greenbutterfly

Abstract

I like to recommend going lengthy DigitalOcean (NYSE:DOCN). The expansion within the variety of SMBs worldwide and the shift in direction of multi-cloud deployments by companies are underlying developments that can drive demand for DOCN’s companies.

Firm overview

DOCN helps software program builders, startups, and small and medium-sized companies (SMBs) by offering them with on-demand infrastructure and platform instruments for utility improvement, deployment, and scaling.

Loads of underlying developments for DOCN to journey on

The usage of expertise in customer support, company administration, and the pursuit of a aggressive edge is revolutionizing organizations of all types. Because of the worldwide phenomena of technology-powered development and innovation, virtually all companies should give attention to utilizing expertise by means of cloud companies. Firms are more and more adopting cloud computing as their most well-liked IT infrastructure resulting from its scalability, adaptability, and dependability. With cloud computing, firms can give attention to customer-facing functions quite than on constructing out expensive in-house IT programs. Notably interesting to new ventures and SMBs is the truth that cloud computing allows them to entry and use superior options that might be prohibitively costly or troublesome to implement on-premises.

Contemplating that there are 32.5 million SMBs in america and round 400 million SMBs worldwide, I feel DOCN has an enormous market alternative. Moreover, I consider this quantity will proceed to rise partially as a result of there are much less constraints positioned on would-be enterprise homeowners. As well as, many SMB’s founding groups more and more include a significantly extra various set of individuals than solely technical individuals. These individuals can launch companies with the assistance of available and cheap cloud computing and easy, reliable programming instruments. Because of the benefits of cloud computing when it comes to pace, price, and ease of administration, a rising variety of new companies and established SMBs are adopting this mannequin.

One other important shift I’ve seen is the widespread adoption of quite a few cloud platforms by enterprises. Reasonably than counting on a single supplier for his or her IT wants, companies and people are more and more turning to multi-cloud deployments as a way to higher tailor their functions to probably the most acceptable tech stacks and mannequin for working them, whereas avoiding the seller lock-in that’s typical of conventional IT infrastructure companies. In my view, the rising recognition of utilizing a number of cloud companies may have a optimistic long-term affect on the worldwide cloud computing market.

DOCN answer is easy and price clear

The first subject for SMBs is that the options supplied by main distributors are designed for enterprise functions. These firms’ choices normally aren’t made with SMB in thoughts. These services probably do not present what customers want, are overly sophisticated, don’t have any clear value or billing construction, and sometimes have substantial hidden charges. Subsequently, many SMBs lack the assets crucial to completely achieve from adopting these cloud computing capabilities from massive distributors.

The DOCN platform was made to hurry up the time it takes to go from inquiring to deploying an answer, all with out the necessity for substantial preparation or coaching. What this implies is that the elemental barrier to adoption, the problem in deployment, is successfully eliminated. The platform can also be made to accommodate builders for all kinds of use circumstances, and it may be deployed in minutes. (Observe: I encourage readers to undergo DOCN product web page for full understanding of Droplet technicalities).

SMBs rely closely on money move, so surprising prices can significantly have an effect on their monetary image. Subsequently, I feel that open pricing is a significant component encouraging SMBs to undertake DOCN options. Attributable to DOCN’s clear pricing construction (consumption-based and renewed on a month-to-month foundation), optimizing deployments for patrons is a breeze. DOCN allows customers to watch their month-to-month finances and keep away from disagreeable surprises.

Buyer acquisition mannequin stems from neighborhood ecosystem

DOCN is answerable for establishing one of the vital in depth on-line communities for developer schooling. The S-1 claims that there are about 3.5 million month-to-month distinctive visits as a result of energy and development of the DOCN neighborhood ecosystem. I see this as a serious aggressive benefit when it comes to attracting new clients. Because the community’s person base expands and extra invaluable materials is produced, DOCN advantages from a larger variety of paying subscribers and a extra sturdy self-service infrastructure. The extra advantages of this are as follows:

- A platform the place DOCN can achieve insights on what are the upcoming merchandise that builders demand

- A platform the place builders can achieve confidence with DOCN’s merchandise and capabilities earlier than testing out the product itself

In my view, DOCN has a large window of alternative to considerably broaden its present buyer base. An instance of DOCN is the hiring of extra inside salespeople, probably even in different international locations.

