Bulgac/E+ by way of Getty Photos

Cytodyn (OTCQB:CYDY) has undergone some main adjustments since my final article. Primarily, the corporate made adjustments to the CEO place and the corporate’s board of administrators. As well as, the corporate seems to have secured funds to preserve the lights on in the interim. Apart from that, the corporate has gone into full silence, which is a stark distinction to the corporate’s earlier practices. Buyers are ready for updates on a number of key objects together with the standing of Leronlimab’s BLA resubmission, Amarex litigation, COVID-19 trials, and NASH knowledge, simply to call a number of. The shortage of communication has crushed the share value and has many buyers questioning if the corporate is just winding down operations forward of a possible chapter submitting or just attempting to put low whereas beneath investigation. On one hand, I perceive the corporate’s efforts to wipe the slate clear as doable… however, I’m desperate to see overdue updates on these important applications.

I intend to replace buyers on among the current occasions and supply my opinion on how they may impression the corporate going ahead. As well as, I talk about among the potential situations and the way I plan to handle my place whereas we wait.

Firm Updates: Finish Of An Period

Again on January 25th, CytoDyn introduced that “the Board of Administrators terminated the employment of Nader Z. Pourhassan, Ph.D., as President and CEO of the Firm and he’s not a member of the Board of Administrators.” The corporate’s CFO, Antonio Migliarese, is taking up as interim president because the board searches for a everlasting CEO. As well as, the corporate introduced their CMO, Scott A. Kelly, M.D, is stepping down from being Chairman of the Board however will keep on the Board of Administrators. The board additionally elected Tanya Durkee Urbach as Chairman of the Board, “who has expertise in company governance, company finance, enterprise progress, and securities litigation, compliance and regulatory points.”

Since this announcement, the corporate has primarily gone silent, with solely SEC filings that reveal the corporate is dealing with authorized and monetary issues. That is mainly a stark distinction to the Nader Pourhassan period, which was crammed with common press releases and displays that up to date their buyers on the corporate’s ongoing efforts, progress, and plans for the longer term. Most significantly, administration answered direct questions from buyers in a public discussion board.

Firm Updates: Financing

For the reason that starting of the yr, the corporate has been securing financing by way of notes, non-public placements of frequent inventory, bonds, and warrants. The corporate has been burning by way of money to help their day-to-day operations and prices related to Leronlimab. As well as, the corporate is coping with authorized points and funds to Samsung Biologics. It’s unclear what the corporate’s money place is true now, but it surely appears to be like as if the corporate is trying to keep up their funds by way of a wide range of strategies.

The Influence

The removing of Nader Pourhassan, Ph.D. because the president and CEO of the corporate may have a serious impression on CytoDyn, Leronlimab, and the inventory’s efficiency. Say what you need about Nader Pourhassan’s management model and his choices, however one can’t argue he was not dedicated to increasing Leronlimab to be a platform drug. Below Nader Pourhassan’s management, the corporate bought Leronlimab in 2013 and took intention at HIV. Since then, the corporate has mobilized Leronlimab in opposition to, GvHD, mTNBC, NASH, COVID-19, with the potential of a number of different targets.

Throughout Nader’s time as CEO, the corporate made common press releases and took part in quite a few investor displays. These communications all the time appeared to maneuver the share value and offered shareholders with some perception into the corporate’s efforts. With out Nader, the corporate has gone silent and has put shareholders at the hours of darkness. Take note, CYDY is an OTC inventory, so it’s closely depending on retail buyers to help the share value. With out information, retail buyers might be much less more likely to be motivated to click on the purchase button. Clearly, the dearth of enthusiasm round an OTC inventory can crush each the share value and shareholder sentiment. I consider the inventory’s current efficiency validates this thesis.

Certainly, a few of Nader’s ways might need been interpreted as “promotional” and definitely unconventional. Nevertheless, one has to do not forget that small-cap OTC shares will not be usually invited to current at Wall St. investor conferences, so the corporate has to seek out their very own method of reaching their buyers… who’re by and enormous not institutional. Definitely, I might have appreciated to see the corporate attain a serious trade and have publicity to institutional buyers, however is clearly going to require help from retail buyers on OTC to get there. Basically, the corporate’s technique matched the place the corporate is at and who their buyers are.

