Vertigo3d

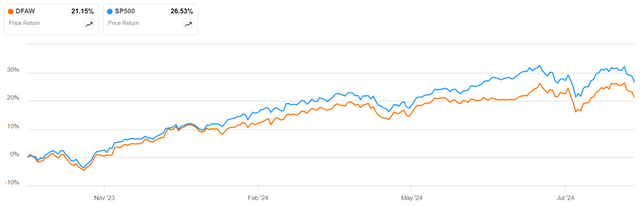

The Dimensional World Fairness ETF (NYSEARCA:DFAW) laps its first yr since inception this month. This various international fairness fund has, up to now, didn’t generate any alpha over broad-market U.S.-domestic ETFs, however that is not shocking for the reason that U.S. market has been dominated by the meteoric rise of the Magnificent 7, and that is the essence of my Maintain (do not buy) thesis for DFAW proper now.

SA

Low cost Fund Targeted on Historic Outperformance

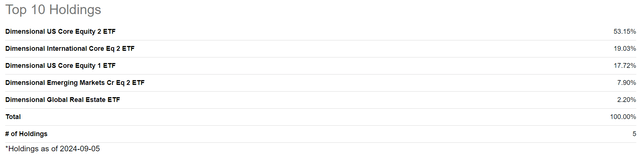

This 0.25% expense ratio fund’s technique is actually tutorial, that means years and years of educational knowledge is used to tweak the fund’s holdings on a periodic foundation. Technically, this can be a fund of funds, as a result of DFAW solely holds different Dimensional ETFs in its portfolio, so I count on the ‘rebalancing’ is extra of a reallocation inside these 5 funds.

DFAW Holdings

One level I would like to attract your consideration to is the truth that this isn’t a very international ETF. Rising markets, for instance, are hardly consultant of these economies and solely make up about 10% of the fund. It is nonetheless geared to U.S. and Worldwide, which is one other time period for ‘developed’ markets. For instance, the Dimensional Worldwide Core Fairness 2 ETF (DFIC), which includes a few fifth of DFAW’s holdings, has the next nation allocations.

DFIC Holdings by Nation

That is one believable purpose why DFAW is nearly mimicking SP500 however unable to generate alpha over it and unable to offset it in durations of decline. It is not likely designed to do this. It is merely meant to observe historic tendencies the place alpha has been generated. I do not suppose that is an excellent technique, and I’ve my causes.

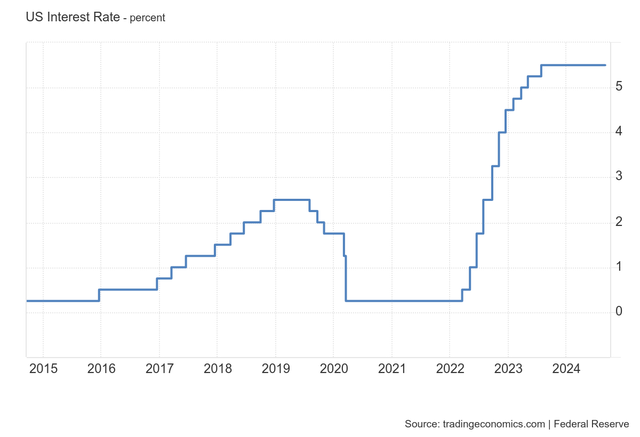

First, the market we see now’s nowhere near being a standard market combine the place the cyclicality of sectors makes itself identified very clearly at completely different durations of time. As an example, in increase instances and near-zero rates of interest, markets are usually buoyant, uplifting all ships like a rising tide however primarily pushed by development shares; on the flip facet, excessive rates of interest, unsure political outcomes, international battle, and many others. are inclined to spook buyers into rotating funds into worth shares. That is not likely occurring proper now, which additionally means a conventional market combine – even a worldwide one – is not very prone to generate alpha in such an irrational market setting.

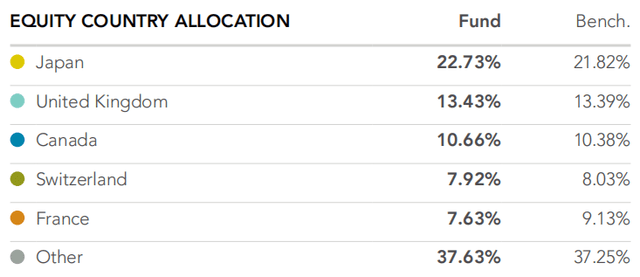

SA

In the event you want proof of that, simply take a look at SP500 for the reason that pandemic. The place’s the response to the preliminary battle flaring up in Europe? The place’s the impact of the Fed’s QT effort that began in early 2022? What marks the primary transfer by the Hamas in opposition to Israel? Other than what I can solely name a sideways motion between 2022 and 2024, this appears to be like nothing like a disturbed or panicked market. My view is that the ‘new regular’ everybody was speaking about after the pandemic has really set in, and most of us do not even comprehend it.

