WTI Crude Oil, China, Shanghai, Covid, Russia, Sanctions – Speaking Factors

- WTI and Brent crude oil costs dropped greater than 8% in a single day on Shanghai lockdown

- Negotiation odds between Ukraine and Russia seen rising amid army stalemate

- Costs prone to get better as soon as China lockdowns finish as Russian oil nonetheless shunned by market

WTI and Brent crude oil costs fell greater than 8% in a single day after Shanghai, a key Chinese language monetary hub, started a two-stage lockdown on Monday on account of surging Covid-19 circumstances. The town east of the Huangpu River makes up stage one whereas the world west of the river makes up stage two, anticipated to start April 1. The transfer got here as a shock to markets, provided that metropolis officers have been denying hypothesis of a widespread lockdown as late as Saturday. Beijing might have influenced that call as China makes an attempt to stay to its “Zero Covid” coverage.

Nonetheless, oil costs stay increased on the month, propped up by Western sanctions on Russia which have dented world provide. Whereas a lot of Europe has foregone concentrating on Russian oil imports, america has banned them. That, together with the barring of key banks from the SWIFT world messaging system, has lower off a big share of Russian-sourced oil barrels from the world market. China is reportedly absorbing among the displaced Russian output at a steep low cost of round $20 to $30 per barrel, in line with numerous sources.

Whereas the lockdown in China hit costs, the draw back might not final. Negotiations between Ukraine and Russia haven’t discovered a lot success, however the odds of a cease-fire have elevated in current weeks amid a army stalemate. Nonetheless, Western sanctions will seemingly stay even with a cease-fire or wider settlement, no less than for the near-term. A number of enterprise divestment can also be seemingly everlasting. That would power Russia to cease pumping oil at a lot of its wells within the coming months.

That might danger doing long-term injury to world vitality markets, as taking wells offline has lasting injury to their capability to provide oil. Furthermore, most of Russia’s oil fields are nonetheless utilizing oil Soviet know-how, additional crippling the nation’s capability to revive as a lot manufacturing as potential. If that have been to happen, it may dent world provide for good, which may successfully put a long-term tailwind behind oil costs.

Nonetheless, the present pullback might not final as soon as markets begin to look previous the present scenario in China. It is usually necessary to remember the fact that China stays dedicated to strict Covid containment measures. That leaves the door open for additional lockdowns if the virus outbreak spreads to different main cities.

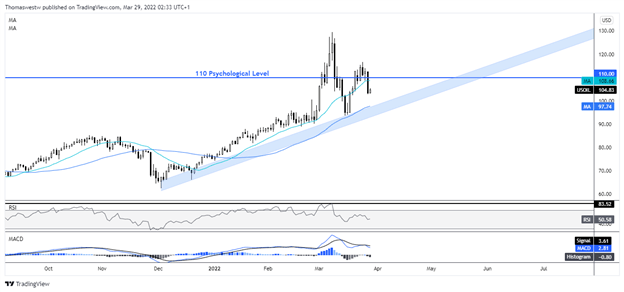

WTI Crude Oil Technical Outlook

WTI costs fell beneath the 110 psychological degree however stopped wanting the high-profile 100 mark. A small bounce in early Tuesday APAC buying and selling noticed costs elevate a bit over 1%, however bulls might need to recapture the 110 degree earlier than hitting the purchase button with confidence. The 20-day Easy Shifting Common (SMA) slightly below that degree might supply some resistance. Alternatively, a resumption to the draw back would carry the 50-day SMA and trendline assist from the December swing low into focus.

WTI Crude Oil Every day Chart

Chart created with TradingView

— Written by Thomas Westwater, Analyst for DailyFX.com

To contact Thomas, use the feedback part beneath or @FxWestwater on Twitter