[ad_1]

Up to date on January twenty third, 2023 by Samuel Smith

With regards to dividend investing, the Dividend Aristocrats are the “cream of the crop.”

The Dividend Aristocrats are a gaggle of shares within the S&P 500 Index, with 25+ consecutive years of dividend will increase.

There are simply 65 corporations which have attained Dividend Aristocrat standing.

Consequently, it isn’t straightforward to hitch the Dividend Aristocrats checklist. With that in thoughts, we created a downloadable checklist of all 66 Dividend Aristocrats, together with necessary metrics like dividend yields and price-to-earnings ratios.

You may obtain a free copy of the Dividend Aristocrats checklist by clicking on the hyperlink under:

There are literally thousands of dividend shares to select from, however the Dividend Aristocrats are a novel group. The Dividend Aristocrats have worthwhile companies, and the power to develop their income over time. This permits them to face up to recessions, and proceed growing their dividends annually.

Franklin Sources (BEN) has elevated its dividend for 43 consecutive years, and the inventory has a excessive dividend yield of 4.0%.

Franklin Sources has endured a number of robust years. Nonetheless, given the corporate’s monitor file of dividend progress and present yield, Franklin Sources is a lovely inventory for earnings traders.

Enterprise Overview

Franklin Sources is an funding administration firm. It was based in 1947 in New York, by Rupert H. Johnson Sr., who had beforehand managed a Wall Avenue brokerage agency. He named the corporate after Benjamin Franklin, the founding father who was seen as an emblem for frugality, saving, and smart investments.

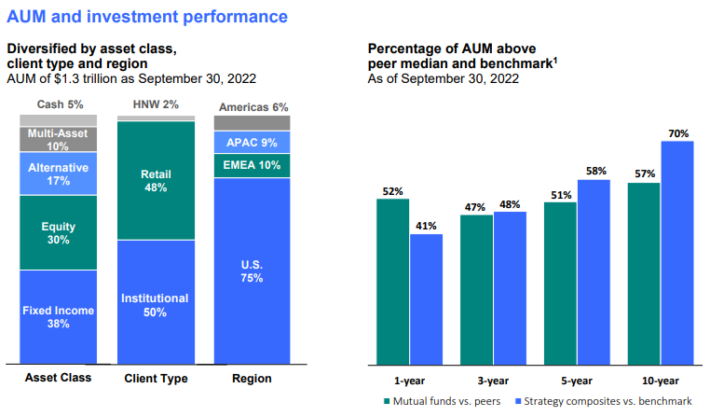

At this time, Franklin Sources manages the Franklin and Templeton households of mutual funds. The corporate ended This fall 2022 with property below administration of $1.3 trillion. It has diversified AUM and a robust long-term efficiency monitor file.

Supply: Investor Presentation

The previous few years have been tough for Franklin Sources. Franklin Sources was gradual to adapt to the altering atmosphere within the asset administration business. The explosive progress in exchange-traded funds and indexing investing caught conventional mutual funds unexpectedly.

ETFs have turn out to be highly regarded with traders due largely to their decrease charges than conventional mutual funds. In response, the asset administration business has needed to lower charges and commissions or threat shedding shopper property.

Franklin Sources has additionally struggled the previous few years because of the broad deterioration within the world economic system brought on by the coronavirus pandemic, as its funds have barely underperformed friends and benchmarks on common over the previous three years.

Development Prospects

Regardless of the tough working atmosphere, there are causes to be optimistic in regards to the firm’s long-term progress. First, the U.S. is an getting older inhabitants. There are literally thousands of Child Boomers retiring each day. Mixed with rising life expectancy, there’s a nice want for funding planning for these in or nearing retirement.

Franklin Sources continues to be making investments in driving long-term earnings per share progress. This previous 12 months the corporate funded two acquisitions and 4 investments and purchased again inventory pretty aggressively. Specifically, the corporate has been strategically increasing into different investments in an effort to generate another progress vertical. A few of these embrace Legg Mason, Lexington Companions, and Alcentra.

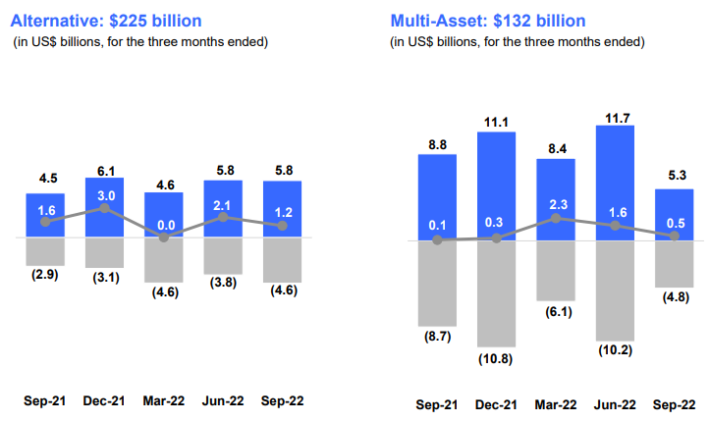

These investments have paid off up to now as the corporate generated internet inflows in its different and multi-asset classes and lowered internet outflows in equities this previous 12 months.

