Let’s be completely clear: Your cryptocurrency is taxable!

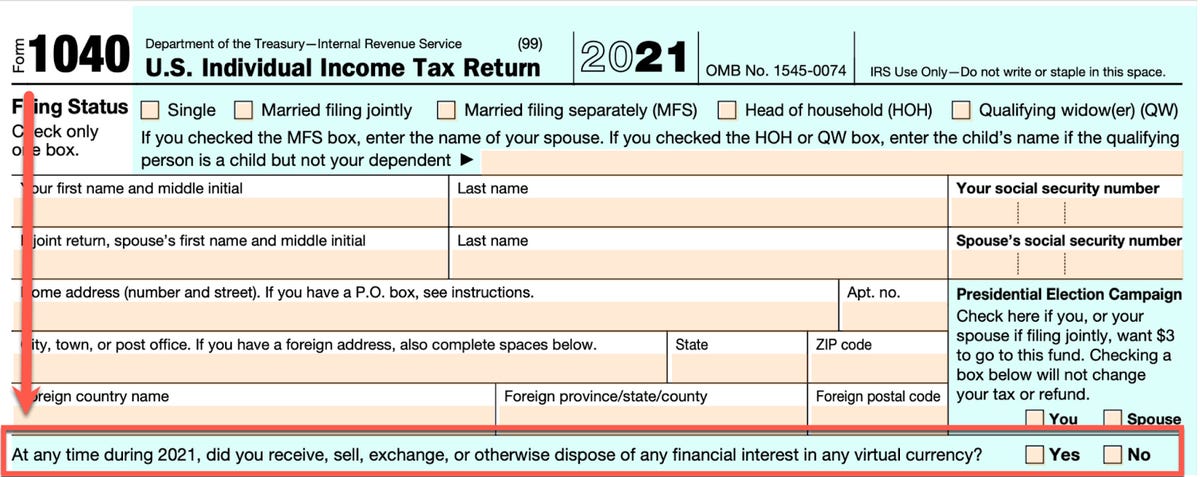

The cryptocurrency market actually hit its stride in 2021. It introduced extra monetary establishments and particular person traders into shopping for, holding and promoting cash than ever earlier than. For tax yr 2021, the IRS needs to know if you happen to held, offered or traded digital foreign money (together with NFTs); it’s a required area to enter. The 2021 Type 1040 features a required query about cryptocurrency.

Cryptocurrency is handled like property for tax functions. You’ve features and losses in your crypto. Relying on what number of trades you probably did, this could be a daunting activity. Some exchanges simply ship you a Type 1099-B which merely reveals your proceeds (buys and sells mixed) and requires you to submit a price foundation. If you do not have this data, you’re on the hook.

Within the crypto world, if you buy and maintain a digital coin, you owe zero taxes. For instance, I bought 0.10 Bitcoin in 2021 for $6,000. Bitcoin has a price foundation of 60,000 fiats (or $60,000). If I maintain this Bitcoin, or any digital coin, for all of 2021, and I do not promote or commerce it for one more coin, I owe no taxes for 2021. I nonetheless need to mark “Sure” within the query above, however I owe no taxes since no taxable occasion has occurred. I’m merely holding the coin. We name this HODL within the crypto world.

Let’s take it a step additional now. For instance I promote Bitcoin in 2021 and Bitcoin is now valued at $35,000. I promote that 0.10 Bitcoin for $3,500. I offered this Bitcoin for a $2,500 loss. After I do my taxes, I’ve a documented lack of $2,500.

If Bitcoin occurs to shoot as much as $100,000 and I offered 0.10 BTC for $10,000, I now have a achieve of $4,000. We might owe capital features taxes on $4,000, not the unique $6,000 we bought Bitcoin with.

I’ll pause right here. I do know this can be a lot, however I feel you get the precept. It is the identical as buying shares, however now here is the place it will get fascinating. You additionally owe taxes on trade-to-trades!

