[ad_1]

wildpixel

Article Thesis

Decrease-than-expected inflation numbers on Thursday fueled a large rally within the broad market and particularly the tech-heavy Nasdaq that comprises many long-duration equities, the place sensitivity to rates of interest is very excessive. The decrease inflation studying makes a Fed pivot extra possible, however traders should not assume that rates of interest shall be falling quickly. As a substitute, it is rather possible that rates of interest will proceed to climb, though possible at a considerably slower tempo. In spite of everything, inflation continues to be very elevated in absolute phrases.

What Occurred?

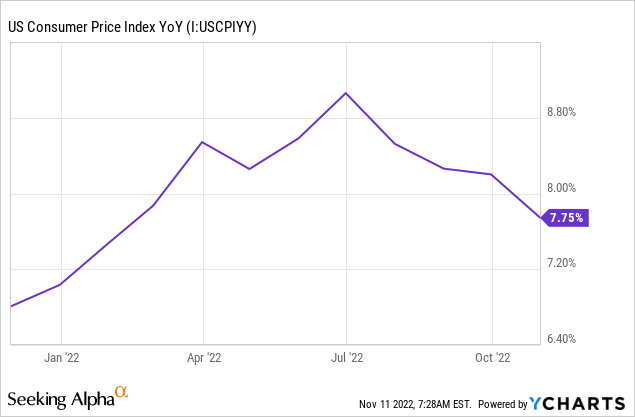

On Thursday, the newest inflation numbers had been launched, for October 2022:

In search of Alpha

A 7.7% year-over-year enhance continues to be fairly excessive, round 4x as a lot as what the Fed is mostly concentrating on. However in contrast to throughout earlier months, the studying was barely decrease than anticipated, beating estimates of an 8.0% enhance. Likewise, month-over-month inflation was decrease than anticipated as effectively, coming in at 0.4%. If month-over-month inflation had been to remain at that stage going ahead, annual inflation can be round 5%, which might nonetheless be too excessive, however considerably decrease than the trailing 12-month studying. In different phrases, it appears like inflation is decelerating, though inflation has not but come all the way down to the goal stage of round 2% per yr, or 0.17% per thirty days.

In earlier months, inflation has repeatedly been increased than anticipated, which often resulted in violent sell-offs, because the market immediately priced in a better probability of a big rate of interest enhance. This time, the reverse got here true — the market immediately noticed a better probability of a smaller rate of interest enhance within the upcoming report (50 base factors as an alternative of the 75 base level hikes we have now seen in latest conferences), which made the broad market rally.

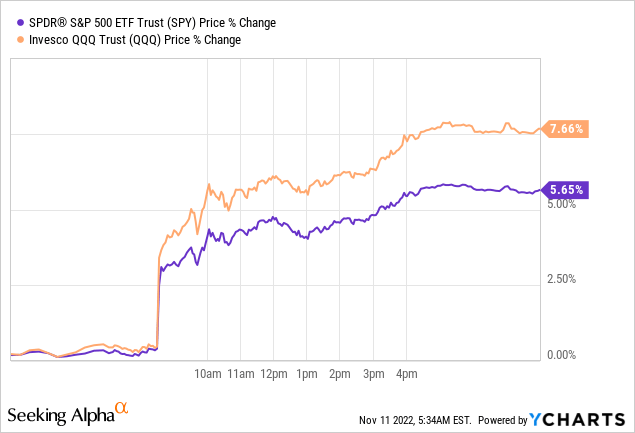

The S&P 500 index (SPY) soared by 5.7%, its finest day in additional than two years, whereas the Nasdaq index (NASDAQ:QQQ) jumped by a good higher 7.7%, which was the first-ever 700 base level transfer in its existence, and probably the greatest days in relative phrases.

On the similar time, bond yields declined meaningfully, because the bond market additionally began to cost in a better probability that future rate of interest hikes can be smaller. The ten-year Treasury yield, for instance, dropped from 4.15% to three.82% on Thursday, which is a relative decline of 8%. Likewise, 2-year yields additionally noticed a giant decline of 30 foundation factors on the day.

Decrease yields on US authorities bonds, mixed with a unique outlook in relation to future rate of interest will increase, additionally had an affect on foreign exchange charges. When traders get decrease returns by investing in Treasuries and different USD-denominated fixed-rate property, that signifies that these property develop into considerably much less engaging to overseas traders. Because of this, the US Greenback weakened in opposition to different currencies, because the Greenback Index (DXY) dropped by 2.3% on the day, though it’s nonetheless up rather a lot over the past yr.

What Is The Outlook?

