German Dax 40 Talking Points

- Dax futures move higher amid speculation of a potential Fed pivot

- German equities turn green as utilities lead gains

- This week’s ECB rate decision could provide an additional threat to European equities

Recommended by Tammy Da Costa

Get Your Free Equities Forecast

Global equities received an additional boost in sentiment which has allowed the German Dax to retest 13,000. With a hawkish Federal Reserve and ‘sticky’ inflation weighing on risk assets, commentary from San Francisco Fed president Mary Daly (a non-voting member of the FOMC for 2022 and 2023) fueled speculation that the Fed may be reaching a pivot point for rate hikes.

With an additional 75 basis point rate hike in November already priced in, a slowdown in the pace of tightening could mean a less aggressive rate hike in December which could bode well for stocks.

For more information on central banks, please visit the DailyFX Central Bank Release Calendar.

As German companies continue to release their Q3 earnings, Dax 40 optimism is currently being led by the utilities sector which has risen by approximately 3.79% for the day.

Source: Refinitiv

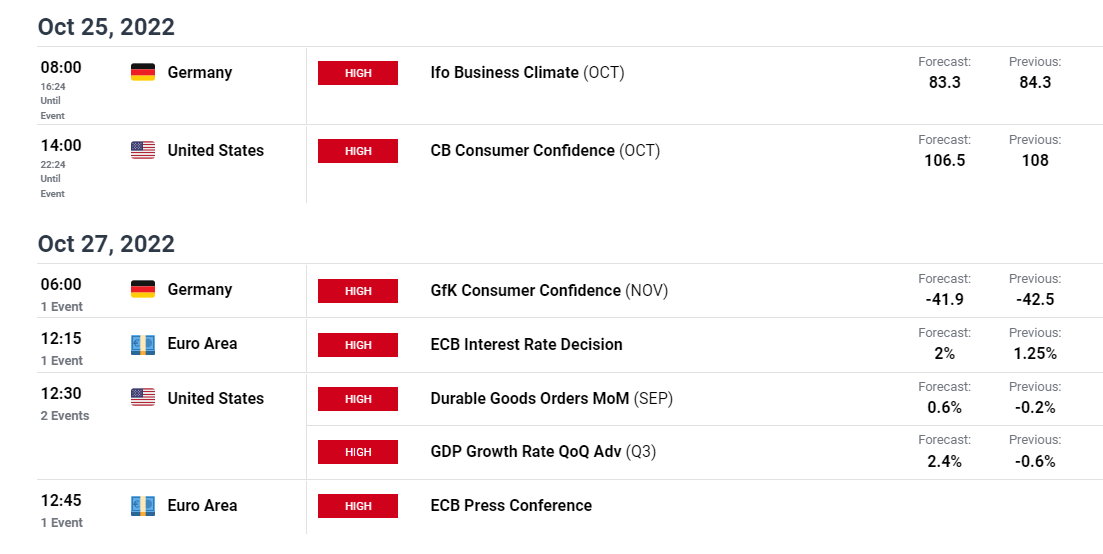

However, with the ECB rate decision and the subsequent press conference on this week’s economic agenda, Dax bulls aren’t in the clear just yet.