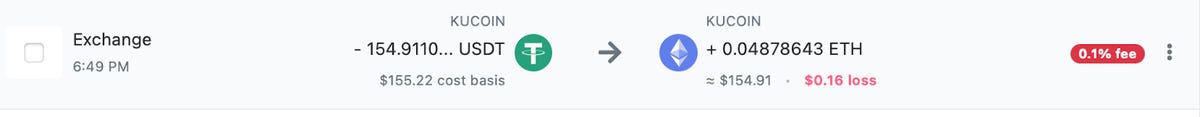

If, for instance, you buy 0.10 Bitcoin for $6,000 (Price Foundation -$60,000 for 1 BTC) and also you commerce it for Ethereum (ETH), that is a taxable occasion. You’d be accountable for the capital features, if any. Here is an instance of a commerce I did the place my tax software program dealt with it:

I exchanged the stablecoin Tether (USDT) for Ethereum which is a taxable occasion, however the trade did not incur capital achieve, however relatively a loss.

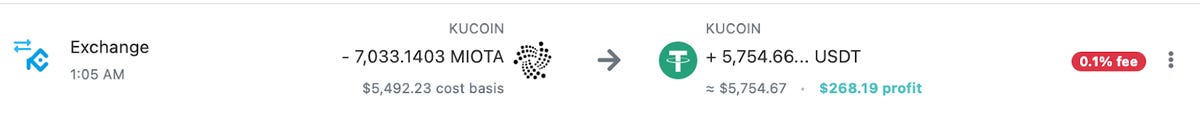

Right here is one other instance:

I exchanged MIOTA (IOTA) for USDT. The trade is a taxable occasion. Changing it to USDT was a capital achieve on revenue of $268.19. Monitoring all of this in a spreadsheet could be overwhelming. You can have lots of of trades in a yr, if not 1000’s.

For this reason I exploit cryptocurrency tax software program. There are lots of you’ll be able to select from comparable to:

