[ad_1]

Heading into 2022, an in any other case very bearish Goldman (whose chief fairness strategist David Kostin forecast a 3-month S&P worth goal of 3600 and anticipated the index to finish the 12 months at 4,000, whilst its way more correct stream merchants accurately predicted a meltup, extra on that later) mentioned that the one brilliant gentle on the in any other case drear 2023 horizon was in commodities which the financial institution mentioned would “be the best-performing asset class as soon as once more in 2023, handing traders returns of greater than 40%.” The Wall Road financial institution mentioned that whereas the primary quarter could also be “bumpy” as a result of financial weak point within the US and China, scarcities of uncooked supplies from oil to pure fuel and metals will increase costs after that.

“Regardless of a close to doubling year-on-year of many commodity costs by Could 2022, capex throughout the whole commodity advanced dissatisfied,” Goldman chief commodity analyst Jeff Currie wrote on Dec. 14. “That is the only most essential revelation of 2022 — even the terribly excessive costs seen earlier this 12 months can’t create ample capital inflows and therefore provide response to unravel long-term shortages.”

Again in 2020, Goldman predicted a multi-year commodities supercycle and had caught to that view whilst vitality costs dipped in latest months as a result of China’s coronavirus restrictions and a worldwide financial slowdown suppressing demand. And whereas the financial institution was right in its bullish view in each 2021 and particularly 2022, thus far 2023 has been a bust with each oil sliding to pre-Ukraine warfare ranges and the Bloomberg commodity index approaching one 12 months lows.

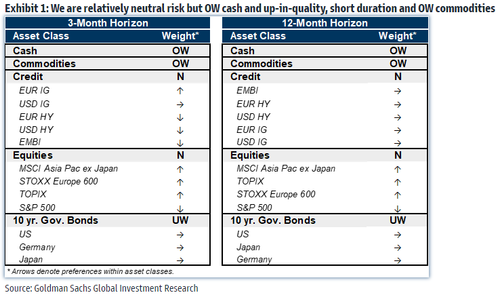

Paradoxically, whilst commodities have sunk – largely as a result of relentless CTA promoting and hedge fund shorting, offsetting any incremental demand for bodily from a lately reopened China – it’s the identical danger belongings that Goldman panned just some months in the past which have soared, forcing the financial institution’s fairness strategist to lift his 3M worth goal from 3,600 to 4,000, whereas on the identical time the financial institution’s tactical analysis staff led by Peter Oppenheimer, upgraded its 3M and 12M funding horizon for shares to Impartial From Underweight.

So having thrown within the towel on its bearish equities case, would Goldman do the identical with its bullish commodity view?

We acquired the reply this morning, when the financial institution’s commodity guru Jeffrey Currie printed what quantities to a mea culpa, but whereas he conceded that his favourite commerce of 2023 had been a dud thus far, within the be aware titled “Caught between the Fed and a tough place” he forecast that the value surge has solely been delayed and can come within the spring, which is why he stays “convicted that oil and steel fundamentals will rebound and preserve our bullish outlook with 12-month whole returns of 29% on the S&P GSCI.”

Some background as excerpted from his be aware:

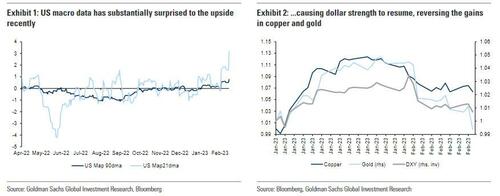

An excessive amount of of factor within the US. In the beginning of the 12 months, the core of our commodity view was pushed by a cooling US financial system, a resurgent China and a recovering Europe. These are ultimate situations for a commodity rally as a cooling US would permit for a Fed pause, resulting in a weaker greenback which might permit for stronger Chinese language fundamentals to dominate commodity pricing to the upside related to 2007/08. Whereas the recovering Europe assumption remains to be very a lot intact, the market is starting to query the Chinese language restoration, notably inside the property sector, and the latest string of sturdy US macro information factors extra in the direction of an accelerating US than a slowing US. The following rally within the greenback has had a unfavorable affect on all of the commodities that rallied late final 12 months within the context of a weaker greenback atmosphere, i.e. copper and gold. Our view on China is unchanged as we consider latest steel inventory builds will show short-term, whereas the dangers across the Fed going farther for longer have risen, creating a possible headwind to what we nonetheless consider are constructive micro fundamentals, notably in oil. Our economists level to the nonetheless comparatively benign core inflation image as a purpose to stick with the core view, however the bar for commodities to rally continues to rise.

