[ad_1]

Under is an evaluation of the efficiency of a number of the most necessary sectors and asset courses relative to one another with an interpretation of what underlying market dynamics could also be signaling in regards to the future route of risk-taking by buyers. The beneath charts are all worth ratios which present the underlying development of the numerator relative to the denominator. A rising worth ratio means the numerator is outperforming (up extra/down much less) the denominator. A falling worth ratio means underperformance.

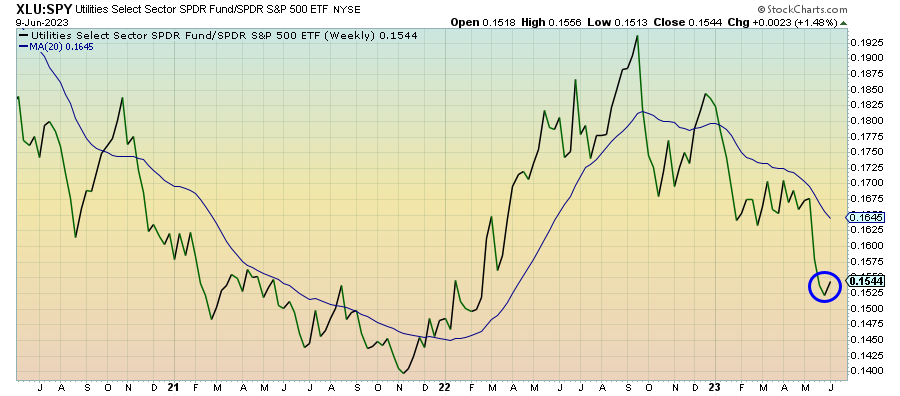

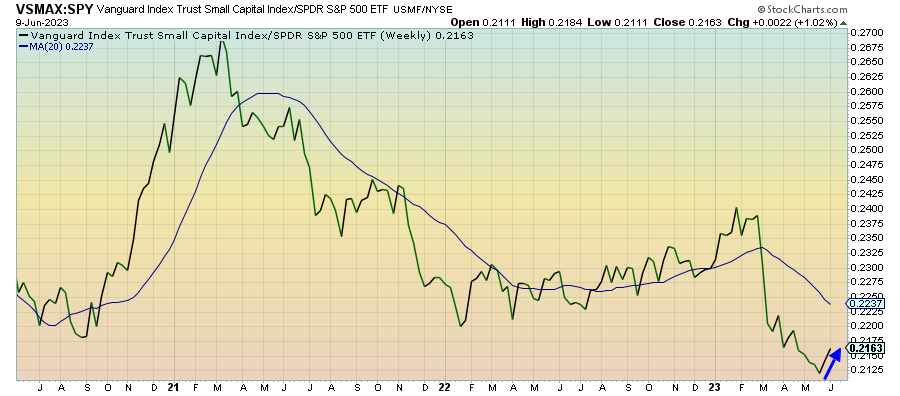

This is not a rotation into small-caps; it is a rotation out of mega-cap tech.

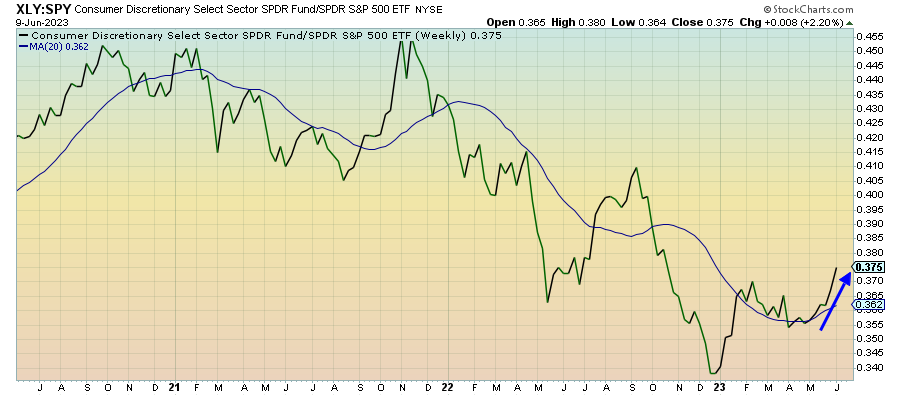

Shopper Discretionary (XLY) – Macro Backdrop Weaker Than the Numbers Recommend

Discretionary shares () are nonetheless getting some beneficial tailwinds boosted by a still-tight labor market and a resilient U.S. economic system. This seems to be like a case the place the numbers may be overshadowing the actual state of the retail sector. Greater than a half dozen main retailers have already warned a couple of slowdown in shopper spending. Could U.S. retail gross sales numbers will arrive later this week and are anticipated to be adverse once more, which might be the fifth time up to now 7 months.

