[ad_1]

The DAX index, a European monetary staple, tracks 40 outstanding corporations on the Frankfurt Inventory Change. These aren’t your common corporations; they’re the cream of the crop, representing the European enterprise elite. Calculated meticulously utilizing the free-float market capitalization technique, the DAX is a barometer of those business giants, influencing the heart beat of European markets.

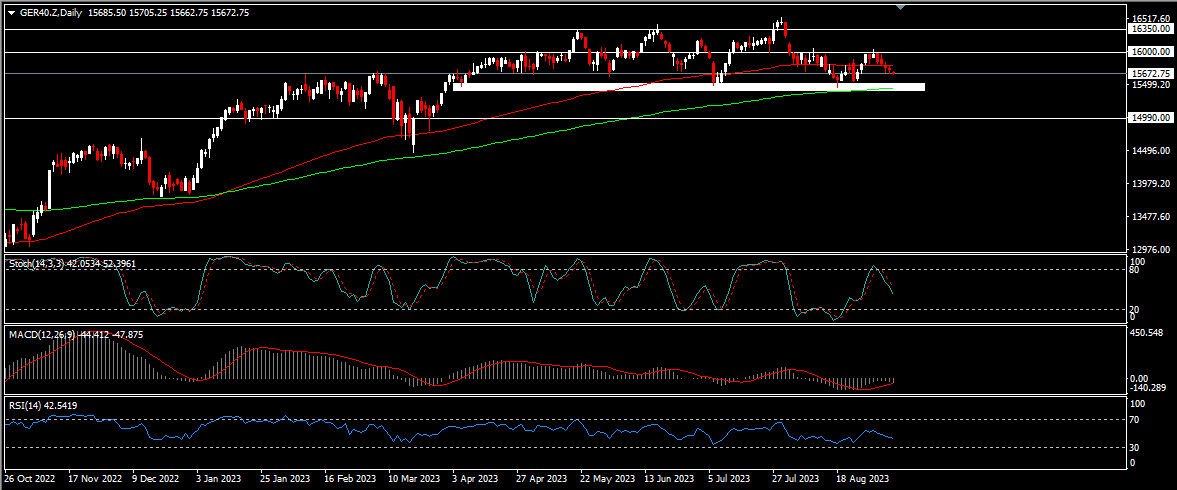

As of September 6, 2023, the DAX index sits at 15,678, bearing the load of European financial expectations. Its journey since April 2023 has been intriguing. After touching a low level at 15,445, it launched into a 3.9% ascent, overcoming resistance ranges and navigating the complexities of shifting averages. Now, it stands at a essential juncture, nearing the 15,500 assist degree examined in August and July 2023. Will it maintain, opening doorways to additional good points, or will it break, resulting in a descent towards 14,990? The 16,000 degree and the shifting averages await, able to information its path.

Inspecting the technical indicators, we discover principally bearish indicators. The MACD lingers under the zero line, signalling destructive momentum. The RSI stays under the 50 degree, reflecting bearish strain. But, amidst this, a spark of intrigue – the Stochastic indicator flirts with the overbought territory, hinting at a possible reversal or pause.

Essentially, the DAX index is influenced by varied elements. The efficiency of Germany, the financial powerhouse of Europe, performs a major function. Challenges and uncertainties abound, with a destructive 0.1% GDP development charge in June 2023, decrease than anticipated, and a 5.6% unemployment charge in August. Inflation raises eyebrows too, sitting at 6.1% in August.

Essentially, the DAX index is influenced by varied elements. The efficiency of Germany, the financial powerhouse of Europe, performs a major function. Challenges and uncertainties abound, with a destructive 0.1% GDP development charge in June 2023, decrease than anticipated, and a 5.6% unemployment charge in August. Inflation raises eyebrows too, sitting at 6.1% in August.

Nonetheless, the DAX index’s destiny extends past Germany, intertwining with world giants like China and the US. The choices of the European Central Financial institution (ECB) and the Federal Reserve (Fed) ripple by way of its actions. Political stability and financial stimulus in Germany and Europe contribute to its story. The shifting sands of world danger sentiment additionally depart their mark.

Click on right here to entry our Financial Calendar

Francois du Plessis

Market Analyst

Disclaimer: This materials is supplied as a basic advertising communication for info functions solely and doesn’t represent an unbiased funding analysis. Nothing on this communication comprises, or needs to be thought of as containing, an funding recommendation or an funding suggestion or a solicitation for the aim of shopping for or promoting of any monetary instrument. All info supplied is gathered from respected sources and any info containing a sign of previous efficiency shouldn’t be a assure or dependable indicator of future efficiency. Customers acknowledge that any funding in Leveraged Merchandise is characterised by a sure diploma of uncertainty and that any funding of this nature includes a excessive degree of danger for which the customers are solely accountable and liable. We assume no legal responsibility for any loss arising from any funding made primarily based on the data supplied on this communication. This communication should not be reproduced or additional distributed with out our prior written permission.

[ad_2]

Source link