[ad_1]

Up to date on February twenty eighth, 2024

At Positive Dividend, we’re enormous proponents of investing in high-quality dividend progress shares. We imagine corporations with lengthy histories of elevating their dividends are more than likely to reward their shareholders with superior long-term returns.

For this reason we focus so intently on the Dividend Aristocrats.

Our evaluation of every of the 68 Dividend Aristocrats, a bunch of corporations within the S&P 500 Index with 25+ consecutive years of dividend will increase, continues with medical provide firm Becton Dickinson (BDX).

You’ll be able to obtain an Excel spreadsheet with the total listing of all 68 Dividend Aristocrats (plus essential metrics like dividend yields and price-to-earnings ratios) through the use of the hyperlink beneath:

Disclaimer: Positive Dividend isn’t affiliated with S&P International in any manner. S&P International owns and maintains The Dividend Aristocrats Index. The knowledge on this article and downloadable spreadsheet is predicated on Positive Dividend’s personal evaluation, abstract, and evaluation of the S&P 500 Dividend Aristocrats ETF (NOBL) and different sources, and is supposed to assist particular person traders higher perceive this ETF and the index upon which it’s primarily based. Not one of the data on this article or spreadsheet is official knowledge from S&P International. Seek the advice of S&P International for official data.

Becton Dickinson has grown into a world big. In 2017, Becton Dickinson accomplished its $24 billion acquisition of C.R. Bard. This was Becton Dickinson’s largest acquisition ever and brings collectively two enormous corporations within the medical provide business.

The basics of the business stay very wholesome. Growing old world populations, progress of healthcare spending, and growth within the rising markets are engaging progress catalysts. On this article, we study Becton Dickinson’s funding prospects.

Enterprise Overview

Each Becton Dickinson and C.R. Bard have lengthy working histories. C.R. Bard was based in 1907 by Charles Russell Bard, an American importer of French silks, after he started importing Gomenol to New York Metropolis. On the time, Gomenol was generally utilized in Europe, and Mr. Bard used it to deal with his discomfort from tuberculosis.

By 1923, C.R. Bard was included. Later, it developed the primary balloon catheter, and slowly expanded its product portfolio.

In the meantime, Becton Dickinson has been in enterprise for greater than 120 years. At present, the corporate employs greater than 75,000 workers in over 50 nations. The corporate generates roughly $20 billion in annual income. Roughly 43% of annual gross sales come from exterior the U.S.

With the addition of C.R. Bard, Becton Dickinson now has three segments: Medical, Life Sciences, and Intervention, which homes merchandise manufactured by Bard. The corporate sells merchandise in a number of classes inside these companies. A few of its core product classes embody diagnostics, an infection prevention, surgical gear, and diabetes administration.

On February 1st, 2024, BD launched earnings outcomes for the primary quarter of fiscal yr 2024, which ended on December thirty first, 2023.

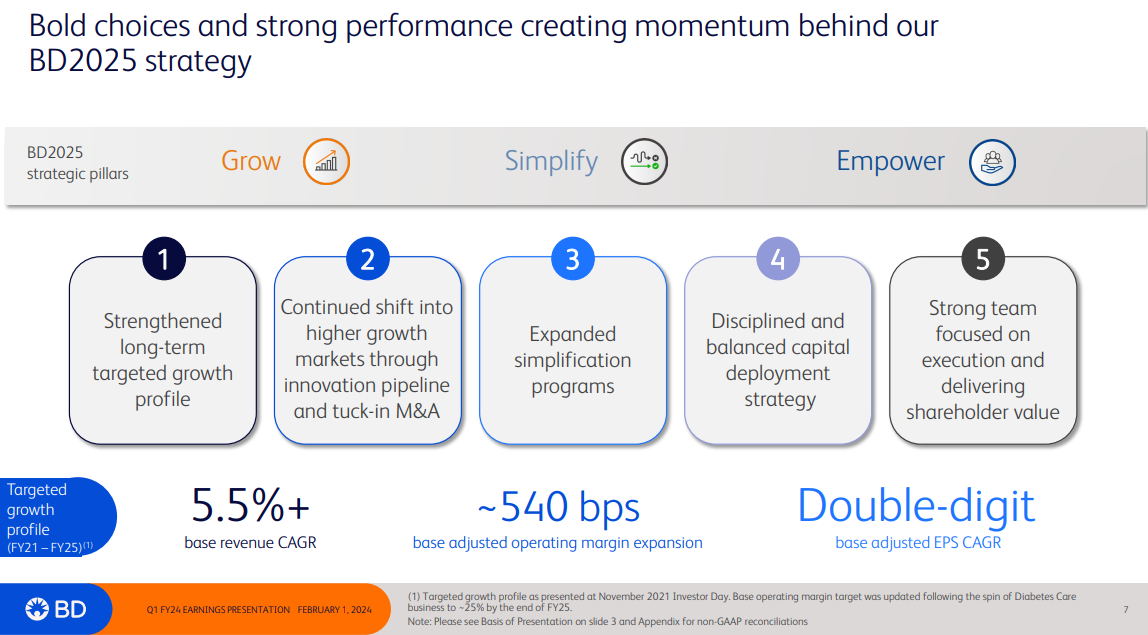

Supply: Investor Presentation

For the quarter, income grew 2.6% to $4.7 billion, however missed estimates by $30 million. On a forex impartial foundation, income grew 1.6%. Adjusted earnings-per-share of $2.68 in contrast unfavorably to $2.98 within the prior yr, however was $0.28 above expectations.

