[ad_1]

FTSE 100, DAX 40, Wall Road 30 Overview:

Advisable by Tammy Da Costa

Futures for Newbies

Threat Aversion Returns to Markets as Protests in China Make Headlines

Main inventory indices are buying and selling decrease after protests in China decreased demand for threat property. With Dax, FTSE and Dow going through elementary and technical headwinds, a surge in volatility may drive value motion for the rest of the week.

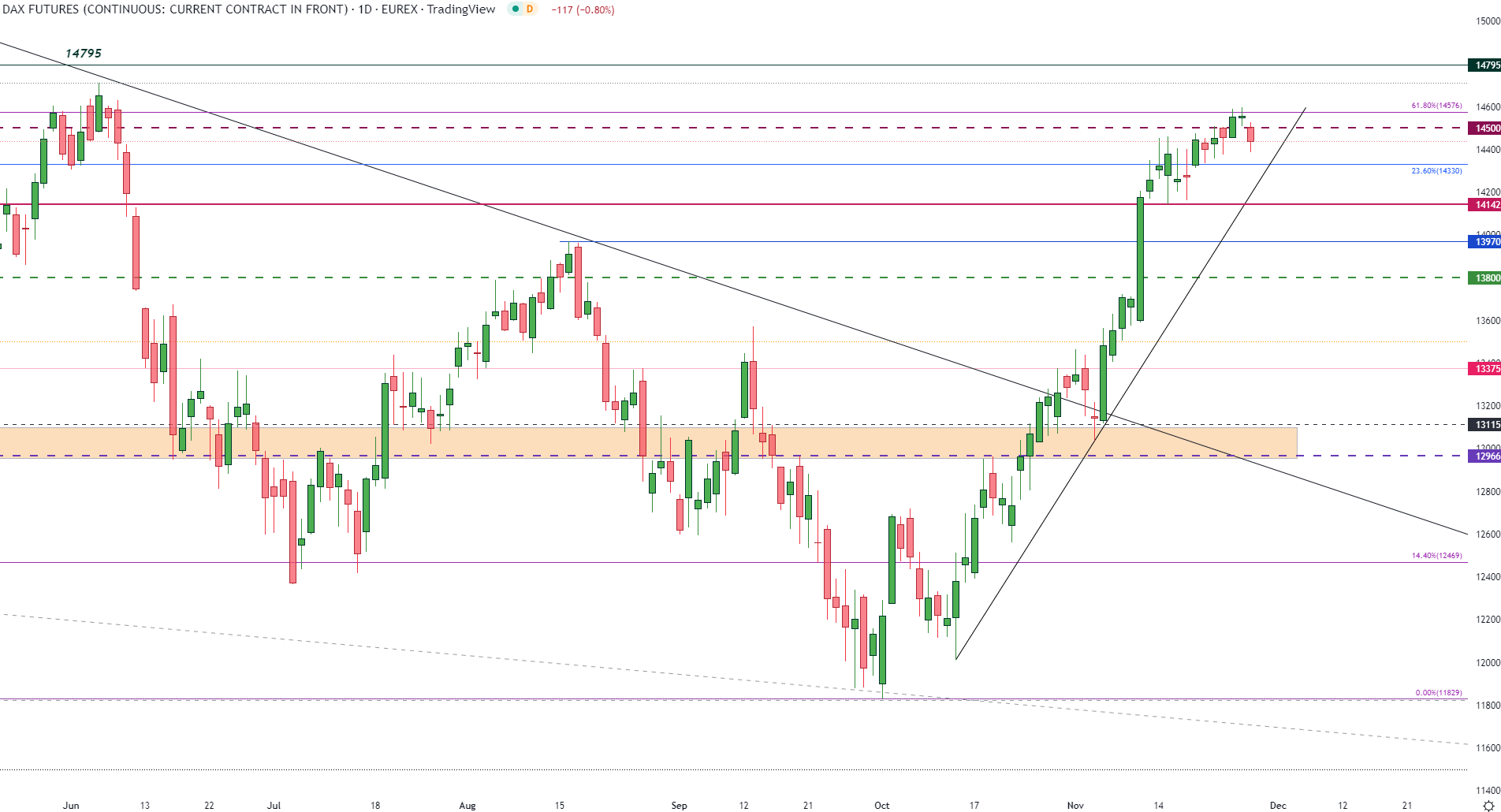

Because the eight-week Dax 40 rally eases again from the 14500 psychological stage, the 23.6% Fibonacci retracement of the 2020 – 2021 is holding as assist at 14330. Whereas the weekly chart illustrates a slowdown in bullish momentum, the 61.8% retracement of the 2022 transfer offers further resistance at 14576.

Dax 40 Weekly Chart

Chart ready by Tammy Da Costa utilizing TradingView

Advisable by Tammy Da Costa

Prime Buying and selling Classes

From a shorter timeframe, the every day chart exhibits a doji candle forming between 14500 and 14576, highlighting indecision. However, with US liquidity returning to markets, a present 0.78% every day decline has pushed Dax 40 again to prior historic resistance turned assist at 1440.