Rebuilding belief. After yet one more setback, the renewed rangebound commerce in oil and metals is inflicting the market to develop into cautious, demanding extra cyclical proof to put money into the structural bull case. Since late final 12 months we’ve got been repeatedly arguing that the momentum in commodity markets stays constructive but each time the markets start to rally, they’ve confronted a setback and dump. Copper seemed on its option to $10,000/t with constructive coverage information out of China, however as a result of disappointing Chinese language stock information, it discovered itself beneath $9,000/t as soon as once more, inflicting the market to query the China re-opening thesis. Equally, oil examined $90/bbl twice solely to the touch $80/bbl days later earlier than rapidly rebounding to $85/bbl; nonetheless, with long-dated WTI oil costs dropping beneath $60/bbl, the market has begun to even query the under-investment thesis. And now with sturdy US macro information driving up charges expectations and questioning the weaker greenback assumption, gold dropped again to $1850/toz. The extra tied the market to macro sentiment, the larger the selloff. As a counterfactual, markets like soybeans the place macro sentiment is just not wanted and have visibly tight close to time period fundamentals have continued to commerce larger. We acknowledge and respect that the market seems to be shedding endurance within the bullish thesis, as on internet, commodities are down -1.5% ytd, making them one of many worst performing asset class this 12 months. Nevertheless, we stay convicted that oil and steel fundamentals will rebound this spring and preserve our bullish outlook with 12-month whole returns of 29% on the S&P GSCI

Why this conviction that the present downdraft in commodities is simply short-term? We’ll reply that shortly however first, a detour into why Currie believes oil costs will rise regardless of his $5 worth minimize simply final week: in a nutshell “Stock ranges are nonetheless low, spare manufacturing capability is restricted and world demand is bettering throughout almost all of the important thing commodity markets. Even entrance finish oil timespreads have moved again into backwardation, an indication of bodily tightness.” Right here is the longer model:

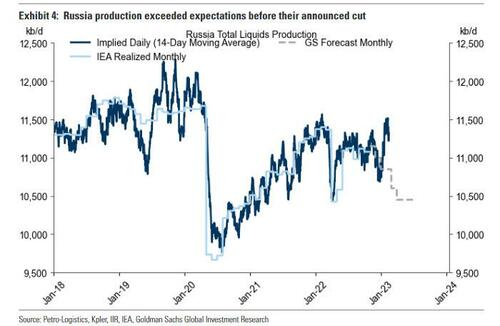

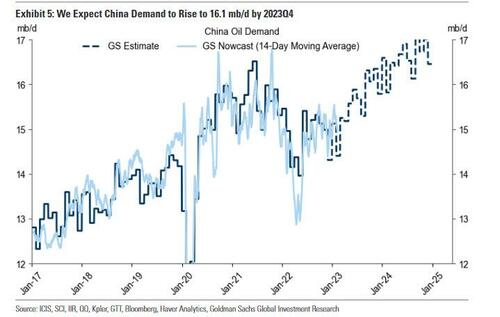

3. The oil downgrade was extra of a mark-to-market. Regardless of this directionless commerce, the bullish micro basic story remains to be very a lot intact. Stock ranges are nonetheless low, spare manufacturing capability is restricted and world demand is bettering throughout almost all of the important thing commodity markets. Even entrance finish oil timespreads have moved again into backwardation, an indication of bodily tightness. Our $5/bbl oil worth downgrade final week was merely a mark-to-market of each previous fundamentals and long-dated costs. In our view, each the trail and long-dated terminal values remained unchanged at $80/bbl – it’s simply going to take longer to get there. We now have oil crossing $100/bbl in late 4Q23. Larger than anticipated US and Russian manufacturing and the lack of distillate-based gas-to-oil switching left the oil market with larger than anticipated present stock. At the identical time, the sharp decline in long-dated oil costs was pushed by a surge in pent-up hedging exercise that was profiting from sharply decrease change margin necessities pushed by extra secure markets. However the ahead basic paths are unchanged. Chinese language mobility stays sturdy and our China oil demand nowcast suggests oil demand is 1.0 million b/d off the November lows. Additional, the announcement from Russia final week and the latest drop in our Russia nowcast means that Russian output will doubtless fall consistent with our expectations.

