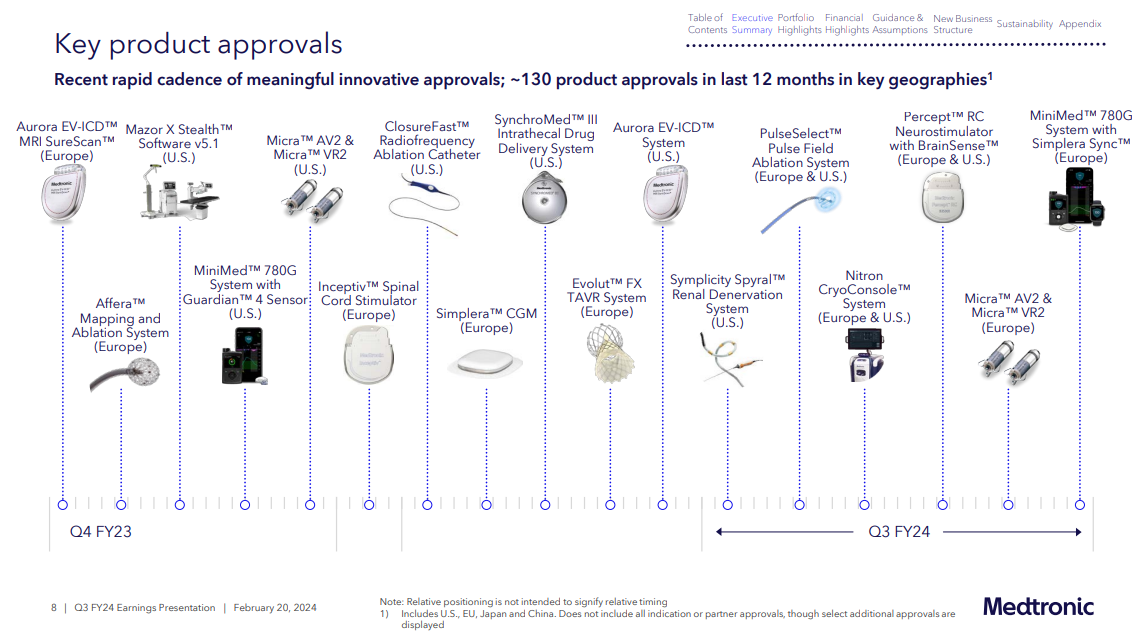

The corporate has had many regulatory product approvals previously 12 months. The brand new merchandise ought to drive progress, permitting the corporate to keep up and even acquire market share.

Supply: Investor Presentation

Medtronic additionally has a significant progress alternative in new geographic markets. Particularly, Medtronic has a presence in a number of rising markets, similar to China, India, Africa, and extra. These nations have giant populations and excessive financial progress charges.

Medtronic’s rising market income has constantly grown at a double-digit fee for a few years. Whereas the U.S. at the moment accounts for simply over half of Medtronic’s income, rising markets are rising quicker.

Medtronic is buying tuck-in acquisitions and has spent greater than $3.3 billion on 9 acquisitions since 2021. These corporations embody Acutus Medical, Medicrea, RIST, Avenu Medical, Companion Medical, Sonarmed, intersect ENT, AFFERA, and AI Biomed.

Total, we anticipate Medtronic to develop its earnings-per-share by 7.0% per 12 months on common till 2029.

Aggressive Benefits & Recession Efficiency

The principle aggressive benefit for Medtronic is its analysis and growth capabilities. The corporate spends closely on R&D annually, which offers it with product innovation. Medtronic’s R&D investments over the previous few years exceed $2 billion annually.

The results of all this spending is that the corporate has an enormous mental property portfolio with almost 86,000 awarded patents. This reality has allowed Medtronic to construct a powerful product pipeline throughout every of its enterprise segments.

As well as, Medtronic advantages tremendously from its world scale. The corporate operates in over 140 nations world wide. It has the operational flexibility to generate industry-leading revenue margins, which helps gasoline its progress.

One other aggressive benefit for Medtronic is that it operates in a defensive {industry}. Shoppers typically can’t forego medical therapies, even when the financial system is in recession.

Medtronic’s earnings-per-share in the course of the Nice Recession are as follows:

- 2007 earnings-per-share of $2.61

- 2008 earnings-per-share of $2.92 (12% enhance)

- 2009 earnings-per-share of $3.22 (10% enhance)

- 2010 earnings-per-share of $3.37 (5% enhance)

Medtronic had the uncommon achievement of earnings progress annually in the course of the recession. The corporate additionally confirmed exceptional energy in the course of the pandemic. This demonstrates its recession-resistant enterprise mannequin.

Medtronic ought to be capable of proceed rising its dividend annually in each financial recessions and expansions.

Valuation & Anticipated Returns

Based mostly on the current share value of ~$87 and anticipated earnings-per-share of $5.20 in fiscal 2024, Medtronic inventory trades for a price-to-earnings ratio of 16.7. The inventory’s present valuation is under that of the broader S&P 500 Index and modestly under its long-term common.

Within the final decade, shares of Medtronic have traded palms at a mean price-to-earnings ratio of 17.0. We consider that this can be a honest valuation baseline.

In consequence, Medtronic shares look like barely undervalued immediately. If the inventory valuation expands to our honest worth estimate by 2029, the corresponding a number of enlargement will increase shareholder returns by roughly 0.4% per 12 months over this era.

We anticipate 7% annual earnings progress for Medtronic by way of 2029, and the inventory has a 3.2% dividend yield. There may be loads of room for continued dividend will increase annually.

With a dividend payout ratio of simply over 50%, and a constructive earnings progress outlook, Medtronic ought to proceed its streak of annual dividend will increase.

Complete returns would include the next:

- 7.0% earnings progress fee

- 0.4% a number of enlargement

- 3.2% dividend yield

Medtronic is predicted to return 10.6% yearly over the following 5 years. That is a pretty potential fee of return, giving the inventory a purchase ranking.

Remaining Ideas

Medtronic has nearly all the qualities dividend progress traders ought to search for. It possesses a extremely worthwhile enterprise, a management place in its core markets, and long-term progress potential. It additionally has a number of catalysts for future progress and the flexibility to continue to grow its dividend even throughout recessions.

Medtronic has elevated its dividend for greater than 4 a long time, which is very spectacular given the continued headwinds from a troublesome macroeconomic atmosphere.

Medtronic inventory seems to offer a compelling funding alternative for long-term dividend progress traders.

Moreover, the next Positive Dividend databases comprise probably the most dependable dividend growers in our funding universe:

Should you’re in search of shares with distinctive dividend traits, think about the next Positive Dividend databases:

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to [email protected].

[ad_2]

Source link