DailyFX Economic Calendar

Recommended by Tammy Da Costa

Introduction to Forex News Trading

German Dax 40 Technical Analysis

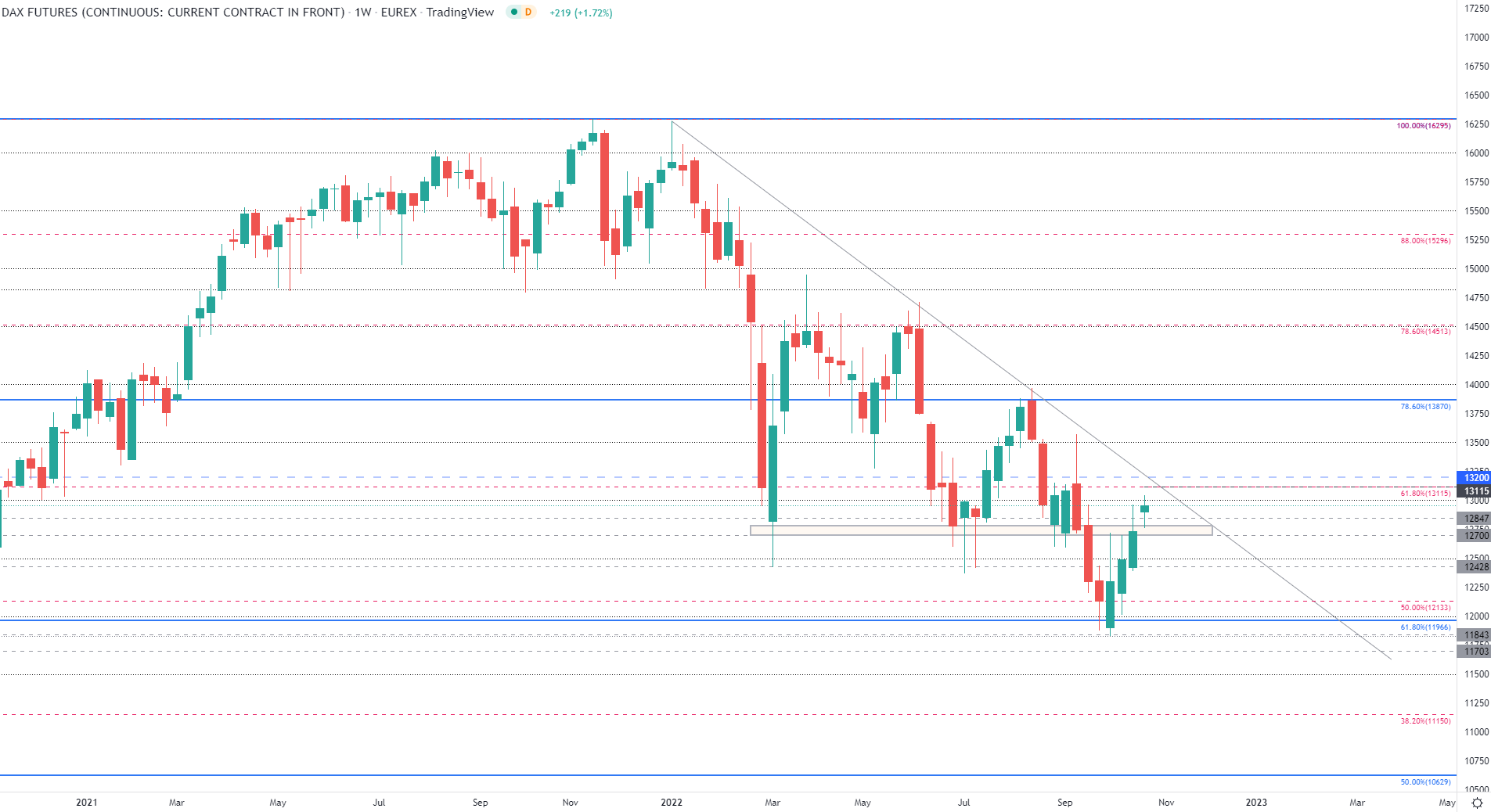

With the 61.8% Fibonacci retracement of the 2020 – 2021 currently holding at 13,115, a strong recovery from the September low has allowed the index to rise approximately 7% this month. As the major stock index heads for its fourth consecutive week of gains, the descending trendline from the January 2022 high (16,274) has formed an additional barrier of resistance that coincides with the key psychological level of 13,200.

