[ad_1]

- Oil costs have rallied this week on considerations over provide disruption within the Purple Sea.

- WTI is displaying early indicators of reversing off bearish development line resistance.

- USD/CAD is oversold at 4-month lows, however the bearish development stays intact.

WTI Crude Oil Evaluation

Simply when all hope appeared misplaced for bulls, the market has staged a powerful comeback.

From a basic, geopolitical view, the current Houthi assaults on ships within the Purple Sea has heightened considerations about potential oil provide disruptions within the area; headlines that drilling big British Petroleum (BP (NYSE:)) would quickly halt transits by way of the Purple Sea exacerbated these fears. Now, the US and its allies are reportedly contemplating army strikes towards the rebels, suggesting that the beforehand introduced regional job pressure might not be sufficient to safe the important thing area.

Partially allaying these considerations this afternoon, the EIA reported that weekly oil inventories report by 2.9M barrels, an enormous shift from the two.3M drawdown economists had anticipated. This determine comes on the again of reports that US manufacturing hit a report excessive of 1.3M bpd final week. Whereas the worldwide provide image stays murky, the continued progress of US manufacturing stays a long-term secular development, however the potential for disruptions within the Center East is a short-term danger that’s driving costs larger for now.

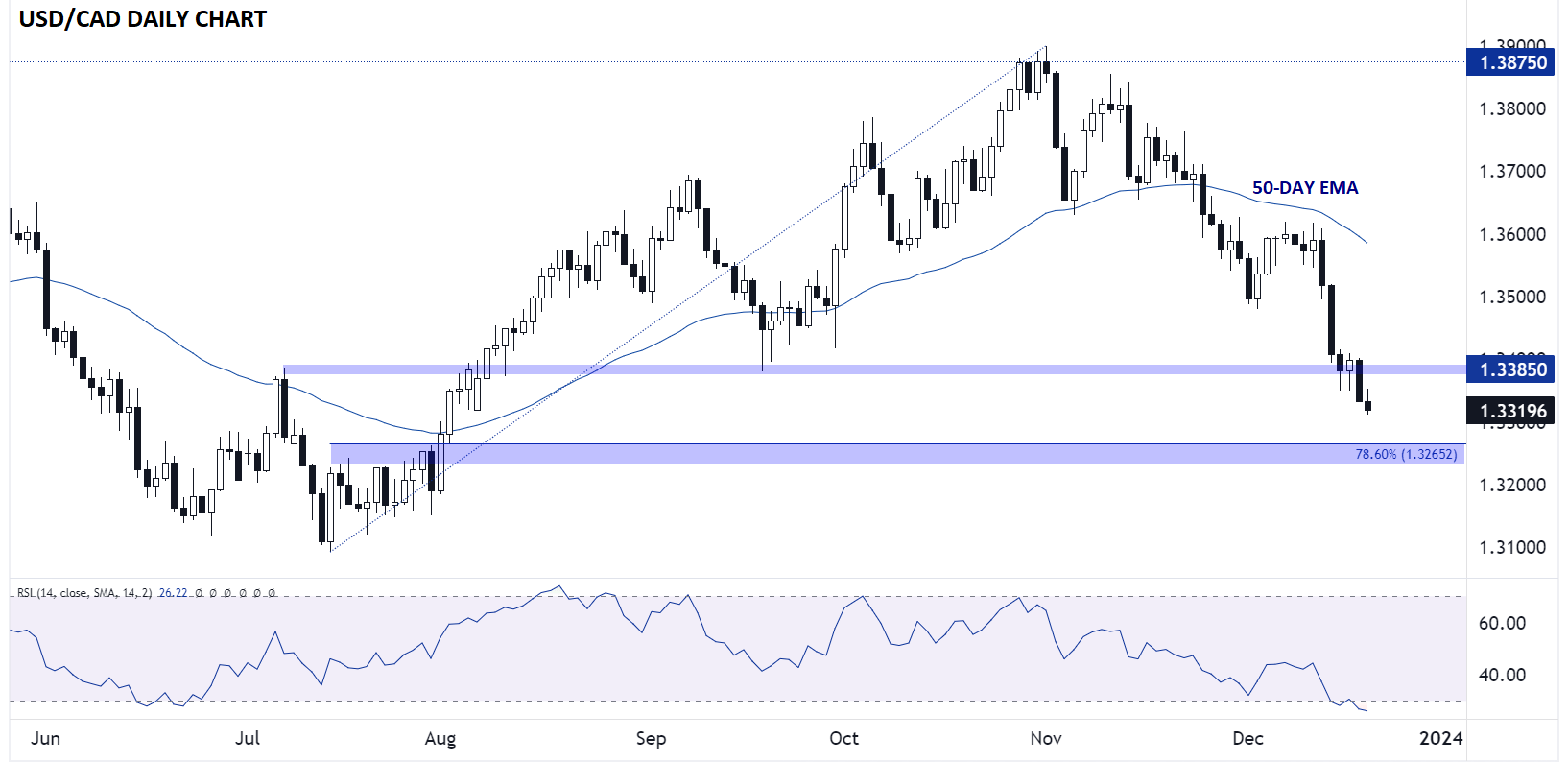

Crude Oil Technical Evaluation – WTI Each day Chart

Supply: TradingView, StoneX

West Texas Intermediate (WTI) crude oil costs reached as excessive as 75.30 earlier right now earlier than reversing again decrease after the surprising construct in US inventories. The reversal occurred at a key technical degree, the highest of the 3-month bearish channel and just under the downward-trending 50-day EMA.

