Writer’s Notice: This text was printed on iREIT on Alpha in Might of 2022.

Alexandros Michailidis/iStock Editorial through Getty Photos

Expensive readers/followers

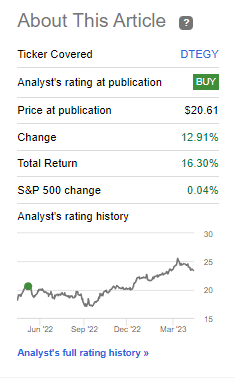

Deutsche Telekom (OTCQX:DTEGY) (OTCQX:DTEGF) has been an excellent funding for me. I’ve outperformed the market, and been capable of earn a good yield and security by investing in one of many largest telecommunication companies round. Some buyers would let you know that the corporate is definitely nonetheless value investing in right here at this level.

Whereas I see a possible upside if development charges stay good, I additionally see the potential for a valuation decline if historic patterns sustain. Moreover, with comparatively excessive uncertainty on the forecast facet, and one of many highest leverages within the telecommunications business, I do see Deutsche Telekom as coming right into a extra “honest valued” place presently.

On this article, I’ll justify to you why that’s.

Deutsche Telekom – Updating the thesis

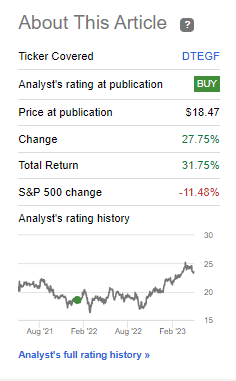

Once I final clarified my thesis on Deutsche Telekom inventory, we have been again in June of 2022. That makes it virtually a 12 months previous at this level. After all, since that exact time, the corporate has outperformed not solely different telco shares, but it surely has handily outperformed the S&P500 as nicely, confirming my long-term enchantment on this enterprise.

Deutsche Telekom RoR (In search of Alpha)

A few of you would possibly say that I am “leaving” too early. I say to you that the basics and the long run are modified sufficient to the place I see higher alternate options on the market, and whereas I trim some, I am not leaving all of it behind right here.

To place it merely, Deutsche Telekom at these valuations, or on the valuations the place I bought the inventory, went from a double-digit conservative upside to a single-digit conservative upside – however extra on that in valuation.

DT is a story of two worlds – and this makes it interesting.

It is the European operations, which in the intervening time, are those chargeable for rewarding shareholders with dividends, and which rely upon many legacy markets with very good market positioning.

Nevertheless it’s additionally the US section, which is characterised by extra of a “development” story with the expectation for an eventual dividend that, in fact, will stream to DTEGY as nicely.

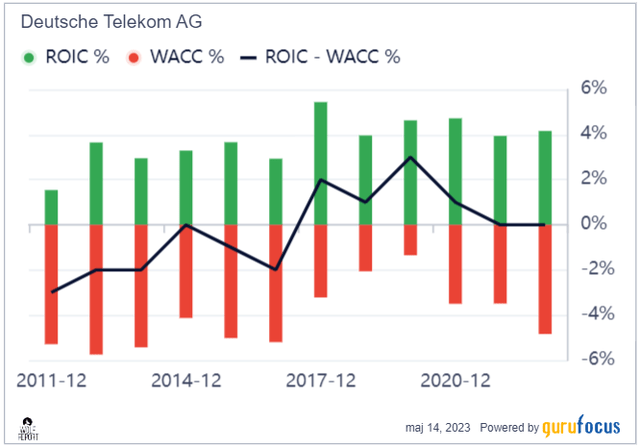

Not less than, this makes it enticing so long as development and fundamentals proceed on level. And in the intervening time, even with the most recent quarter within the bag, this appears to be considerably the case. On a GM and RoE foundation, the corporate stays an above-average-telco with good profitability. In different revenue KPIs, it is considerably common or beneath common. What I need to draw your consideration to although on this article as a result of it is related as a consequence of rates of interest, is debt. The corporate is likely one of the higher-leveraged telcos on the market, with a cash-to-debt of 0.04x, debt-to-equity of three.04%, and an LT debt/cap of over 62%. Curiosity protection is not more than 1.67x. Even for a Telco, which may deal with larger quantities of leverage, I think about this to be excessive. And that is mirrored by a BBB ranking, which usually for bigger telcos could be larger.