Dax Each day Chart

Chart ready by Tammy Da Costa utilizing TradingView

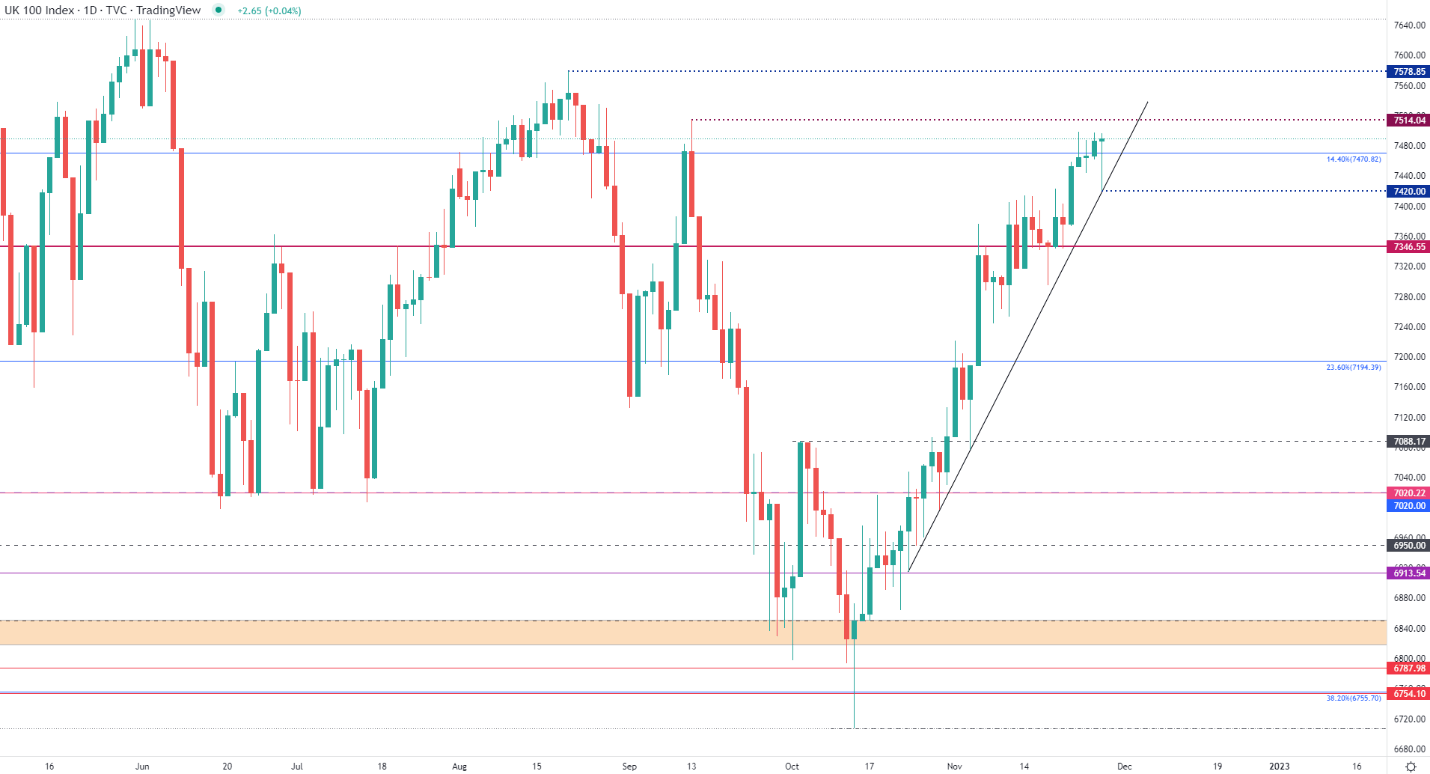

FTSE Technical Evaluation

For the FTSE 100, costs have remained in a decent vary all through the day as costs commerce between 7486 and 7490. With the rising trendline forming assist at 7420, the 7400 and 7346 have supplied historic assist and resistance and should proceed to take action within the short-term.

FTSE Each day Chart

Chart ready by Tammy Da Costa utilizing TradingView

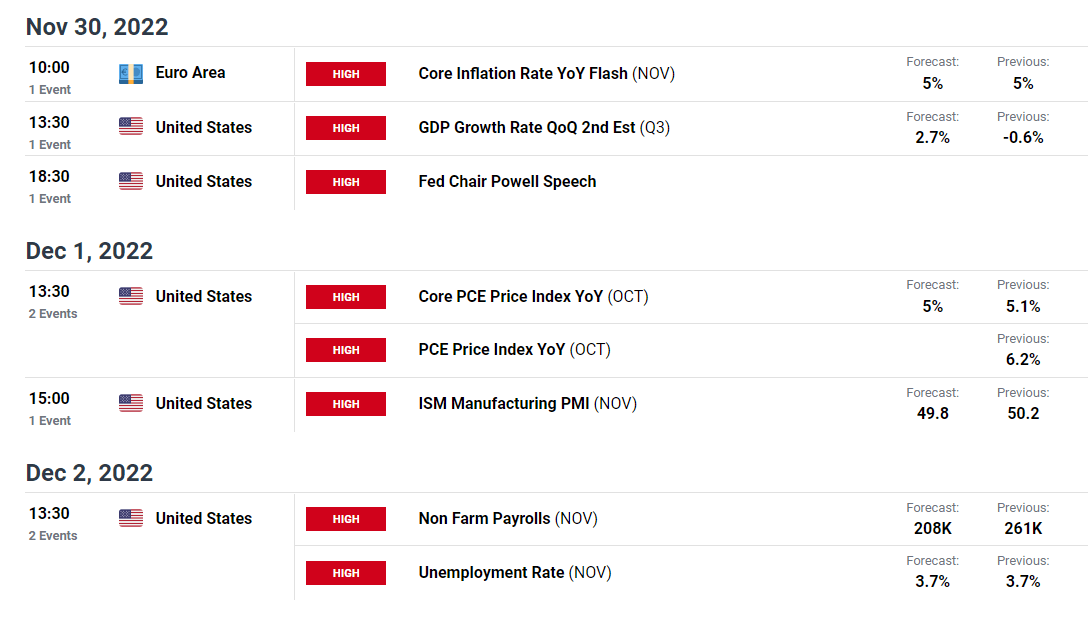

As recession fears and better charges threatening development forecasts, focus has shifted again to the financial calendar. With central banks centered on restoring value stabilities, the Federal Reserve is anticipated to maintain an in depth eye on this week’s financial releases.

Whereas Dow futures observe Dax in shedding roughly 0.79% for the day, GDP, Core PCE, NFP’s (non-farm payrolls) and developments in China are elements that would threaten the trajectory for equities this week.

DailyFX Financial Calendar

— Written by Tammy Da Costa, Analyst for DailyFX.com

Contact and observe Tammy on Twitter: @Tams707

[ad_2]

Source link