Supply: Investor Presentation

On November 1st, 2022 Franklin Sources reported outcomes for the fourth quarter of fiscal 2022. Whole property below administration equaled $1.2974 trillion, down $82.4 billion in comparison with final quarter, because of $(62.1) billion of internet market cost, distributions and different, and $20.4 billion of long-term internet outflows. For the quarter, working income totaled $1.939 billion, down 11% year-over-year. On an adjusted foundation, internet earnings equaled $394 million or $0.78 per share in comparison with $416 million or $0.82 per share in This fall 2021.

Throughout This fall, Franklin repurchased 1.0 million shares of inventory for $27 million. For the total fiscal 12 months 2022, Franklin Sources earned $3.63 per share in adjusted internet earnings, which was a 3% decline in comparison with $3.74 in FY 2021. Franklin ended the fiscal 12 months with $6.8 billion of money and investments, reflecting prudent steadiness sheet administration within the face of headwinds.

We really feel traders can moderately anticipate 5% annualized earnings-per-share progress over the following 5 years. Earnings-per-share progress can be pushed by income progress, primarily resulting from rising AUM, in addition to a lift from share repurchases.

Aggressive Benefits & Recession Efficiency

Asset administration is a extremely aggressive enterprise, and there will not be many aggressive benefits within the monetary providers business. The flexibility to retain shoppers relies upon largely on efficiency. If funds carry out worse than their benchmarks, shoppers usually withdraw their funds.

Nonetheless, Franklin Sources has a number of benefits going for it. The primary, and maybe most necessary, is model recognition. Franklin Sources has been in operation for over 70 years. That signifies a sure developed experience and a few innate funding talents. Franklin Sources additionally nonetheless has large property below administration, permitting the corporate to supply a variety of funding alternatives to shoppers and generate some economies of scale.

Counterbalancing these benefits, Franklin Sources’ most up-to-date recession efficiency was poor:

- 2007 earnings-per-share of $2.37

- 2008 earnings-per-share of $2.24 (5.5% decline)

- 2009 earnings-per-share of $1.30 (42% decline)

- 2010 earnings-per-share of $2.12 (63% enhance)

As you may see, earnings-per-share fell steeply in 2009 throughout the worst a part of the Nice Recession. This could come as no shock since investing is hardly recession-resistant. Throughout recessions, inventory markets usually decline. For asset managers, this may decrease property below administration and costs. That mentioned, Franklin Sources recovered rapidly, and noticed earnings soar in 2010 and thereafter.

Whereas the corporate entered one other downturn in fiscal 2020 because of the coronavirus pandemic, the corporate remained worthwhile, which allowed it to proceed elevating its dividend. Additionally it is ready to return to progress within the present fiscal 12 months, assuming a continued financial restoration.

Valuation & Anticipated Returns

We anticipate that Franklin Sources will earn $2.55 per share within the fiscal 12 months 2023. The inventory has a price-to-earnings ratio of 11.9. That is above our honest worth P/E estimate of 9.0. A compressing valuation a number of might cut back annualized whole returns considerably shifting ahead.

This valuation headwind will probably be offset by earnings-per-share progress and dividends. Franklin Sources has a lovely dividend yield of 4.0%, and the dividend payout seems to be safe. A breakdown of potential returns is as follows:

- 5.0% earnings-per-share progress

- 4.0% dividend yield

- 5.4% valuation headwind

If Franklin Sources can return to progress, traders shopping for the inventory now might see annualized whole returns of three.6% over the following 5 years.

Remaining Ideas

Franklin Sources’ future progress is determined by a robust economic system, rising inventory costs, and growing property below administration. Its current investments in different asset managers and aggressive inventory buybacks look like a very good begin in that path.

With a robust 4.0% dividend yield and a constructive progress outlook, Franklin Sources might be enticing for earnings traders.

Nonetheless, provided that anticipated annualized whole returns are pretty weak, traders within the inventory are inspired to attend for a pullback or an enchancment in fundamentals earlier than shopping for Franklin Sources. As such, the inventory receives a Maintain advice.

Moreover, the next Positive Dividend databases include essentially the most dependable dividend growers in our funding universe:

In the event you’re searching for shares with distinctive dividend traits, take into account the next Positive Dividend databases:

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to [email protected].

[ad_2]

Source link