[ad_1]

Up to date on February eleventh, 2023 by Quinn Mohammed

Expeditors Worldwide of Washington Inc. (EXPD) might not be the best-known inventory to most buyers on condition that it providers a logistics and transportation area of interest in international commerce. Nonetheless, the corporate has a terrific monitor report creating worth for shareholders, each through appreciation within the share worth, and by growing its dividend cost.

The 12 months 2019 marked the twenty fifth consecutive 12 months Expeditors elevated its payout, making it a member of the distinguished Dividend Aristocrats, a bunch of S&P 500 shares with at the very least 25 consecutive years of dividend will increase.

There at the moment are 68 Dividend Aristocrats. You possibly can obtain an Excel spreadsheet of all 68, together with vital metrics resembling dividend yields and P/E ratios, by clicking the hyperlink under:

Expeditors has confirmed over time to be a enterprise with sturdy progress prospects, though that progress hasn’t been linear by any means. The cyclical nature of the transport enterprise creates inherent volatility, however over time, Expeditors has delivered progress.

Expeditors inventory seems to be undervalued right now. In consequence, this can be a very good time to purchase this explicit Dividend Aristocrat.

Enterprise Overview

Expeditors is a worldwide logistics firm that gives providers together with consolidation and forwarding of air and ocean freight, customs brokerage, vendor consolidation, cargo insurance coverage, time-sensitive supply choices, order administration, warehousing and distribution, and different custom-made logistics options. Briefly, Expeditors presents firms international commerce logistics options in all sizes and shapes.

Expeditors was based in 1979 in Seattle and since that point, it has grown from a single workplace into greater than 350 places throughout six continents, spanning greater than 100 international locations and using greater than 18,000 folks.

EXPD is a large-cap inventory with a market cap above $17.5 billion.

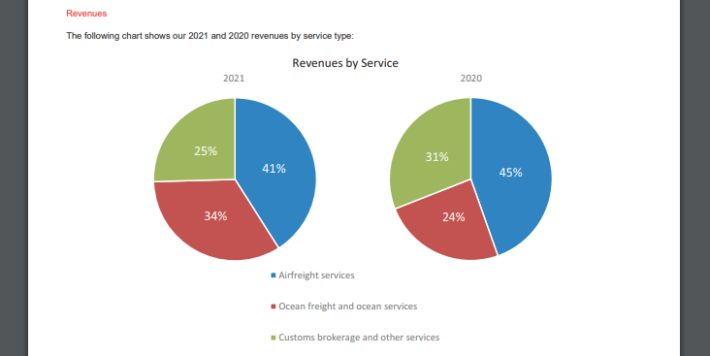

The corporate is pretty effectively diversified with its income streams, as we are able to see under:

Supply: 2021 Annual Report

The corporate carried out effectively within the first 9 months of 2022, regardless of the worldwide provide chain constraints. Within the third quarter of 2022, revenues noticed a rise of 1%, from $4.3 billion to $4.4 billion. Web earnings grew 15% year-over-year to $414 million, and earnings-per-share rose by 22% in comparison with the third quarter of 2021 to $2.54, which additionally beat estimates by $0.55.

For the primary 9 months of 2022, gross sales have been up 22% versus the identical 9 months of 2021. Web earnings have been additionally up 18% in comparison with the 9 months of 2021. The corporate achieved a 22% enhance in earnings-per-share.

We estimate that Expeditors will generate earnings-per-share of $8.96 for full 12 months 2022, which might symbolize an 8.3% enhance over 2021.

Development Prospects

Over the previous 10 years, the corporate has seen earnings develop at a compound annual progress fee (CAGR) of 20.3%. For the previous 5 years, it has risen barely larger, reaching 27.2% CAGR. We see Expeditors producing annual earnings-per-share progress within the space of two% as we count on the financial system to decelerate.

Expeditors stays well-positioned to proceed to see income progress over time by its various community of income streams, however be aware that recessions, international commerce fears, and different shocks pose a danger to progress.

