[ad_1]

By Matthew Piepenburg

Beneath we study credit score markets shedding all credibility as rising fee shark fins circle in for the kill.

Treasuries Matter for the World Un-Deserved/Reserve Forex

The yield on the 10Y UST is understood by most traders to symbolize the actual value of capital/borrowing.

Briefly, it’s an important yield on the earth, because it costs the price of the world’s reserve (undeserved) forex.

Thus, when the yields rise, the price of debt rises, and in a world awash in USD-denominated debt, such rising yields are like approaching shark fins to inventory and bond markets.

Yields, in fact, rise when bond costs fall; equally, yields fall when bond costs rise.

Thus, markets prefer to see sturdy and pure (and even un-natural QE) bond demand to maintain yields low and markets wholesome.

Lately, there have been indicators of rising demand for UST’s, which must be good for the bond markets, proper?

Properly, not so quick…

Head Pretend within the Bond Markets

Latest numbers from the Treasury Worldwide Capital (TIC) experiences, for instance, point out that YTD overseas funding/demand in 8-month US bonds has reached a strong $556B.

Does this imply that Powell and Yellen’s deliberate plan to rase charges and strengthen the USD has succeeded in engaging overseas patrons (suckers?) to buy US IOUs because the proverbial finest horse in a world glue manufacturing facility of in any other case negative-yielding sovereign bonds?

As hinted above, the reply isn’t any.

However given such ostensible rising overseas demand for Uncle Sam’s IOU’s, shouldn’t bond costs be rising and therefore yields and charges falling to extra comfy/reasonably priced ranges?

The truth is, yields on the 10Y UST are fatally climbing—so what offers?

Properly, the arduous actuality is that USTs are actually unloved and oversold relatively than in excessive demand and overbought.

Hedge Fund Demand is Capricious Demand

And as to the “promising” TIC knowledge above, it’s value noting that a variety of that overseas bond shopping for has been coming in by way of the Cayman Islands, which (if my hedge fund recollections with offshore docs serve me accurately) suggests that almost all of these overseas patrons are (US) hedge funds relatively than international central banks.

This distinction is vital.

The profile of cash managers and hedge fund patrons will not be that of long-term political holders or true believers in UST’s.

As an alternative, the cash managers are shopping for USTs to arbitrage FX positions and lever fast returns—i.e., pump after which dump relatively than purchase after which maintain.

Overseas Bond Demand Simply Aint There

The extra alarming concern within the Treasury market is the lack of shopping for curiosity from central banks, all of which means that the actual, sticky and as soon as politically-dependable patrons of Uncle Sam’s more and more unloved IOUs are now not ingesting the US Kool aide nor trusting Uncle Sam’s bar tab.

The dealer in me feels strongly that the hedge funds and cash managers shopping for USTs to hedge FX positions in the present day will probably be web sellers tomorrow as a result of the USD is simply too sturdy, charges are simply too excessive and therefore the bond market is simply too damaged.

As warned above, extra promoting (and therefore provide) of UST’s means rising shark fins approaching your markets.

How you can Preserve the Rising Shark Fins (Charges) Away?

In easiest phrases, these lethal fins received’t go away till the USD weakens and charges are paused after which minimize. In different phrases: a Fed pivot.

Till then, the US bond market will probably be too scary for sticky cash.

In the meantime, the Tightening Continues—And Therefore the Shark Fins Multiply

Another excuse bond yields are rising and bond costs are falling is that the Powell/Volckerish Fed will not be solely elevating the Fed Funds Price, it’s additionally tightening its stability sheet—which implies it’s dumping treasury provide into the open market.

This new tidal wave of bond provide pushes bond costs down and therefore their yields (and charges) painfully north. Briefly, the shark fin is getting greater and quicker.

Cue the Jaws music…

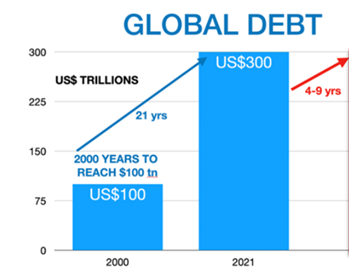

People, rising charges (i.e., the price of debt) aren’t any joke in a world that lives atop the most important debt bubble in recorded historical past…

Overseas Holders of UST’s—The Nice White Shark Simply Beneath the Floor

What’s even scarier, in my view, is the larger image (and shark) behind Uncle Sam’s unloved IOU’s, particularly the $3.9T value of these bonds at the moment held by different overseas nations (assume China, UK, Japan, EU and so on.).

As I see it, much more of these USTs are about to get dumped.

As winter will get colder and vitality will get scarcer, and because the deliberately sturdy and weaponized USD unloads an increasing number of inflationary, debt and forex ache upon America’s overseas enemies and pals alike, lots of these duped/wounded international locations holding UST’s in the present day will probably be promoting them this winter as their currencies soften away beside a scorching Dollar.

Like Japan, an increasing number of nations will probably be compelled to dump an increasing number of USTs to strengthen their very own currencies (which the intentionally rate-hiked and therefore sturdy USD have crushed), in order that they’ll in flip be capable of purchase oil and fuel from the East.

Hmmm…it appears to be like like all these sanctions and powerful USD concepts in February are backfiring as predicted at even larger velocity, no?