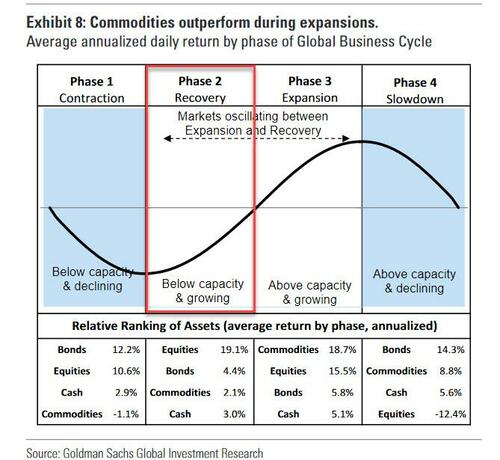

Currie then touches on his bullish view of metals which he argues are merely “ready on China” earlier than explaining why in his view, the commodity market is positioned for a pointy transfer larger because of a “uncommon macro setup” the place because of China, the “world financial system is beneath capability and rising which is early cycle (what we’ve got termed the ‘restoration’ section of the enterprise cycle), but inventories and spare capability are depleted which is late cycle (what we’ve got termed the ‘slowdown’ section of the enterprise cycle). That is uncommon, as usually at this stage of the enterprise cycle the financial system is above capability and slowing, because the US financial system skilled late final 12 months, with commodity inventories exhausted. Throughout this ‘slowdown’ section though demand development is slowing sharply as a result of larger curiosity charges, demand nonetheless stays above provide which towards exhausted inventories results in vital commodity returns. Nevertheless, this isn’t what performed out late final 12 months. Due to China being locked down in the course of the second half of final 12 months, the worldwide financial system was slowing beneath capability and by late 4Q22 commodity inventories have been outright constructing. Now we’ve got a worldwide financial system the place the US is accelerating above capability and China is accelerating far beneath capability, however at an rising fee. This setup, nonetheless, is occurring within the context of late cycle inventories and exhausted spare capability, however accelerating demand development that’s beneath pattern. When China pushes demand above provide, the system will doubtless stumble upon capability constraints on provide and inventories, recreating traditional late cycle sturdy returns.”

The underside line, and the explanation why Goldman believes the commodity cycle is simply simply getting began is that the arrange is finally just like 2007:

This isn’t the primary time we’ve got seen this arrange. We noticed it within the 2006 to 2007 interval. In late 2006, after the Fed raised charges by 450bp, oil bought off from $77/bbl to $52/bbl on the again of recession considerations and a heat winter. Markets have been primed for a recession that didn’t happen for one more 12 months. The yield curve inverted and commodity markets destocked amid restricted spare manufacturing capability. As the Fed paused, China aggressively stimulated, and Europe finally raised charges. These shifts led to a 12% decline within the Greenback and a close to doubling in commodity costs.”

Paradoxically, as Currie reminds us, it was the onset of a US recession—which everybody fears right now—that pushed commodity costs to dizzying heights in early 2008 as Fed minimize charges, coupled with Chinese language stimulus, led to a surge in commodity demand, inflicting provide constraints to bind.

After all, if 2007 is on deck, then 2008 must be as nicely (and everybody is aware of what occurred then to quick circuit the commodity meltup, one thing we mentioned one 12 months in the past in “Shades Of 2008 As Oil Decouples From The whole lot”). To Goldman that is not the case – for apparent causes, in any case one other spherical of financial institution nationalizations and bailouts is just not what strategists need to be pitching proper now – and as Currie caveats rapidly “we don’t count on a repeat of 2008 right now” but he provides that “these occasions underscore the vulnerability of commodity markets to a resurgent China, slowing US, and weak Greenback towards a backdrop of critically low inventories and restricted spare manufacturing capability.”

We, however, do count on a repeat of 2008, however it will not happen for some time – it can doubtless begin a while in late 2023 or early 2024 when the Fed Funds fee could also be as excessive as 6% in line with some, and when the following “arduous touchdown” disaster will strike, however not earlier than sending commodities hovering to the dizzying stratospheric heights of summer time 2008… proper at the beginning crashed.

Rather more within the full Goldman be aware out there to professional subs.

Loading…

[ad_2]

Source link