The second purpose I believe DFAW’s technique is ineffective on this market is what I have been saying concerning the Magazine 7 for a number of months now. So long as these giants of tech, communications, and client discretionary proceed to dominate all different segments, it may be laborious to generate alpha over that from every other sectoral or geographic mixture of equities.

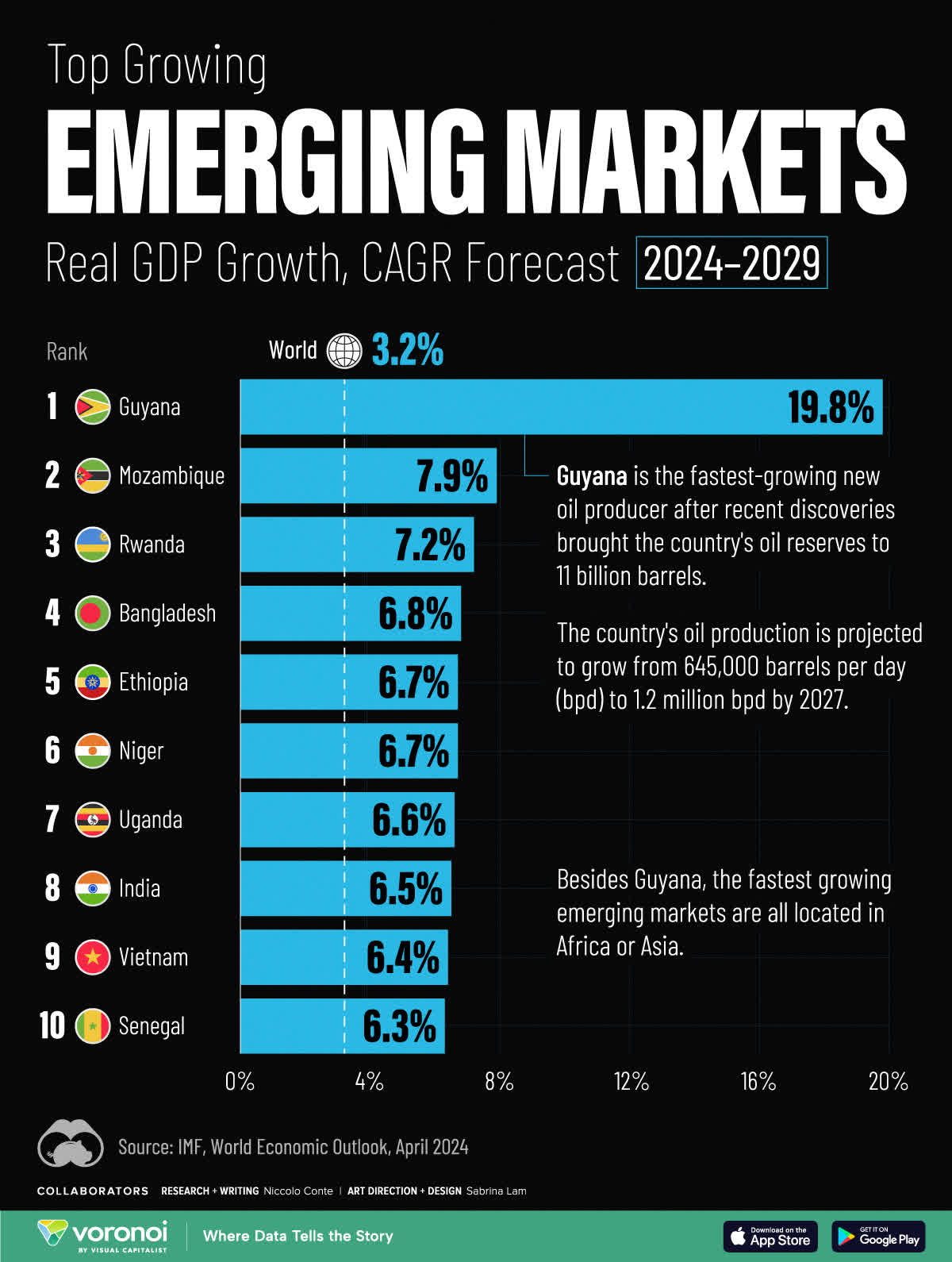

General, I might say that DFAW would possibly theoretically be designed for outperformance, however with out satisfactory tweaks to its ETFs’ holdings to incorporate actual development from rising markets comparable to Africa, South Asia, and Southeast Asia, I do not imagine this ETF goes to outperform the home U.S. market.

