CRUDE OIL HIGHLIGHTS:

- Headline Danger Stays Elevated for Crude Oil Merchants

- Iran Nuclear Deal Additionally in Focus

Headline Danger Stays Elevated for Crude Oil Merchants

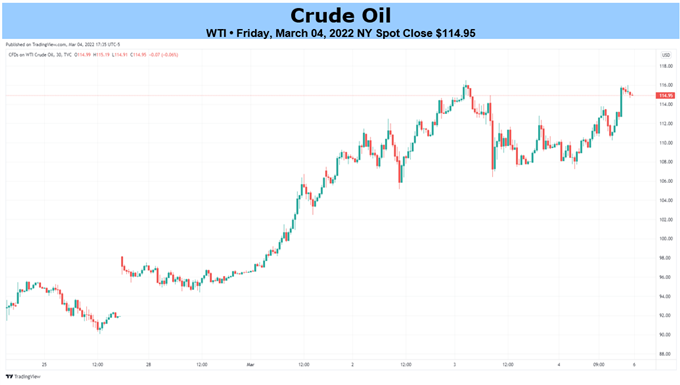

One other bout of danger aversion stemmed from reviews that Russian troops had seized Europe’s largest nuclear energy plant, which in flip noticed oil costs retain a bid, in the meantime European equities prolonged their current run of losses, posting the worst weekly efficiency since Q1 2020. Including to this, the worth motion, does seem like considerably of a deleveraging with a view to cut back weekend hole danger. Subsequently, IF there is no such thing as a vital escalation throughout the weekend, markets may even see a slight restoration at first of the week.

Iran Nuclear Deal Additionally in Focus

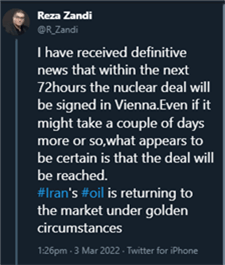

As geopolitical battle exhibits little or no indicators of receding within the near-term, oil costs will stay elevated. That mentioned, headline danger will persist and given the typical every day vary over the previous week of $8/bbl, remaining agile shall be key for merchants, given loads of dangers on either side. As such, on this present backdrop, sources comparable to Twitter could be important in present instances with the chance to supply a time benefit for merchants. This had been evidenced throughout yesterday’s session in gentle of reviews that an Iranian nuclear deal could possibly be brokered inside 72 hours. In response, Brent crude futures fell 1.5% initially, with a complete drop of 6% within the following half-hour.

Supply: Twitter

Brent Crude Futures Intra-day Chart

Supply: Refinitiv

TRADE THE NEWS

An space that has been coated extensively by DailyFX is “buying and selling international macro information”, which ties in fairly properly as to how one can method social media for analysing monetary markets. Subsequently, it will be important that in the first place, you could have a agency understanding of the elemental drivers for the belongings that you simply commerce and are additionally continually up-to-date with the present themes/narratives. With this information of key market drivers, alongside present market positioning/sentiment, as a dealer, this may higher put together you as to how markets will react to new info. Take into account that the present worth of an asset displays all accessible info (or so it ought to, in accordance with the Environment friendly Market Speculation). Subsequently, each time new info is launched, whether or not that be financial information or central financial institution fee choices, the worth of an asset will sometimes transfer to discover a new worth, which displays that info.

That mentioned nevertheless, there’s an argument that numerous macro newsflow is solely noise and doesn’t have a major influence on the belongings you commerce, now whereas I do sympathise with that view to an extent. In regard to that time, when incoming newsflow is flashing in your display, you possibly can break this down by asking your self two questions:

- Is that this info new and if that’s the case, does it deviate from the market narrative (consensus/expectations)

- Is that this info noteworthy

In case your reply to each questions is ‘no’, then you possibly can say with good authority that the brand new info is just not notably market shifting. Whereas I admire that it is a talent that won’t be mastered instantly, and fairly frankly might by no means be fully mastered. As is often the case with something you do in life, expertise over time is what counts, which is able to go a good distance in serving to your capacity to digest key macro newsflow effectively.

As I discussed above, DailyFX has coated this matter in nice element, so for an entire complete information on buying and selling the information, click on on the hyperlink under.

TWITTER AHEAD OF TRADITIONAL NEWSWIRES

Over time and extra not too long ago given notable political occasions, particularly Brexit and US-China Commerce Wars, there have been quite a few events the place Twitter has been faster to report breaking macro and firm information than conventional newswires (Bloomberg and Refintiv). When this happens, I choose this as offering merchants with an edge over the market. What I imply by the market is algo’s buying and selling off Bloomberg and Refinitiv headlines. However to avoid wasting column inches I’ll undergo a couple of noteworthy examples the place Twitter has supplied an edge.

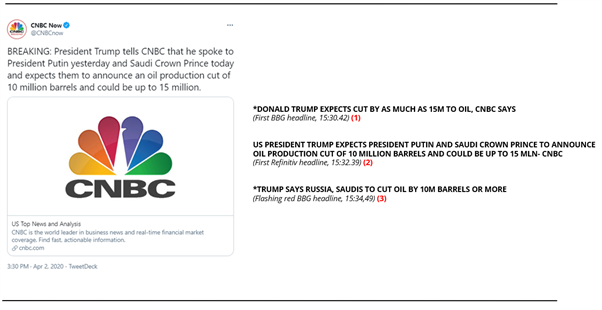

CASE STUDY 1: OIL MARKET, APRIL 2020

Oil costs had collapsed as merchants responded to the onset of the coronavirus disaster with the primary wave of worldwide lockdowns prompting oil demand to plunge by 1/3. Issues had been made worse for the oil market with oil plummeting to an 18-year low after Russia and Saudi Arabia had engaged in a worth battle.

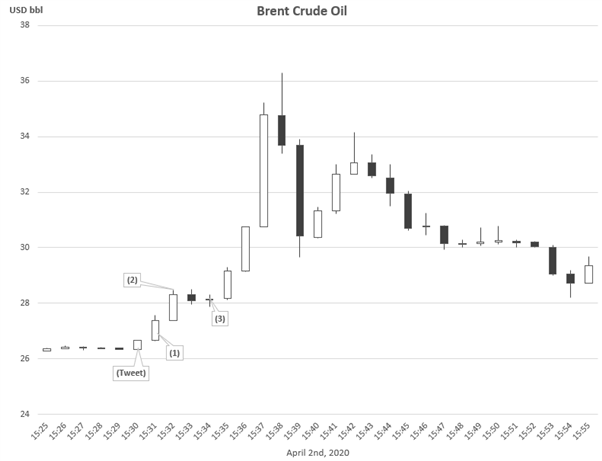

On April 2nd, 2020 at 15:30GMT, CNBC printed the tweet under. Within the following 42 seconds, Bloomberg had printed the unique tweet, whereas a flashing pink BBG headline occurred at 15:34.49. Refinitiv alternatively had run the total tweet at 15:32.39. In an 8-minute interval from Tweet to peak, Brent crude oil rose over 37%.

Supply: ICE, DailyFX

Easy methods to Create a Buying and selling Plan