From 2014-2018, the corporate grew airfreight tonnage, ocean containers, and gross income yearly. Nonetheless, within the third quarter of 2022, airfreight tonnage quantity and ocean container quantity decreased 13% and 10%, respectively. Tonnage is the popular quantity methodology Expeditors makes use of to evaluate efficiency, and whereas progress charges have been risky, the overall route has been larger lately.

Regardless of brief time period headwinds, we consider the long-term pattern is larger for volumes. This can assist drive revenues larger over time, because it has for a few years.

Income, working earnings, and earnings-per-share have moved considerably larger over time, however there have been durations for all classes that confirmed unfavourable year-over-year progress. Given the inherently risky nature of the transport enterprise, we don’t see this as altering, however nonetheless count on to see low single-digit earnings-per-share progress yearly over full financial cycles.

We predict income will produce the majority of those positive factors, whereas margins could develop barely, together with a small tailwind from share repurchases. In whole, we forecast 2% annual earnings-per-share progress yearly.

Aggressive Benefits & Recession Efficiency

Expeditors’ aggressive benefit is its measurement and scale in a distinct segment of world transportation of products. Expeditors presents clients the dimensions of a worldwide transport firm with a various community of ports and airports, however with the native and customised choices of a smaller agency. This units Expeditors other than others within the logistics trade, however be aware that that is an trade the place benefits are tough to come back by.

Expeditors’ earnings-per-share through the Nice Recession are under:

- 2007 earnings-per-share: $1.21

- 2008 earnings-per-share: $1.37

- 2009 earnings-per-share: $1.12

- 2010 earnings-per-share: $1.59

Expeditors noticed its earnings decline through the Nice Recession, however solely barely. The truth is, Expeditors held up significantly better than one would maybe suppose given its leverage to the worldwide financial system. The following recession will probably crimp earnings progress quickly however will probably be removed from disastrous for Expeditors. Expeditors exemplified a robust monitor report through the Nice Recession, one of many worst financial durations in latest historical past.

The corporate continued to carry out effectively in 2020 and 2021, throughout one other significantly difficult interval for the financial system. Expeditors achieved report outcomes final 12 months and maintained its spectacular streak of annual dividend will increase.

Valuation & Anticipated Returns

Expeditor’s historic progress and future progress potential are spectacular, and the inventory seems pretty undervalued right now. We count on to see $8.96 in earnings-per-share for 2022. With the share worth at $112, Expeditors is buying and selling for about 12.5 occasions earnings.

We see 18 occasions earnings as honest worth for the inventory. Due to this fact, an growing P/E a number of from 12.5 to 18.0 might enhance annual returns by 7.5% per 12 months over the subsequent 5 years.

Combining the forecast for two% earnings-per-share progress, and the present 1.2% dividend yield, we see whole annual returns of 10.6% over the subsequent 5 years.

We predict Expeditors can even proceed to develop its dividend at sturdy charges over time, as the corporate has a monitor report that’s tough to match. Expeditors’ present yield is under the S&P 500 common and subsequently is unattractive for earnings buyers, however it stays a robust dividend progress inventory.

Remaining Ideas

Expeditors has been a robust participant within the logistics trade for a few years. The corporate has a various community of world ports and airports it providers, in addition to providing custom-made, precious providers to its international community of shoppers. Development will probably proceed to be risky and susceptible to interruptions, significantly throughout recessions, however we see Expeditors as enticing for the long-term.

The valuation right now is reasonable, however the yield is sort of low at simply 1.2%. Nonetheless, dividend progress ought to proceed for a few years to come back given the payout ratio is round 16%.

Expeditors is interesting for dividend progress buyers, however not these searching for a excessive dividend inventory, or earnings security and consistency. General, the inventory is enticing right now given its valuation towards historic norms.

In case you are fascinated about discovering extra high-quality dividend progress shares appropriate for long-term funding, the next Certain Dividend databases will probably be helpful:

The foremost home inventory market indices are one other strong useful resource for locating funding concepts. Certain Dividend compiles the next inventory market databases and updates them month-to-month:

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to [email protected].

[ad_2]

Source link