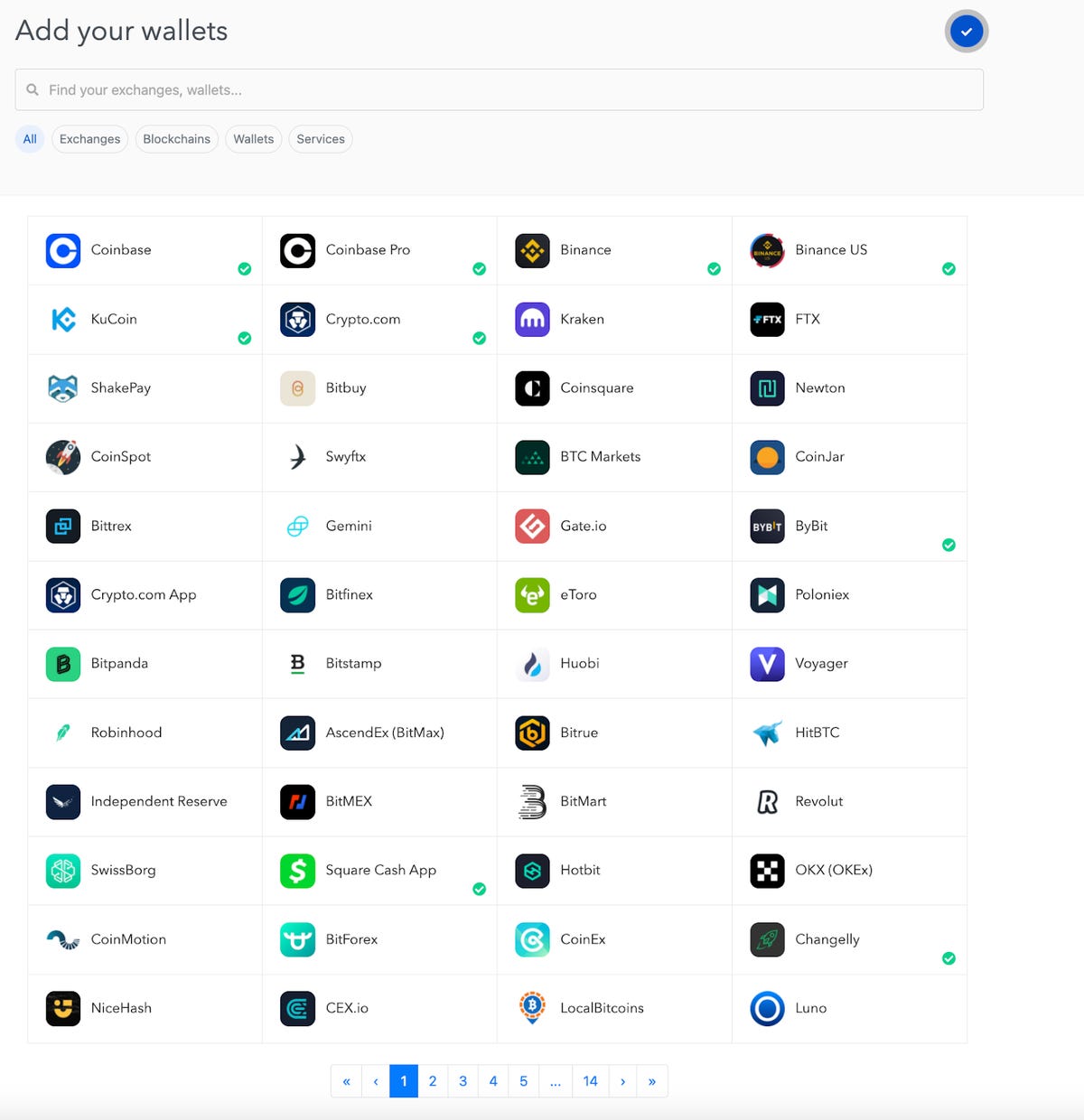

With crypto tax software program, you’ll be able to join your Exchanges and Wallets to the software program and add all your transactions. I exploit Koinly to trace all of my trades. I’ve all of my Exchanges and Wallets related, which embrace:

You may join all your Exchanges and Wallets (see under). It is easy to configure. Simply select your trade and comply with the directions to attach by way of API or do a CSV add.

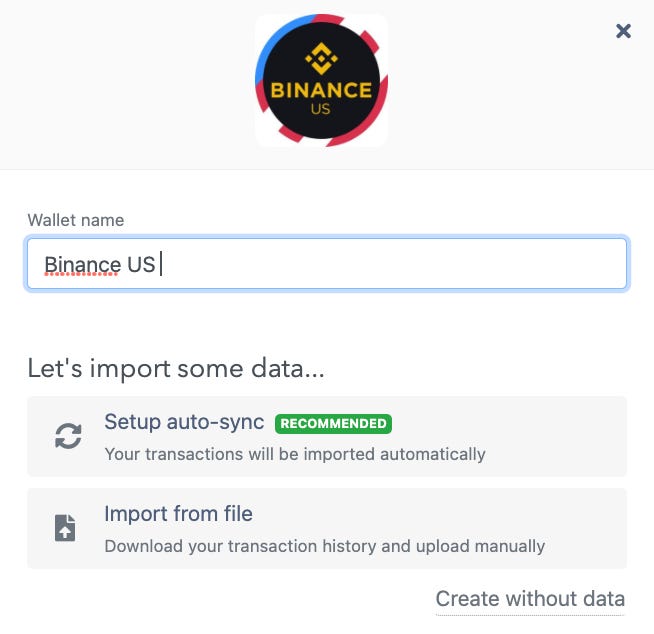

If, for instance, you select, Binance.US, you’ll be able to select Auto-Sync or Import from CSV.