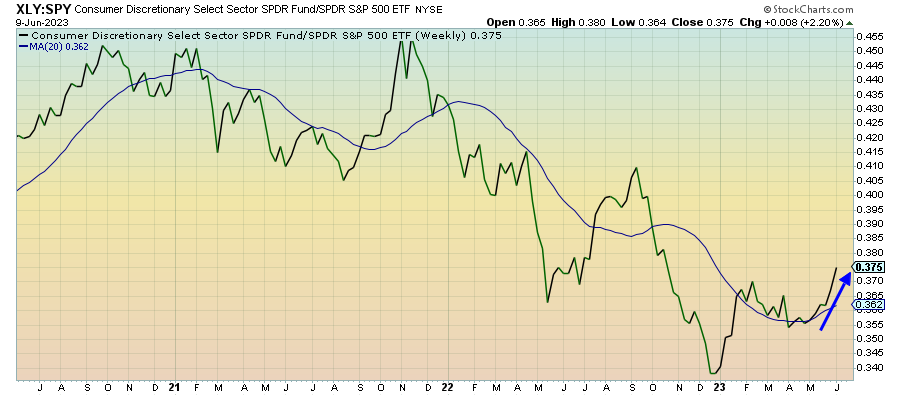

Communication Providers (XLC) – Potential Sentiment Shift

This sector () isn’t experiencing a pullback in the way in which the tech sector is true now, but it surely’s affordable to imagine that the habits between the 2 might be comparable. This group has outperformed the market constantly since This autumn of final yr and might be overdue for a pullback right here. The latest tick-up in additional defensive asset courses, together with utilities and Treasuries, might be signaling a short-term sentiment shift.

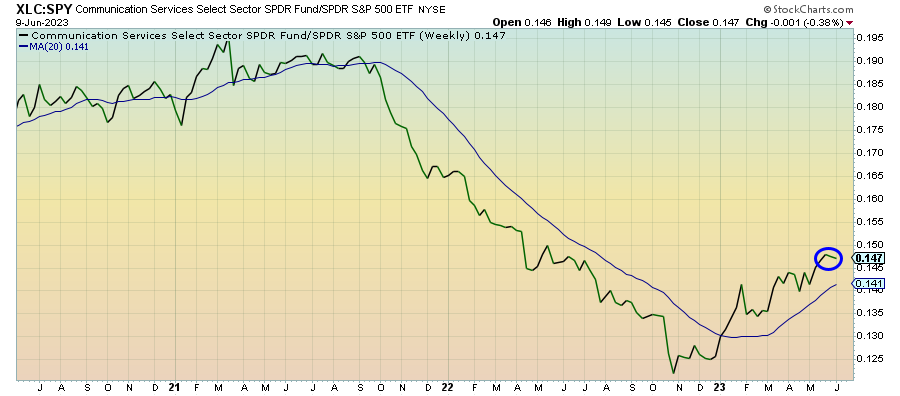

Utilities (XLU) – Getting Some Motion Once more

Utilities () are lastly beginning to get some motion once more because the rotation out of tech mega-caps continues. Small-caps are the group getting lots of consideration as the large rotation beneficiary, however this sector, Treasuries and cyclicals are additionally getting picked up. The truth that all of those teams are beginning to tick greater means that that is actually only a rotation out of mega-caps versus a rotation into small-caps.

Small-Caps (VSMAX) – Not a Sturdy Transfer

Whereas the market appears to need to promote itself on the thought of a small-cap rally right here, it appears extra per lots of areas of the market outperforming the just lately on account of the rotation out of mega-caps. Relative worth continues to be a giant element of small-caps versus large-caps and we’re nonetheless not seeing any actual outperformance of worth over development. Except that flips, I’m unsure there’s a lot of a case that this can be a wholesome, sturdy transfer.

[ad_2]

Source link