Acquisition of Cloudways

The acquisition is a superb one for my part. The enlargement of Cloudways’ market entry for DOCN offers new alternatives for enlargement.

Prospects’ lack of self-assurance of their talents to handle cloud infrastructure is cited as a number one reason for their departure from the DOCN platform in the course of the first 90 days. Administration thinks it might retain and increase ARPU with Cloudways’ SMB purchasers by providing extra managed companies to these clients. This is smart to me as it’s the lowest hanging fruit to extract synergies.

DOCN has been the inspiration for the success of many ecommerce-specific managed internet hosting firms. DOCN’s transfer into the identical ultimate market may put it in direct competitors with a few of its present clientele. Nevertheless, I do not assume this can be a serious downside as a result of the TAM is so huge. Finally, I feel this can be a good enterprise transfer that can assist DOCN develop quicker.

3Q was good but additionally signifies near-term dangers

The third quarter was DOCN’s finest ever, with income up 3% and EBIT up 850 foundation factors from the earlier 12 months. DOCN supplied quantitative particulars concerning the results on its mannequin, comparable to a 900bps headwind to 3Q resulting from poor macro, declining blockchain developments, and the affect from the Russia/Ukraine warfare. On the flipside, this was considerably countered by a 12% value hike on July 1. On steering, I consider 4Q targets for 35% income development implies an additional deceleration in underlying development, on condition that Cloudway and a pricing step up are included.

One other factor to focus on is that DOCN is enacting to foster long-term development regardless of macroeconomic constraints. Put merely:

- By controlling OPEX development

- Bettering combine shift by means of continued spending on options like higher storage and safety. Administration believes storage income may double in combine

- Optimizing pricing technique

I anticipate that these levers will end in long-term structural enhancements. Having stated that, I consider there are some near-term dangers as a result of demand in key finish markets is predicted to stay weak till 2023.

Valuation

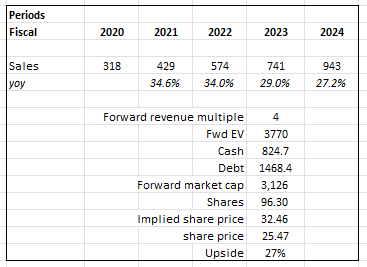

I feel traders can anticipate a 27% return based mostly on my mannequin.

My mannequin assumption is predicated on my perception that, given the scale of the TAM, DOCN inventory will proceed to develop at a fast tempo. Having stated that, I anticipate a slowing of development from 30%+ to the excessive 20%’s in 2023. That is to mirror end-market strain.

Over time, as DOCN grows and expands its margins (Gross margin and EBITDA margin), I consider the valuation will return to historic ranges (not at 4x, which is close to an all-time low). Nevertheless, given the near-term headwinds, I consider valuation will stay unchanged.

Personal calculations

Dangers

Elevated competitors

Given the dimensions and development of the general public cloud marketplace for SMBs, it appears solely logical for bigger public cloud firms to compete on this market. DigitalOcean’s aggressive place may weaken if this occurs.

Execution

Direct gross sales development, model consciousness enlargement, upselling present clients, and improved buyer retention are all methods by which DOCN would possibly pace up its income improvement. If these gross sales, advertising, and buyer success playbooks aren’t applied correctly, future development could also be jeopardized.

Conclusion

DOCN is a cloud computing firm that helps software program builders, startups, and SMBs entry on-demand infrastructure and platform instruments for utility improvement, deployment, and scaling. The development in direction of companies adopting cloud computing, significantly SMBs, is a serious alternative for DOCN. Moreover, the rising recognition of multi-cloud deployments implies that companies are more and more turning to a number of cloud platforms, quite than only one supplier. DOCN’s platform is designed to be easy and cost-effective, with a clear pricing construction and optimized for ease of deployment. General, DOCN seems to have a robust market alternative and enticing choices for its goal customers.