This leaves us with an organization that shuttered the home windows and has wiped the corporate’s web site clear of previous releases and displays. Now, we don’t know if the corporate goes to go after their “eight duties for 2022”, which incorporates:

- Leronlimab’s BLA Resubmission for HIV Mixture

- Leronlimab’s HIV Section III Pivotal Research Monotherapy

- Leronlimab’s Section II Trial for COVID-19 Lengthy-Hauler

- Leronlimab’s NASH Knowledge with Choice on BTD or Section III

- Leronlimab’s mTNBC Choice for BTD or Section III

- Leronlimab’s Most cancers Basket Trial

- Leronlimab’s Knowledge from Brazil Research with Potential EUA

- Leronlimab in Critically Ailing COVID-19 Research within the U.S. with Potential EUA

The shortage of communication and clarification of those unknowns has buyers speculating about what’s going to occur subsequent. I got here up with a number of potential situations.

State of affairs 1: SEC and DOJ Inquiries

CytoDyn has subpoenas from the U.S. SEC and DOJ requesting paperwork and knowledge concerning Leronlimab, and the corporate’s public statements concerning the drug’s use, amongst different objects. Though subpoenas don’t signify that any violations of legislation have transpired and it’s merely fact-finding investigations at this cut-off date. Nevertheless, one can’t predict the eventual consequence and potential losses from these occasions.

I’ve to suspect these investigations are one of many major causes the corporate determined to let Nader go… particularly contemplating the brand new chair for the corporate’s board of administrators has “experience within the conduct of securities choices, securities litigation, company finance and enterprise progress, company governance, and different company enterprise and authorized points to the Board.” For me, this means the corporate is taking these subpoenas critically and might be the primary trigger for the removing of firm press releases and displays.

State of affairs 2: Chapter

Maybe probably the most regarding subject I’ve is the probability the corporate is shifting in direction of chapter. The corporate has had substantial web losses over the previous couple of years and it seems 2022 just isn’t going to be totally different. Again on January sixth, Samsung despatched CytoDyn a written discover that that they had breached its agreements by failing to pay roughly $13.5M due by the year-end of 2021. A further $22.8M was due on January thirty first. The corporate has 45 days to make efforts to “start curing the breach.” If the corporate fails, Samsung might terminate the agreements. Administration intends on curing the breach previous to the expiration of the treatment interval, however we have now but to listen to if that has been profitable. These funds do increase the priority that the corporate will be unable to handle their ~$44.5M of debt whereas additionally conserving the lights on.

Definitely, the corporate may handle the problems with Samsung to alleviate that risk. As well as, the corporate has already made some strikes to safe financing firstly of this yr. Nevertheless, we don’t have a transparent view of what the corporate’s present funds are and what are their plans shifting ahead.

State of affairs 3: Acquisition

One other potential state of affairs is the corporate being acquired at a good or discounted valuation. I consider that it’s unlikely that the corporate may be acquired at such a weak place, however it’s doable {that a} suitor would possibly reap the benefits of an organization that’s down on its luck. As well as, CytoDyn administration and the board would possibly see a reduced acquisition to be a chance to protect shareholder worth and keep away from their ongoing litigation, regulatory considerations, and business agreements.

State of affairs 4: Proceed Ahead

In fact, there may be the chance that the corporate decides to proceed going ahead in a “silent mode” with minimal updates by way of required SEC filings. It’s doable to proceed to execute these Band-Assist-style monetary transactions to stay on life-support lengthy sufficient to submit the ultimate portion of the BLA together with pipeline updates. The corporate must handle the problems I said above, nonetheless, there’s a main subject with the Amarex case that the corporate must handle in the event that they transfer ahead. The courtroom ruling that to ensure that CytoDyn to realize entry to the Leronlimba HIV database, the corporate must publish a $6.5M bond to cowl a portion of disputed invoices for companies… which might be an issue contemplating CytoDyn’s present monetary place. If CytoDyn is unable to offer the $6.5M for the bond, Amarex may maintain out for a number of months or longer, leading to additional setbacks within the BLA resubmission. It will seem among the current financings might need coated this… however since we don’t have any updates from the corporate, we don’t know the standing of the surety bond.

