[ad_1]

The occasions of the final three years have proven that digital transformation is important for even essentially the most conventional industries. Many industries are taking the digital leap for the primary time and the waste administration business is not any completely different. Whereas a lot of the technological development within the area has been centered on the dealing with of waste, corporations are embracing expertise to usher in a brand new period to undertake instruments centered on enhancing operational effectivity. CurbWaste is a SaaS platform for the waste administration business that centralizes the various transferring elements together with CRM, activity administration, on-line ordering, invoicing, funds, asset deployment, logistics, fleet monitoring, and reporting. The versatile cloud-native platform can be utilized throughout the group from administrative personnel to the precise haulers. The business is capital-intensive requiring corporations to steadily borrow to cowl operational bills and CurbWaste is now launching a lending unit to assist waste administration corporations bridge any gaps. Haulers and waste corporations utilizing the platform at the moment course of a number of million transactions per thirty days, main the corporate to develop income for 4 consecutive quarters since elevating its preliminary seed spherical final fall.

AlleyWatch caught up with CurbWaste Founder and CEO Michael Marmo to be taught extra in regards to the enterprise, the corporate’s strategic plans, newest spherical of funding, and far, far more…

Who have been your buyers and the way a lot did you elevate?

We simply closed our $4M seed extension spherical, led by TTV Capital with participation from B Capital Group and Mucker Capital. We beforehand raised $7.2M in seed and pre-seed funding, bringing us to a complete of $11.2M raised up to now.

Inform us in regards to the services or products that CurbWaste affords.

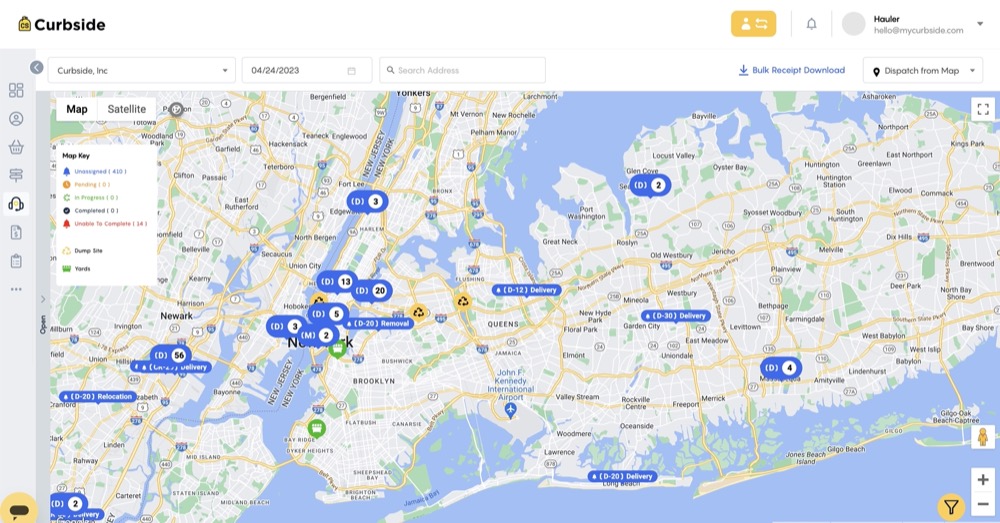

CurbWaste is the primary built-in software program resolution for waste and recycling haulers that mixes CRM, activity administration, on-line ordering, invoicing, funds, asset administration, route logistics, fleet monitoring, and information reporting in an easy-to-use app and cloud-based platform.

What impressed the beginning of CurbWaste?

I bought into waste administration nearly accidentally; I used to be teaching baseball at evening and dealing at my household’s switch station in New York Metropolis by day. I fell in love with the business – it’s vital infrastructure work that’s taken without any consideration, and it allowed me to know the interior workings of the town. I spent 4 years studying the enterprise and began my very own hauling firm, Curbside, in 2016. My crew and I constructed proprietary expertise that made our operations simpler and introduced extra transparency to the waste course of. When the pandemic hit NYC, we confronted challenges like everybody else however have been truly capable of develop the enterprise since our operations have been digitized. I had associates and opponents asking if they might use our software program, and that’s once I actually felt the market pull.

How is CurbWaste completely different?

Till now, outdated waste administration software program has did not maintain tempo with the business’s technological developments, environmental laws, and buyer expectations for digital interactions. CurbWaste allows haulers and disposal facilities to optimize their companies by managing and streamlining operations at each step of the method, in actual time.

What market does CurbWaste goal and the way massive is it?