Dax 40 Weekly Chart

Chart prepared byTammy Da Costausing TradingView

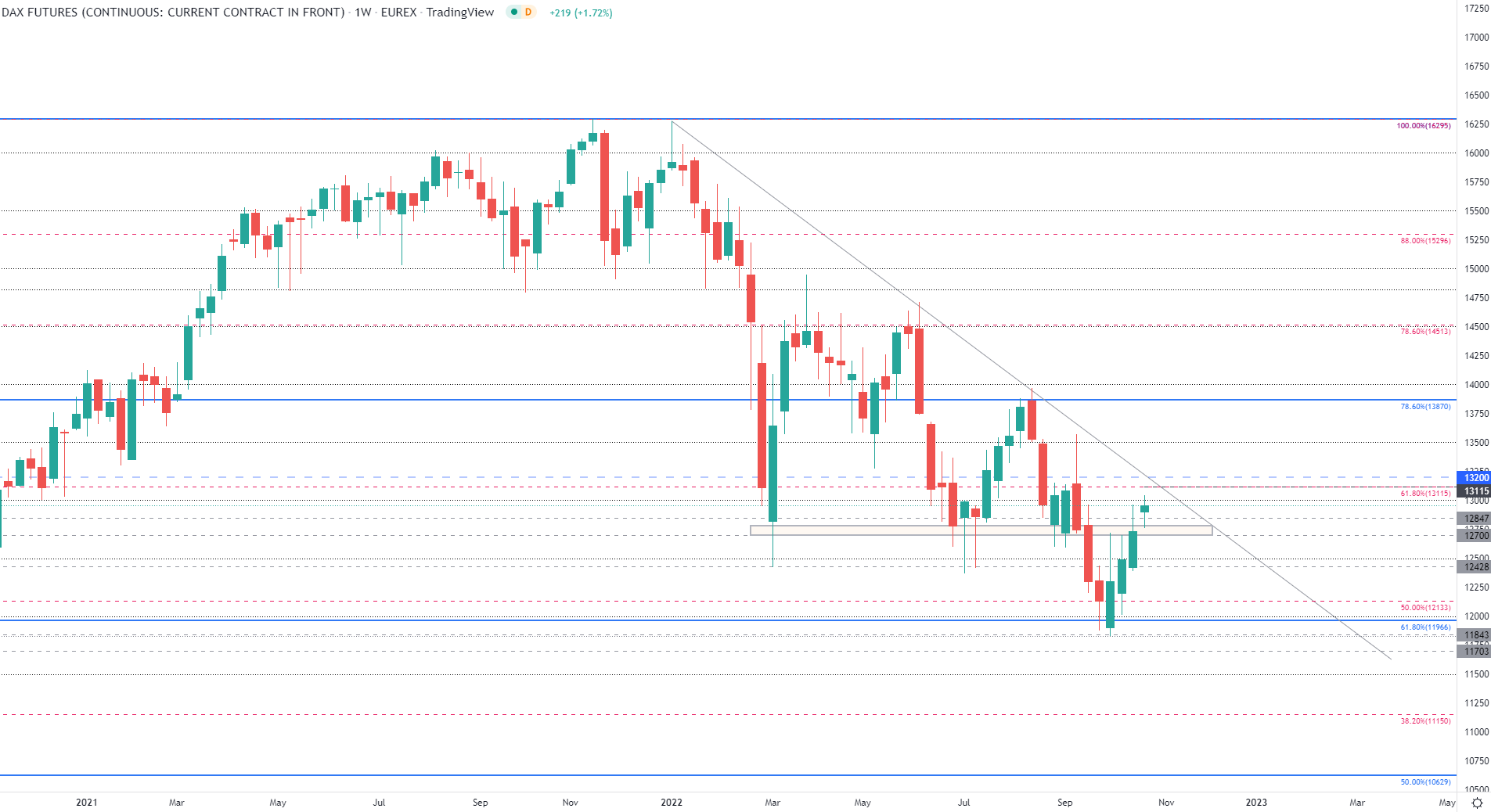

As Dax futures strive to gain traction above 13,000, failure to hold above this level and increased selling pressure could lead the index back towards prior resistance turned support which continues to hold at 12,700.

Dax Futures Daily Chart

Chart prepared byTammy Da Costausing TradingView

— Written by Tammy Da Costa, Analyst for DailyFX.com

Contact and follow Tammy on Twitter: @Tams707