Native margins are good – Germany stays at that 40%, which is rather like Orange (ORAN) in its relative dwelling markets. The important thing distinction between Deutsche Telekom and different extra native and worldwide telcos is that DTEGY is definitely a little bit of a development story, versus a zero-growth story like most telcos are, and this stays a part of the main target right here.

The story for T-Cellular continues to be a part of the thesis – by which I imply that when TMUS begins paying its dividend, we’re seemingly 5%. The issue is, I haven’t got a problem discovering a higher-rated telco dividend at that degree or above elsewhere – and at a greater valuation than this one.

Comparative margins for Deutsche Telekom are a blended bag. In some and metrics, the corporate’s margins are very good – like internet and Gross – however in some, they’re beneath common, similar to an working margin of round 8.5%. This implies the corporate has each efficiencies and inefficiencies to contemplate, however on a excessive degree, we will agree that the corporate’s profitability over time has truly markedly improved.

Deutsche Telekom ROIC/WACC (GuruFocus)

The corporate’s heaviest points from a margin/operational perspective lie within the comparatively excessive quantity of OpEx, which is why we get such a below-average Working revenue margin. Anyway, we now have 1Q23, so let us take a look at that.

Bear in mind, I’m an lively supervisor of my investments. This implies I each add and trim stakes – I do not maintain without end, and I typically measure my potential returns in a single funding on a conservative foundation relative to the conservative potential in one other funding.

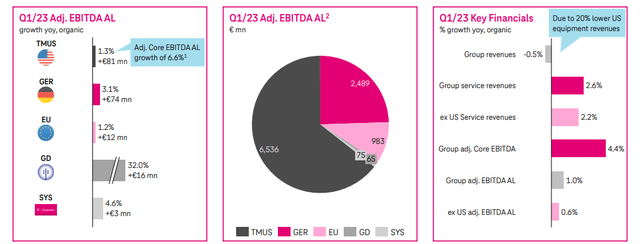

I totally anticipated DTEGY to outperform 1Q, they usually did. For a telco, natural development of two.6% for an organization this dimension is nothing to essentially ignore or clarify away, and the adjusted EBITDA will increase of just about 4.5% are wonderful as nicely. With TMUSA elevating steerage, the DTEGY “sphere” is doing very nicely, and DTEGY now has a majority stake within the US arm, at 50.2%, achieved in March of 2023.

The corporate additionally just lately closed on its tower deal, receiving over €10B value of money, and decreasing firm leverage down beneath 3x.

That is wonderful.

Check out the organics for the quarter.

DT IR (DT IR)

This combine and this enchantment are actually second to only a few telcos on the market. The one sub-par variables we will point out at this level, other than mentioning that the valuation is not dirt-cheap, is that the corporate’s yield continues to be considerably decrease than on-sale telcos on the market.

Nonetheless, high quality issues – and DT is unquestionably high quality.

The corporate is pushing the envelope each on the Community facet, a pacesetter in 5G in most of its markets, and prospects are principally rising – some churn on the US postpaid, however development in broadband provides. The corporate additionally moved ahead and notched up its local weather/ESG ambitions – however you all know, if you realize my work, that I put this pretty low on the precedence record when an organization.

DT IR (DT IR)

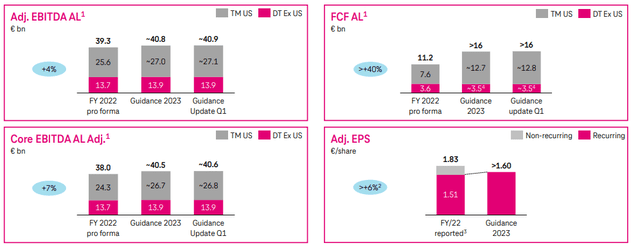

The corporate even ratcheted up its steerage considerably, now anticipating practically €41B in adjusted EBITDA, and slight enhancements throughout the board with EPS down (however up on internet of non-recurring).

