[ad_1]

Up to date on February tenth, 2023 by Nathan Parsh

The Dividend Aristocrats are among the many highest-quality dividend progress shares an investor should buy. The Dividend Aristocrats have elevated their dividends for 25+ consecutive years.

Changing into a Dividend Aristocrat is not any small feat. Past sure market capitalization and buying and selling quantity necessities, Dividend Aristocrats should have raised their dividends annually for at the very least 25 years, and be included within the S&P 500 Index.

This presents a excessive hurdle that comparatively few corporations can clear. For instance, there are at present 68 Dividend Aristocrats out of the five hundred corporations that comprise the S&P 500 Index.

We created a whole listing of all 68 Dividend Aristocrats, together with necessary monetary metrics like dividend yields and price-to-earnings ratios. You’ll be able to obtain an Excel spreadsheet of all 68 Dividend Aristocrats by clicking the hyperlink beneath:

A fair smaller group of shares have raised their dividends for 50+ years in a row. These are referred to as the Dividend Kings.

Real Components (GPC) has elevated its dividend for 66 consecutive years, giving it one of many longest dividend progress streaks available in the market. You’ll be able to see all 48 Dividend Kings right here.

There’s nothing overly thrilling about Real Components’ enterprise mannequin, however its regular annual dividend will increase show {that a} “boring” enterprise may be simply what earnings traders want for long-term dividend progress.

Enterprise Overview

Real Components traces its roots again to 1928 when Carlyle Fraser bought Motor Components Depot for $40,000. He renamed it, Real Components Firm. The unique Real Components retailer had annual gross sales of simply $75,000 and solely 6 workers.

At this time, Real Components has the world’s largest world auto elements community. Real Components generated $18.9 billion in annual income. Real Components is a distributor of automotive alternative elements, industrial alternative elements, workplace merchandise, and electrical supplies.

Supply: Investor Presentation

It operates 4 segments, led by automotive elements, which homes the NAPA model.

The commercial elements group sells industrial alternative elements to MRO (upkeep, restore, and operations) and OEM (unique tools producer) prospects. Prospects are derived from a variety of segments, together with meals and beverage, metals and mining, oil and gasoline, and well being care.

The workplace merchandise section distributes enterprise merchandise within the U.S. and Canada. Prospects embody workplace merchandise sellers, workplace provide shops, faculty bookstores, workplace furnishings sellers, and extra.

Real Components additionally distributes electrical and digital supplies to unique tools producers and industrial meeting companies.

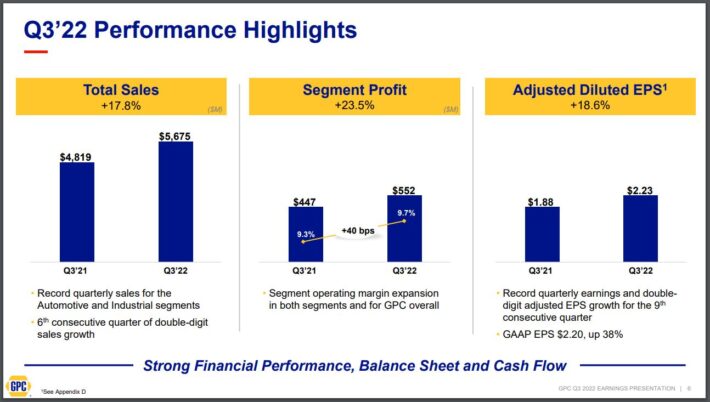

Real Components reported third quarter earnings outcomes on October twentieth, 2022.

Supply: Investor Presentation

Income was $5.68 billion in Q3, up 17.8% from the identical interval a 12 months in the past. The advance is attributable to a 12.7% improve in comparable gross sales and a 9.1% profit from acquisitions, partially offset by a 4% headwind from unfavorable foreign money trade.

Web earnings from persevering with operations got here to $312 million on an adjusted foundation, up from $229 million in the identical interval of 2021. On a per-share foundation, earnings have been $2.20, up 38% from $1.59 within the year-ago interval.

2020 was a troublesome 12 months for Real Components, because the coronavirus pandemic dragged the U.S. financial system into recession. Nonetheless, Real Components remained extremely worthwhile throughout and after this era, which allowed it to proceed elevating its dividend. And, the significant enchancment seen within the third quarter of the 12 months bodes nicely for continued progress shifting ahead.

We count on Real Components to earn $8.15 per share for 2022, which might be an almost 18% enchancment from the prior 12 months.

Development Prospects

Real Components is primed for fulfillment, because the setting for auto alternative elements is very optimistic. Shoppers are holding onto their vehicles longer and are more and more making minor repairs to maintain vehicles on the highway for longer, moderately than shopping for new vehicles. As common prices of auto restore improve because the automobile ages, this instantly advantages Real Components.

In keeping with Real Components, autos aged six years or older now characterize over ~70% of vehicles on the highway. This bodes very nicely for Real Components.

