[ad_1]

At this level, you’re all conscious of the transient tried and aborted rebellion in Russia over the weekend, led by businessman and mercenary Yevgeny Prigozhin and carried out by the non-public navy group Wagner. It isn’t our goal to delve into additional geo-political situations right here, however sure, to see the results on the monetary markets of what at one level gave the impression to be the most important disaster within the former Soviet nation in 30 years. And the very fact is that there was virtually none: Crude oil futures are completely flat on the time of writing, as are corn futures; wheat is rising barely, however has been doing so for at the least a few weeks; and the identical might be stated of pure fuel (Henry Hub), which, having reached a statistically low stage of $2, has discovered bids once more inside a really regular market logic.

Unusual that in a state of affairs that also appears to be very unsure, no threat premium is but showing on these markets during which Russia has a excessive particular weight.

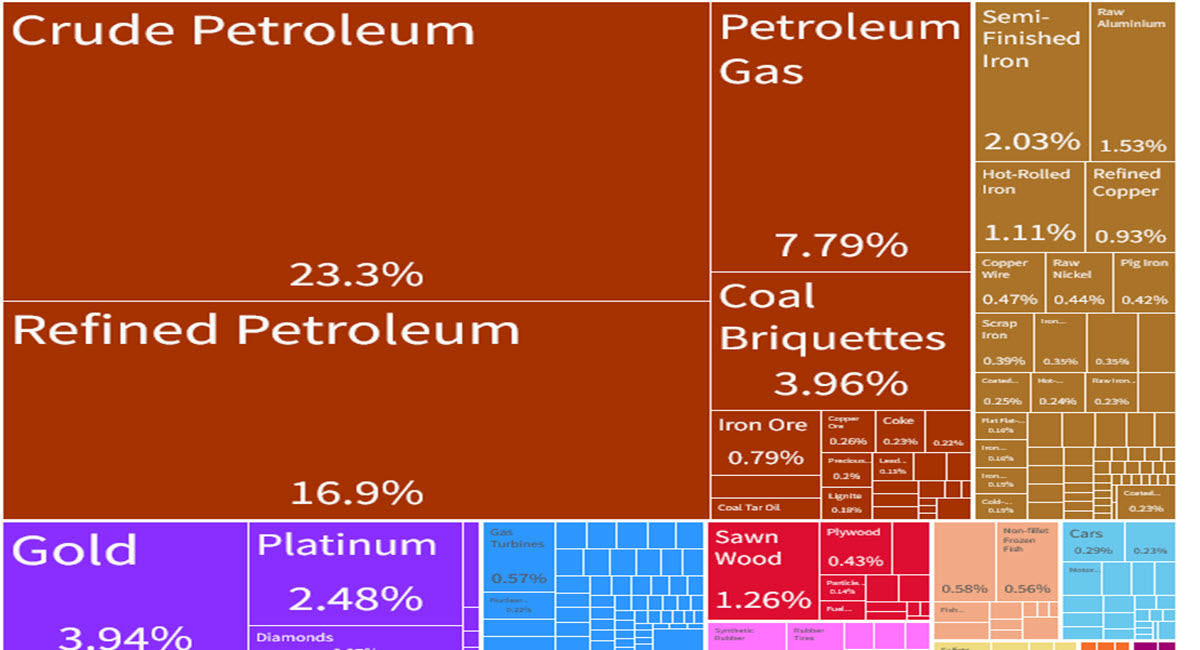

Related Russian Exports by class, 2021 ($484B whole). Supply: OEC

The Putin-ruled nation was the world’s third largest oil producer in 2022, behind the US and Saudi Arabia: round 10.3 million barrels per day are produced there and contemplating an anticipated IEA demand for 2023 H2 of 103.2 million b/d we’re speaking about 10% of world manufacturing. That is the most important voice amongst Russian exports and accounted for 47.99% of the whole in 2021: the nationwide authorities price range itself is calculated on the idea of value forecasts for this commodity.