Waste administration is an $80 billion business, with small, mid-range and enormous companies. We offer software program options for each disposal facilities and waste haulers, and our main clients often personal small or mid-sized operations. For disposal facilities, our platform supplies a solution to take funds and monitor how a lot waste is being processed. For waste haulers, we allow invoicing and funds, route optimization, information reporting and extra. We’re extraordinarily proud that CurbWaste was constructed for haulers, by haulers, and so we perceive the ache factors which can be distinctive to this business.

What’s your online business mannequin?

We’ve a number of income streams and are utilizing this new infusion of capital to construct out extra choices. First, as a standard SaaS resolution, we cost a month-to-month charge per driver, per thirty days. We additionally take a proportion of the funds which can be made by means of our platform. With our new funding, we plan to construct out lending providers.

How has the enterprise modified since we spoke final 12 months?

We’ve seen 4 consecutive quarters of progress and have been capable of deliver on some superb expertise to spherical out our core crew. We’ve launched new options whereas iterating on present ones primarily based on buyer suggestions. The system continues to evolve, turning into simpler to make use of whereas remaining complete. As a startup, issues transfer in a short time, and we’re steadily tasked with bringing on clients whereas ramping up a newly shaped crew. One factor that hasn’t modified, nonetheless, is that buyer happiness remains to be our North Star. Every thing we construct is designed to make their jobs simpler.

What was the funding course of like?

We use Payabli to handle our automated bank card and ACH funds, and TTV Capital is certainly one of their buyers. We had been on the lookout for an funding companion with fintech business information, and I knew TTV Capital could possibly be an amazing match. What moved the needle for me is that certainly one of their companions had a background in waste administration, so that they understood our worth proposition. All of us simply aligned straight away, and that’s how TTV Capital got here on board as our lead investor for the spherical.

What are the most important challenges that you simply confronted whereas elevating capital?

The market situations have been difficult, and we realized in a short time that the requirements had modified. One of many hardest issues to do is pitch your imaginative and prescient in a method that’s each simply understood and genuine. After our seed spherical, we knew we wanted to indicate extra tangible outcomes and progress than we had beforehand. I wished to be extra data-driven whereas additionally speaking the higher imaginative and prescient of our path to success. We additionally needed to cope with the SVB fallout through the closing course of, which added a problem that I by no means may have predicted. Luckily, we aligned with an amazing strategic investor who bought it straight away and believed in us from the primary name. They have been extremely supportive and passionate, and that made the method much less painful.

What elements about your online business led your buyers to put in writing the verify?

I do know that TTV Capital actually appreciated that I had firsthand expertise within the waste administration business. As an operator, you be taught so many issues that an outsider wouldn’t know, and that’s an enormous benefit. They noticed the market alternative and the massive image, they usually additionally understood our imaginative and prescient and what we’re making an attempt to construct, particularly in terms of monetary providers.

What are the milestones you propose to realize within the subsequent six months?

Our targets stay unchanged. At the beginning is to make the purchasers comfortable. To try this, we’re persevering with to develop and onboard new clients – small to mid-sized waste haulers who wish to digitize their operations – and we’ll deliver on engineers to construct out our options inside our product roadmap, together with new fintech capabilities. We just lately introduced on Don Cansino as our VP of Engineering to assist lead that cost. Our product roadmap is aggressive however achievable, and we wish to make sure that we proceed to put money into system stability.

What recommendation are you able to supply corporations in New York that do not need a contemporary injection of capital within the financial institution?

That is positively a time to be cash-conscious and put together your startup for the potential uncertainty that lies forward. Attempt to be as lean as potential and make investments in your core competencies inside your product. One factor we do is put money into our buyer relationships and ensure our clients know our plan for each the near-term and the long run. We worth transparency with our staff and clients, and that affords us a chance to set lifelike expectations. That goes a good distance once you’re making an attempt to preserve money.

The place do you see the corporate going now over the close to time period?

We’ll instantly deploy capital into R&D and buyer expertise. Over the course of the subsequent 12 months, we intend to proceed to launch high-quality options, full extra discovery by participating with our clients, and proceed to work in the direction of establishing true product-market match.

With a plethora of commuting choices within the metropolis, how do you sometimes get to work every day?

I dwell on Lengthy Island, so I sometimes take the LIRR. Our workplace relies in Midtown, so I can stroll to the workplace from both Grand Central Station or Penn Station.

You’re seconds away from signing up for the most popular record in Tech!

Join right now

[ad_2]

Source link