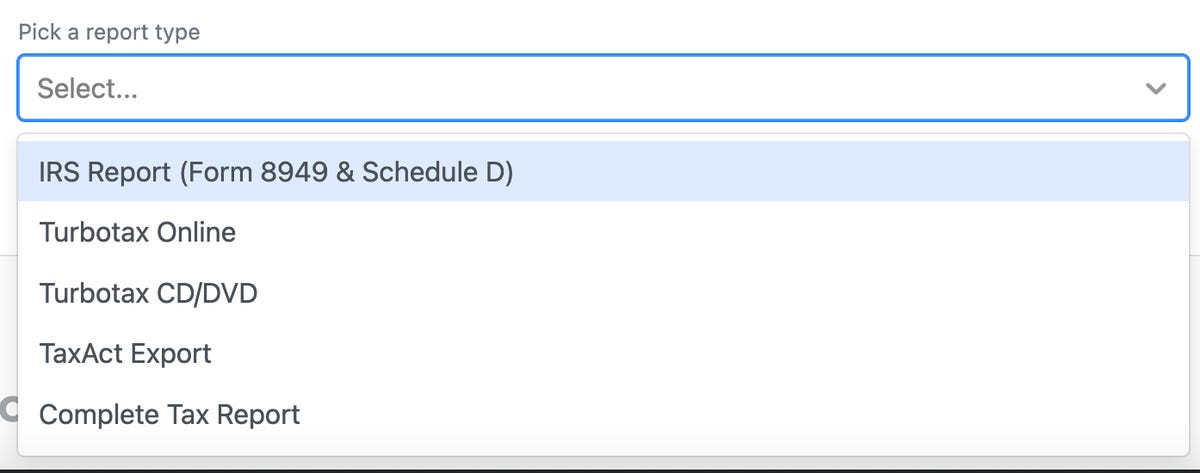

The tax software program will calculate your losses and features and supply all the correct tax experiences. It helps a direct add into Turbotax in addition to different choices proven under:

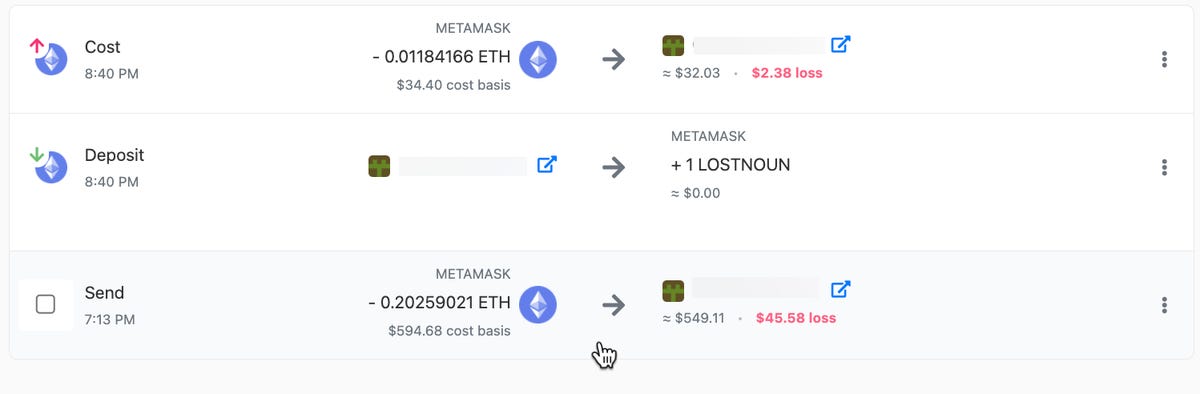

The software program additionally helps the taxes surrounding buying NFTs. Shopping for and Promoting NFTs is a taxable occasion. Right here is an instance of the tax implication of an NFT I not too long ago bought:

Let’s break it down. I bought the NFT with ETH and you may see three trades.

- Buying with ETH (price foundation of ETH was greater so I had a loss on the acquisition since commerce to trades is a taxable occasion).

- The NFT being deposited to my account is proven.

- Price – Gasoline charges

Now once I promote the NFT, if I promote it for a revenue, I’ve the fee foundation tracked and I’ll know what my capital features tax is. If I promote it for a loss, I’ll know what my loss relies on a price foundation.

Cryptocurrency goes up and down many instances a day. Since trade-to-trades are taxable occasions, attempting to handle every little thing in a spreadsheet is subsequent to inconceivable. It is crucial in case you are buying and selling or buying to have an automatic strategy to monitor your trades.

Wanting ahead to our conversations within the feedback under.

Acronyms on this column

As promised, listed here are definitions of the acronyms I used:

Fiat – Foreign money we sometimes use to accumulate items and providers. Examples embrace the US greenback, euro and yen.

HODL – Merely a catchphrase. A misspelling of the phrase HOLD. Should you maintain a coin via the ups and downs, you’re HODLING. Some even say Maintain on to Pricey Life.