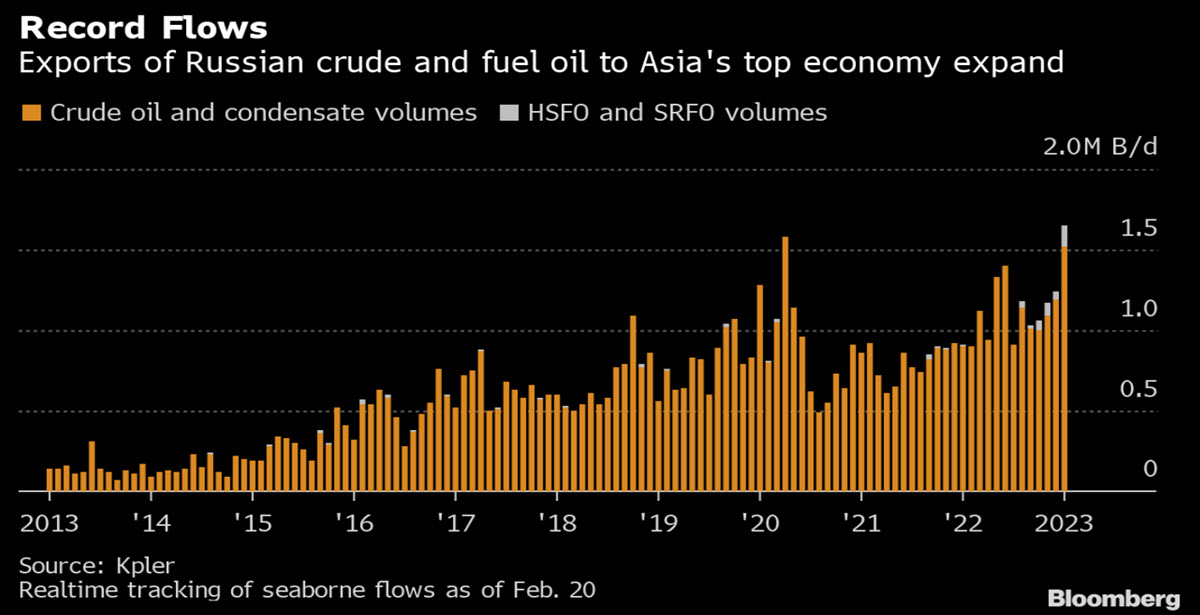

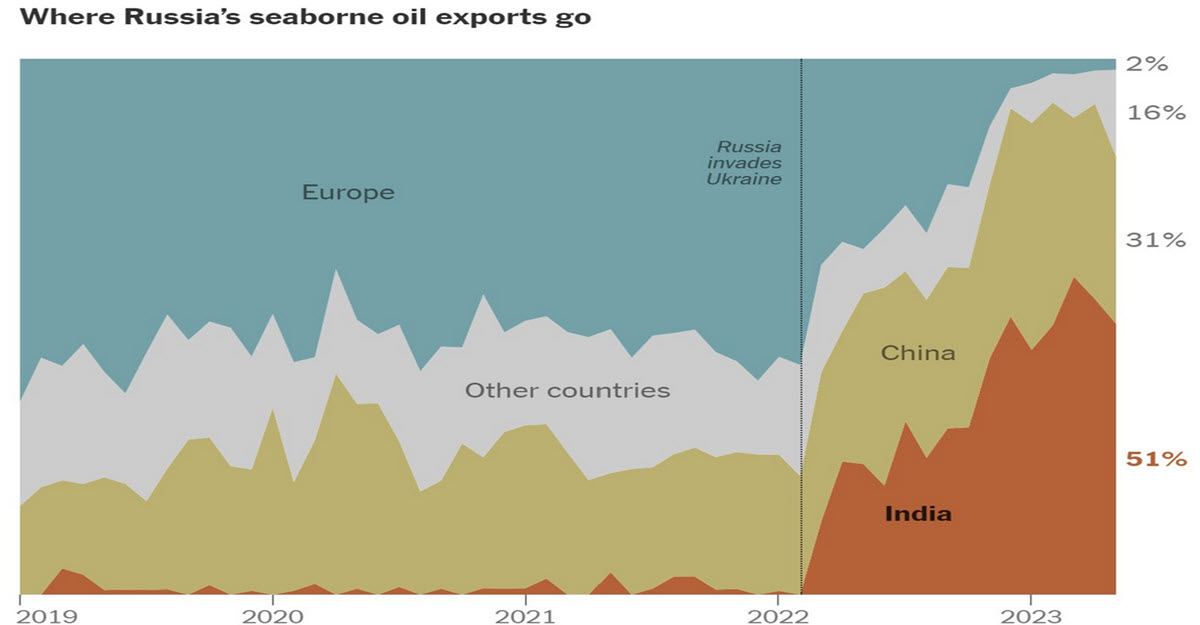

Those that suppose that with the sanctions and the warfare the blow suffered has been heavy are partly mistaken: in accordance with the IEA’s Could report, Russia produced 9.6 million b/d of which 8.3 have been for export: income for the month reached $15 bn, up $1.7 bn from Apr 2023 (however formally down -27% from the earlier yr). Actually, the combo has modified: exports to Asia but additionally Saudi Arabia have elevated considerably with India presently shopping for half of Russian seaborne oil as new refining capability is driving a continued shift east in forecast crude runs for the rest of the yr, mirroring regional demand energy.

Think about additionally that Mix Urals, ESPO and Sokol -typical Russians- all commerce at a reduction between $13 and $5 towards crude. Clearly, exports to Europe have plummeted although one EU state – Greece – is accountable by means of its tankers for 60 per cent of exports from the Black Sea.

Think about additionally that Mix Urals, ESPO and Sokol -typical Russians- all commerce at a reduction between $13 and $5 towards crude. Clearly, exports to Europe have plummeted although one EU state – Greece – is accountable by means of its tankers for 60 per cent of exports from the Black Sea.

