As we speak new shopper inflation information awaits with the launch of CPI and Core CPI readings for July 2023. The expectation is for a headline y/y quantity up from final month (+3.3% in July vs. +3% in June) towards a barely decrease core one (+4.7% vs. +4.8%). Actually, the rationale for the rise can also be purely mathematical since m/m the CPI had stayed flat in Lug 2022.

The descent of inflation is not a shock to anybody and this may be clearly seen within the earlier desk displaying the efficiency of the SP500 on the day of the discharge: volatility is clearly on a downward development with a True Vary of simply over 1% throughout 2023 ($56.45 common motion) towards excursions near 3% over the last 7 months of 2022.

However right here’s the place one thing attention-grabbing is available in: the idea of nowcasting (versus forecasting) is more and more in vogue and numerous FED Banks have developed fashions for this: specifically, the Cleveland FED makes use of a mannequin to trace inflation. In it the CPI is seen to rise much more (+3.4%) and the core can also be seen to rise (to 4.9%). Not that these numbers are an amazing shock – now we have not too long ago traced what number of commodities have been rising within the final two months – however why would possibly there be this slight spike up?

Cleveland Fed Inflation Nowcasting Projections

We’re within the realm of hypothesis, however current indications from US airways present that People nonetheless choose spending cash on experiences moderately than purchasing: actually airways and lodge chains in current weeks have reported a surge in bookings and rising costs whereas theme park operators and eating places are additionally seeing good site visitors. It appears that evidently People are being very cautious the place and the way they’re spending their cash in an age of rising costs however they nonetheless don’t wish to surrender having fun with their free time at any time when doable.

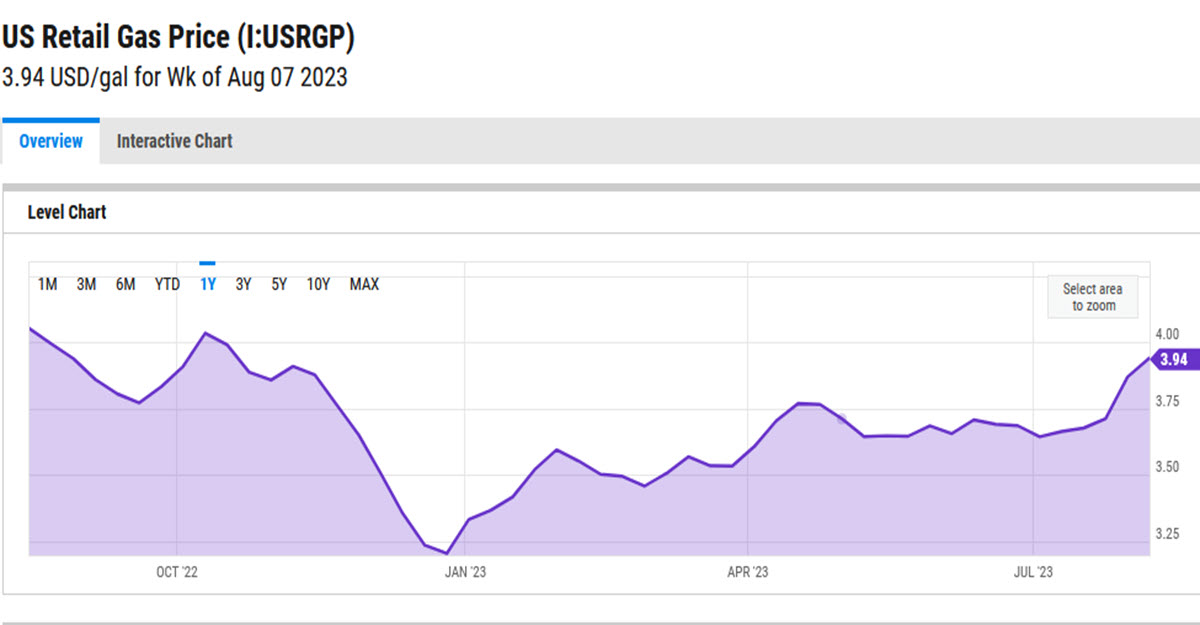

And with all this wanderlust, have in mind that the worth of a gallon of petrol within the US is at its highest of the yr, $3.94.

How would possibly the US500 react? Effectively, now we have simply seen that not too long ago the typical motion on days like these has been round $45, however a shock to the upside may undoubtedly enhance this vary. The index is cooling off and is down 2.5% from the highs of two weeks in the past however extra importantly it’s approaching the trendline that has supported costs since March and its MA 50. At present these 2 buildings are near $4450 (buying and selling at $4488 proper now). Upwards the trendline which is pulling the index down is passing at $4507 at this time.

Click on right here to entry our Financial Calendar

Marco Turatti

Market Analyst

Disclaimer: This materials is offered as a common advertising communication for data functions solely and doesn’t represent an impartial funding analysis. Nothing on this communication incorporates, or must be thought of as containing, an funding recommendation or an funding suggestion or a solicitation for the aim of shopping for or promoting of any monetary instrument. All data offered is gathered from respected sources and any data containing a sign of previous efficiency isn’t a assure or dependable indicator of future efficiency. Customers acknowledge that any funding in Leveraged Merchandise is characterised by a sure diploma of uncertainty and that any funding of this nature entails a excessive stage of threat for which the customers are solely accountable and liable. We assume no legal responsibility for any loss arising from any funding made primarily based on the data offered on this communication. This communication should not be reproduced or additional distributed with out our prior written permission.