Natural progress was 2.4% for the interval. For the quarter, U.S. grew 0.7% whereas worldwide was up 2.9% (up 5.5% on a reported foundation). COVID-19 diagnostic income was not materials throughout the interval. The Medical section grew 2.4% to $2.23 billion as all companies have been up year-overyear. Life Science income declined 2.5% to $1.29 billion as a weaker demand for respiratory merchandise impacted demand.

BD supplied an up to date outlook for fiscal yr 2024 as effectively. The corporate expects natural progress in a spread of 5.5% to six.25%, in comparison with 5.25% to six.25% beforehand. Adjusted earnings-per-share is projected to be in a spread of $12.82 to $13.06, in comparison with $12.70 to $13.00 beforehand.

Development Prospects

Becton Dickinson has been in a position to enter a number of new progress classes with C.R. Bard in tow, within the U.S. and around the globe. First, there are healthcare related infections, which Becton Dickinson estimates prices sufferers practically $10 billion yearly.

Based on Becton Dickinson, one out of each 15 sufferers acquires an an infection throughout care. The mixed firm will have the ability to deal with these unaddressed situations, particularly in surgical website infections, blood stream infections, and urinary tract infections brought on by catheters.

Supply: Investor Presentation

Subsequent, C.R. Bard has helped broaden Becton Dickinson’s oncology and surgical procedure merchandise, in biopsies, meshes, biosurgery, and an infection prevention gadgets. Lastly, the acquisition boosts Becton Dickinson’s worldwide presence, notably in medical know-how. The corporate already generates practically half of its annual gross sales from exterior the U.S.

Over the long-term, the acquisition supplies Becton Dickinson the chance to broaden its attain in new therapeutic areas. The corporate is focusing on funding in diabetes, peripheral vascular illness, and continual kidney illness. Together with natural progress, the acquisition ought to present synergies that will probably be a lift to Becton Dickinson’s earnings.

BDX has elevated earnings-per-share by roughly 8% per yr over the previous 10 years, and has grown earnings in 9 out of the final 10 years. We really feel the corporate can develop earnings-per-share at a charge of 8% per yr by fiscal 2029.

Aggressive Benefits & Recession Efficiency

Becton Dickinson has vital aggressive benefits, together with scale and an unlimited patent portfolio. These aggressive benefits are as a result of excessive ranges of funding spending.

Becton Dickinson spends over $1 billion per yr on analysis and improvement. This spending has actually paid off, with sturdy income and earnings progress over the previous a number of years. The corporate has obtained management positions of their respective classes due to product innovation, a direct results of R&D investments.

These aggressive benefits present the corporate with constant progress, even throughout financial downturns. Becton Dickinson steadily grew earnings throughout the Nice Recession. Becton Dickinson’s earnings-per-share throughout the recession are as follows:

- 2007 earnings-per-share of $3.84

- 2008 earnings-per-share of $4.46 (16% improve)

- 2009 earnings-per-share of $4.95 (11% improve)

- 2010 earnings-per-share of $4.94 (0.2% decline)

Becton Dickinson generated double-digit earnings progress in 2008 and 2009, throughout the worst years of the recession. It took a small step again in 2010, however continued to develop within the years since, together with the financial restoration.

The power to persistently develop earnings annually of the Nice Recession, which was arguably the worst financial downturn in many years, is extraordinarily spectacular.

The explanation for its sturdy monetary efficiency, is that well being care sufferers want medical provides. Sufferers can not select to forego needed healthcare provides. This retains demand regular from yr to yr, whatever the situation of the economic system.

Becton Dickinson has a singular potential to face up to recessions, which explains its 52-year historical past of consecutive dividend will increase. Becton Dickinson’s dividend can be very secure primarily based on its fundamentals.

Valuation & Anticipated Returns

Utilizing estimated earnings-per-share of $12.94 for the fiscal yr 2024, the inventory has a price-to-earnings ratio of 18.5. Our honest worth estimate for BDX inventory is a P/E ratio of 19, that means shares seem simply barely undervalued. A number of growth to the honest worth P/E may improve annual returns by 0.5% per yr over the following 5 years.

However valuation isn’t the one consider estimating whole returns. BDX inventory will generate returns from earnings progress and dividends as effectively.

In whole, we challenge annual returns of 10% by fiscal yr 2029, stemming from 8% earnings progress, the present dividend yield of 1.5%, and the 0.5% annual enhance from P/E growth. The anticipated return of 10% yearly makes the inventory a purchase in our view.

So far as dividends, Becton Dickinson stays a top quality dividend progress inventory. It has a really safe payout, with room for progress. Primarily based on fiscal 2024 earnings steering, Becton Dickinson will seemingly have a dividend payout of roughly 30%.

This can be a very low payout ratio. It leaves loads of room for sustained dividend progress shifting ahead, notably since earnings will proceed to develop.

Last Ideas

Becton Dickinson’s enterprise continues to carry out very effectively. Given the optimistic progress outlook for the healthcare business, we really feel that Becton Dickinson has room for sturdy earnings progress.

As well as, Becton Dickinson has a excessive probability of annual dividend will increase for a few years. With anticipated whole returns of 10% per yr and a secure and rising dividend, Becton Dickinson is a lovely inventory for dividend progress traders.

Moreover, the next Positive Dividend databases comprise probably the most dependable dividend growers in our funding universe:

When you’re searching for shares with distinctive dividend traits, take into account the next Positive Dividend databases:

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to [email protected].

[ad_2]

Source link