Visible Capitalist

My Ideas on DFAW

In closing, I do just like the method that DFAW is utilizing. Though historic efficiency can usually be a mirage when projected ahead, it is equally true that corporations which have a historical past of sturdy efficiency are prone to proceed in that vein, ceteris paribus, in fact.

The issue is, there’s nothing to counsel the ‘all else being equal’ half. Nothing is because it was earlier than the pandemic, and with the appearance of AI, I imagine the funding panorama has undergone an much more important transformation to a extra risk-on state of affairs and a better dependence on just a few securities to hold the burden of the market.

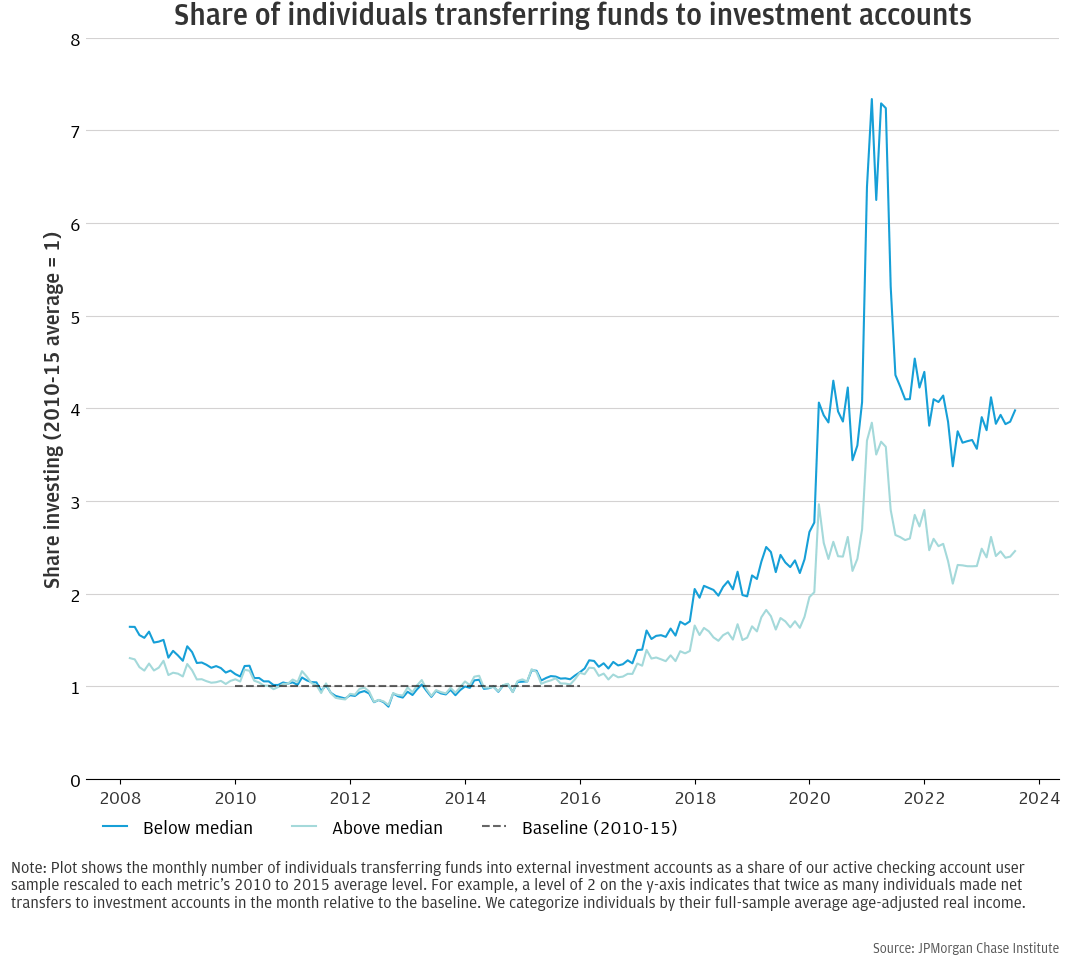

One attainable purpose might be the gush of retail buyers now taking part in secondary markets. This graph from JPMorgan Chase does converse a thousand phrases.