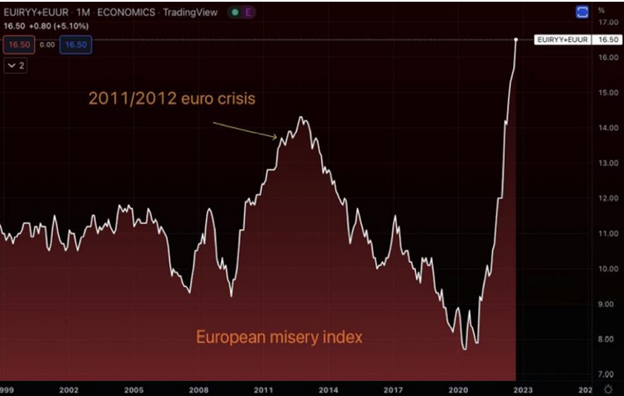

I’m wondering how good (and poorer) the Germans and different NATO companions are gonna really feel come winter as these vitality costs spike and their Greenback-crushed currencies tank?

The brief reply: They really feel depressing.

Like Japan and the UK, the EU’s ECB will ultimately each pivot to QE and dump USTs to strengthen their Greenback-bullied currencies and discover some money to purchase vitality.

Already, and outdoors of the EU, the Swiss Nationwide Financial institution is begging for (and receiving) billions in Fed swaps (i.e., USDs).

As extra international locations dump UST’s, their yields rise and therefore their charges rise, inflicting even additional hurt to a debt-soaked nation, Predominant Road and securities market.

From Sharks to Pyromania

As warned so many instances, the ticking timebomb of each US and international debt is a like an open barrel of gasoline to which rising yields and charges, described above, are an apparent and slowly approaching blowtorch.

Because the hawkish (and apparently pyromaniac) Fed sends international markets and USTs right into a tailspin, the debt gasoline and rising yield/fee blowtorch will collide; thereafter, your complete and debt-soaked international system slowly burns alive.

The risks of an oversold Treasury market are thus not fables however credit score market details, details which a cornered and determined Powell and others will ignore till their fingers (and our financial system) are already burned.

At that time, and all the time two steps too late, the Fed too will pivot towards its brazenly inflationary cash printers and flip from hawk to dove nearly as quick as valuable metals go from south to north.

Will extra QE save the West? Sure, however Hell No…

Properly…Sure however No.

Cash Printers, as Powell is aware of, can theoretically save every part and each market—from shares to bonds to Malibu actual property–besides they’ll by no means save the buying energy of the underlying “cash” they print or the markets they “accommodate” or inflate.

In the long run, and as even a younger and as soon as sincere Greenspan admitted way back, printing cash can profit markets, however an excessive amount of of it kills currencies (and sends gold to the moon).

“We will assure money advantages as far out and at no matter dimension you want, however we can’t assure their buying energy.” –Alan Greenspan

For now, annoyed but macro-conscious gold holders should wait patiently on the launch pad as Powell’s inevitable pivot from tightening to easing (and a high-rate sturdy Greenback to a low-rate weak Greenback) follows a percolating but inevitable international credit score disaster.

This new wave of printed (nugatory) cash, in fact, sends gold up, up and away.

Gold: Nonetheless Ready on the Launchpad

However gold hardly feels up, up and away in the present day. The truth is, the stress ranges on the gold value (in USD phrases) have hardly ever been increased.

I’ve endeavored to elucidate gold’s present headwinds in macro phrases on quite a few events, all of which boil right down to an un-naturally manipulated and powerful USD in addition to a very (but legally) rigged COMEX commerce.

Backward Video games and Backwardation

For these, nevertheless, taking a look at technical hints, historical past and indicators from the derivatives on line casino, the set-up for gold is sort of attention-grabbing of late.

The truth is, gold appears as careworn as ever—or at the very least as careworn because it was in 2015.

The COMEX athletes, for instance, will remind that 1st to 2nd month gold contract backwardation has reached ranges not seen since late 2015, when the gold cycle reached the December low of simply over $1000/oz. (See little containers/squares beneath)

Translated into primary English, this backwardation signifies that the provide value of contracted gold is decrease than the present bid.

Paper Fiction vs. Bodily Actuality

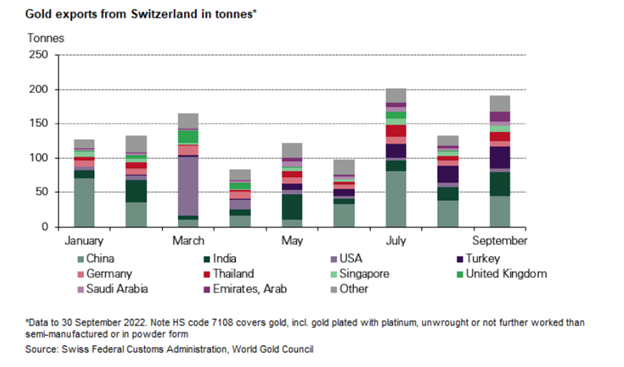

From the place we sit in Switzerland, nevertheless, the bodily story appears to be like rather a lot completely different than the fictional story on the COMEX.

In line with the World Gold Council, for instance, bodily gold exports out of Switzerland and into Turkey, China, the UAE and India are ripping.

This disconnet between bodily actuality and paper fiction is nothing new…

If the bodily buy of gold is ripping at a tempo of 100% month-to-month mining provide, why would the paper gold value be going backward within the futures market?

Properly, as we’ve written many instances earlier than, the COMEX market papers over actuality for a dwelling—that’s, a handful of bullion banks levers a everlasting brief in opposition to all different lengthy contracts to artificially repress the paper value.

That is executed to maintain the spot value from embarrassing in any other case nugatory paper currencies from the pound to the Greenback, the Yen to the euro.

As additionally written, nevertheless, the times of this shell recreation of open fraud on the COMEX are numbered as derivatives markets march towards a disaster of each credit score and credibility.

For now, present backwardation seems to be signaling a gold backside and therefore an opportune second to accumulate gold for long-term, knowledgeable valuable steel traders.

By the best way, why do you assume all these different nations are shopping for gold relatively than USTs?

Simply saying…

[ad_2]

Source link