Sadly, even when the corporate will get Leronlimab throughout the end line this yr, they’re nonetheless going to should cope with some commercialization points. First, the corporate wants to determine what they’re going to do about their present associate… who’s now Regnum Corp. (OTCPK:RGMP). It seems CytoDyn’s settlement with Vyera to be used with HIV sufferers within the U.S., was reassigned from SevenScore Prescription drugs to Regnum in December. Vyera, SevenScore, and Regnum are associates of Phoenixus AG, so it seems the settlement is simply altering banners. Nevertheless, as of September thirtieth, Regnum solely had $4,000 in belongings and had no operations or revenues. Regnum goes to wish loads of capital to fund its commitments beneath the settlement following a possible approval. One may make loads of speculations about why Phoenixus AG put Leronlimab’s settlement in Regnum, nonetheless, it’s a concern that CytoDyn’s present associate doesn’t have the capability to market the drug in its present state.

So, even when the corporate continues to function on “silent mode” and keep the course, it seems the corporate nonetheless has a number of different main hurdles to handle.

My Plans

Sadly, it appears to be like as if the times of CYDY being an incredible buying and selling vessel are actually over. We gained’t have Nader and the corporate injecting volatility into the ticker with updates that offered quite a few alternatives to purchase at a reduction and promote at a premium. Now, CYDY is turning into a real speculative ticker that can take a look at the investor’s perception within the firm and Leronlimab. On one hand, the corporate has a number of monumental hurdles to beat in a brief time period. However, the corporate has a drug candidate that has proven unbelievable potential in a mess of indications. Truthfully, at this level, I don’t know if there may be something a longstanding investor can do to arrange for a possible consequence of those situations. Maybe the corporate is already addressing these points preemptively with the removing of Nader and purge of the corporate’s investor displays on-line. As for the funds, the corporate seems to be scrambling to collect enough capital to appease Samsung, pay the surety bond, and preserve the corporate shifting ahead.

Personally, I stepped again from buying and selling the ticker and I’m sticking to extra of an funding strategy. Nevertheless, I’ve pulled the plug accumulating extra shares as a way to protect my earnings from earlier CYDY trades and can preserve the place in a “home cash” state. I’ve accepted that the drug’s potential just isn’t going to outweigh the corporate’s present state. Because of this, I might possible maintain my remaining shares as we anticipate one in all my proposed situations transpires.

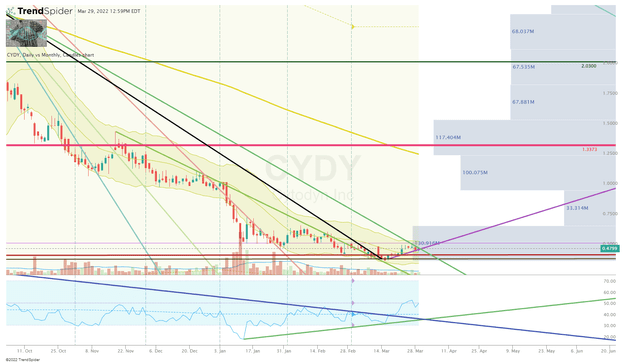

CYDY Every day Chart (Trendspider)

CYDY Every day Chart Improve View (Trendspider)

For individuals who are nonetheless seeking to commerce CYDY, the ticker seems to be buying and selling sideways and is exhibiting some indications of bottoming. First, it seems the each day RSI broke its long-term downtrend. Second, we will see there may be an uptrend ray that spawned from the March 15th low. Nevertheless, the angle of assault from the downtrend rays remains to be pretty steep, which suggests the ticker goes to wish a strong bump in shopping for exercise to interrupt the present development.

Take note, CYDY is an especially speculative enterprise that would end in one dropping most or all of their funding.