JPMorgan Chase

As extra individuals pour cash into the funding pool, these funds are naturally going to gravitate towards high-performance securities – each from a yield perspective in addition to from a capital appreciation one. Look a bit nearer and you will see that inflation and ensuing greater rates of interest managed to place a damper on fairness investments as a result of fastened revenue merchandise had been beginning to yield comparatively greater charges, and nonetheless are. Even so, the optimism is shining via; buyers are clearly nonetheless in search of alpha from a market that bounced again so shortly from the post-pandemic dip.

Buying and selling Economics

Nevertheless, I additionally posit that this was not essentially a post-pandemic improvement. In the event you superimpose the Fed Funds Charge chart over the retail investor chart, you may see that the sluggish cadence of rate of interest hikes beginning in 2016 triggered the preliminary move of funds into funding accounts. From there, the pandemic triggered an enormous surge in funding curiosity that also persists in the present day.

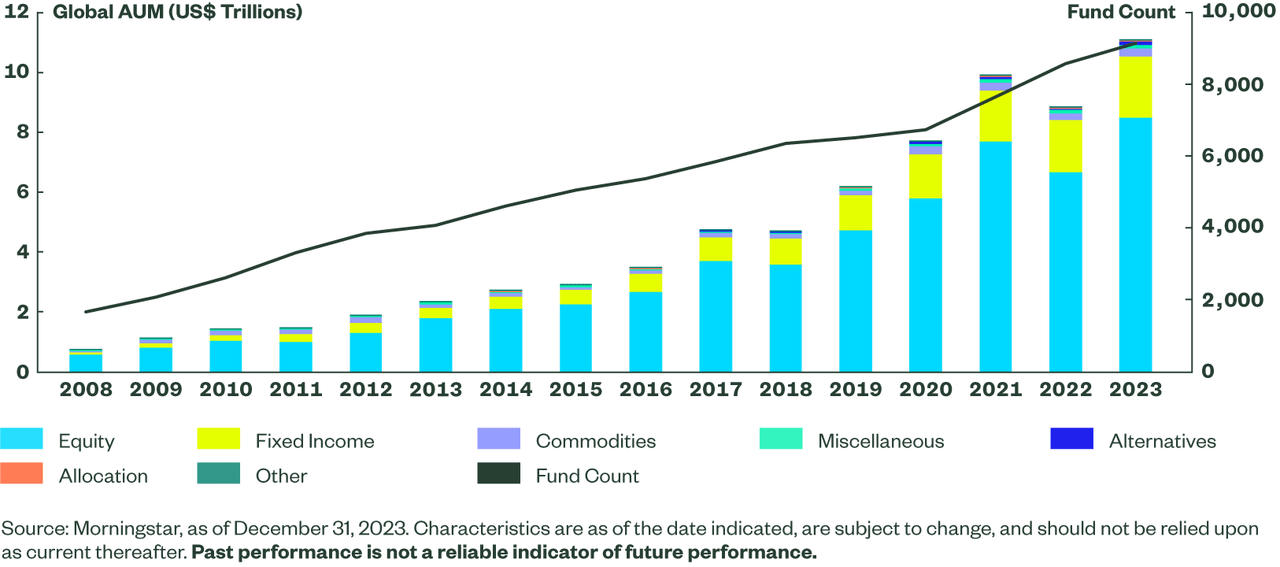

There’s an issue related to that, sadly. As extra funds move into funding accounts, the pool of uninformed buyers rises. That is given impetus to the ETF market, which is why we’re seeing this.

State Road International Advisors

You’ll be able to see the surge within the ETF depend reflecting investor curiosity in fairness funds since 2020. There’s been development in different areas comparable to fastened revenue as properly, however aside from the 2022 dip in fairness ETF AUMs and depend, development has been regular.

And that brings us again to why DFAW is unable to outperform the market. In a state of affairs the place market actions are dictated by an elevated few (Magazine 7), buyers counting on fund managers are naturally going to see sturdy allocations to those large winners. As an example, the Dimensional U.S. Core Fairness 2 ETF (DFAC), which is DFAW’s largest holding at 53%, has Apple (AAPL), Microsoft Corp (MSFT), Nvidia Corp (NVDA), Meta Platforms (META), and Amazon (AMZN) as its prime 5 holdings, weighted at a mixed +17%.

And that skews the market in a manner the place different sectors are compelled into the background, having solely minimal affect in opposition to the actions of the Magazine 7. That is why I would not advocate DFAW proper now. In some unspecified time in the future, as soon as the Magazine 7 have exhausted their development gasoline and their valuations come right down to extra digestible ranges, it’d properly present that elusive alpha. For the foreseeable future, nonetheless, I do not see that taking place.