Let’s first consider what it means when rates of interest rise lower than anticipated, or what it means if they really decline. That naturally impacts the returns from Treasuries, each in relation to their worth efficiency and in relation to the earnings yields they provide. However importantly, rates of interest additionally affect equities. First, because of the truth that earnings traders can determine between investing in earnings shares and treasuries. When rates of interest change, their choice may change, thus earnings shares are impacted. In a zero-rate surroundings, a 3%-yielding fairness is extra compelling than in an surroundings the place treasuries supply a 4% yield, all else equal.

Rates of interest additionally affect the curiosity bills of firms, though oftentimes with a time lag, as many firms primarily make the most of fixed-rate debt. Nonetheless, over time, rate of interest actions affect the online income that firms generate, all else equal.

Final however not least, rates of interest are vital in relation to the valuation of shares. One quite common strategy to discover the truthful worth for an fairness is the discounted money stream technique. Future free money flows of an fairness are estimated or modelled. Then, because of the time worth of cash idea, these money flows are discounted in the direction of the current — in any case, $1 billion in free money stream 10 years from now’s price lower than $1 billion in free money subsequent yr. The low cost fee usually is calculated through a number of components, considered one of them being the beta (relative volatility) of an fairness, however the risk-free fee (treasury yield) additionally is part of that equation. Larger rates of interest end in a better low cost fee, and decrease rates of interest end in a decrease low cost fee. The next low cost fee reduces the truthful worth of equities, all else equal. That explains why equities have been falling this yr, as rates of interest have risen. After all, there are another components at play, akin to worries a few recession, however the rate of interest situation is vital for positive. With the lower-than-expected October CPI studying leading to a better probability that rates of interest rise much less going ahead, market expectations for future rates of interest have modified. This ends in a decrease anticipated low cost fee for equities, which ends up in a better truthful worth for shares, all else equal. It thus is sensible that the market rose on the CPI information.

Not all equities are impacted equally by modifications within the low cost fee. So-called long-duration property, the place the vast majority of all future money flows are generated within the distant future, are extra closely impacted by rate of interest modifications. That is why long-duration property, akin to these held by ARK Innovation (ARKK), which was up 10% on the day, rose greater than the broad market. The tech-heavy Nasdaq additionally comprises many long-duration property, which is why it rose greater than the broad market, too.

After all, earlier than traders chase equities proper now, they need to contemplate a few gadgets. First, the CPI beat for October could not essentially be the primary in a line of downward beats. As a substitute, it’s doable that inflation reverses increased once more. That is removed from assured, and never essentially possible, however it’s doable.

In spring, inflation had skilled a downward transfer as effectively, earlier than operating to even increased highs. The downward transfer has now been in place for a few months, which signifies that it’s extra possible that this can be a extended development, however traders ought to nonetheless not consider that it’s assured that inflation shall be heading decrease with out pause.

On prime of that, even when inflation continues to move decrease going ahead, it’ll probably take a very long time earlier than the two% goal is reached. The Fed will not be proud of the time it takes till that occurs, thus Fed members could determine to lift charges greater than the market anticipates proper now to be able to convey down inflation quicker.

Additionally, traders mustn’t chase equities with out wanting on the macroeconomic outlook. The speed will increase to this point this yr make it possible that there shall be an financial downturn subsequent yr, which may imply that income for publicly traded firms come below stress. Shopping for into equities solely as a result of inflation has come down from the 40-year excessive whereas ignoring {that a} recession may affect firms’ income could possibly be a dangerous transfer.

Proper now, there’s a variety of enthusiasm a few Fed pivot, and plenty of traders are completely happy to purchase equities. However we have now seen such rallies a few instances over the past couple of months, and so they had been oftentimes not sustained. As a substitute, they had been repeatedly pale, as recession worries or Fed statements about there being no pivot harm sentiment once more. This might occur once more. The Fed’s subsequent assembly shall be roughly one month from now, on December 13-14. Markets may react closely to statements of Fed members then, and the rate of interest enhance that shall be introduced can be extremely vital. Perhaps, the Fed surprises with a lower-than-expected enhance (25 base factors), however the reverse may additionally come true. Within the close to time period, I anticipate that markets will stay unstable, that macro information will proceed to have massive short-term impacts on fairness costs, however I don’t consider that it is a good time to name for a transparent upwards development in equities but. There are nonetheless uncertainties concerning the Fed’s path, inflation continues to be fairly excessive, and ignoring the recession threat additionally looks like a foul concept.

Takeaway

The CPI studying was surprisingly low versus expectations, however nonetheless fairly excessive in absolute phrases. The markets noticed this as a motive to rally, however chasing equities now appears dangerous. Previous “Fed pivot hope” rallies have failed repeatedly, and the macroeconomic image stays cloudy. Traders ought to be cautious to not be too euphoric.

[ad_2]

Source link