As well as, the marketplace for automotive aftermarket services is critical. Real Components has a large portion of the $200 billion and rising automotive aftermarket enterprise.

A method Real Components has captured market share on this house has traditionally been acquisitions. It incessantly acquires smaller corporations, within the U.S. and within the worldwide markets, to spice up market share in current classes or develop in new areas. Real Components has made a number of acquisitions over the course of its historical past.

For instance, Real Components acquired Alliance Automotive Group for $2 billion. Alliance is a European distributor of auto elements, instruments, and workshop tools. This was a lovely acquisition, as Alliance Automotive holds a high 3 market share place in Europe’s largest automotive aftermarkets: the U.Okay., France, and Germany.

Offers accomplished over the previous few years have added considerably to Real Components’ annual gross sales and income. The corporate has persistently generated progress over the long run. Future earnings progress continues to be attainable, by way of natural progress, acquisitions, and share repurchases.

Extra not too long ago, Real Components accomplished its $1.3 billion all-cash buy of Kaman Distribution Group, which is a number one energy transmission, automation, and fluid energy firm, on January 4th, 2022.

This deal added meaningfully to Q3 outcomes.

We count on 8% annual EPS progress over the subsequent 5 years for Real Components.

Aggressive Benefits & Recession Efficiency

The most important problem going through the retail trade proper now, is the specter of e-commerce competitors. However automotive elements retailers akin to NAPA should not uncovered to this danger.

Automotive repairs are sometimes complicated, difficult duties. NAPA is a number one model, thanks partially to its popularity for high quality merchandise and repair. It’s invaluable for patrons to have the ability to ask inquiries to certified employees, which supplies Real Components a aggressive benefit.

Real Components has a management place throughout its companies. All 4 of its working segments characterize the #1 or #2 model in its respective class. This results in a powerful model, and regular demand from prospects.

Real Components’ earnings-per-share throughout the Nice Recession are beneath:

- 2007 earnings-per-share of $2.98

- 2008 earnings-per-share of $2.92 (2.0% decline)

- 2009 earnings-per-share of $2.50 (14% decline)

- 2010 earnings-per-share of $3.00 (20% improve)

Earnings-per-share declined considerably in 2009, which ought to come as no shock. Shoppers are inclined to tighten their belts when the financial system enters a downturn.

That mentioned, Real Components remained extremely worthwhile all through the recession, and returned to progress in 2010 and past. The corporate remained extremely worthwhile in 2020, regardless of the financial injury attributable to the coronavirus pandemic. There’ll all the time be a sure degree of demand for automotive elements, which supplies Real Components’ earnings a excessive flooring.

Valuation & Anticipated Returns

Based mostly on the latest closing worth of ~$173 and our expectation for 2022 earnings-per-share of $8.15, Real Components has a price-to-earnings ratio of 21.2. Our truthful worth estimate for Real Components is a price-to-earnings ratio of 18. Consequently, Real Components is overvalued nowadays. A number of contraction would negatively affect future returns by 3.2% per 12 months over the subsequent 5 years.

Real Components’ future earnings progress and dividends will greater than offset this potential headwind.

We count on Real Components to develop its earnings-per-share by 8% yearly over the subsequent 5 years. The inventory additionally has a 2.1% present yield, which is larger than the typical yield of the S&P 500 Index. And, Real Components raises its dividend annually, together with a current 9.8% improve in February of 2022.

Real Components has a extremely sustainable dividend. The corporate has paid a dividend yearly because it went public in 1948. The dividend is prone to proceed rising for a few years to come back. That mentioned, traders must also think about the affect of valuation in the case of a inventory’s whole returns.

Real Components’ whole annual returns would include the next:

- 8% earnings progress

- 2.1% dividend yield

- -3.2% valuation reversion

In whole, Real Components is anticipated to supply a complete annual return of 6.5% over the subsequent 5 years. It is a mediocre charge of return in our opinion regardless of the corporate’s spectacular dividend progress streak. Shares earn a maintain score on account of potential returns.

Last Ideas

Real Components doesn’t get a lot protection within the monetary media. It’s removed from the high-flying tech startups that sometimes obtain extra consideration. Nevertheless, Real Components is a really interesting inventory for traders searching for steady profitability and dependable dividend progress.

The corporate has an extended runway of progress forward, because of favorable trade dynamics. It ought to proceed to boost its dividend annually, because it has for the previous 66 years.

Given its historical past of dividend progress, Real Components is appropriate for traders wanting earnings, in addition to regular dividend will increase annually. Buyers searching for extra in the way in which of whole returns will probably wish to look ahead to a extra engaging entry level.

In case you are interested by discovering extra high-quality dividend progress shares appropriate for long-term funding, the next Positive Dividend databases shall be helpful:

The main home inventory market indices are one other strong useful resource for locating funding concepts. Positive Dividend compiles the next inventory market databases and updates them month-to-month:

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to [email protected].

[ad_2]

Source link