Important uncertainty stays across the scenario within the Purple Sea, but when tensions dissipate from right here, WTI will probably resume its medium-term downtrend. In that situation, it might revisit the early December lows underneath $70 sooner quite than later, with potential for a continuation down towards the H2 lows at $67 from there. Solely a break above right now’s excessive and the 50-day EMA close to $76.50 would erase the present bearish bias.

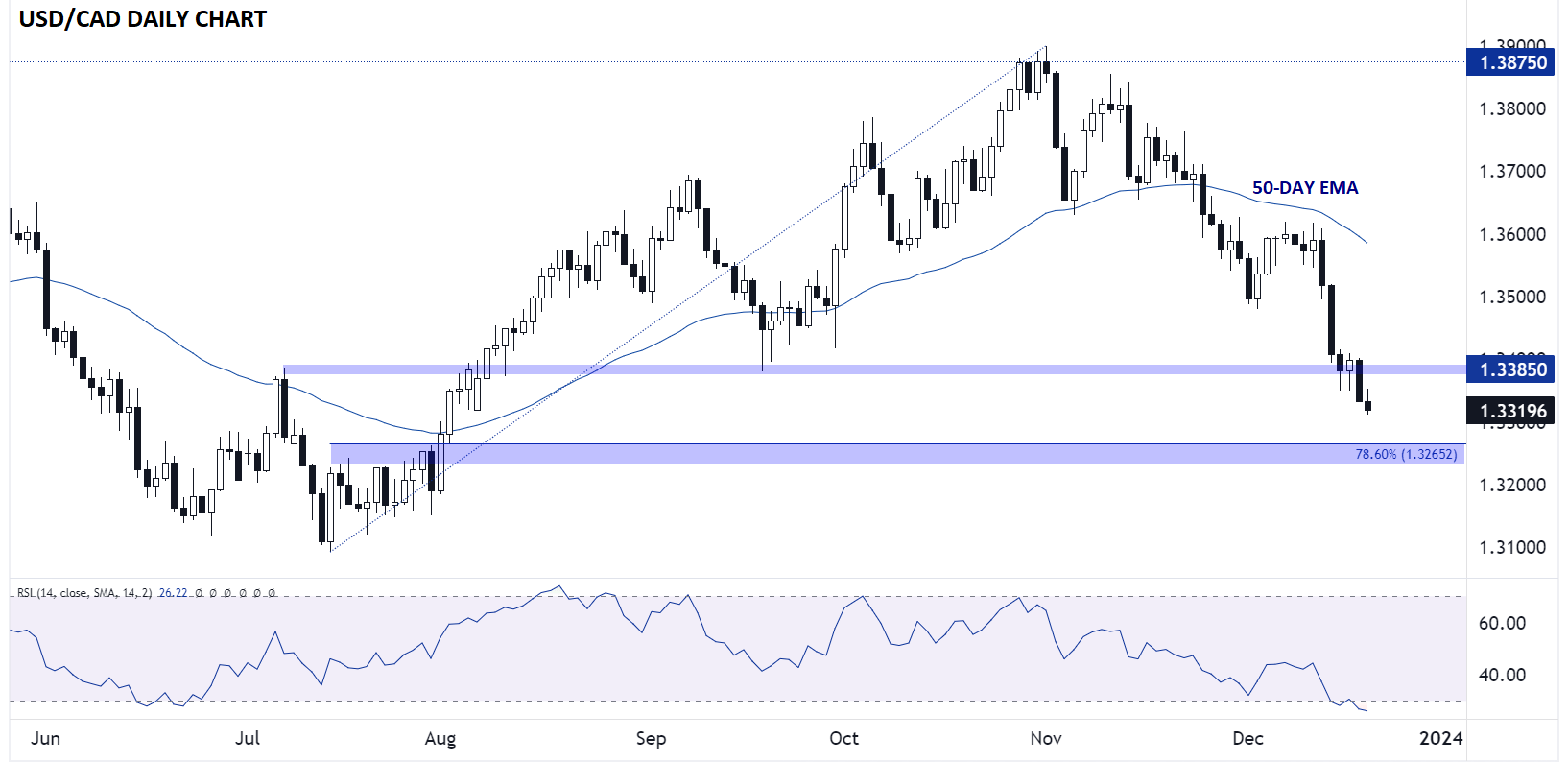

Canadian Greenback Technical Evaluation – USD/CAD Each day Chart

Supply: TradingView, StoneX

In fact, any time we’re speaking about oil, foreign exchange merchants naturally consider the . In any case, oil is Canada’s most essential export and there was a robust historic correlation between the value of crude and the loonie (although that correlation might not essentially maintain as strongly sooner or later).

Taking a look at USD/CAD, the North American pair is falling for the fifth day previously six to hit a 4-month low close to 1.3300 as we go to press. The 14-day RSI is in oversold territory, suggesting that we might see a bounce forward of the weekend, however the near-term development clearly stays to the draw back. The following degree of assist to look at is the 78.6% Fibonacci retracement of the July-November rally at 1.3265, whereas near-term resistance looms at 1.3385 if we do see a near-term bounce.

Unique Submit

[ad_2]

Source link