A lot of the constructive stance I held on Deutsche Telekom presently is beginning to materialize. A number of issues I forecasted have come to cross, and the ensuing positive factors in share worth imply following me has had the potential to outperform the market by a good quantity right here.

With lowered churn and the twenty first consecutive quarter of EU natural EBITDA development, the dangers or considerations to Deutsche Telekom needs to be thought of to be extraordinarily restricted in scope. Web debt excluding leases is now down beneath €100B, which marks the primary time in a while that it has managed this – and as a comparability, the corporate’s leverage was at 3.07x on the finish of 2022 – so Deutsche is progressing quickly in carving away at its mountain of debt (that almost all telcos do have).

1Q23 was a superb begin to an excellent 12 months. I have been involved with DT IR, and the breach above €20/share was a giant deal each on the company facet and on the investor facet. It proved that issues are transferring the appropriate manner.

In reality, at one level it went so nicely that the corporate reached my first “trim” degree as soon as it broached €22.2/share again in April. I bought a small quantity of my giant, 4.2% stake on the time, and I am hoping to reinvest as soon as issues cool off a bit. With the journey we have seen from €17.5 again in September to over €22/round €21 native right here, the corporate has been on an absolute run.

Let’s take a look at what valuation dictates us doing from right here on out.

Deutsche Telekom Valuation – decrease upside, however nonetheless good

So, the explanation I bought at €22.5/share could be very easy (and by promoting, I imply trimming round 1%). At that time, my conservatively adjusted upside on a 2025-2027E foundation fell beneath 10% per 12 months, even together with a normalized, conservative dividend.

When this occurs, I act for the sake of capital diversification, and preservation, and on this case, as a result of the market provided substantial reductions in finance, actual property, and different firms. Had these reductions and the market not been in turmoil, I most likely would have let my full place “experience”.

So does this imply it’s good to promote Deutsche Telekom?

No, I might say that might be a little bit of an exaggeration.

What I will say, nevertheless, is that Deutsche Telekom has gone from being considerably undervalued relative to its earnings potential and the anticipated returns we as buyers may realistically calculate, to being “common” when it comes to upside.

2023E is, as clarified above, anticipated to be a 12 months that is adverse for EPS. IFRS would not keep in mind the non-recurring nature of parts of its earnings. So, Deutsche Telekom is probably going, as I see it, to see some near-term stress because of the YoY nature of its earnings. Past 2024-2025, I see EPS development potential within the excessive single digits and, if the corporate continues to outperform, low double digits as a few of the puzzle items with TMUSA fall into place.

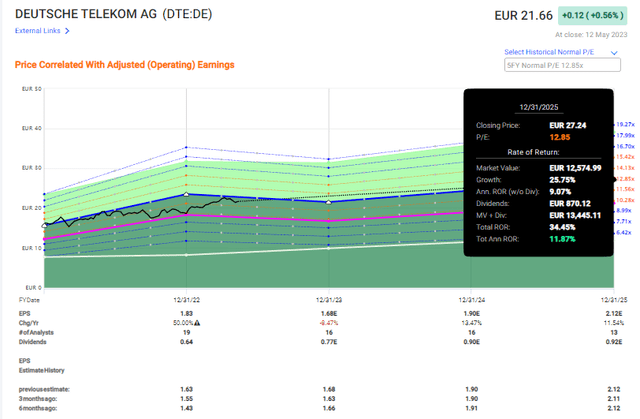

Nonetheless, this dictates a barely double-digit charge of RoR even at €21.66/share. One take a look at the FactSet/F.A.S.T graphs forecasts right here…

Deutsche Telekom Upside (F.A.S.T graphs)

And please keep in mind that these forecasts are extra constructive than my very own. Adjusted for my forecasts, we’re an annualized RoR of round 9.87% right here. Once more, that is nonetheless market-beating and on no account dangerous – but it surely’s additionally not near any of the very good potential we now have in different communications shares or different sectors on the market in the present day.