However as some funding banks, together with GS and RBC, have identified, the potential dangers transcend Russian territory and the Rostov on Don space, an necessary strategic hub for oil distribution from the Sea of Azov: Wagner is current and energetic in Libya, for instance, and any blockades have the potential to take a further 1.1 million b/d out of the market. But crude oil marks +0.22% at $69.65 with out -we repeat- any additional premium being demanded by merchants and speculators.

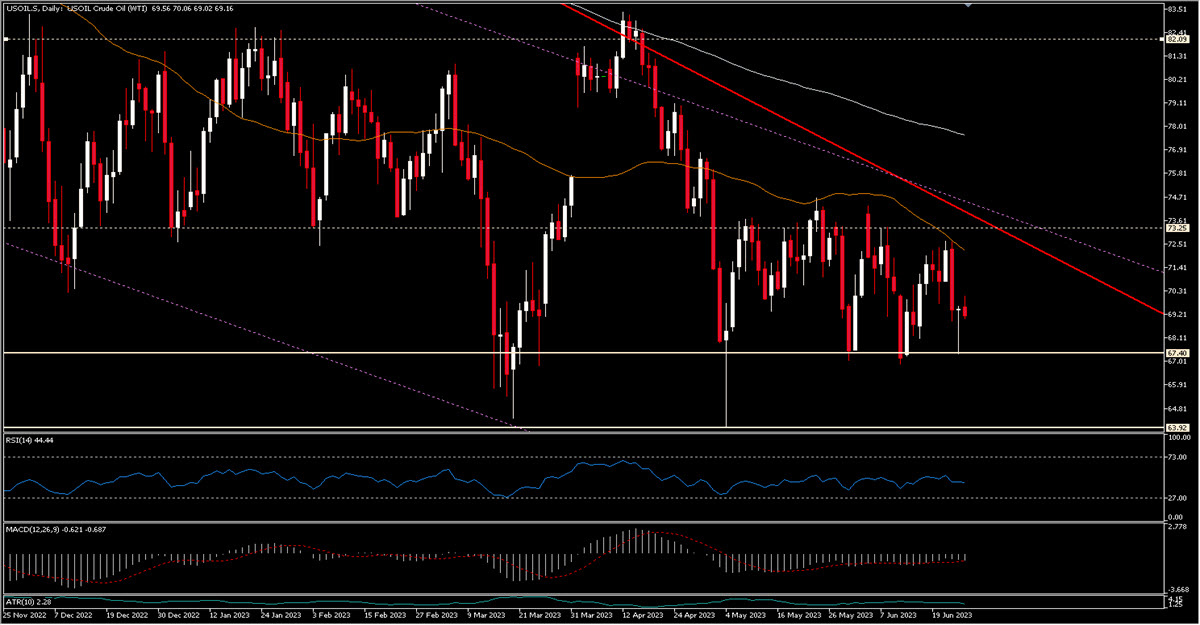

TECHNICAL ANALYSIS

On the day by day crude oil chart nothing has modified and we’re nonetheless in a sideways consolidation part inside a broader descending construction (originating in early 2022). The vary inside which the worth has been shifting because the starting of Could is $67.40 – $73.25. Beforehand, from December 2022 till Mar 2023 with larger charitableness, oil had nonetheless moved in a variety, between $73.25 and $82. If in some unspecified time in the future within the yr we have been to commerce once more at these ranges it might most definitely be a bullish sign, because the pink trendline and the higher a part of the violet channel would have been damaged and we’d most definitely be above the 50 and 200MA. However we might hardly really feel comfy taking a bullish stance earlier than a break of $73.25 – $74.50, from which we’re nonetheless a good distance off.

Crude Oil Day by day, Nov 2022 – Right now

Within the meantime, we proceed to watch very rigorously $67.40, which has been examined a couple of too many instances recently (4 because the starting of Could) and that if it have been to be damaged it might instantly open the doorways to $64 (which if damaged would in flip take us to the $58.50 space.

How this matches in with an elevated threat of stability on the planet’s third largest producer is troublesome to justify in the intervening time: what is definite is that there isn’t a actual response to this elevated geopolitical threat in the intervening time and the very best factor you’ll be able to all the time do as a dealer is to simply observe the cash.

Click on right here to entry our Financial Calendar

Marco Turatti

Market Analyst

Disclaimer: This materials is offered as a normal advertising and marketing communication for info functions solely and doesn’t represent an impartial funding analysis. Nothing on this communication incorporates, or ought to be thought of as containing, an funding recommendation or an funding advice or a solicitation for the aim of shopping for or promoting of any monetary instrument. All info offered is gathered from respected sources and any info containing a sign of previous efficiency is just not a assure or dependable indicator of future efficiency. Customers acknowledge that any funding in Leveraged Merchandise is characterised by a sure diploma of uncertainty and that any funding of this nature includes a excessive stage of threat for which the customers are solely accountable and liable. We assume no legal responsibility for any loss arising from any funding made based mostly on the data offered on this communication. This communication should not be reproduced or additional distributed with out our prior written permission.

[ad_2]

Source link