Many buyers are comfy letting their winners “breathe” or “experience”. Supplied I see additional upside, I haven’t got a problem with this. That’s the reason I solely trimmed 1% on the onset of this climb to €22/share. Nonetheless, I do suppose it vital to level out that there are a variety of things that may, should you have been minded in such a manner, level to the corporate beginning to grow to be overvalued right here.

These embody:

- A comparatively excessive, 62%+ Lt/debt Cap

- Near a 5-year P/E premium

- An imperfect, 25% adverse miss forecast accuracy ratio (Supply: FactSet)

- The low development charges are attribute of Telcos.

As buyers, as with anybody, with can by no means relaxation on our laurels. DT was an excellent funding – and should still be. However as anybody who has been any type of supervisor in any group will let you know – when everyone seems to be blissful and every little thing goes swimmingly, and your division heads will not be reporting any points in any way, that is the time to be in your sport.

In order firms grow to be higher – I grow to be extra alert.

As I’m now. Easy DCFs that account for a sector-relevant development charge of 2-4% put the corporate at a long-term present FV of €24-€25/share. Accounted for sector-specific valuation pressures which aren’t a part of such a mannequin, something above €21-23/share for this firm is beginning to be a worth the place the actual upside is decrease than it as soon as was.

I feel it is a good time to level out what kind of returns chances are you’ll be sitting on with DTEGY, should you adopted my stance.

In search of Alpha DT RoR (In search of Alpha)

Particularly, I wrote the next:

So, a couple of issues.

I imagine, at that time, that DTE will rise considerably in valuation.

I additionally imagine that DTE might be probably the most qualitative Telco in Europe presently. Notice that I didn’t say most cost-effective. I imagine that to be Orange, and as you realize, I am deeply invested in Orange.

(Supply: Deutsche Telekom Article)

This brings me to my up to date thesis for Deutsche Telekom, which presently is as follows.

Thesis

- Deutsche Telekom is likely one of the extra qualitative and worth/mix-appealing telco companies on earth. Whereas it does have considerably larger leverage and decrease credit standing and yield than a few of its friends, it makes up for this with a possible longer-term upside and development that’s outdoors the 1-2% norm discovered within the sector.

- I imagine Deutsche Telekom might be purchased with ease and as a “STRONG BUY” at something involving a €1X native share worth.

- When the native share worth reaches above €21/share, issues look considerably totally different. It is nonetheless a “BUY”, and I put the PT round €24.5/share, however at over €21/share, your returns are wanting more likely to embody single-digit RoR.

- I am nonetheless at a “BUY” for the corporate, however I am extra cautious right here, and I’ve trimmed.

Bear in mind, I am all about :1. Shopping for undervalued – even when that undervaluation is slight, and never mind-numbingly huge – firms at a reduction, permitting them to normalize over time and harvesting capital positive factors and dividends within the meantime.

2. If the corporate goes nicely past normalization and goes into overvaluation, I harvest positive factors and rotate my place into different undervalued shares, repeating #1.

3. If the corporate would not go into overvaluation, however hovers inside a good worth, or goes again right down to undervaluation, I purchase extra as time permits.

4. I reinvest proceeds from dividends, financial savings from work, or different money inflows as laid out in #1.

Listed here are my standards and the way the corporate fulfills them (italicized).

- This firm is total qualitative.

- This firm is essentially protected/conservative & well-run.

- This firm pays a well-covered dividend.

- This firm is presently low cost.

- This firm has a practical upside based mostly on earnings development or a number of growth/reversion.

Deutsche Telekom is not low cost – but it surely’s respectable sufficient with an excellent upside, and I preserve my “BUY” right here.

Editor’s Notice: This text discusses a number of securities that don’t commerce on a serious U.S. trade. Please concentrate on the dangers related to these shares.